Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) This section applies to the members of a pensioner couple.

(2) If one or both of the members of a couple have financial assets, the members of the couple are taken, for the purposes of this Act, to receive together ordinary income on those assets in accordance with this section.

(3) If the total value of the couple's financial assets is equal to or less than the couple's deeming threshold, the ordinary income the couple is taken to receive per year on the financial assets is the amount worked out by multiplying the value of those assets by the below threshold rate.

(3A) If the total value of the couple's financial assets exceeds the couple's deeming threshold, the ordinary income that the couple is taken to receive is worked out as follows:

Method statement

Step 1. Multiply the couple's deeming threshold by the below threshold rate.

Note 1: For deeming threshold see subsection 1081(2).

Note 2: For below threshold rate see subsection 1082(1).

Step 2. Subtract the deeming threshold from the total value of the couple's financial assets.

Note: For deeming threshold see subsection 1081(2).

Step 3. Multiply the remainder worked out at Step 2 by the above threshold rate.

Note: For above threshold rate see subsection 1082(2).

Step 4. The total of the amounts worked out at Steps 1 and 3 represents the ordinary income the couple is taken to receive per year on the financial assets.

(3B) However, if subsection 1118(2) applies in relation to a member of the couple and:

(a) the couple have financial assets that are proceeds:

(i) from the sale of the principal home of a member of the couple; and

(ii) described in paragraph 1118(2)(a) or (c); and

(b) the earlier of the times mentioned in that paragraph has not occurred for the member of the couple and the proceeds;

then:

(c) those financial assets are to be disregarded for the purposes of working out the ordinary income the couple is taken to receive under subsection (3) or (3A); and

(d) the ordinary income the couple is taken to receive per year on those financial assets is the amount worked out by multiplying the value of those financial assets by the below threshold rate.

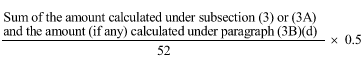

(4) Each member of the couple is taken, for the purposes of this Act, to receive, as ordinary income during each week, an amount worked out under the following formula: