Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated ActsSettlement of civil action

(1) If the Commonwealth has agreed to settle a civil action against a debtor for recovery of a debt for less than the full amount of the debt, the Secretary must waive the right to recover the difference between the debt and the amount that is the subject of the settlement.

Settlement of proceedings before the ART

(2) If the Secretary has agreed to settle proceedings before the ART relating to recovery of a debt on the basis that the debtor will pay less than the full amount of the debt, the Secretary must waive the right to recover the difference between the debt and the amount that is the subject of the settlement.

Waiver where at least 80% of debt recovered and debtor cannot pay more

(3) If:

(a) the Commonwealth has recovered at least 80% of the original value of a debt from a debtor; and

(b) the Commonwealth and the debtor agree that the recovery is in full satisfaction for the whole of the debt; and

(c) the debtor cannot repay a greater proportion of the debt;

the Secretary must waive the remaining 20% or less of the value of the original debt.

Agreement for part - payment in satisfaction of outstanding debt

(4) If the Secretary and a debtor agree that the debtor's debt will be fully satisfied if the debtor pays the Commonwealth an agreed amount less than the amount of the debt outstanding at the time of the agreement (the unpaid amount ), the Secretary must waive the right to recover the difference between the unpaid amount and the agreed amount.

Limits on agreement to accept part - payment in satisfaction of outstanding debt

(5) The Secretary must not make an agreement described in subsection (4) unless the Secretary is satisfied that the agreed amount is at least the present value of the unpaid amount if it is repaid in instalments of amounts, and at times, determined by the Secretary.

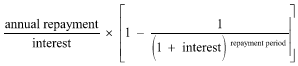

Formula for working out present value of unpaid amount

(6) For the purposes of subsection (5), the present value of the unpaid amount is the amount worked out in accordance with the following formula:

where:

"annual repayment" is the amount of the debt that the Secretary believes would be recovered under Part 5.3 in a year if subsection (4) did not apply in relation to the debt.

"interest" is the annual rate of interest specified by the Minister by legislative instrument.

"repayment period" is the number of years needed to repay the unpaid amount if repayments equal to the annual repayment were made each year.

Example:

Facts: Bill owed a debt of $35,000 to the Commonwealth. After repaying $5,000 (leaving an unpaid amount of $30,000), he offers to make an immediate payment of a further $20,000 in full satisfaction of the debt. The Secretary is satisfied that Bill cannot repay a larger amount of the debt than this. The Secretary believes that $1,500 of the debt would be recovered under Part 5.3 in a year, at which rate it would take 20 years to repay the debt. The Minister has specified an interest rate of 5% a year for the purposes of subsection (6).

Application: The Secretary can accept Bill's offer and make an agreement with him as described in subsection (4), because the $20,000 is more than the present value of $30,000 repaid over 20 years at a 5% interest rate (which is

![]()

If the Secretary makes the agreement, the Secretary must waive $10,000 of the debt (the difference between the unpaid amount of $30,000 and the agreed amount of $20,000).

Note: Section 1237AAE limits the circumstances in which an assurance of support debt may be waived under this section, and the amount of the debt that may be waived.