Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts

Petroleum Resource Rent Tax Assessment Act 1987

1 Section 2

Insert:

"designated frontier area" means that block or those blocks that constitute both:

(a) an area or part of an area:

(i) specified in section 36A; or

(ii) specified in an instrument made under subsection 36B(1); and

(b) an exploration permit area.

2 Section 2

Insert:

"designated frontier expenditure" , in relation to a petroleum project and a financial year, means exploration expenditure that is actually incurred:

(a) by a person in that year where the eligible exploration or recovery area in relation to the project is a designated frontier area; and

(b) during the original period of the exploration permit concerned (before the permit is first renewed or ceases to be in force);

other than exploration expenditure that is incurred in evaluating or delineating a petroleum pool (within the meaning of the Petroleum (Submerged Lands) Act 1967 ) that has been discovered in a designated frontier area.

3 Section 2

Insert:

"uplifted frontier expenditure" has the meaning given by section 36C.

4 After section 36

Insert:

36A Designated frontier areas for 2004

For the purposes of the definition of designated frontier area , the following areas are specified:

(a) Area T04 - 5, as first gazetted in the Tasmanian Government Gazette on 5 May 2004 under subsection 20(1) of the Petroleum (Submerged Lands) Act 1967 ;

(b) Areas W04 - 2, W04 - 4, W04 - 15 and W04 - 16, as first gazetted in the Western Australia Government Gazette on 30 March 2004 under subsection 20(1) of the Petroleum (Submerged Lands) Act 1967 ;

(c) Area NT04 - 3, as first gazetted in the Northern Territory Government Gazette on 14 April 2004 under subsection 20(1) of the Petroleum (Submerged Lands) Act 1967 .

Note: An amount of exploration expenditure incurred in respect of an area that is specified under this section might be increased by 150% (before the GDP factor or the augmented bond rate is applied to the amount under the Schedule): see section 36C.

36B Designated frontier areas for 2005 to 2008

(1) For the purposes of the definition of designated frontier area , the Minister administering the Petroleum (Submerged Lands) Act 1967 may designate, in writing, up to (and including) 20% of potential exploration permit areas as frontier areas.

Note: An amount of exploration expenditure incurred in respect of an area that is specified under this section might be increased by 150% (before the GDP factor or the augmented bond rate is applied to the amount under the Schedule): see section 36C.

(2) The Minister must not specify new areas for a calendar year after 2008.

(3) The Minister must publish an instrument made under subsection (1) in the Gazette .

(4) An instrument made under subsection (1) is not a legislative instrument for the purposes of the Legislative Instruments Act 2003 .

(5) The Minister may, by signed instrument, delegate his or her power under subsection (1) to an SES employee or an acting SES employee in the Minister's Department.

Note: The expressions SES employee and acting SES employee are defined in section 17AA of the Acts Interpretation Act 1901 .

(6) In this section:

"potential exploration permit area" means an area or areas constituted by a block or blocks in respect of which applications for exploration permits have been invited, but not yet granted, under Division 2 of Part III of the Petroleum (Submerged Lands) Act 1967 .

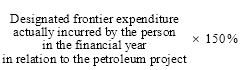

36C Uplifted frontier expenditure

For the purposes of this Act, the amount of uplifted frontier expenditure that a person is taken to have incurred in a financial year in relation to a petroleum project is worked out as follows:

5 Subsection 45C(9)

Omit ", within 60 days of being given the notice, lodge with the Commissioner a written objection against the decision setting out fully and in detail the grounds on which the person relies", substitute "object against the decision in the manner set out in Part IVC of the Taxation Administration Act 1953 ".

6 Subsection 45C(10)

Repeal the subsection.

7 Clause 1 of the Schedule (definition of incurred exploration expenditure amount )

Repeal the definition, substitute:

"incurred exploration expenditure amount" , in relation to a petroleum project that is not a combined project and in relation to a financial year, means the sum of the following:

(a) any amounts of exploration expenditure (other than designated frontier expenditure) actually incurred by the person in the financial year in relation to the project;

(b) any amounts of uplifted frontier expenditure that the person is taken by section 36C to have incurred in the financial year in relation to the project;

(c) any amounts of expenditure that the person is taken by subparagraph 48(1)(a)(ia) or paragraph 48A(5)(c) to have incurred in the financial year in relation to the project.

