Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts1 Application

The amendments made by this Schedule apply on and after 1 July 2002.

Part 2 -- Amount of certain liabilities for purpose of calculating allocable cost amount on exit

Income Tax Assessment Act 1997

2 At the end of section 711 - 45

Add:

Adjustment where amount of liability differed for purpose of calculating allocable cost amount on entry

(8) If:

(a) a leaving entity's liability mentioned in any preceding subsection was taken into account in working out the * allocable cost amount for a * subsidiary member (whether or not the leaving entity) of the old group in accordance with Division 705 (the entry ACA ); and

(b) the amount (the entry amount ) of the liability that was so taken into account is different from the amount (the exit amount ) of the liability taken into account in applying the subsection; and

(c) the entry ACA was different from what it would have been if the exit amount, instead of the entry amount, had been taken into account in working it out;

then, for the purpose of applying the subsection, the liability is taken to be of an amount equal to the entry amount.

Part 3 -- Ensuring no double reduction in working out step 3 of allocable cost amount on entry

Income Tax Assessment Act 1997

3 Subsection 705 - 90(6)

Repeal the subsection, substitute:

Undistributed profits must have accrued to joined group

(6) Next, work out the extent to which the undistributed profits that satisfy the requirements of subsection (3) accrued to the joined group before the joining time (subsection (7) states what it means for a profit to accrue to the joined group before the joining time). The result is the step 3 amount.

Income Tax (Transitional Provisions) Act 1997

4 Paragraph 701 - 30(2)(a)

Omit ", and paragraph (6)(b),".

Income Tax Assessment Act 1997

5 At the end of Division 709

Add:

Subdivision 709 - D -- Deducting bad debts

709 - 200 What this Subdivision is about

An entity can deduct a bad debt that:

(a) has for a period been owed to a member of a consolidated group; and

(b) has for another period been owed to an entity that was not a member of that group;

only if each entity that has been owed the debt for such a period could have deducted the debt had it been written off as bad at the end of the period. This applies even if the debt is owed to the same entity for different periods.

Table of sections

Application and object

709 - 205 Application of this Subdivision

709 - 210 Object of this Subdivision

Limit on deduction of bad debt

709 - 215 Limit on deduction of bad debt

709 - 205 Application of this Subdivision

(1) This Subdivision affects whether an entity (the claimant ) that is or has been a * member of a * consolidated group and writes off a debt, or part of a debt, as bad may deduct the debt or part if the conditions in subsection (2) exist.

(2) The conditions are that, in the time starting when the debt was incurred (whether to the claimant or another entity) and ending when the claimant wrote off the debt or part:

(a) the debt was owed to an entity (whether the claimant or another entity) for a period (a debt test period ) when the entity was a * member of a * consolidated group; and

(b) the debt was owed to an entity (whether the claimant or another entity) for a period (also a debt test period ) when the entity was a not a member of that group.

Note 1: The debt must have been owed to the claimant for at least one of the debt test periods for the claimant to have been able to write it off.

Note 2: One effect of section 701 - 1 (Single entity rule) is that a debt is taken to be owed to the head company of a consolidated group while the debt is owed to a subsidiary member of the group.

(3) Ignore section 701 - 5 (Entry history rule) and section 701 - 40 (Exit history rule) in identifying a debt test period.

Note: Subsection (3) does not affect sections 701 - 5 and 701 - 40 so far as they operate to treat the debt, or part of the debt, as having been included in the claimant's assessable income. That inclusion is generally a condition under section 25 - 35 for the claimant to be able to deduct the debt.

(4) This Subdivision does not apply in relation to a debt merely because it is assigned:

(a) from an entity that is a * member of a * consolidated group to an entity that is not a member of that group; or

(b) from an entity that is not a member of a consolidated group to an entity that is a member of a consolidated group; or

(c) from an entity that is a member of a consolidated group to an entity that is a member of another consolidated group.

This subsection has effect despite subsections (1) and (2).

Note: There is not an assignment of a debt from one entity to another merely because section 701 - 1 (Single entity rule) starts or ceases to apply in relation to the entities so that the debt ceases to be a debt owed to one entity and becomes a debt owed to the other entity.

709 - 210 Object of this Subdivision

The main object of this Subdivision is to ensure that the claimant can deduct the debt, or part of it, only if each entity that was owed the debt for a debt test period could have deducted the debt if it had been written off as bad at the end of the period.

