Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated ActsAct No. 132 of 2000 as amended

This compilation was prepared on 18 July 2005

[This Act was amended by Act No. 100 of 2005]

Amendment from Act No. 100 of 2005

[Schedule 2 (item 25) amended heading to item 23 of Schedule 1

Schedule 2 (item 25) commenced immediately after 13 November 2000]

Prepared by the Office of Legislative Drafting and Publishing,

Attorney-General's Department, Canberra

Contents

1 Short title

2 Commencement

3 Schedule(s)

Schedule 1--Amendment of the Social Security Act 1991

Schedule 2--Amendment of the Veterans' Entitlements Act 1986

Schedule 3--Amendment of the Farm Household Support Act 1992

Schedule 4--Amendment of the Income Tax Assessment Act 1936

Schedule 5--Amendment of the Taxation Administration Act 1953

[Assented to 13 November 2000]

The Parliament of Australia enacts:

This Act may be cited as the Social Security and Veterans' Entitlements Legislation Amendment (Private Trusts and Private Companies--Integrity of Means Testing) Act 2000 .

This Act commences on the day on which it receives the Royal Assent.

Each Act that is specified in a Schedule to this Act is amended or repealed as set out in the applicable items in the Schedule concerned, and any other item in a Schedule to this Act has effect according to its terms.

1 Subsection 11(1) (definition of asset)

After "property" (wherever occurring), insert "or money".

2 At the end of section 198E

Add:

; and (c) Part 3.18, except Division 9.

3 Paragraph 547D(a)

After "(c)", insert "and Part 3.18".

4 At the end of paragraphs 547D(b) and (c)

Add "(disregarding Part 3.18)".

5 Section 1064

Omit "section 1207", substitute "section 1210".

6 Section 1066

Omit "section 1207", substitute "section 1210".

7 Section 1066A

Omit "section 1207", substitute "section 1210".

8 Section 1067G

Omit "section 1207", substitute "section 1210".

9 Points 1067G-G3, 1067G-G3A and 1067G-G4

After "specified in the regulations", insert "(disregarding Part 3.18)".

10 Section 1067L

Omit "section 1207", substitute "section 1210".

11 Section 1068

Omit "section 1207", substitute "section 1210".

12 Section 1068A

Omit "section 1207", substitute "section 1210".

13 Paragraph 1133(1)(d)

Repeal the paragraph, substitute:

(d) either:

(i) the value of the person's real assets (after deduction of any guaranteed amount) is sufficient to secure the payment of any debt that may become payable to the Commonwealth under this Division; or

(ii) subsection (3) applies to the person.

14 Paragraph 1133(2)(d)

Repeal the paragraph, substitute:

(d) either:

(i) the value of the couple's real assets (after deduction of any guaranteed amount) is sufficient to secure the payment of any debt that may become payable to the Commonwealth under this Division; or

(ii) subsection (3) applies to both of the members of the couple.

15 At the end of section 1133

Add:

(3) This subsection applies to a person if:

(a) either:

(i) the person is an attributable stakeholder of a company or trust (within the meaning of Part 3.18); or

(ii) the person is a member of a couple and the other member of the couple is an attributable stakeholder of a company or trust (within the meaning of Part 3.18); and

(b) the company or trustee has given the Commonwealth a guarantee that the company or trustee will pay any debt that may become payable to the Commonwealth by the person under this Division; and

(c) the company's or trustee's liability under the guarantee is secured by a charge against real property of the company or trust in Australia; and

(d) the Secretary is satisfied that the value of that real property is sufficient to secure the payment of any amount that may become payable by the company or trustee under the guarantee; and

(e) the Secretary has, by writing, approved the guarantee and the charge.

16 Subsection 1135A(1) (definition of value of real assets)

Repeal the definition, substitute:

value of real assets means:

(a) if neither subparagraph 1133(1)(d)(ii) nor subparagraph 1133(2)(d)(ii) applied to the person when the person made his or her request to participate in the pension loans scheme--the value of the real assets (after deduction of any guaranteed amount); or

(b) if subparagraph 1133(1)(d)(ii) or (2)(d)(ii) applied to the person when the person made his or her request to participate in the pension loans scheme--the value of the charge referred to in paragraph 1133(3)(c).

17 After subsection 1136(1A)

Insert:

(1B) Paragraphs (1A)(a) and (b) do not apply if subparagraph 1133(1)(d)(ii) or (2)(d)(ii) applied to the person when the person made his or her request to participate in the pension loans scheme.

18 After subsection 1137(1)

Insert:

(1A) Paragraphs (1)(a) and (c) do not apply if subparagraph 1133(1)(d)(ii) or (2)(d)(ii) applied to the person when the person made his or her request to participate in the pension loans scheme.

19 At the end of section 1138

Add:

(4) This section does not apply if subparagraph 1133(1)(d)(ii) or (2)(d)(ii) applied to the person when the person made his or her request to participate in the pension loans scheme.

20 Section 1168

Omit "section 1207" (wherever occurring), substitute "section 1210".

21 Section 1190 (at the end of the table)

Add:

| Attribution threshold |

|

|

65 | Primary production attribution threshold | Primary production attribution threshold | Section 1208U |

22 Subsection 1191(1) (at the end of the table)

Add:

| Primary production attribution threshold |

|

|

|

|

37 | Primary production attribution threshold | 1 July | December | Most recent December quarter before reference quarter | $250.00 |

23 After Part 3.16B

Insert:

The following is a simplified outline of this Part:

• This Part sets up a system for the attribution to individuals of the assets and income of private companies and private trusts (sections 1207Y and 1208E).

• Attribution starts on 1 January 2002.

• For an asset or income to be attributed to an individual:

(a) the company must be a designated private company or the trust must be a designated private trust (sections 1207N and 1207P); and

(b) the company must be a controlled private company in relation to the individual or the trust must be a controlled private trust in relation to the individual (sections 1207Q and 1207V); and

(c) the individual must be an attributable stakeholder of the company or trust (section 1207X).

• A company or trust will be a controlled private trust or a controlled private company if the individual passes a control test or a source test.

• An individual will not be an attributable stakeholder of a trust if the trust is a concessional primary production trust in relation to the individual.

• The asset deprivation rules and the income deprivation rules are modified if attribution happens.

In this Part, unless the contrary intention appears:

actively involved with a primary production enterprise has the meaning given by section 1207J.

actual transfer, in relation to property or services, means a transfer of the property or services other than a transfer that is taken to have been made because of subsection 1207H(1), (3) or (4).

adjusted net primary production income (in Division 11) has the meaning given by section 1209.

adjusted net value (in Division 11) has the meaning given by section 1208Z.

arm's length amount, in relation to an actual transfer of property or services to a company or a trust, means the amount that the company or trust could reasonably be expected to have been required to pay to obtain the property or the services concerned from the transferor under a transaction where the parties to the transaction are dealing with each other at arm's length in relation to the transaction.

asset attribution percentage has the meaning given by section 1207X.

associate has the meaning given by section 1207C.

attributable stakeholder has the meaning given by section 1207X.

attribution period has the meaning given by section 1208D.

business partnership means a partnership within the meaning of the Income Tax Assessment Act 1997 .

child, in relation to a person, includes an adopted child, a step-child or a foster -child.

company has the same meaning as in the Income Tax Assessment Act 1997 .

concessional primary production trust has the meaning given by section 1208U.

constituent document, in relation to a company, means:

(a) the memorandum and articles of association of the company; or

(b) any rules or other documents constituting the company or governing its activities.