Note: The effect of subsections 35A(2), 35B(2) and 45D(3) must be taken into account when working out an incurred exploration expenditure amount.

8 Clause 1 of the Schedule

Insert:

"incurred exploration expenditure amount" , in relation to a petroleum project that is a combined project and in relation to a financial year, means the sum of the following:

(a) any amounts of:

(i) exploration expenditure (other than designated frontier expenditure) actually incurred by the person; and

(ii) uplifted frontier expenditure that the person is taken by section 36C to have incurred;

in the financial year in relation to the project (not being amounts incurred before the project combination certificate in relation to the project came into force);

(b) any amounts of expenditure that the person is taken by subparagraph 48(1)(a)(ia) or paragraph 48A(5)(c) to have incurred in the financial year in relation to the project;

(c) if the project combination certificate came into force during the financial year:

(i) any amounts of exploration expenditure (other than designated frontier expenditure) actually incurred by the person in the financial year; and

(ii) any amounts of uplifted frontier expenditure that the person is taken by section 36C to have incurred in the financial year; and

(iii) any amounts of exploration expenditure that the person is taken by section 48 or 48A to have incurred in the financial year;

in relation to the pre - combination projects.

Note: The effect of subsections 35A(2), 35B(2) and 45D(3) must be taken into account when working out an incurred exploration expenditure amount.

9 Paragraph 15(1)(a) of the Schedule

After "incurred exploration expenditure", insert ", or is taken to have incurred uplifted frontier expenditure,".

10 Subclause 15(1) of the Schedule

Omit "all of the exploration expenditure is non - transferable expenditure", substitute "the total of the amounts of exploration expenditure (other than designated frontier expenditure), and uplifted frontier expenditure, is taken to be non - transferable expenditure".

11 Paragraph 15(2)(b) of the Schedule

Repeal the paragraph, substitute:

(b) the total of:

(i) any amounts of exploration expenditure (other than designated frontier expenditure) actually incurred by the person; and

(ii) any amounts of uplifted frontier expenditure taken to be incurred by the person in respect of designated frontier expenditure actually incurred by the person;

in relation to the notional project in the financial year exceeds the excess referred to in paragraph (a) by an amount (the non - transferable amount );

12 Subclause 15(2) of the Schedule

Omit "so much of the exploration expenditure as equals the non - transferable amount is non - transferable expenditure", substitute "so much of the expenditure as equals the non - transferable amount is taken to be non - transferable expenditure".

13 Paragraph 15(3)(b) of the Schedule

Omit "the exploration expenditure incurred", substitute "any exploration expenditure (other than designated frontier expenditure) incurred, or any uplifted frontier expenditure taken to be incurred,".

14 Paragraph 15(4)(c) of the Schedule

Repeal the paragraph, substitute:

(c) add amounts in accordance with the following rules:

(i) start with the oldest amount of any exploration expenditure (other than designated frontier expenditure) incurred, or any uplifted frontier expenditure taken to be incurred, by the person in the financial year;

(ii) add to that, in order starting with the next oldest amount, each of the other amounts incurred, or taken to be incurred, by the person in the financial year;

(iii) if adding an amount of expenditure would make the total exceed the non - transferable amount, add only so much of the amount as makes the total equal the non - transferable amount and do not add any later amount of expenditure;

15 Paragraph 15(4)(d) of the Schedule

Omit "subparagraphs (c)(i) and (ii)", substitute "paragraph (c)".

16 Paragraph 16(c) of the Schedule

Repeal the paragraph, substitute:

(c) the total of:

(i) any amounts of exploration expenditure (other than designated frontier expenditure) actually incurred by the person; and

(ii) any amounts of uplifted frontier expenditure taken to be incurred by the person in respect of designated frontier expenditure actually incurred by the person;

in relation to the notional project during the period starting on 1 July 1990 and ending at the end of the assessable year;

17 Application

(1) The amendments made by this Schedule (other than items 5 and 6) apply in respect of any exploration expenditure incurred (whether before or after this Schedule commences) where the eligible exploration or recovery area is a designated frontier area.

(2) The amendments made by items 5 and 6 apply in respect of any objection made (whether before or after that item commences) that has not yet been finally determined or otherwise disposed of.