Limit on deduction of bad debt

709 - 215 Limit on deduction of bad debt

(1) The claimant can deduct the debt, or part of the debt, if, and only if:

(a) section 8 - 1 or 25 - 35 permits the deduction (ignoring subsection 25 - 35(5) and the provisions mentioned in that subsection); and

(b) the condition in subsection (2) is met for each debt test period.

(2) The condition is that the entity that was owed the debt for the debt test period could have deducted the debt for an income year (the debt test income year ) starting and ending at the times identified in subsection (3) if:

(a) the entity had written off the debt as bad at the end of the period; and

(b) these provisions (the modified provisions ) had effect as described in this section:

(i) sections 165 - 123 and 165 - 126 (which are about conditions that must be met for a company to be able to deduct a bad debt);

(ii) sections 266 - 35, 266 - 85, 266 - 120, 266 - 160 and 267 - 25 in Schedule 2F to the Income Tax Assessment Act 1936 (which are about conditions that must be met for certain kinds of trusts to be able to deduct a bad debt);

(iii) other provisions of this Act so far as they relate to a section listed in subparagraph (i) or (ii); and

(c) these provisions did not apply:

(i) subsections 165 - 120(2) and (3);

(ii) section 267 - 65 in Schedule 2F to the Income Tax Assessment Act 1936 .

Note 1: Some of the other provisions of this Act that relate to a section listed in subparagraph (2)(b)(i) are sections 165 - 120, 165 - 129 and 165 - 132 and Subdivision 166 - C.

Note 2: Some of the other provisions of this Act that relate to a section listed in subparagraph (2)(b)(ii) are sections 266 - 40, 266 - 45, 266 - 90, 266 - 125, 266 - 165, 267 - 30, 267 - 35, 267 - 40 and 267 - 45 in Schedule 2F to the Income Tax Assessment Act 1936 .

Debt test income year

(3) The table shows when the debt test income year starts and ends.

Start and end of debt test income year | |||

| If: | The start of the debt test income year is: | The end of the debt test income year is: |

1 | Both these conditions are met: (a) the entity that is owed the debt for the debt test period is the claimant; (b) the period ends at the time (the write - off time ) the claimant actually writes off the debt or part of the debt | The later of these times (or either of them if they are the same): (a) the start of the income year in which the write - off time occurs; (b) the start of the debt test period | The end of the income year in which the write - off time occurs |

2 | Either: (a) the entity that is owed the debt for the debt test period is not the claimant; or (b) that entity is the claimant but that period ends before the claimant actually writes off the debt or part of the debt | The later of these times (or either of them if they are the same): (a) 12 months before the end of the debt test period; (b) the start of the debt test period | The end of the debt test period |

Continuity periods, ownership test periods and test periods

(4) For the purposes of subsection (2), the modified provisions have effect as if:

(a) the * first continuity period started at the start time shown in the table and ended at the start of the debt test income year; and

(b) the * second continuity period were the debt test income year or, for the purposes of section 165 - 123 and Subdivision 166 - C defining periods by reference to the second continuity period, the period:

(i) starting at the start of the debt test income year; and

(ii) ending at the end time shown in the table; and

(c) each section listed in subparagraph (2)(b)(ii) specified that the test period identified in the section:

(i) started at the start time shown in the table; and

(ii) ended at the end time shown in the table.

Start time and end time | |||

| If: | The start time is: | The end time is: |

1 | All these conditions are met: (a) the entity that is owed the debt for the debt test period is the claimant; (b) the period ends at the time (the write - off time ) the claimant actually writes off the debt or part of the debt; (c) the claimant is the * head company of a * consolidated group at the write - off time | The start of the debt test period | The end of the income year in which the write - off time occurs |

2 | All these conditions are met: (a) the entity that is owed the debt for the debt test period is the claimant; (b) the period ends at the time (the write - off time ) the claimant actually writes off the debt or part of the debt; (c) the claimant is not the * head company of a * consolidated group at the write - off time | Just before the start of the debt test period | The end of the income year in which the write - off time occurs |

3 | The debt test period: (a) starts at a time other than a time when the entity that is owed the debt for the period ceases to be a * member of a * consolidated group; and (b) ends when the entity becomes a member of such a group; (whether or not the entity was the * head company of another such group during the period) | The start of the debt test period | Just after the end of the debt test period |

4 | Both these conditions are met: (a) the entity that is owed the debt for the debt test period is the * head company of a * consolidated group; (b) the period ends when: (i) a * subsidiary member of the group becomes a * member of another consolidated group; or (ii) the entity ceases to be the head company of the group without becoming a member of another consolidated group | The start of the debt test period | The end of the debt test period |

5 | The debt test period: (a) starts when the entity that is owed the debt for the period ceases to be a * member of a * consolidated group; and (b) ends later when the entity becomes a member of a consolidated group | Just before the start of the debt test period | Just after the end of the debt test period |

(5) For the purposes of subsection (2), the modified provisions have effect as if section 267 - 25 in Schedule 2F to the Income Tax Assessment Act 1936 applied in relation to debts whether they were incurred in the income year or an earlier income year.

Test time for same business test under section 165 - 126

(6) For the purposes of subsection (2), the modified provisions have effect as if subsection 165 - 126(2) specified that the test time were the later of these times (or either of them if they are the same):

(a) the first time at which it is not practicable to show that the company will meet the conditions in section 165 - 123 (as modified by this section);

(b) the time just after the start of the debt test period.

Business at and just after the end of the debt test period

(7) If:

(a) the debt test period ends when the entity that was owed the debt for the period becomes a * member of a * consolidated group; and

(b) under the modified provisions, the * business that the entity carried on at or just after the end of the period is relevant to the question whether the entity could have deducted the debt as described in subsection (2);

those provisions have effect for the purposes of that subsection as if the entity carried on at those times the business it carried on just before the end of the period.

Division 2--Consequential amendments

Income Tax Assessment Act 1936

6 At the end of subsection 266 - 35(1) in Schedule 2F

Add:

Note: Subdivision 709 - D of the Income Tax Assessment Act 1997 modifies how this section operates in relation to a trust that used to be a member of a consolidated group and that writes off as bad a debt that used to be owed to a member of the group.

7 At the end of subsection 266 - 85(3) in Schedule 2F

Add:

Note: Subdivision 709 - D of the Income Tax Assessment Act 1997 modifies how this section operates in relation to a trust that used to be a member of a consolidated group and that writes off as bad a debt that used to be owed to a member of the group.

8 At the end of subsection 266 - 120(1) in Schedule 2F

Add:

Note: Subdivision 709 - D of the Income Tax Assessment Act 1997 modifies how this section operates in relation to a trust that used to be a member of a consolidated group and that writes off as bad a debt that used to be owed to a member of the group.

9 At the end of subsection 266 - 160(2) in Schedule 2F

Add:

Note: Subdivision 709 - D of the Income Tax Assessment Act 1997 modifies how this section operates in relation to a trust that used to be a member of a consolidated group and that writes off as bad a debt that used to be owed to a member of the group.

10 At the end of subsection 267 - 25(1) in Schedule 2F

Add:

Note: Subdivision 709 - D of the Income Tax Assessment Act 1997 affects the application of this section to a trust that used to be a member of a consolidated group and that writes off as bad a debt that used to be owed to a member of the group.

11 At the end of subsection 267 - 65(1) in Schedule 2F

Add:

Note: Subdivision 709 - D of the Income Tax Assessment Act 1997 modifies how this section operates in relation to a trust that used to be a member of a consolidated group and that writes off as bad a debt that used to be owed to a member of the group.

Income Tax Assessment Act 1997

12 Section 12 - 5 (table item headed "bad debts")

After:

debt/equity swaps .......................... | 63E, 63F |

insert:

deduction of a debt that used to be owed to a member of a consolidated group by an entity that used to be a member of the group | Subdivision 709 - D |

13 Subsection 25 - 35(5) (at the end of the table)

Add:

6 | An entity that used to be a member of a consolidated group can deduct a bad debt that used to be owed to a member of the group only if certain conditions are met | Subdivision 709 - D

|

14 At the end of subsection 165 - 120(1)

Add:

Note 3: Subdivision 709 - D modifies how this Subdivision operates in relation to a company that used to be a member of a consolidated group and that writes off as bad a debt that used to be owed to a member of the group.

15 Subsection 995 - 1(1) (definition of test time )

After "707 - 135,", insert "709 - 215,".

Income Tax (Transitional Provisions) Act 1997

16 After Division 707

Insert:

Division 709 -- Other rules applying when entities become subsidiary members etc.

Table of Subdivisions

709 - D Deducting bad debts

Subdivision 709 - D -- Deducting bad debts

Table of sections

709 - 200 Application of Subdivision 709 - D of the Income Tax Assessment Act 1997

709 - 200 Application of Subdivision 709 - D of the Income Tax Assessment Act 1997

Subdivision 709 - D of the Income Tax Assessment Act 1997 applies on and after 1 July 2002.

Income Tax Assessment Act 1997

17 At the end of section 67 - 25

Add:

Life insurance company's subsidiary joining consolidated group

(5) The * tax offset available under subsection 713 - 545(5) is subject to the refundable tax offset rules.

18 Subsection 320 - 175(2) (notes)

Repeal the notes, substitute:

Note 1: The time when a life insurance company joins or leaves a consolidated group is also a valuation time: see sections 713 - 525 and 713 - 585.

Note 2: A life insurance company that fails to comply with this section is liable to an administrative penalty: see section 288 - 70 in Schedule 1 to the Taxation Administration Act 1953 .

19 Subsection 320 - 230(2) (notes)

Repeal the notes, substitute:

Note 1: The time when a life insurance company joins or leaves a consolidated group is also a valuation time: see sections 713 - 525 and 713 - 585.

Note 2: A life insurance company that fails to comply with this section is liable to an administrative penalty: see section 288 - 70 in Schedule 1 to the Taxation Administration Act 1953 .

20 Group heading before section 713 - 505

Repeal the heading, substitute:

General modifications for life insurance companies

21 Section 713 - 510

Repeal the section, substitute:

713 - 510 Certain subsidiaries of life insurance companies cannot be members of consolidated group

(1) An entity cannot be a * subsidiary member of a * consolidated group or * consolidatable group of which a * life insurance company is a * member if:

(a) the life insurance company owns, either directly or indirectly through one or more interposed entities, all the * membership interests in the entity and either:

(i) some, but not all, of the membership interests described in subsection (3) (the key interests ) are * virtual PST assets of the life insurance company; or

(ii) some, but not all, of the key interests are * segregated exempt assets of the life insurance company; or

(b) the life insurance company owns, either directly or indirectly through one or more interposed entities, only some of the membership interests in the entity and any of the key interests are virtual PST assets or segregated exempt assets of the life insurance company.

Note: The entity could, however, be a member of another consolidated group or consolidatable group.

(2) An entity cannot continue to be a * subsidiary member of a * consolidated group of which a * life insurance company is a * member if:

(a) the life insurance company owns, either directly or indirectly through one or more interposed entities, all the * membership interests in the entity and, had the entity not been a subsidiary member of the group, either:

(i) some, but not all, of the membership interests described in subsection (3) (the key interests ) would be * virtual PST assets of the life insurance company; or

(ii) some, but not all, of the key interests would be * segregated exempt assets of the life insurance company; or

(b) the life insurance company owns, either directly or indirectly through one or more interposed entities, only some of the membership interests in the entity and, had the entity not been a subsidiary member of the group, any of the key interests would be virtual PST assets or segregated exempt assets of the life insurance company.

(3) The key interests are the * membership interests the * life insurance company owns directly in:

(a) the entity; or

(b) an interposed entity.

Life insurance companies' liabilities on joining consolidated group

(1) This section affects how paragraph 320 - 15(1)(h) and section 320 - 85 apply if:

(a) a * life insurance company becomes a * subsidiary member of a * consolidated group at a time (the joining time ); and

(b) just before the joining time, the life insurance company had one or more liabilities under the * net risk components of life insurance policies.

Note: Paragraph 320 - 15(1)(h) and section 320 - 85 both operate on the basis of a comparison of the value of the company's liabilities under the net risk components of life insurance policies at the end of the current year with the value of those liabilities at the end of the previous year, so that:

(a) that paragraph includes an amount in the company's assessable income for the current year if the value at the end of the current year is less than the value at the end of the previous income year; and

(b) that section allows a deduction for the current year if the value at the end of the current year is more than the value at the end of the previous income year.

(2) The object of this section is to ensure that the * head company of the * consolidated group bears the income tax consequences relating to a change in * value of the liabilities only after the joining time.

Note: The life insurance company bears the income tax consequences relating to a change in value of the liabilities before the joining time, because section 701 - 30 ensures that paragraph 320 - 15(1)(h) and section 320 - 85 apply in relation to a part of the income year before that time when the company was not a subsidiary member of a consolidated group as if that part were an income year.

(3) Paragraph 320 - 15(1)(h) and section 320 - 85 apply for the head company core purposes set out in section 701 - 1 (Single entity rule) as if the * value of the liabilities at the end of the last income year ending before the joining time were the value of the liabilities (for the * life insurance company) just before the joining time.

22 Before section 713 - 515

Insert:

Tax cost setting rules for life insurance companies joining consolidated group

23 Section 713 - 515 (heading)

Repeal the heading, substitute:

24 Section 713 - 520 (heading)

Repeal the heading, substitute:

713 - 520 Valuing certain liabilities where life insurance company joins group

25 Sections 713 - 525 and 713 - 530

Repeal the sections, substitute:

713 - 525 Obligation to value certain assets and liabilities at joining time

Division 320 has effect as if the time when a * life insurance company becomes a * subsidiary member of a * consolidated group were a * valuation time for the purposes of sections 320 - 175 and 320 - 230.

Note: This means that there must be a valuation of the virtual PST assets and virtual PST liabilities under section 320 - 175 (with the consequences set out in section 320 - 180), and a valuation of the segregated exempt assets and exempt life insurance policy liabilities under section 320 - 230 (with the consequences set out in section 320 - 235), as at that time.

Losses of life insurance companies joining consolidated group

713 - 530 Treatment of certain losses of life insurance company

(1) This section applies if:

(a) a * life insurance company becomes a * member of a * consolidated group at a time (the joining time ); and

(b) just before the joining time, the life insurance company had either:

(i) a * tax loss of the * complying superannuation class; or

(ii) a * net capital loss from * virtual PST assets.

(2) This Act operates (except so far as the contrary intention appears) for the purposes of income years ending after the joining time as if:

(a) the * head company of the * consolidated group had made the loss for the income year in which the joining time occurs; and

(b) the * life insurance company had not made the loss for the income year for which it made the loss.

(3) The * head company is not prevented from * utilising the loss for the income year in which the joining time occurs merely because this Act operates as if the head company had made the loss for that year.

(4) Division 707 does not apply in relation to the * net capital loss or the * tax loss at the joining time.

Losses of life insurance companies' subsidiaries joining consolidated group

(1) This section applies if:

(a) a * life insurance company becomes a * member of a * consolidated group at a time (the joining time ); and

(b) at the joining time, the life insurance company owns, either directly or indirectly through one or more interposed entities, all the * membership interests in yet another entity (the life insurance subsidiary ) that becomes a * subsidiary member of the group at that time; and

(c) all the following membership interests are * virtual PST assets of the life insurance company:

(i) the membership interests (if any) that the life insurance company owns directly in the life insurance subsidiary;

(ii) the membership interests (if any) that the life insurance company owns directly in the interposed entities; and

(d) the * head company of the group makes a * tax loss or * net capital loss under Subdivision 707 - A because of a transfer from the life insurance subsidiary.

(2) This Act operates for the purposes of income years ending after the transfer as if:

(a) the * tax loss were of the * complying superannuation class; or

(b) the * net capital loss were from * virtual PST assets.

(3) Subdivisions 707 - B, 707 - C and 707 - D do not affect the * utilisation of the loss by the * head company of the * consolidated group.

(1) This section applies if:

(a) a * life insurance company becomes a * member of a * consolidated group at a time (the joining time ); and

(b) at the joining time, the life insurance company owns, either directly or indirectly through one or more interposed entities, all the * membership interests in yet another entity (the life insurance subsidiary ) that becomes a * subsidiary member of the group at that time; and

(c) all the following membership interests are * segregated exempt assets of the life insurance company:

(i) the membership interests (if any) that the life insurance company owns directly in the life insurance subsidiary;

(ii) the membership interests (if any) that the life insurance company owns directly in the interposed entities.

(2) A * tax loss or * net capital loss of the life insurance subsidiary for an income year ending before the joining time cannot be * utilised by the life insurance subsidiary for an income year ending after that time.

