Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

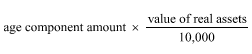

Commonwealth Consolidated Acts(1) The maximum loan available to a person under the pension loans scheme is the amount worked out using the formula:

where:

"age component amount" means the amount that is specified in a determination under subsection (3) and that relates to:

(a) if the person is not a member of a couple--the age the person turned on his or her last birthday; or

(b) if the person is a member of a couple--the age the younger member of the couple turned on his or her last birthday.

"value of real assets" means:

(a) if neither subparagraph 1133(1)(d)(ii) nor subparagraph 1133(2)(d)(ii) applied to the person when the person made his or her request to participate in the pension loans scheme--the value of the real assets (after deduction of any nominated amount); or

(b) if subparagraph 1133(1)(d)(ii) or (2)(d)(ii) applied to the person when the person made his or her request to participate in the pension loans scheme--the value of the charge referred to in paragraph 1133(3)(c).

Note 1: For real assets see subsection 1133AA(1).

Note 2: For nominated amount see subsection 1133AA(1).

(2) For the purposes of subsection (1), the following provisions have effect:

(a) if, but for this paragraph, the value of real assets would be an amount that exceeds $10,000 but is not a multiple of $10,000, the value is to be taken to be the next lower amount that is a multiple of $10,000;

(b) if, but for this paragraph, the value of real assets would be less than $10,000, the value is to be taken to be nil.

(3) The Minister may, by legislative instrument, make a determination for the purposes of the following:

(a) the definition of age component amount in subsection (1) of this section;

(b) the definition of age component amount in subsection 52ZCA(1) of the Veterans' Entitlements Act 1986 .