Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) A person's family tier 1 threshold for a financial year is an amount equal to double his or her * singles tier 1 threshold for the financial year.

(2) A person's family tier 2 threshold for a financial year is an amount equal to double his or her * singles tier 2 threshold for the financial year.

(3) A person's family tier 3 threshold for a financial year is an amount equal to double his or her * singles tier 3 threshold for the financial year.

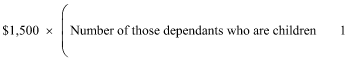

(4) However, if the person has 2 or more dependants (within the meaning of the A New Tax System (Medicare Levy Surcharge--Fringe Benefits) Act 1999 ) who are children, increase his or her family tier 1 threshold , family tier 2 threshold and family tier 3 threshold for the financial year by the result of the following formula:

Example: If the person has 3 such dependants who are children, the person's family tier 2 threshold for the 2021 - 22 and 2022 - 23 financial year is:

![]()

Note: A person may be a tier 1 earner, tier 2 earner or tier 3 earner if his or her income for surcharge purposes exceeds the applicable threshold for that tier: see section 22 - 30.