Note: This prevents the loss from being transferred to the head company of the consolidated group under Subdivision 707 - A (because it means the life insurance subsidiary could not have utilised the loss for the trial year). As a result, section 707 - 150 prevents any other entity from utilising the loss for an income year ending after the joining time.

Imputation rules for life insurance companies joining consolidated group

(1) This section applies if:

(a) a * life insurance company becomes a * member of a * consolidated group at a time (the joining time ); and

(b) at the joining time, the life insurance company owns, either directly or indirectly through one or more interposed entities, * membership interests in yet another entity (the life insurance subsidiary ) that becomes a * subsidiary member of the group at that time; and

(c) the life insurance subsidiary's * franking account is in surplus just before the joining time.

(2) Paragraph 709 - 60(2)(b) does not apply in relation to the life insurance subsidiary.

(3) A * franking credit arises at the joining time in the * franking account of the * head company of the group. The amount of the credit is the amount worked out under subsection (4).

(4) The amount is equal to the amount of the * franking credit that would arise in the * life insurance company's * franking account just before the joining time under item 5 of the table in subsection 219 - 15(2) if:

(a) the life insurance subsidiary made a * franked distribution to the life insurance company just before the joining time; and

(b) the amount of the franking credit on the distribution were equal to the surplus mentioned in paragraph (1)(c).

(5) The * head company of the group is entitled to a * tax offset for the income year in which the joining time occurs. The amount of the tax offset is:

(a) if all the * membership interests (if any) that the * life insurance company owns directly in the life insurance subsidiary, and all the membership interests (if any) that the life insurance company owns directly in interposed entities, are * segregated exempt assets of the life insurance company--the surplus mentioned in paragraph (1)(c), reduced by the amount worked out under subsection (4); or

(b) if all the membership interests (if any) that the life insurance company owns directly in the life insurance subsidiary, and all the membership interests (if any) that the life insurance company owns directly in interposed entities, are * virtual PST assets of the life insurance company--the amount worked out under subsection (6); or

(c) otherwise--nil.

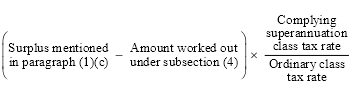

(6) The amount is worked out using the following formula (or is nil if it would otherwise be negative):

where:

"complying superannuation class tax rate" means the rate of tax in respect of the * complying superannuation class of the taxable income of a * life insurance company for the income year in which the joining time occurs (see paragraph 23A(b) of the Income Tax Rates Act 1986 ).

"ordinary class tax rate" means the rate of tax in respect of the * ordinary class of the taxable income of a life insurance company for the income year in which the joining time occurs (see subparagraph 23A(a)(ii) of the Income Tax Rates Act 1986 ).

713 - 550 Treatment of head company's franking account after joining

Sections 709 - 70 and 709 - 75 do not apply in relation to a * subsidiary member of a * consolidated group if:

(a) the subsidiary member is a * life insurance company; or

(b) a life insurance company that is a * member of the group owns * membership interests, either directly or indirectly through one or more interposed entities, in the subsidiary member.

Annuity payable by life insurance company to another member of a consolidated group

713 - 553 Special rules relating to segregated exempt assets

Conditions for sections 713 - 555 and 713 - 560 to apply

(1) Sections 713 - 555 and 713 - 560 apply only if both the conditions in subsections (2) and (3) are met.

Note: Each of those sections sets out extra conditions that must also be met for the section to apply.

(2) The first condition is that there is a time (the fusion time ) when it starts to be the case that both these entities (the fused entities ) are * members of a single * consolidated group:

(a) a * life insurance company;

(b) an entity (the policyholder ) holding an * exempt life insurance policy (the fused entities' policy ) that:

(i) was issued when the policyholder and the life insurance company were not both members of a single consolidated group; and

(ii) provided for the life insurance company to pay an * immediate annuity to the policyholder.

(3) The second condition is that the * head company of the * consolidated group determines the following amounts:

(a) the total * transfer value of the head company's * segregated exempt assets;

(b) the amount of the head company's * exempt life insurance policy liabilities;

as at a time (the determination time ) that is the fusion time or, if the head company does not determine those amounts as at the fusion time, the first time after the fusion time as at which the head company determines those amounts.

Note: If the life insurance company becomes a subsidiary member of the consolidated group, that company's segregated exempt assets become segregated exempt assets of the head company of the group because of section 701 - 5 (Entry history rule) and section 713 - 505 (Head company treated as a life insurance company).

