Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) Compensation payable to an employee who is incapacitated for work as a result of an injury is determined in accordance with this section if:

(a) the employee is retired from his or her employment (whether the employee retired voluntarily or was compulsorily retired); and

(b) the employee receives:

(i) a pension; and

(ii) a lump sum benefit;

under a superannuation scheme as a result of the employee's retirement.

(2) The Commonwealth is liable to pay compensation to the employee, in respect of the injury, in accordance with this section for each week after the date of the retirement during which the employee is incapacitated.

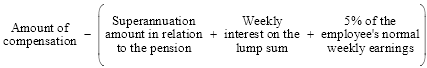

(3) The amount of compensation is the amount worked out using this formula:

where:

"amount of compensation" means the amount of compensation that would have been payable to the employee for the relevant week if:

(a) section 19, other than subsection 19(6), had applied to the employee; and

(b) in the case of an employee who was not a member of the Defence Force immediately before retirement--the relevant week were a week referred to in subsection 19(3).

"superannuation amount in relation to the pension" means the superannuation amount in relation to the pension received by the employee in respect of the relevant week.

"weekly interest on the lump sum" means the amount worked out by:

(a) multiplying the superannuation amount in relation to the lump sum benefit received by the employee by the rate specified in an instrument made under subsection 21(5); and

(b) dividing the result of paragraph (a) by 52.

(4) In using the formula in subsection (3) to calculate an amount of compensation for an employee who retired before the day on which item 22 of Schedule 1 to the Safety, Rehabilitation and Compensation and Other Legislation Amendment Act 2007 commenced, use "SC" instead of "5% of the employee's normal weekly earnings". For this purpose:

"SC" means the amount of superannuation contributions that the employee would have been required to pay in that week if he or she were still contributing to the superannuation scheme.