Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) This section applies in calculating the value of a person's investment in a superannuation fund if:

(a) the fund has 4 or fewer members; and

(b) the fund has reserves (within the meaning of section 115 of the Superannuation Industry (Supervision) Act 1993 ).

Note: The value of a person's investment in a superannuation fund is only included in the value of the person's assets after the person reaches pension age or starts to receive a pension or annuity out of the fund (see paragraph 1118(1)(f)).

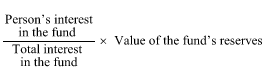

(2) Despite paragraph 1118(1)(h), the value of the person's investment in the superannuation fund includes the following amount:

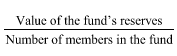

(3) However, if it is not possible to work out the person's interest in the superannuation fund, the value of the person's investment in the fund includes the following amount: