Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) If a person is not a member of a couple, the person's rate of parenting payment is the pension PP (single) rate.

(2) The pension PP (single) rate is worked out in accordance with the rate calculator at the end of this section.

Note: For rate of a person who is a member of a couple see section 1068B.

(3) If:

(a) a person has a relationship with another person, whether of the same sex or a different sex (the other person ); and

(b) the relationship between them is a de facto relationship in the Secretary's opinion (formed after the Secretary has had regard to all the circumstances of the relationship, including, in particular, the matters referred to in paragraphs 4(3)(a) to (e) and subsection 4(3A)); and

(c) either or both of them are under the age of consent applicable in the State or Territory in which they are living;

the person's pension PP (single) rate is not to exceed the benefit PP (partnered) rate which would be payable to the person if the other person were the person's partner.

Method of calculating rate

1068A - A1 The rate of pension PP (single) is a daily rate. That rate is worked out by dividing the annual rate calculated according to this Rate Calculator by 364 (fortnightly rates are provided for information only).

Method statement

Step 1. Work out the person's maximum basic rate using Module B below.

Step 1A. Work out the amount of pension supplement using Module BA below.

Step 1B. Work out the energy supplement (if any) using Module BB below.

Step 2. Work out the amount per year (if any) of pharmaceutical allowance using Module C below.

Step 3. Work out the amount per year (if any) for rent assistance in accordance with paragraph 1070A(b).

Step 4. Add up the amounts obtained in Steps 1, 1A, 1B, 2 and 3: the result is called the maximum payment rate .

Step 5. Apply the ordinary income test using Module E below to work out the income reduction.

Step 6. Take the income reduction away from the maximum payment rate: the result is called the provisional annual payment rate .

Step 7. The rate of pension PP (single) is the amount obtained by:

(a) subtracting from the provisional annual payment rate any special employment advance deduction (see Part 3.16B); and

(b) if there is any amount remaining, subtracting from that amount any advance payment deduction (see Part 3.16A); and

(c) adding any amount payable by way of remote area allowance (see Module F).

Note 1: If a person's rate is reduced under Step 6, the order in which the reduction is to be made against the components of the maximum payment rate is laid down by section 1210.

Note 2: In some circumstances a person may also be qualified for a pharmaceutical allowance under Part 2.22.

Note 3: An amount of remote area allowance is to be added under Step 7 only if the person's provisional payment rate under Step 6 is greater than nil.

1068A - B1 A person's maximum basic rate is $21,470.80 per year ($825.80 per fortnight).

Note: The maximum basic rate is indexed 6 monthly in line with CPI increases (see sections 1191 to 1194).

1068A - BA1 A pension supplement amount is to be added to the person's maximum basic rate.

Residents of pension age who are in Australia etc.

1068A - BA2 If the person is residing in Australia, has reached pension age and:

(a) is in Australia; or

(b) is temporarily absent from Australia and has been so for a continuous period not exceeding 6 weeks;

the person's pension supplement amount is:

(c) if an election by the person under subsection 1061VA(1) is in force--the amount worked out under point 1068A - BA4; and

(d) otherwise--the amount worked out under point 1068A - BA3.

Residents of pension age in Australia etc.--no election in force

1068A - BA3 The person's pension supplement amount is the amount worked out by:

(a) working out 66.33% of the combined couple rate of pension supplement; and

(b) if the result is not a multiple of $2.60, rounding the result up or down to the nearest multiple of $2.60 (rounding up if the result is not a multiple of $2.60 but is a multiple of $1.30).

Note: For combined couple rate of pension supplement , see subsection 20A(1).

Residents of pension age in Australia etc.--election in force

1068A - BA4 The person's pension supplement amount is the amount worked out as follows:

(a) work out the amount for the person under point 1068A - BA3 as if the election were not in force;

(b) from that amount, subtract the person's minimum pension supplement amount.

Other persons

1068A - BA5 If the person is not covered by point 1068A - BA2, the person's pension supplement amount is the person's pension supplement basic amount.

1068A - BB1 An energy supplement is to be added to the person's (the recipient's ) maximum basic rate if the recipient is residing in Australia and:

(a) is in Australia; or

(b) is temporarily absent from Australia and has been so for a continuous period not exceeding 6 weeks.

However, this Module does not apply if quarterly energy supplement is payable to the recipient.

Note: Section 918 may affect the addition of the energy supplement.

Recipient has reached pension age

1068A - BB2 If the recipient has reached pension age, the recipient's energy supplement is $366.60.

