Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) This section applies to a person if:

(a) the person's rate of social security pension is calculated in accordance with Pension Rate Calculator A at the end of section 1064; and

(b) the person has reached pension age.

Note: For pension age see subsections 23(5A), (5B), (5C) and (5D).

Work bonus income greater than or equal to income concession amount

(2) If the person's work bonus income for an instalment period is greater than or equal to the income concession amount for that period, then, for the purposes of Module E of that Rate Calculator, the amount of the person's work bonus income for that period is reduced by an amount equal to the income concession amount.

Note: For work bonus income , see subsection (4BA).

Example 1: David has $2,300 of work bonus income in an instalment period of 14 days. David's rate of social security pension for that period is greater than nil.

David's work bonus income for that period is reduced by $300, leaving David $2,000 of work bonus income for that period.

Example 2: Amy has $1,000 of work bonus income in an instalment period of 14 days. Amy's rate of social security pension for that period is greater than nil.

Amy's work bonus income for that period is reduced by $300, leaving Amy $700 of work bonus income for that period.

(3) If the person's unused concession balance (see section 1073AB) is greater than or equal to the amount (the current amount ) of the person's work bonus income that remains after applying subsection (2) of this section in relation to an instalment period:

(a) for the purposes of Module E of that Rate Calculator, the person's work bonus income for that period is further reduced to nil; and

(b) if the person's rate of social security pension for that period is greater than nil--the person's unused concession balance is reduced by an amount equal to the current amount.

Example 1: To continue example 1 in subsection (2), assume David's unused concession balance is $2,000. The current amount is $2,000.

David's work bonus income for that period is further reduced to nil.

David's unused concession balance is now nil.

Example 2: To continue example 2 in subsection (2), assume Amy's unused concession balance is $1,600. The current amount is $700.

Amy's work bonus income for that period is further reduced to nil.

Amy's unused concession balance is now $900.

(4) If the person's unused concession balance (see section 1073AB) is greater than nil but less than the amount of the person's work bonus income that remains after applying subsection (2) of this section in relation to an instalment period:

(a) for the purposes of Module E of that Rate Calculator, the person's work bonus income for that period is further reduced by an amount equal to that unused concession balance; and

(b) if the person's rate of social security pension for that period is greater than nil--the person's unused concession balance is reduced to nil.

Example: Bill has $1,300 of work bonus income in an instalment period of 14 days. Bill's rate of social security pension for that period is greater than nil.

Under subsection (2), Bill's work bonus income for that period is reduced by $300, leaving Bill $1,000 of work bonus income for that period.

Assume Bill's unused concession balance is $800.

Under subsection (4), Bill's work bonus income for that period is further reduced by $800 leaving Bill $200 of work bonus income for that period.

Bill's unused concession balance is now nil.

Work bonus income less than income concession amount

(4A) If the person has work bonus income for an instalment period but that income is less than the income concession amount for that period:

(a) for the purposes of Module E of that Rate Calculator, the person's work bonus income for that period is reduced to nil; and

(b) if the person's rate of social security pension for that period is greater than nil--the person's unused concession balance (see section 1073AB) is increased, subject to subsection 1073AB(2), by an amount equal to the difference between that income concession amount and that work bonus income (before it was reduced).

Note: For work bonus income , see subsection (4BA).

Example: Emma has $100 of work bonus income in an instalment period of 14 days. Emma's rate of social security pension for that period is greater than nil.

Emma's work bonus income for that period is reduced to nil.

Emma's unused concession balance is increased by $200.

(4B) If:

(a) the person has no work bonus income for an instalment period; and

(b) the person's rate of social security pension for that period is greater than nil;

the person's unused concession balance (see section 1073AB) is increased, subject to subsection 1073AB(2), by an amount equal to the income concession amount for that period.

Note: For work bonus income , see subsection (4BA).

(4BA) For the purposes of this section, a person's work bonus income for an instalment period is the sum of the following:

(a) the person's employment income taken, in accordance with Division 1AA, to have been received for that period;

(b) the sum of the person's gainful work income for each day in that period.

Note: For employment income , see section 8.

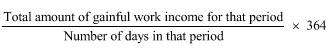

(4BB) For the purposes of this section, a person's gainful work income for a day in an instalment period is the amount worked out using the following formula:

where:

"annual amount" means the annual amount of ordinary income of the person that is earned, derived or received by the person from gainful work (within the meaning of section 1073AAA) undertaken by the person, being the annual amount as last determined by the Secretary.

(4BC) The amount at paragraph (4BA)(b) is to be rounded to the nearest cent (rounding 0.5 cents downwards).

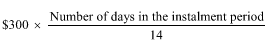

(4C) The income concession amount is:

(a) for an instalment period of 14 days--$300; and

(b) for an instalment period of less than 14 days--the amount worked out using the following formula:

Interpretation

(5A) If a person has gainful work income for an instalment period, the rate of the person's gainful work income on a yearly basis for each day in that period may be worked out using the following formula:

Note: This subsection will be relevant to working out the person's rate of social security pension in accordance with Pension Rate Calculator A at the end of section 1064 or Pension Rate Calculator C at the end of section 1066.

(5B) An amount worked out under subsection (5A) is to be rounded to the nearest cent (rounding 0.5 cents downwards).

(6) If the person is a member of a couple, apply this section in relation to the person, and to the person's partner, before applying point 1064 - E2.

(7) In working out a person's employment income for the purposes of this section, disregard subsection 8(1B).

(8) If:

(a) the person is a member of a couple; and

(b) the person's partner's work bonus income (within the meaning of section 46AA of the Veterans' Entitlements Act 1986 ) is reduced by one or more amounts (each of which is a reduction amount ) under section 46AA of that Act;

then, in applying point 1064 - E2, the ordinary income of the person's partner is to be reduced by an amount equal to the total of the reduction amounts.