control includes control as a result of, or by means of, trusts, agreements, arrangements, understandings and practices, whether or not having legal or equitable force and whether or not based on legal or equitable rights.

controlled private company has the meaning given by section 1207Q.

controlled private trust has the meaning given by section 1207V.

decision-making principles means decision-making principles under section 1209E.

derivation period has the meaning given by section 1208C.

designated private company has the meaning given by section 1207N.

designated private trust has the meaning given by section 1207P.

director includes any person (by whatever name called) occupying the position of a director of a company.

entity means any of the following:

(a) an individual;

(b) a company;

(c) a trust;

(d) a business partnership;

(e) a corporation sole;

(f) a body politic.

group includes:

(a) one entity alone; or

(b) a number of entities, even if they are not in any way associated with each other or acting together.

income attribution percentage has the meaning given by section 1207X.

interest in a share has the meaning given by section 1207U.

majority voting interest, in relation to a company, has the meaning given by section 1207E.

primary production enterprise means a business in Australia that consists of primary production.

property includes money.

relative, in relation to a person, has the meaning given by section 1207B.

scheme means:

(a) any agreement, arrangement, understanding, promise or undertaking, whether express or implied and whether or not enforceable, or intended to be enforceable, by legal proceedings; or

(b) any scheme, plan, proposal, action, course of action or course of conduct, whether there are 2 or more parties or only one party involved.

services includes any benefit, right (including a right in relation to, and an interest in, real or personal property), privilege or facility and, without limiting the generality of the foregoing, includes a benefit, right, privilege, service or facility that is, or is to be, provided under:

(a) an arrangement for or in relation to:

(i) the performance of work (including work of a professional nature), whether with or without the provision of property; or

(ii) the provision of, or of the use of facilities for, entertainment, recreation or instruction; or

(iii) the conferring of benefits, rights or privileges for which remuneration is payable in the form of a royalty, tribute, levy or similar exaction; or

(b) a contract of insurance; or

(c) an arrangement for or in relation to the lending of money.

share includes stock.

spouse includes, in relation to a person who is a member of a couple (as defined by section 4), the other member of the couple.

subsidiary has the same meaning as in the Corporations Law.

sufficiently influenced, in relation to a company, has the meaning given by section 1207D.

transfer:

(a) in relation to property--includes dispose of (whether by assignment, declaration of trust or otherwise) or provide; and

(b) in relation to services--includes allow, confer, give, grant, perform or provide.

trust means a person in the capacity of trustee or, as the case requires, a trust estate.

trustee has the same meaning as in the Income Tax Assessment Act 1997 .

underlying transfer, in relation to a transfer of property or services to an entity, means:

(a) if that transfer was an actual transfer--the actual transfer; or

(b) if that transfer was taken to have been made because of subsection 1207H(1)--the actual transfer referred to in that subsection; or

(c) if that transfer was taken to have been made because of subsection 1207H(3)--the actual transfer referred to in paragraph 1207H(3)(b); or

(d) if that transfer was taken to have been made because of subsection 1207H(4)--the actual transfer referred to in paragraph 1207H(4)(c).

voting power has the meaning given by section 1207S.

(1) For the purposes of this Part, a relative, in relation to a person (the first person), means any of the following:

(a) the spouse of the first person;

(b) a parent, grandparent, brother, sister, uncle, aunt, nephew, niece, first cousin, second cousin or lineal descendant of the first person;

(c) the spouse of a person covered by paragraph (b);

(d) a parent, grandparent, brother, sister, uncle, aunt, nephew, niece, first cousin, second cousin or lineal descendant of the spouse of the first person;

(e) the spouse of a person covered by paragraph (d);

(f) a child of a person covered by any of the preceding paragraphs.

(2) For the purposes of this section, in determining who is a parent, grandparent, brother, sister, uncle, aunt, nephew, niece, first cousin, second cousin or lineal descendant of a person, treat each of the following relationships as if they were biological child -parent relationships:

(a) the relationship between an adopted child and his or her adoptive parent;

(b) the relationship between a step -child and his or her step-parent;

(c) the relationship between a foster -child and his or her foster-parent.

(1) For the purposes of this Part, in determining:

(a) whether a trust is a designated private trust; or

(b) whether a company is a controlled private company in relation to an individual; or

(c) whether a trust is a controlled private trust in relation to an individual; or

(d) whether a trust is a concessional primary production trust in relation to an individual;

the following are associates of an individual:

(e) a relative of the individual;

(f) an entity who, in matters relating to the trust or company:

(i) acts, or is accustomed to act; or

(ii) under a contract or an arrangement or understanding (whether formal or informal), is intended or expected to act;

in accordance with the directions, instructions or wishes of:

(iii) the individual; or

(iv) the individual and another entity who is an associate of the individual because of another paragraph of this subsection;

(g) an entity that is a declared associate of the individual (see subsection (2));

(h) a business partner of the individual or a business partnership in which the individual is a business partner;

(i) if a business partner of the individual is an individual--the spouse or a child of that business partner;

(j) a trustee of a trust, where:

(i) the individual; or

(ii) another entity that is an associate of the individual because of another paragraph of this subsection;

benefits or is capable (whether by the exercise of a power of appointment or otherwise) of benefiting under the trust, either directly or through any interposed companies, business partnerships or trusts;

(k) a company, where the company is sufficiently influenced by:

(i) the individual; or

(ii) another entity that is an associate of the individual because of another paragraph of this subsection; or

(iii) another company that is an associate of the individual because of another application of this paragraph; or

(iv) 2 or more entities covered by the preceding subparagraphs;

(l) a company, where a majority voting interest in the company is held by:

(i) the individual; or

(ii) the entities that are associates of the individual because of any of the preceding paragraphs of this subsection; or

(iii) the individual and the entities that are associates of the individual because of any of the preceding paragraphs of this subsection.

Declared associate

(2) The Secretary may, by writing, determine that each entity included in a specified class of entities is taken to be a declared associate of an individual for the purposes of this section.

(3) A determination under subsection (2) has effect accordingly.

(4) A determination under subsection (2) is a disallowable instrument for the purposes of section 46A of the Acts Interpretation Act 1901 .

For the purposes of this Part, a company is sufficiently influenced by an entity or entities if the company, or its directors:

(a) are accustomed or under an obligation (whether formal or informal); or

(b) might reasonably be expected;

to act in accordance with the directions, instructions or wishes of the entity or entities.

For the purposes of this Part, an entity or entities hold a majority voting interest in a company if the entity or entities are in a position to cast, or control the casting of, more than 50% of the maximum number of votes that might be cast at a general meeting of the company.

For the purposes of this Part, an entity is entitled to acquire anything that the entity is absolutely or contingently entitled to acquire, whether because of any constituent document of a company, the exercise of any right or option or for any other reason.

(1) A reference in this Part to the transfer of property or services to a trust includes a reference to the transfer of such property or services by way of the creation of the trust.

(2) For the purposes of this Part, if an entity acquires property that did not previously exist, the property is taken to have existed immediately before the acquisition and to have been transferred by the entity who created the property.

(3) For the purposes of this Part, property or services are taken to have been transferred to an entity if the property or services have been applied for the benefit of, or in accordance with the directions of, the entity.

(4) Without limiting the generality of subsection (3), a reference in that subsection to the application of property or services for the benefit of an entity includes a reference to the application of property or services in the discharge, in whole or in part, of a debt due by the entity.

(1) For the purposes of this Part, if an entity (the prime entity) causes another entity to actually transfer property or services to a third entity, the prime entity is taken to have transferred the property or services (instead of the other entity).

(2) Subsection (1) does not limit the operation of subsection (3).

(3) If, under a scheme:

(a) an entity (the scheme entity) actually transfers property or services to another entity; and

(b) property or services are actually transferred to a third entity at a particular time otherwise than by the scheme entity;

the Secretary may, for the purposes of this Part, treat the property or services mentioned in paragraph (b) as having been transferred by the scheme entity to the third entity (instead of by any other entity) at that time to such extent as the Secretary considers reasonable.

(4) If:

(a) an individual transfers property or services to an entity (the interposed entity), being a company, a business partnership or a trust; and

(b) a winding -up event occurs in relation to the interposed entity; and

(c) an actual transfer of property or services is made to another entity (the ultimate transferee) at a particular time as a consequence of the interposed entity being wound -up or ceasing to exist;

the Secretary may, for the purposes of this Part, treat the property or services mentioned in paragraph (c) as having been transferred by the individual to the ultimate transferee (instead of by any other entity) at that time to such extent as the Secretary considers reasonable.

(5) For the purposes of this section, each of the following events is a winding-up event in relation to a company:

(a) the company passes a resolution for its winding -up;

(b) an order is made for the winding -up of the company;

(c) any similar event.

(6) For the purposes of this section, a winding-up event occurs in relation to a business partnership if the business partnership ceases to exist for the purposes of the Income Tax Assessment Act 1997.

(7) For the purposes of this section, a winding-up event occurs in relation to a trust if:

(a) the trust commences to be wound -up; or

(b) the trust ceases to exist for the purposes of the Income Tax Assessment Act 1997.

For the purposes of this Part, an individual is taken to have been actively involved with a primary production enterprise if, and only if, the individual:

(a) has contributed a significant part of his or her labour to the development of the enterprise; or

(b) has undertaken educational studies or training in a field that, in the opinion of the Secretary, is relevant to the development or management of the enterprise.

For the purposes of this Part, if the decisions of a trustee are subject to the consent of an entity, the entity is taken to be able to veto the decisions of the trustee.

(1) This Part extends to acts, omissions, matters and things outside Australia.

(2) Disregard subsection (1) in determining whether a provision of this Act (other than this Part) extends to acts, omissions, matters and things outside Australia.

The use of the present tense in a provision of this Part does not imply that the provision does not apply to things happening before the commencement of this Part.

(1) For the purposes of this Part, a company is a designated private company at a particular time if:

(a) the company satisfies at least 2 of the following conditions in relation to the last financial year that ended before that time:

(i) the consolidated gross operating revenue for the financial year of the company and its subsidiaries is less than $10 million;

(ii) the value of the consolidated gross assets at the end of the financial year of the company and its subsidiaries is less than $5 million;

(iii) the company and its subsidiaries have fewer than 50 employees at the end of the financial year; or

(b) the company came into existence after the end of the last financial year that ended before that time; or

(c) the company is a declared private company (see subsection (2));

and the company is not an excluded company (see subsection (5)).

Declared private company

(2) The Secretary may, by writing, determine that each company included in a specified class of companies is a declared private company for the purposes of this section.

(3) A determination under subsection (2) has effect accordingly.

(4) A determination under subsection (2) is a disallowable instrument for the purposes of section 46A of the Acts Interpretation Act 1901 .

Excluded companies

(5) The Secretary may, by writing, declare that each company included in a specified class of companies is an excluded company for the purposes of this section.

(6) A declaration under subsection (5) has effect accordingly.

(7) An instrument under subsection (5) is a disallowable instrument for the purposes of section 46A of the Acts Interpretation Act 1901.

Definitions

(8) In this section:

consolidated gross operating revenue has the same meaning as in section 45A of the Corporations Law.

financial year, in relation to a company, means:

(a) a period of 12 months beginning on 1 July; or

(b) if some other period is the company's tax year--that other period.

value of consolidated gross assets has the same meaning as in section 45A of the Corporations Law.

(1) For the purposes of this Part, a trust is a designated private trust unless:

(a) all of the following conditions are satisfied:

(i) the trust is a fixed trust;

(ii) the units in the trust are held by 50 or more persons;

(iii) the trust was not created, continued in existence or operated under a scheme that was entered into or carried out for the sole or dominant purpose of enabling any individual or individuals to avoid the application of this Part and/or Division 11A of Part IIIB of the Veterans' Entitlements Act; or

(b) the trust is a complying superannuation fund (see subsection (3)); or

(c) the trust is an excluded trust (see subsection (4)).

(2) For the purposes of subparagraph (1)(a)(ii), an individual and his or her associates are taken to be one person.

Complying superannuation funds

(3) For the purposes of this section, a fund is a complying superannuation fund at a particular time if:

(a) that time occurs during a particular tax year of the fund; and

(b) under section 45 of the Superannuation Industry (Supervision) Act 1993, the fund is a complying superannuation fund for the purposes of Part IX of the Income Tax Assessment Act 1936 in relation to that tax year.

Excluded trusts

(4) The Secretary may, by writing, declare that each trust included in a specified class of trusts is an excluded trust for the purposes of this section.

(5) The declaration has effect accordingly.

(6) An instrument under subsection (4) is a disallowable instrument for the purposes of section 46A of the Acts Interpretation Act 1901.

Definitions

(7) In this section:

fixed trust means a trust where persons have fixed entitlements to all of the income and corpus of the trust.

income means income within the ordinary meaning of that expression.

unit, in relation to a trust, includes a beneficial interest, however described, in the property or income of the trust.

(1) For the purposes of this Part, a company is a controlled private company in relation to an individual if the company is a designated private company and:

(a) the individual passes the control test set out in subsection (2); or

(b) the individual passes the source test set out in subsection (3).

Control test

(2) For the purposes of this section, an individual passes the control test in relation to a company if:

(a) the aggregate of:

(i) the direct voting interests in the company that the individual holds; and

(ii) the direct voting interests in the company held by associates of the individual;

is 50% or more; or

(b) the aggregate of:

(i) the direct control interests in the company that the individual holds; and

(ii) the direct control interests in the company held by associates of the individual;

is 15% or more; or

(c) the company is sufficiently influenced by:

(i) the individual; or

(ii) an associate of the individual; or

(iii) 2 or more entities covered by the preceding subparagraphs; or

(d) the individual (either alone or together with associates) is in a position to exercise control over the company.

Source test

(3) For the purposes of this section, an individual passes the source test in relation to a company if:

(a) the individual has transferred property or services to the company after 7.30 pm, by standard time in the Australian Capital Territory, on 9 May 2000; and

(b) the underlying transfer was made for no consideration or for a consideration less than the arm's length amount in relation to the underlying transfer.

No double counting

(4) In calculating the aggregate referred to in paragraph (2)(a), a direct voting interest held because of subsection 1207R(2) is not to be counted under subparagraph (2)(a)(i) to the extent to which it is calculated by reference to a direct voting interest in the company that is taken into account under subparagraph (2)(a)(ii).

(5) In calculating the aggregate referred to in paragraph (2)(b), a direct control interest held because of subsection 1207T(4) is not to be counted under subparagraph (2)(b)(i) to the extent to which it is calculated by reference to a direct control interest in the company that is taken into account under subparagraph (2)(b)(ii).

(1) An entity holds a direct voting interest in a company at a particular time equal to the percentage of the voting power in the company that the entity is in a position to control at that time.

(2) If:

(a) an entity holds a direct voting interest (including a direct voting interest that is taken to be held because of one or more previous applications of this subsection) in a company (the first level company ); and

(b) the first level company holds a direct voting interest in another company (the second level company);

the entity is taken to hold a direct voting interest in the second level company equal to the percentage worked out using the formula:

![]()

where:

first level percentage means the percentage of the direct voting interest held by the entity in the first level company.

second level percentage means the percentage of the direct voting interest held by the first level company in the second level company.

(1) A reference in this Division to the voting power in a company is a reference to the total rights of shareholders to vote, or participate in any decision -making, concerning any of the following:

(a) the making of distributions of capital or profits of the company to its shareholders;

(b) the constituent document of the company;

(c) any variation of the share capital of the company;

(d) any appointment of a director of the company.

(2) A reference in this Division to control of the voting power in a company is a reference to control that is direct or indirect, including control that is exercisable as a result of or by means of arrangements or practices:

(a) whether or not having legal or equitable force; and

(b) whether or not based on legal or equitable rights.

(3) If the percentage of total rights to vote or participate in decision -making differs as between different types of voting or decision-making, the highest of those percentages applies for the purposes of this section.

(4) If a company:

(a) is limited both by shares and by guarantee; or

(b) does not have a share capital;

this section has effect as if the members or policy holders of the company were shareholders in the company.

(1) An entity holds a direct control interest in a company at a particular time equal to the percentage of the total paid-up share capital of the company in which the entity holds an interest at that time.

(2) An entity also holds a direct control interest in a company at a particular time equal to the percentage that the entity holds, or is entitled to acquire, at that time of the total rights to distributions of capital or profits of the company to its shareholders on winding -up.

(3) An entity also holds a direct control interest in a company at a particular time equal to the percentage that the entity holds, or is entitled to acquire, at that time of the total rights to distributions of capital or profits of the company to its shareholders, otherwise than on winding -up.

(4) If:

(a) an entity holds a particular type of direct control interest (including a direct control interest that is taken to be held because of one or more previous applications of this subsection) in a company (the first level company); and

(b) the first level company holds the same type of direct control interest in another company (the second level company);

the entity is taken to hold that type of direct control interest in the second level company equal to the percentage worked out using the formula:

![]()

where:

first level percentage means the percentage of the direct control interest held by the entity in the first level company.

second level percentage means the percentage of the direct control interest held by the first level company in the second level company.

(1) This section applies for the purpose of working out the percentage of a company's total paid -up share capital in which an entity holds an interest.

(2) Subject to this section, for the purposes of this Division, an entity holds an interest in a share if the entity has any legal or equitable interest in the share.

(3) For the purposes of this Division, an entity is taken to hold an interest in a share if:

(a) the entity has entered into a contract to purchase the share; or

(b) the entity has a right (otherwise than because of having an interest under a trust) to have the share transferred to the entity or to the entity's order (whether the right is exercisable presently or in the future and whether or not on the fulfilment of a condition); or

(c) the entity has a right to acquire the share, or an interest in the share, under an option (whether the right is exercisable presently or in the future and whether or not on the fulfilment of a condition); or

(d) the entity is otherwise entitled to acquire the share or an interest in the share; or

(e) the entity is entitled (otherwise than because of having been appointed as a proxy or representative to vote at a meeting of members of the company or of a class of its members) to exercise or control the exercise of a right attached to the share.

(4) Subsection (3) does not, by implication, limit subsection (2).

(5) An entity is taken to hold an interest in a share even if the entity holds the interest in the share jointly with another entity.

(6) For the purpose of determining whether an entity holds an interest in a share, it is immaterial that the interest cannot be related to a particular share.

(7) An interest in a share is not to be disregarded only because of:

(a) its remoteness; or

(b) the manner in which it arose; or

(c) the fact that the exercise of a right conferred by the interest is, or is capable of being made, subject to restraint or restriction.

(1) For the purposes of this Part, a trust is a controlled private trust in relation to an individual if the trust is a designated private trust and:

(a) the individual passes the control test set out in subsection (2); or

(b) the individual passes the source test set out in subsection (3).

Control test

(2) For the purposes of this section, the individual passes the control test in relation to a trust if:

(a) the individual, or an associate of the individual (other than an associate covered by paragraph 1207C(1)(j)), is the trustee, or any of the trustees, of the trust; or

(b) a group in relation to the individual was able to remove or appoint the trustee, or any of the trustees, of the trust; or

(c) a group in relation to the individual was able to vary the trust deed or to veto the decisions of the trustee; or

(d) the aggregate of:

(i) the beneficial interests in the corpus or income of the trust held by the individual (whether directly or indirectly); and

(ii) the beneficial interests in the corpus or income of the trust held by associates of the individual (whether directly or indirectly);

is 50% or more; or

(e) a group in relation to the individual had the power (by means of the exercise by the group of any power of appointment or revocation or otherwise) to obtain, with or without the consent of any other entity, the beneficial enjoyment of the corpus or income of the trust; or

(f) a group in relation to the individual was able in any manner whatsoever, whether directly or indirectly, to control the application of the corpus or income of the trust; or

(g) a group in relation to the individual was capable under a scheme of gaining the enjoyment or the control referred to in paragraph (e) or (f); or

(h) a trustee of the trust was accustomed or under an obligation (whether formally or informally) or might reasonably be expected to act in accordance with the directions, instructions or wishes of a group in relation to the individual.

Source test

(3) For the purposes of this section, an individual passes the source test in relation to a trust if:

(a) the individual has transferred property or services to the trust after 7.30 pm, by standard time in the Australian Capital Territory, on 9 May 2000; and

(b) the underlying transfer was made for no consideration or for a consideration less than the arm's length amount in relation to the underlying transfer.

Group

(4) A reference in this section to a group in relation to an individual is a reference to:

(a) the individual acting alone; or

(b) an associate of the individual acting alone; or

(c) the individual and one or more associates of the individual acting together; or

(d) 2 or more associates of the individual acting together.

Income

(5) In this section:

income means income within the ordinary meaning of that expression.

(1) For the purposes of this Division, if an entity:

(a) has entered into a contract to purchase a beneficial interest in the corpus or income of a trust; or

(b) has a right, otherwise than by reason of holding an interest in a trust, to have such an interest transferred to the entity or to the entity's order (whether the right is exercisable presently or in the future) and whether on the fulfilment of a condition or not; or

(c) has the right to acquire such an interest under an option (whether the right is exercisable presently or in the future) and whether on the fulfilment of a condition or not; or

(d) is otherwise entitled to acquire such an interest;

the entity is taken to hold that interest in the trust.

(2) An entity is taken to hold an interest in the corpus or income of a trust even if the entity holds the interest jointly with another entity.

(3) An interest in the corpus or income of a trust is not to be disregarded only because of:

(a) its remoteness; or

(b) the manner in which it arose; or

(c) the fact that the exercise of a right conferred by the interest is, or is capable of being made, subject to restraint or restriction.

(4) In this section:

income means income within the ordinary meaning of that expression.

Company

(1) For the purposes of this Part, if a company is a controlled private company in relation to an individual:

(a) the individual is an attributable stakeholder of the company unless the Secretary otherwise determines; and

(b) if the individual is an attributable stakeholder of the company--the individual's asset attribution percentage in relation to the company is:

(i) 100%; or

(ii) if the Secretary determines a lower percentage in relation to the individual and the company--that lower percentage; and

(c) if the individual is an attributable stakeholder of the company--the individual's income attribution percentage in relation to the company is:

(i) 100%; or

(ii) if the Secretary determines a lower percentage in relation to the individual and the company--that lower percentage.

Trust

(2) For the purposes of this Part, if:

(a) a trust is a controlled private trust in relation to an individual; and

(b) the trust is not a concessional primary production trust in relation to the individual (see section 1208U);

then:

(c) the individual is an attributable stakeholder of the trust unless the Secretary otherwise determines; and

(d) if the individual is an attributable stakeholder of the trust--the individual's asset attribution percentage in relation to the trust is:

(i) 100%; or

(ii) if the Secretary determines a lower percentage in relation to the individual and the trust--that lower percentage; and

(e) if the individual is an attributable stakeholder of the trust--the individual's income attribution percentage in relation to the trust is:

(i) 100%; or

(ii) if the Secretary determines a lower percentage in relation to the individual and the trust--that lower percentage.

Determinations

(3) A determination under this section is to be in writing.

(4) A determination under this section has effect accordingly.

(5) In making a determination under this section, the Secretary must comply with any relevant decision -making principles.

(1) For the purposes of this Act, if:

(a) during a particular derivation period of a company or trust, the company or trust derives an amount that is ordinary income; and

(b) an individual is an attributable stakeholder of the company or a trust throughout the attribution period that relates to the derivation period of the company or trust; and

(c) the attribution period begins on or after 1 January 2002; and

(d) if that amount:

(i) had been derived by the individual instead of by the company or trust; and

(ii) in the case of income accounted for on an accrual basis as mentioned in subsection (5)--had been so derived by the individual on a cash basis;

that amount would have been ordinary income of the individual; and

(e) that amount is not excluded income (see subsection (2));

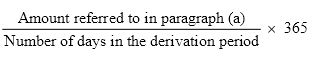

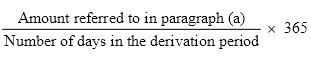

then, in addition to any other ordinary income of the individual, the individual is taken to receive, during that attribution period, ordinary income at an annual rate equal to the individual's income attribution percentage of the amount worked out using the formula:

Excluded income

(2) The Secretary may, by writing, determine that, for the purposes of the application of subsection (1) to a specified individual and a specified company or trust, a specified amount is excluded income.

(3) A determination under subsection (2) has effect accordingly.

(4) In making a determination under subsection (2), the Secretary must comply with any relevant decision-making principles.

Accrual v. cash accounting

(5) If the income of a company or trust is accounted for on an accrual basis for the purposes of section 6-5 of the Income Tax Assessment Act 1997, the ordinary income of the company or trust is accounted for on an accrual basis for the purposes of this section.

(6) If the income of a company or trust is accounted for on a cash basis for the purposes of section 6-5 of the Income Tax Assessment Act 1997, the ordinary income of the company or trust is accounted for on a cash basis for the purposes of this section.

(1) If:

(a) a company makes a distribution of capital or profits of the company to a particular shareholder of the company; and

(b) the shareholder is an individual; and

(c) the individual is an attributable stakeholder of the company;

the Secretary may, by writing:

(d) determine that, for the purposes of this Act, the ordinary income of the individual does not include the amount or value distributed to the individual; or

(e) determine that, for the purposes of this Act, the ordinary income of the individual does not include so much of the amount or value distributed to the individual as is specified in the determination.

(2) If:

(a) a trust:

(i) makes a distribution (whether in money or in other property) to a particular beneficiary of the trust; or

(ii) credits an amount to a particular beneficiary of the trust; and

(b) the beneficiary is an individual; and

(c) the individual is an attributable stakeholder of the trust;

the Secretary may, by writing:

(d) determine that, for the purposes of this Act, the ordinary income of the individual does not include the amount distributed or credited to the individual; or

(e) determine that, for the purposes of this Act, the ordinary income of the individual does not include so much of the amount distributed or credited to the individual as is specified in the determination.

(3) In making a determination under this section, the Secretary must comply with any relevant decision -making principles.

(4) This section is to be disregarded for the purposes of paragraph 1207Y(1)(d).

(1) For the purposes of this Division, the ordinary income of a company or trust is to be worked out as if:

(a) exempt lump sums were not excluded from the definition of ordinary income in subsection 8(1); and

(b) each reference in section 8 to a person included a reference to a company or trust; and

(c) the following provisions had not been enacted:

(i) subsection 8(7A);

(ii) subsection 8(8);

(iii) subsection 8(11);

(iv) Part 3.10.

(2) Paragraphs (1)(a) and (c) have effect subject to paragraph 1207Y(1)(d).

(3) A reference in this Division to the ordinary income of a company or trust is a reference to the company's or trust's gross ordinary income from all sources calculated without any reduction, other than a reduction under section 1208A or 1208B.

(1) For the purposes of this Division, if:

(a) a company or trust carries on a business; and

(b) the value of all the trading stock on hand at the end of a derivation period is greater than the value of all the trading stock on hand at the beginning of that derivation period;

the company's or trust's ordinary income for that derivation period in the form of profits from the business is to include the amount of the difference in values.

(2) For the purposes of this Division, if:

(a) a company or trust carries on a business; and

(b) the value of all the trading stock on hand at the end of a derivation period is less than the value of all the trading stock on hand at the beginning of that derivation period;

the company's or trust's ordinary income for that derivation period in the form of profits from the business is to be reduced by the amount of the difference in values.

(1) For the purposes of this Division, if a company or trust carries on a business or holds an investment, the company's or trust's ordinary income from the business or investment is to be reduced by:

(a) losses and outgoings that relate to the business or investment and are allowable deductions for the purposes of section 51 of the Income Tax Assessment Act 1936 or section 8-1 of the Income Tax Assessment Act 1997, as appropriate; and

(b) depreciation that relates to the business or investment and is an allowable deduction for the purposes of subsection 54(1) of the Income Tax Assessment Act 1936 or Division 42 of the Income Tax Assessment Act 1997; and

(c) amounts that relate to the business or investment and are allowable deductions under any other provision of the Income Tax Assessment Act 1936 or the Income Tax Assessment Act 1997.

(2) However, the rule in subsection (1) does not apply to:

(a) an ineligible deduction (see subsection (3)); or

(b) an ineligible amount (see subsection (4)); or

(c) an ineligible part of a deduction (see subsection (5)).

(3) The Secretary may, by writing, determine that a specified deduction is an ineligible deduction for the purposes of this section.

(4) The Secretary may, by writing, determine that a specified amount is an ineligible amount for the purposes of this section.

(5) The Secretary may, by writing, determine that a specified part of a specified deduction is an ineligible part of the deduction for the purposes of this section.

(6) A determination under subsection (3), (4) or (5) has effect accordingly.

(7) A determination under subsection (3), (4) or (5) is a disallowable instrument for the purposes of section 46A of the Acts Interpretation Act 1901 .

(1) For the purposes of this Part:

(a) if a company or trust was in existence throughout a tax year of the company or trust--the tax year is a derivation period of the company or trust; and

(b) if a company or trust was in existence during a part of a tax year of the company or trust--that part of the tax year is a derivation period of the company or trust.

(2) Subsection (1) has effect subject to subsection (3).

(3) The Secretary may, by writing, determine that, for the purposes of the application of this Division to a specified individual and a specified company or trust, a specified period is a derivation period of the company or trust.

(4) A determination under subsection (3) has effect accordingly.

(5) In making a determination under subsection (3), the Secretary must comply with any relevant decision-making principles.

(6) To avoid doubt, for the purposes of the application of this Division to a particular individual and a particular company or trust, it is not necessary that the individual be an attributable stakeholder of the company or trust throughout a derivation period of the company or trust.

(7) A derivation period may begin or end before the commencement of this Part.

