Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) If there is a charge or encumbrance over a particular asset of the person, the value of the asset, for the purposes of calculating the value of the person's assets for the purposes of this Act (other than Division 1B of Part 3.10), is to be reduced by the value of that charge or encumbrance.

Note: This section does not apply to an asset to which section 1121A (primary production assets) applies.

(1A) Subsection (1) does not apply to a charge that arises under section 1138.

Note: See subsection (5) for a charge that arises under section 1138.

(2) Subsection (1) does not apply to a charge or encumbrance over an asset of a person to the extent that:

(a) the charge or encumbrance is a collateral security; or

(b) the charge or encumbrance was given for the benefit of a person other than the person or the person's partner.

(3) Subsection (1) does not apply to a charge or encumbrance over assets that are to be disregarded under section 1118.

(3A) Subsection (1) does not apply to an asset that is an asset - tested income stream (long - term).

(3B) Subsection (1) does not apply to an asset that is a partially asset - test exempt income stream (within the meaning of section 1118).

(3C) Subsection (1) does not apply to an asset that is an asset - tested income stream (lifetime).

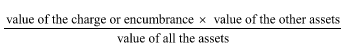

(4) If:

(a) there is a charge or encumbrance over assets; and

(b) the charge does not arise under section 1138; and

(c) the assets consist of assets whose value is to be disregarded under section 1118 and other assets;

the amount to be deducted under subsection (1) is:

(5) If:

(a) a person is or was participating in the pension loans scheme; and

(b) either:

(i) the person's real assets are subject to a charge under section 1138; or

(ii) if the person is a member of a couple--the couple's real assets are subject to a charge under section 1138;

then the value of those real assets, for the purposes of calculating the value of the person's assets for the purposes of this Act (other than Division 1B of Part 3.10), is to be reduced by the amount of the debt owed by the person under section 1135 because of that participation.

Note: If there are other charges or encumbrances over any of those real assets, there may be a further reduction under subsection (1) in the value of those assets.

(6) This section has effect subject to sections 1145A to 1157 (special residences).