Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) If:

(a) an employer is liable to make weekly payments under section 31, 33, 34, 35 or 36 to an employee for an injury resulting in an incapacity; and

(b) the amount of those payments is $62.99 per week or less; and

(c) the employer is satisfied that the degree of the employee's incapacity is unlikely to change;

the employer must make a determination that any liability to make further payments to the employee under that section be redeemed by the payment to the employee of a lump sum.

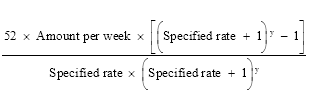

(2) The amount of the lump sum is the amount worked out using the formula:

where:

"Amount per week" means the amount per week payable to the employee under section 31, 33, 34, 35 or 36 as the case may be, at the date of the determination.

"Specified rate" means the specified rate, expressed as a decimal fraction, applicable at the date of the determination.

"y" [number of years] means the number (calculated to 3 decimal places) worked out by dividing by 365 the number of days in the period beginning on the day after the date of the determination and:

(a) if the employee is injured before reaching the age that is 2 years before pension age--ending on the day immediately before the day on which the employee reaches pension age; and

(b) if the employee is injured on or after reaching the age that is 2 years before pension age--ending on the day immediately before the employee would cease to be entitled to receive compensation under section 31, 33, 34, 35 or 36.

(2A) If the number worked out under the definition of y [number of years] in subsection (2) would, if it were calculated to 4 decimal places, end with a number greater than 4, the number is taken to be the number calculated to 3 decimal places in accordance with that definition and increased by 0.001.

(3) The Minister may, from time to time, by legislative instrument, specify a rate for the purposes of subsection (2).