(1) The Secretary may, by writing, determine that, in the event that a specified individual is an attributable stakeholder of a specified company or trust at a specified time (the start time ):

(a) a period beginning at the start time and ending at whichever is the earlier of the following times:

(i) the later time specified in the determination;

(ii) the time when the individual ceases to be an attributable stakeholder of the company or trust;

is an attribution period for the purposes of the application of this Part to the individual and the company or trust; and

(b) that attribution period relates to a specified derivation period of the company or trust.

(2) A determination under subsection (1) has effect accordingly.

(3) The Secretary must ensure that, if an individual is an attributable stakeholder of a company or of a trust at a particular time on or after 1 January 2002, that time is included in an attribution period.

(4) An attribution period may, but is not required to, overlap (in whole or in part) the derivation period to which it relates.

(5) An attribution period does not have to be of the same length as the derivation period to which it relates.

(6) Attribution periods do not have to be of the same length.

(7) In making a determination under this section, the Secretary must comply with any relevant decision -making principles.

(1) For the purposes of this Act, if:

(a) an individual is an attributable stakeholder of a company or trust at a particular time on or after 1 January 2002; and

(b) at that time, the company or trust owns a particular asset (whether alone or jointly or in common with another entity or entities); and

(c) if, at that time, that asset had been owned by the individual instead of by the company or trust, the value of the asset would not be required to be disregarded by any express provision of this Act; and

(d) at that time, the asset is not an excluded asset (see subsection (2));

there is to be included in the value of the individual's assets an amount equal to the individual's asset attribution percentage of the value of the asset referred to in paragraph (b).

Excluded assets

(2) The Secretary may, by writing, determine that, for the purposes of the application of subsection (1) to a specified individual and a particular company or trust, a specified asset is an excluded asset.

(3) A determination under subsection (2) has effect accordingly.

(4) In making a determination under subsection (2), the Secretary must comply with any relevant decision-making principles.

(1) For the purposes of this Act, if:

(a) an individual is an attributable stakeholder of a company or trust at a particular time on or after 1 January 2002; and

(b) at that time, the company or trust owns a particular asset (whether alone or jointly or in common with another entity or entities); and

(c) under section 1208E, there is included in the value of the individual's assets an amount equal to the individual's asset attribution percentage of the value of the asset held by the company or trust;

the amount referred to in paragraph (c) is taken not to be an unrealisable asset of the individual unless the asset referred to in paragraph (b) is an unrealisable asset of the company or trust.

(2) For the purposes of this section, in determining whether an asset is an unrealisable asset of a company or trust, ignore any limitation or restriction:

(a) in the constituent document of the company or the trust deed of the trust, as the case requires; or

(b) under a scheme that was entered into or carried out for the sole or dominant purpose of enabling any individual or individuals to avoid the application of this section and/or section 52ZZS of the Veterans' Entitlements Act.

(3) For the purposes of this section, in determining whether an asset is an unrealisable asset of a company or trust, subsections 11(12) and (13) have effect as if each reference in those subsections to a person included a reference to a company or trust.

Charge or encumbrance relating to a single asset

(1) For the purposes of the application of this Division (other than this section) to a particular individual and a particular company or trust, if:

(a) there is a charge or encumbrance over a particular asset of the company or trust; and

(b) the charge or encumbrance relates exclusively to that asset;

the value of the asset is to be reduced by the value of the charge or encumbrance.

(2) Subsection (1) does not apply to a charge or encumbrance over an asset of a company or trust to the extent that:

(a) the charge or encumbrance is a collateral security; or

(b) the charge or encumbrance was given for the benefit of an entity other than the company or trust; or

(c) the value of the charge or encumbrance is excluded under subsection (6).

Charge or encumbrance relating to 2 or more assets

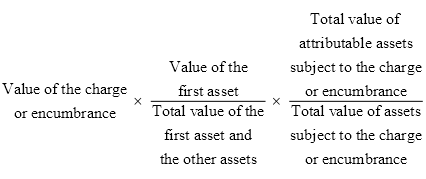

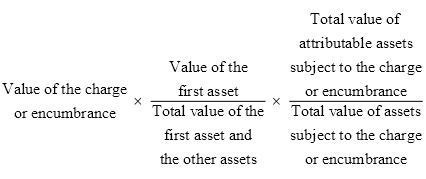

(3) For the purposes of the application of this Division (other than this section) to a particular individual and a particular company or trust, if:

(a) there is a charge or encumbrance over a particular asset (the first asset) of the company or trust; and

(b) the charge or encumbrance relates to the first asset and one or more other assets of the company or trust;

the value of the first asset is to be reduced by the amount worked out using the formula:

(4) Subsection (3) does not apply to a charge or encumbrance over an asset of the company or trust to the extent that:

(a) the charge or encumbrance was given for the benefit of an entity other than the company or trust; or

(b) the value of the charge or encumbrance is excluded under subsection (6).

(5) If (apart from this section), under section 1208E, there is included in the value of the individual's assets an amount equal to the individual's asset attribution percentage of the value of an asset held by the company or trust, the asset held by the company or trust is an attributable asset for the purposes of subsection (3).

Exclusion

(6) The Secretary may, by writing, determine that, for the purposes of the application of this section to a specified individual and a specified company or trust, the whole or a specified part of a specified charge or encumbrance over one or more of the assets of the company or trust is excluded for the purposes of paragraphs (2)(c) and (4)(b).

(7) A determination under subsection (6) has effect accordingly.

(8) In making a determination under subsection (6), the Secretary must comply with any relevant decision-making principles.

(1) For the purposes of the application of this Division to a particular individual and a particular company or trust, if:

(a) the company or trust is the borrower under a loan; and

(b) the loan is not secured by a charge or encumbrance over one or more of the assets of the company or trust;

the Secretary may, by writing, determine that the value of a specified asset of the company or trust is to be reduced by the whole, or a specified part, of the amount of the loan.

(2) A determination under subsection (1) has effect accordingly.

(3) In making a determination under subsection (1), the Secretary must comply with any relevant decision-making principles.

(1) For the purposes of this Division, the value of a company's or trust's assets, or of a charge or encumbrance on such assets, is to be worked out as if:

(a) each reference in section 11 to a person included a reference to a company or trust; and

(b) Division 1 of Part 3.12 (other than section 1122) had not been enacted.

(2) Paragraph (1)(b) has effect subject to paragraph 1208E(1)(c).

(1) If:

(a) an individual transfers property to a company or trust on or after 1 January 2002; and

(b) either:

(i) as a result of the transfer, the individual became an attributable stakeholder of the company or trust; or

(ii) at the time of the transfer, the individual was an attributable stakeholder of the company or trust; and

(c) the transfer amounts to a disposal by the individual of an asset of the individual;

the Secretary may, by writing, determine that Division 2 of Part 3.12, section 93U and sections 198F to 198MA (inclusive) apply to that disposal as if:

(d) the amount of the disposition were nil; or

(e) the amount of the disposition were reduced by the amount specified in the determination.

(2) In making a decision under this section, the Secretary must comply with any relevant decision -making principles.

(1) If:

(a) an individual is an attributable stakeholder of a company or trust; and

(b) the company or trust disposes of an asset of the company or trust;

Division 2 of Part 3.12, section 93U and sections 198F to 198MA (inclusive) apply, and are taken to have applied, as if:

(c) the individual had disposed of an asset of the individual; and

(d) the amount of the disposition referred to in paragraph (c) were equal to the individual's asset attribution percentage of the amount of the disposition referred to in paragraph (b).

(2) Subsection (1) has effect subject to subsection (3).

Secretarial determinations

(3) The Secretary may, by writing:

(a) determine that the disposal of a specified asset is exempt from subsection (1); or

(b) determine that subsection (1) has effect, in relation to the disposal of a specified asset, as if the reference in paragraph (1)(d) to the individual's asset attribution percentage were a reference to such lower percentage as is specified in the determination.