Recipient has not reached pension age

1068A - BB3 If the recipient has not reached pension age, the recipient's energy supplement is $312.00.

Qualification for pharmaceutical allowance

1068A - C1 Subject to points 1068A - C1A, 1068A - C2, 1068A - C3 and 1068A - C5, an additional amount by way of pharmaceutical allowance is to be added to a person's maximum basic rate if the person is an Australian resident.

No pharmaceutical allowance if person has reached pension age

1068A - C1A Pharmaceutical allowance is not to be added to a person's maximum basic rate if the person has reached pension age.

No pharmaceutical allowance if person receiving certain supplements under other Acts

1068A - C2 Pharmaceutical allowance is not to be added to a person's maximum basic rate if the person is receiving:

(a) veterans supplement under section 118A of the Veterans' Entitlements Act; or

(b) MRCA supplement under section 300 of the Military Rehabilitation and Compensation Act; or

(c) pharmaceutical supplement under Part 3A of the Australian Participants in British Nuclear Tests and British Commonwealth Occupation Force (Treatment) Act 2006 ; or

(d) pharmaceutical supplement under Part 4 of the Treatment Benefits (Special Access) Act 2019 .

No pharmaceutical allowance before advance payment period ends

1068A - C3 Pharmaceutical allowance is not to be added to a person's maximum basic rate if:

(a) the person has received an advance pharmaceutical allowance under Part 2.23 of this Act; and

(b) the person's advance payment period has not ended.

Note: For advance payment period see point 1068A - C4.

1068A - C4(1) A person's advance payment period starts on the day on which the advance pharmaceutical allowance is paid to the person.

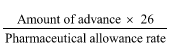

(2) The period ends after the number of paydays worked out using the following formula have passed:

where:

"amount of advance" is the amount of the advance paid to the person.

"pharmaceutical allowance rate" is the yearly amount of pharmaceutical allowance which would be added to the person's maximum basic rate in working out the person's rate of pension PP (single) on the day on which the advance is paid if pharmaceutical allowance were to be added to the person's maximum basic rate on that day.

No pharmaceutical allowance if annual limit reached

1068A - C5 Pharmaceutical allowance is not to be added to a person's maximum basic rate if:

(a) the person has received an advance pharmaceutical allowance during the current calendar year; and

(b) the total amount paid to the person for that year by way of:

(i) pharmaceutical allowance; and

(ii) advance pharmaceutical allowance;

equals the total amount of pharmaceutical allowance that would have been paid to the person during that year if the person had not received any advance pharmaceutical allowance.

Note 1: For the amount paid to a person by way of pharmaceutical allowance see subsections 19A(2) to (7).

Note 2: The annual limit is affected by the following:

(a) how long during the calendar year the person was on pension or benefit;

(b) the rate of pharmaceutical allowance the person attracts at various times depending on the person's family situation.

Amount of pharmaceutical allowance

1068A - C7 The amount of pharmaceutical allowance is $140.40 per year ($5.40 per fortnight).

Note: The annual amount is adjusted annually in line with CPI increases (see section 1206A).

Effect of income on maximum payment rate

1068A - E1 This is how to work out the effect of a person's ordinary income on the person's maximum payment rate:

Method statement

Step 1. Work out the amount of the person's ordinary income on a yearly basis.

Step 2. Work out the person's ordinary income free area (see points 1068A - E14 to 1068A - E18 below).

Note: A person's ordinary income free area is the amount of ordinary income that the person can have without any deduction being made from the person's maximum payment rate.

Step 3. Work out whether the person's ordinary income exceeds the person's ordinary income free area.

Step 4. If the person's ordinary income does not exceed the person's ordinary income free area, the person's ordinary income excess is nil.

Step 5. If the person's ordinary income exceeds the person's ordinary income free area, the person's ordinary income excess is the person's ordinary income less the person's ordinary income free area.

Step 6. Use the person's ordinary income excess to work out the person's reduction for ordinary income using points 1068A - E19 and 1068A - E20 below.

Note 1: See point 1068A - A1 (Steps 5 and 6) for the significance of the person's reduction for ordinary income.

Note 2: The application of the ordinary income test is affected by provisions concerning the following:

(a) the general concept of ordinary income and the treatment of certain income amounts (Division 1 of Part 3.10);

(b) business income (sections 1074 and 1075);

(c) income from financial assets (including income streams (short term) and certain income streams (long term)) (Division 1B of Part 3.10);

(d) income from income streams not covered by Division 1B of Part 3.10 (Division 1C of Part 3.10);

(e) disposal of income (sections 1106 to 1111).

