Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) If, at the end of the contract period in relation to a financial supplement contract between a participating corporation and another person, there was an amount outstanding under the contract, the person incurs on 1 June immediately following the end of that period a debt ( FS debt ) to the Commonwealth worked out using the formula:

![]()

where:

"amount outstanding" means the amount outstanding under the contract at the end of the contract period.

"indexation factor" means the factor calculated under subsection (6).

(2) If an FS debt or FS debts of a person that existed on 1 June in a year ( the relevant date ) are not, or do not include, an FS debt that existed on 1 June in the immediately preceding year, the person incurs on the relevant date an accumulated FS debt to the Commonwealth equal to that FS debt or the total of those FS debts.

(3) If an FS debt or FS debts of a person that existed on 1 June in a year ( the later date ) are, or include, an FS debt or FS debts that existed on 1 June in the immediately preceding year ( the earlier date ), the person incurs on the later date an accumulated FS debt to the Commonwealth worked out using the formula:

![]()

where:

"adjusted accumulated FS debt" means the adjusted accumulated FS debt at the earlier date.

"indexation factor" means the factor calculated under subsection (6).

"later FS debts" means any FS debt, or the total of any FS debts, of the person that did not exist on the earlier date.

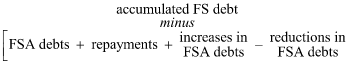

(4) The reference in subsection (3) to the adjusted accumulated FS debt of a person at the earlier date is a reference to the amount worked out using the formula:

where:

"accumulated FS debt" means the accumulated FS debt of the person at the earlier date.

"FSA debts" means the sum of:

(a) any FS assessment debt or FS assessment debts of the person assessed on or after the earlier date and before the later date excluding any such FS assessment debt assessed as a result of a return furnished before the earlier date; and

(b) any FS assessment debt or FS assessment debts of the person assessed on or after the later date as a result of a return furnished before the later date.

"repayments" means any amount, or the sum of any amounts, paid, except in discharge of an FS assessment debt, on or after the earlier date and before the later date in reduction of the accumulated FS debt of the person at the earlier date.

"increases in FSA debts" means any amount, or the sum of any amounts, by which any FS assessment debt of the person is increased by an amendment of the relevant assessment (whether as a result of an increase in the person's taxable income or otherwise), being an amendment made on or after the earlier date and before the later date.

"reductions in FSA debts" means any amount, or the sum of any amounts, by which any FS assessment debt of the person is reduced by an amendment of the relevant assessment (whether as a result of a reduction in the person's taxable income or otherwise), being an amendment made on or after the earlier date and before the later date.

(5) For the purposes of subsection (4), an assessment or an amendment of an assessment is taken to have been made on the date specified in the notice of assessment or notice of amended assessment, as the case may be, as the date of that notice.

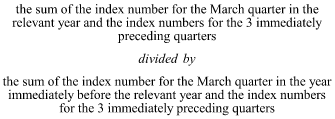

(6) The factor to be calculated for the purposes of the definition of indexation factor in subsection (1) or (3) in determining an FS debt or the accumulated FS debt of a person at 1 June in a year ( the relevant year ) is the number worked out to 3 decimal places using the formula:

.

.

(7) If an indexation factor calculated in accordance with subsection (6) would end with a number greater than 4 if it were worked out to 4 decimal places, the indexation factor is increased by 0.001.

(7A) The Commissioner must cause to be published in the Gazette before each 1 June the indexation factor worked out under subsection (6) (as affected by subsection (7)) that is applicable in working out FS debts and accumulated FS debts incurred in the 1 June concerned.

(7B) An indexation factor published under subsection 12ZZB(4) before the commencement of this subsection has effect as if it were an indexation factor published under subsection (7A).

(8) If, apart from this subsection, the amount of an FS debt or accumulated FS debt worked out under this section would be an amount of dollars and cents, the amount of the cents is to be disregarded.