Object of sections 713 - 555 and 713 - 560

(4) The object of sections 713 - 555 and 713 - 560 is to ensure that the * head company of the * consolidated group:

(a) does not have excessive amounts included in its assessable income because section 701 - 1 (Single entity rule) treats the fused entities as one so liabilities under the fused entities' policy do not contribute to the amount of the head company's * exempt life insurance policy liabilities as at the determination time; and

(b) has amounts included in its assessable income, or is allowed deductions, to reflect what would have happened to the fused entities if they had not both been * members of the group at any time between the fusion time and the determination time when they were both members of the group.

Application

(1) This section applies if:

(a) as at the determination time, the total * transfer value of the * segregated exempt assets of the * head company of the * consolidated group exceeds the amount of that company's * exempt life insurance policy liabilities, wholly or partly because:

(i) those assets include assets out of which exempt life insurance policy liabilities attributable to the fused entities' policy were to have been discharged; and

(ii) while both the fused entities are members of the group, the liability to pay the * annuity is taken not to exist for the head company core purposes set out in section 701 - 1 (Single entity rule), because one or more applications of that section treat the fused entities as one entity; and

(b) because of that excess, the head company transfers under subsection 320 - 235(1) or 320 - 250(2), from its segregated exempt assets, assets (the policy assets ) whose total transfer value equals the amount of the excess attributable to the matters described in subparagraphs (a)(i) and (ii).

However, this section does not apply if the policyholder ceases to be a * member of the consolidated group between the fusion time and the determination time.

Note: Subsections 320 - 235(1) and 320 - 250(2) require a life insurance company to transfer assets from its segregated exempt assets if, at certain times, the total transfer value of the segregated exempt assets exceeds the amount of the company's exempt life insurance policy liabilities.

Policy assets' transfer value not included in assessable income

(2) Paragraph 320 - 15(1)(f) does not apply to the transfer of the policy assets.

Note: Paragraph 320 - 15(1)(f) includes in a life insurance company's assessable income the transfer values of assets transferred by the company from the company's segregated exempt assets under subsection 320 - 235(1) or 320 - 250(2).

Extra assessable income if policy is not a qualifying security

(3) If the fused entities' policy is not a qualifying security (as defined in section 159GP of the Income Tax Assessment Act 1936 ), the assessable income of the * head company of the * consolidated group for the income year in which the company transfers the policy assets includes the amount worked out using the formula:

![]()

where:

"reduced purchase price of the annuity" means the reduced purchase price of the * annuity as at the determination time worked out under Subdivision AA of Division 2 of Part III of the Income Tax Assessment Act 1936 as if the determination time (rather than the fusion time) had been the first time at which both the fused entities were * members of the * consolidated group.

Assessable income or deduction if policy is a qualifying security

(4) If the fused entities' policy is a qualifying security (as defined in section 159GP of the Income Tax Assessment Act 1936 ), section 159GS (Balancing adjustment on transfer of qualifying security) of that Act applies as if:

(a) the * head company of the * consolidated group:

(i) had been the holder (as defined in section 159GP of that Act) of the policy; and

(ii) had transferred the policy when it transferred the policy assets; and

(b) the transfer price had equalled the total * transfer value of the policy assets; and

(c) the determination time (rather than the fusion time) had been the first time at which both the fused entities were * members of the consolidated group.

Note: If the policyholder becomes a subsidiary member of the consolidated group, section 701 - 5 (Entry history rule) treats the head company as if anything that had happened to the policyholder before it became a subsidiary member of the group had happened to the head company.

713 - 560 If valuation of segregated exempt assets is delayed

Application

(1) This section applies if there is a period (the gap ) between:

(a) the fusion time; and

(b) the determination time or the time at which the policyholder ceases to be a * member of the * consolidated group, whichever is earlier;

when the fused entities are both members of the consolidated group.

Continuation of exempt life insurance policy during the gap

(2) For the head company core purposes mentioned in section 701 - 1 (Single entity rule), Division 320 applies in relation to the fused entities' policy as if it continued to be an * exempt life insurance policy during the gap, even though both the fused entities were * members of the * consolidated group.

Transfer from segregated assets to provide for annuity payments

(3) During the gap, the * head company of the * consolidated group may transfer an asset from the head company's * segregated exempt assets to provide for payments of the * immediate annuity under the fused entities' policy.