(4) A determination under subsection (3) has effect accordingly.

(5) In making a determination under subsection (3), the Secretary must comply with any relevant decision-making principles.

General disposal

(6) For the purposes of subsection (1), a company or trust disposes of assets of the company or trust if:

(a) on or after 1 January 2002, the company or trust, or an attributable stakeholder of the company or trust, engages in a course of conduct that directly or indirectly:

(i) destroys all or some of the company's or trust's assets; or

(ii) disposes of all or some of the company's or trust's assets; or

(iii) diminishes the value of all or some of the company's or trust's assets; and

(b) one of the following subparagraphs is satisfied:

(i) the company or trust receives no consideration in money or money's worth for the destruction, disposal or diminution;

(ii) the company or trust receives inadequate consideration in money or money's worth for the destruction, disposal or diminution;

(iii) the Secretary is satisfied that the purpose, or the dominant purpose, of the company, trust or stakeholder in engaging in that course of conduct was to obtain a social security advantage for an attributable stakeholder of the company or trust (who may be the first -mentioned stakeholder) or for a relative of an attributable stakeholder of the company or trust; and

(c) in the case of a company--the disposal is not by way of making a distribution of capital or profits of the company to a shareholder of the company; and

(d) in the case of a trust--the disposal is not by way of:

(i) making a distribution (whether in money or in other property) to a beneficiary of the trust; or

(ii) crediting an amount to a beneficiary of the trust.

(7) If a company or trust disposes of assets as mentioned in subsection (6), the amount of the disposition is:

(a) if the company or trust receives no consideration for the destruction, disposal or diminution--an amount equal to:

(i) the value of the assets that are destroyed; or

(ii) the value of the assets that are disposed of; or

(iii) the amount of the diminution in the value of the assets whose value is diminished; or

(b) if the company or trust receives consideration for the destruction, disposal or diminution--an amount equal to:

(i) the value of the assets that are destroyed; or

(ii) the value of the assets that are disposed of; or

(iii) the amount of the diminution in the value of the assets whose value is diminished;

less the amount of the consideration received by the company or trust in respect of the destruction, disposal or diminution.

Disposal by way of distribution

(8) For the purposes of subsection (1), if a company makes a distribution of capital or profits of the company to a shareholder of the company on or after 1 July 2000 :

(a) the company is taken to have disposed of an asset of the company; and

(b) the amount of the disposition is equal to the amount or value distributed to the shareholder.

(9) For the purposes of subsection (1), if a trust:

(a) makes a distribution (whether in money or in other property) to a beneficiary of the trust on or after 1 July 2000; or

(b) credits an amount to a beneficiary of the trust on or after 1 July 2000;

then:

(c) the trust is taken to have disposed of an asset of the trust; and

(d) the amount of the disposition is equal to the amount or value distributed or credited to the beneficiary.

Obtaining a social security advantage

(10) For the purposes of this section, an entity has a purpose of obtaining a social security advantage for an individual (who may be the entity) if the entity has a purpose of:

(a) enabling the individual to obtain any of the following:

(i) a social security pension;

(ii) a social security benefit;

(iii) a service pension;

(iv) income support supplement; or

(b) enabling the individual to obtain any of the following at a higher rate than would otherwise have been payable:

(i) a social security pension;

(ii) a social security benefit;

(iii) a service pension;

(iv) income support supplement; or

(c) ensuring that the individual would be qualified for fringe benefits for the purposes of this Act or the Veterans' Entitlements Act.

If:

(a) an individual ceases to be an attributable stakeholder of a company or trust on or after 1 January 2002; and

(b) immediately before the cessation, the company or trust owned a particular asset (whether alone or jointly or in common with another entity or entities);

Division 2 of Part 3.12, section 93U and sections 198F to 198MA (inclusive) have effect as if:

(c) the individual had disposed of an asset of the individual; and

(d) the amount of the disposition referred to in paragraph (c) were equal to the individual's asset attribution percentage of the value of the asset referred to in paragraph (b), worked out immediately before the cessation.

(1) If:

(a) an individual has transferred property to a company or trust before 1 January 2002; and

(b) the transfer amounts to a disposal by the individual of an asset of the individual; and

(c) apart from this section:

(i) under Division 2 of Part 3.12 or sections 198F to 198MA (inclusive), as a result of the disposition, a particular amount is included in the value of the individual's assets for the period of 5 years that starts on the day on which the disposition took place; and

(ii) that 5 -year period ends after 1 January 2002; and

(d) the individual is an attributable stakeholder of the company or trust on 1 January 2002;

the Secretary may, by writing, determine that:

(e) in a case where the individual's asset attribution percentage is 100%--Division 2 of Part 3.12, section 93U and sections 198F to 198MA (inclusive) have effect, in relation to the disposal of the asset referred to in paragraph (b), as if a reference in that Division or those sections to the period of 5 years that starts on the day on which the disposition took place were a reference to the period:

(i) beginning on the day on which the disposition took place; and

(ii) ending immediately before 1 January 2002; or

(f) in a case where the individual's asset attribution percentage is less than 100%--Division 2 of Part 3.12, section 93U and sections 198F to 198MA (inclusive) have effect on and after 1 January 2002, in relation to the disposal of the asset referred to in paragraph (b), as if the amount of the disposition were reduced by:

(i) the individual's asset attribution percentage as at 1 January 2002; or

(ii) if a higher percentage is specified in the determination--that higher percentage.

(2) A determination under subsection (1) has effect accordingly.

(3) In making a determination under subsection (1), the Secretary must comply with any relevant decision-making principles.

(1) If:

(a) an individual has transferred property to a company or trust before 1 January 2002; and

(b) the transfer amounts to a disposal by the individual of an asset of the individual; and

(c) apart from this section:

(i) under Division 2 of Part 3.12 or sections 198F to 198MA (inclusive), as a result of the disposition, a particular amount is included in the value of the individual's assets for the period of 5 years that starts on the day on which the disposition took place; and

(ii) that 5 -year period ends after 1 January 2002; and

(d) the individual's spouse is an attributable stakeholder of the company or trust on 1 January 2002;

the Secretary may, by writing, determine that:

(e) in a case where the spouse's asset attribution percentage is 100%--Division 2 of Part 3.12, section 93U and sections 198F to 198MA (inclusive) have effect, in relation to the disposal of the asset referred to in paragraph (b), as if a reference in that Division or those sections to the period of 5 years that starts on the day on which the disposition took place were a reference to the period:

(i) beginning on the day on which the disposition took place; and

(ii) ending immediately before 1 January 2002; or

(f) in a case where the spouse's asset attribution percentage is less than 100%--Division 2 of Part 3.12, section 93U and sections 198F to 198MA (inclusive) have effect on and after 1 January 2002, in relation to the disposal of the asset referred to in paragraph (b), as if the amount of the disposition were reduced by the spouse's asset attribution percentage as at 1 January 2002.

(2) A determination under subsection (1) has effect accordingly.

(3) In making a determination under subsection (1), the Secretary must comply with any relevant decision-making principles.

(1) If:

(a) an individual transfers property to a company or trust on or after 1 January 2002; and

(b) either:

(i) as a result of the transfer, the individual became an attributable stakeholder of the company or trust; or

(ii) at the time of the transfer, the individual was an attributable stakeholder of the company or trust; and

(c) the transfer amounts to a disposal by the individual of ordinary income of the individual; and

(d) if the ordinary income is income from an asset--the course of conduct that constituted the disposition of the income did not also constitute a disposition of the asset;

the Secretary may, by writing, determine that Division 3 of Part 3.10 applies, and is taken to have applied, to the disposal referred to in paragraph (c) as if:

(e) the amount of the disposition were nil; or

(f) the amount of the disposition were reduced by the amount specified in the determination.