Directed termination payments excluded

1068A - E2 If:

(a) a person's employment has been terminated; and

(b) as a result the person is entitled to a lump sum payment from the person's former employer; and

(c) the payment, or part of the payment, is a directed termination payment within the meaning of section 82 - 10F of the Income Tax (Transitional Provisions) Act 1997 ;

the payment, or that part, is to be disregarded in working out the ordinary income of the person for the purposes of this Module.

Certain leave payments taken to be ordinary income--employment continuing

1068A - E3 If:

(a) a person is employed; and

(b) the person is on leave for a period; and

(c) the person is or was entitled to receive a leave payment (whether as a lump sum payment, as a payment that is one of a series of regular payments or otherwise) in respect of a part or all of the leave period;

the person is taken to have received ordinary income for a period (the income maintenance period ) equal to the leave period to which the leave payment entitlement relates.

Certain termination payments taken to be ordinary income

1068A - E4 If:

(a) a person's employment has been terminated; and

(b) the person receives a termination payment (whether as a lump sum payment, as a payment that is one of a series of regular payments or otherwise);

the person is taken to have received ordinary income for a period (the income maintenance period ) equal to the period to which the payment relates.

More than one termination payment on a day

1068A - E5 If:

(a) the person is covered by point 1068A - E4; and

(b) the person receives more than one termination payment on a day;

the income maintenance period is worked out by adding the periods to which the payments relate.

Start of income maintenance period--employment continuing

1068A - E6 If the person is covered by point 1068A - E3, the income maintenance period starts on the first day of the leave period to which the leave payment entitlement relates.

Start of income maintenance period--employment terminated

1068A - E7 If the person is covered by point 1068A - E4, the income maintenance period starts, subject to point 1068A - E8, on the day the person is paid the termination payment.

Commencement of income maintenance period where there is a second termination payment

1068A - E8 If a person who is covered by point 1068A - E4 is subject to an income maintenance period (the first period ) and the person is paid another termination payment during that period (the second leave payment ), the income maintenance period for the second termination payment commences on the day after the end of the first period.

1068A - E9 If the Secretary is satisfied that a person is in severe financial hardship because the person has incurred unavoidable or reasonable expenditure while an income maintenance period applies to the person, the Secretary may determine that the whole, or any part, of the period does not apply to the person.

Note 1: For in severe financial hardship see subsection 19C(2) (person who is not a member of a couple).

Note 2: For unavoidable or reasonable expenditure see subsection 19C(4).

Note 3: If an income maintenance period applies to a person, then, during that period:

(a) the pension PP (single) claimed may not be payable to the person; or

(b) the amount of the pension PP (single) payable to the person may be reduced.

When a person receives a leave payment or a termination payment

1068A - E10 For the purposes of points 1068A - E2 to 1068A - E9 (inclusive), a person (the first person ) is taken to receive a leave payment or termination payment if the payment is made to another person:

(a) at the direction of the first person or a court; or

(b) on behalf of the first person; or

(c) for the benefit of the first person; or

the first person waives or assigns the first person's right to receive the payment.

Single payment in respect of different kinds of termination payments

1068A - E11 If a person who is covered by point 1068A - E4 receives a single payment in respect of different kinds of termination payments, then, for the purposes of the application of points 1068A - E3 to 1068A - E10 (inclusive), each part of the payment that is in respect of a different kind of termination payment is taken to be a separate payment and the income maintenance period in respect of the single payment is worked out by adding the periods to which the separate payments relate.

1068A - E12 In points 1068A - E3 to 1068A - E12 (inclusive):

"leave payment" includes a payment in respect of sick leave, annual leave, maternity leave and long service leave, but does not include an instalment of parental leave pay.

"period to which the payment relates" means:

(a) if the payment is a leave payment--the leave period to which the payment relates; or

(b) if the payment is a termination payment and is calculated as an amount equivalent to an amount of ordinary income that the person would (but for the termination) have received from the employment that was terminated--the period for which the person would have received that amount of ordinary income; or

(c) if the payment is a termination payment and paragraph (b) does not apply--the period of weeks (rounded down to the nearest whole number) in respect of which the person would have received ordinary income, from the employment that was terminated, of an amount equal to the amount of the termination payment if:

(i) the person's employment had continued; and

(ii) the person received ordinary income from the employment at the rate per week at which the person usually received ordinary income from the employment prior to the termination.

