Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) An amount mentioned in section 22 - 35 is indexed for the 2023 - 24 financial year, and later financial years, in accordance with this section.

Indexing amounts

(2) Index the amount by:

(a) firstly, multiplying the amount by the * indexation factor for the financial year under subsection (4); and

(b) next, rounding the result in paragraph (a) down to the nearest multiple of $1,000.

Example 1: If the amount to be indexed is $105,000 and the indexation factor increases this to an indexed amount of $107,500, the indexed amount is rounded back down to $107,000.

Example 2: If the amount to be indexed is $140,000 and the indexation factor increases this to an indexed amount of $142,500, the indexed amount is rounded down to $142,000.

(3) However, do not index the amount for a financial year if the amount worked out under subsection (2) for the financial year is less than the amount applicable under section 22 - 35 or this section for the previous financial year.

(3A) If the amount is not indexed for a financial year because of subsection (3), the amount for the financial year is the same as the amount for the previous financial year.

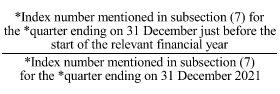

(4) For the purposes of this section, the indexation factor for a financial year is:

(6) Work out the * indexation factor to 3 decimal places (rounding up if the fourth decimal place is 5 or more).

Index number

(7) For calculating the amounts, the index number for a * quarter is the estimate of full - time adult average weekly ordinary time earnings for the middle month of the quarter first published by the Australian Statistician in respect of that month.