(2) In making a decision under this section, the Secretary must comply with any relevant decision -making principles.

(1) If:

(a) an individual is an attributable stakeholder of a company or trust; and

(b) the company or trust disposes of ordinary income of the company or trust; and

(c) if that income had been income of the individual instead of the company or trust, the income would have been ordinary income of the individual; and

(d) if the ordinary income is income from an asset--the course of conduct that constituted the disposition of the income did not also constitute a disposition of the asset;

Division 3 of Part 3.10 applies, and is taken to have applied, as if:

(e) the individual had disposed of ordinary income of the individual; and

(f) the amount of the disposition referred to in paragraph (e) were equal to the individual's income attribution percentage of the amount of the disposition referred to in paragraph (b).

(2) Subsection (1) has effect subject to subsection (3).

Secretarial determinations

(3) The Secretary may, by writing:

(a) determine that the disposal of specified ordinary income is exempt from subsection (1); or

(b) determine that subsection (1) has effect, in relation to the disposal of specified ordinary income, as if the reference in paragraph (1)(f) to the individual's income attribution percentage were a reference to such lower percentage as is specified in the determination.

(4) A determination under subsection (3) has effect accordingly.

(5) In making a determination under subsection (3), the Secretary must comply with any relevant decision-making principles.

General disposal

(6) For the purposes of subsection (1), a company or trust disposes of ordinary income of the company or trust if:

(a) on or after 1 January 2002, the company or trust, or an attributable stakeholder of the company or trust, engages in a course of conduct that directly or indirectly:

(i) destroys the source of the income; or

(ii) disposes of the income or the source of the income; or

(iii) diminishes the income; and

(b) one of the following subparagraphs is satisfied:

(i) the company or trust receives no consideration in money or money's worth for the destruction, disposal or diminution;

(ii) the company or trust receives inadequate consideration in money or money's worth for the destruction, disposal or diminution;

(iii) the Secretary is satisfied that the purpose, or the dominant purpose, of the company, trust or stakeholder in engaging in that course of conduct was to obtain a social security advantage for an attributable stakeholder of the company or trust (who may be the first -mentioned stakeholder) or for a relative of an attributable stakeholder of the company or trust; and

(c) in the case of a company--the disposal is not by way of making a distribution of capital or profits of the company to a shareholder of the company; and

(d) in the case of a trust--the disposal is not by way of:

(i) making a distribution (whether in money or in other property) to a beneficiary of the trust; or

(ii) crediting an amount to a beneficiary of the trust.

(7) If a company or trust disposes of ordinary income as mentioned in subsection (6), the amount of the disposition is:

(a) if the company or trust receives no consideration for the destruction, disposal or diminution--the annual rate of the diminution of the income because of the destruction, disposal or diminution; or

(b) if the company or trust receives consideration for the destruction, disposal or diminution--the annual rate of the diminution of the income because of the destruction, disposal or diminution less the part (if any) of the consideration that the Secretary considers to be fair and reasonable in all the circumstances of the case.

Obtaining a social security advantage

(8) For the purposes of this section, an entity has a purpose of obtaining a social security advantage for an individual (who may be the entity) if the entity has a purpose of:

(a) enabling the individual to obtain any of the following:

(i) a social security pension;

(ii) a social security benefit;

(iii) a service pension;

(iv) income support supplement; or

(b) enabling the individual to obtain any of the following at a higher rate than would otherwise have been payable:

(i) a social security pension;

(ii) a social security benefit;

(iii) a service pension;

(iv) income support supplement; or

(c) ensuring that the individual would be qualified for fringe benefits for the purposes of this Act or the Veterans' Entitlements Act.

Ordinary income

(9) In this section:

ordinary income, in relation to a company or trust, has the same meaning as in Division 7.

(1) If:

(a) an individual has transferred property to a company or trust before 1 January 2002; and

(b) the transfer amounts to a disposal by the individual of ordinary income of the individual; and

(c) apart from this section, under Division 3 of Part 3.10, as a result of the disposition referred to in paragraph (b), a particular amount is included in the individual's ordinary income; and

(d) the individual is an attributable stakeholder of the company or trust on 1 January 2002;

the Secretary may, by writing, determine that:

(e) in a case where the individual's income attribution percentage is 100%--Division 3 of Part 3.10 has effect on or after 1 January 2002, in relation to the disposal of the income referred to in paragraph (b), as if the amount of the disposition were nil; or

(f) in a case where the individual's income attribution percentage is less than 100%--Division 3 of Part 3.10 has effect on and after 1 January 2002, in relation to the disposal of the income referred to in paragraph (b), as if the amount of the disposition were reduced by:

(i) the individual's income attribution percentage as at 1 January 2002; or

(ii) if a higher percentage is specified in the determination--that higher percentage.

(2) A determination under subsection (1) has effect accordingly.

(3) In making a determination under subsection (1), the Secretary must comply with any relevant decision-making principles.

(1) If:

(a) an individual has transferred property to a company or trust before 1 January 2002; and

(b) the transfer amounts to a disposal by the individual of ordinary income of the individual; and

(c) apart from this section, under Division 3 of Part 3.10, as a result of the disposition referred to in paragraph (b), a particular amount is included in the individual's ordinary income; and

(d) the individual's spouse is an attributable stakeholder of the company or trust on 1 January 2002;

the Secretary may, by writing, determine that:

(e) in a case where the spouse's income attribution percentage is 100%--Division 3 of Part 3.10 has effect on or after 1 January 2002, in relation to the disposal of the income referred to in paragraph (b), as if the amount of the disposition were nil; or

(f) in a case where the spouse's income attribution percentage is less than 100%--Division 3 of Part 3.10 has effect on and after 1 January 2002, in relation to the disposal of the income referred to in paragraph (b), as if the amount of the disposition were reduced by the spouse's income attribution percentage as at 1 January 2002.

(2) A determination under subsection (1) has effect accordingly.

(3) In making a determination under subsection (1), the Secretary must comply with any relevant decision-making principles.

(1) For the purposes of this Part, a trust is a concessional primary production trust in relation to an individual at a particular time (the test time), if:

(a) at the test time, the trust is a controlled private trust in relation to the individual; and

(b) at the test time, either:

(i) the trust carries on a primary production enterprise (the first primary production enterprise); or

(ii) the trust makes an asset available to another entity, the other entity carries on a primary production enterprise (the first primary production enterprise), and the asset is used by the other entity wholly or principally for the purposes of carrying on the first primary production enterprise; and

(c) at the test time, more than 70% of the net value of the assets of the trust (excluding the net value of the principal home of the individual if that principal home is owned by the trust) relates to assets used wholly or principally for the purposes of carrying on a primary production enterprise; and

(d) at the test time, the sum of:

(i) the total adjusted net value of assets that are owned or controlled by the individual and used wholly or principally for the purposes of carrying on a primary production enterprise; and

(ii) the total adjusted net value of assets that are owned or controlled by the individual's spouse and used wholly or principally for the purposes of carrying on a primary production enterprise;

is less than the primary production attribution threshold (as defined by subsection (6)); and

(e) if:

(i) the individual or the individual's spouse had adjusted net primary production income for the last tax year that ended before the test time; and

(ii) the individual or the individual's spouse had adjusted net primary production income for the tax year that preceded the tax year first referred to in subparagraph (i); and