"redundancy payment" includes a payment in lieu of notice, but does not include a directed termination payment within the meaning of section 82 - 10F of the Income Tax (Transitional Provisions) Act 1997 .

"termination payment" includes:

(a) a redundancy payment; and

(b) a leave payment relating to a person's employment that has been terminated; and

(c) any other payment that is connected with the termination of a person's employment.

Payment of arrears of periodic compensation payments

1068A - E13 If:

(a) at the time of an event that gives rise to an entitlement of a person to compensation, the person is receiving a compensation affected payment; and

(b) in relation to that entitlement, the person receives a payment of arrears of periodic compensation;

the person is taken to receive, on each day in the periodic payments period, an amount calculated by dividing the amount received by the number of days in the periodic payments period.

Note: For compensation affected payment and periodic payments period see section 17.

How to calculate a person's ordinary income free area

1068A - E14 A person's ordinary income free area is worked out using Table E. The ordinary income free area is the amount in Column 2 plus the additional amount in Column 4 for each dependent child of the person.

Table E--Ordinary income free area | ||||

Column 1 Item | Column 2 Basic free area per year | Column 3 Basic free area per fortnight | Column 4 Additional free area per year | Column 5 Additional free area per fortnight |

1 | $2,600 | $100 | $639.60 | $24.60 |

Note 1: For dependent child see section 5 and point 1068A - E21.

Note 2: The basic free area per year is indexed annually in line with CPI increases (see sections 1191 to 1194).

No additional free area for certain prescribed student children

1068A - E15 No additional free area is to be added for a dependent child who:

(a) has turned 18; and

(b) is a prescribed student child;

unless the person whose rate is being calculated receives carer allowance for the child.

Reduction of additional free area for dependent children

1068A - E16 The additional free area for a dependent child is reduced by the annual amount of any payment received by the person for or in respect of that particular child. The payments referred to in point 1068A - E17 do not result in a reduction.

Payments that do not reduce additional free area

1068A - E17 No reduction is to be made under point 1068A - E16 for a payment:

(a) under this Act; or

(b) of maintenance income; or

(c) under the Veterans' Entitlements Act; or

(d) under an Aboriginal study assistance scheme; or

(e) under the Assistance for Isolated Children Scheme.

Note: For Aboriginal study assistance scheme see subsection 23(1).

Examples of payments reducing additional free area

1068A - E18 Examples of the kinds of payments that result in a reduction under point 1068A - E16 are:

(a) amounts received from State authorities or registered public benevolent institutions in respect of the boarding out of the child; or

(b) amounts of superannuation or compensation paid in respect of the child; or

(c) amounts (other than amounts covered by point 1068A - E17) paid in respect of the child under educational schemes; or

(d) foster care allowance payments made by a State welfare authority.

Ordinary income excess

1068A - E19 A person's ordinary income excess is the person's ordinary income less the person's ordinary income free area.

Reduction for ordinary income

1068A - E20 A person's reduction for ordinary income is:

![]()

1068A - E21 In this Module:

"dependent child" , in relation to a person, includes any child of the person who is under 18 and is receiving a youth allowance.

Remote area allowance

1068A - F1 An amount by way of remote area allowance is to be added to a person's rate if:

(a) any of the following subparagraphs applies:

(i) apart from this point, the person's rate would be greater than nil;

(ii) apart from this point, the person's rate would be nil merely because an advance pharmaceutical allowance has been paid to the person under Part 2.23 of this Act;

(iii) apart from this point, the person's rate would be nil merely because an election by the person under subsection 1061VA(1) is in force;

(iv) apart from this point, the person's rate would be nil merely because of both of the matters mentioned in subparagraphs (ii) and (iii); and

(b) the person's usual place of residence is situated in a remote area; and

(c) the person is physically present in the remote area.

Note: For remote area and physically present in the remote area see section 14.

Rate of remote area allowance

1068A - F2 The rate of remote area allowance payable to a person is worked out using Table F. The rate of remote area allowance is the amount in Column 2 plus the additional corresponding amount in Column 4 for each FTB child, and each regular care child, of the person.

Table F--Remote area allowance | ||||

Column 1 Item | Column 2 Basic allowance per year | Column 3 Basic allowance per fortnight | Column 4 Additional allowance per year | Column 5 Additional allowance per fortnight |

1 | $473.20 | $18.20 | $189.80 | $7.30 |