Effect of transfer

(4) If the * head company of the * consolidated group transfers an asset under subsection (3):

(a) section 320 - 255 applies to the asset in the same way as that section applies to an asset transferred under subsection 320 - 250(2); and

(b) whichever one of subsections (5) and (6) is relevant affects the * head company of the * consolidated group for the income year in which the gap occurs.

Income if policy is not a qualifying security

(5) If the fused entities' policy is not a qualifying security (as defined in section 159GP of the Income Tax Assessment Act 1936 ), the * head company's assessable income includes the amount that, if the fused entities had not been * members of the * consolidated group:

(a) would have been included in the policyholder's assessable income under section 27H of that Act in connection with the policy; and

(b) would have been derived in the gap.

Income or deduction if policy is a qualifying security

(6) If the fused entities' policy is a qualifying security (as defined in section 159GP of the Income Tax Assessment Act 1936 ):

(a) the * head company's assessable income includes the amount (if any) that, if the fused entities had not been * members of the * consolidated group:

(i) would have been included in the policyholder's assessable income under section 159GQ of that Act in connection with the policy; and

(ii) would have been attributable to the gap; or

(b) the head company may deduct the amount (if any) that, if the fused entities had not been members of the consolidated group:

(i) would have been a deduction allowable to the policyholder under section 159GQ of that Act in connection with the policy; and

(ii) would have been attributable to the gap.

Liabilities for life insurance companies leaving consolidated group

(1) This section affects how paragraph 320 - 15(1)(h) and section 320 - 85 apply if:

(a) a * life insurance company ceases to be a * subsidiary member of a * consolidated group at a time (the leaving time ); and

(b) at the leaving time, the * life insurance company has one or more liabilities under the * net risk components of life insurance policies.

Note: Paragraph 320 - 15(1)(h) and section 320 - 85 both operate on the basis of a comparison of the value of a life insurance company's liabilities under the net risk components of life insurance policies at the end of the current year with the value of those liabilities at the end of the previous year, so that:

(a) that paragraph includes an amount in the company's assessable income for the current year if the value at the end of the current year is less than the value at the end of the previous income year; and

(b) that section allows a deduction for the current year if the value at the end of the current year is more than the value at the end of the previous income year.

(2) The object of this section is to ensure that:

(a) the * head company of the * consolidated group bears the income tax consequences relating to a change in * value of the liabilities before the leaving time; and

(b) the * life insurance company bears the income tax consequences relating to a change in value of the liabilities after the leaving time.

Head company's income or deduction from liabilities

(3) For the head company core purposes set out in section 701 - 1 (Single entity rule) relating to the income year in which the leaving time occurs (but not later income years), paragraph 320 - 15(1)(h) and section 320 - 85 have effect as if:

(a) the * head company of the * consolidated group had the liabilities at the end of that income year; and

(b) the * value of the liabilities at the end of that income year had been the amount that was actually the value of the liabilities (for the * life insurance company) at the leaving time.

Life insurance company's income or deduction from liabilities

(4) For the entity core purposes set out in section 701 - 1 (Single entity rule) relating to the * life insurance company and the income year in which the leaving time occurs, paragraph 320 - 15(1)(h) and section 320 - 85 have effect as if the * value of the liabilities at the end of the previous income year had been the amount that was actually the value of the liabilities (for the life insurance company) at the leaving time.

Losses for life insurance companies leaving consolidated group

713 - 570 Certain losses transferred to leaving company

(1) This section applies if:

(a) a * life insurance company ceases to be a * subsidiary member of a * consolidated group at a time (the leaving time ); and

(b) ignoring section 713 - 505, at the leaving time, no other * member of the group is a life insurance company that has a * virtual PST; and

(c) at the leaving time, the * head company has either:

(i) a * tax loss of the * complying superannuation class; or

(ii) a * net capital loss from * virtual PST assets.

(2) This Act operates (except so far as the contrary intention appears) for the purposes of income years ending after the leaving time as if:

(a) the * life insurance company had made the loss for the income year in which the leaving time occurs; and

(b) the * head company had not made the loss for the income year for which it made the loss.

Note: Section 707 - 410 (Exit history rule does not treat entity as having made a loss) does not prevent the life insurance company from having the loss under this section, because that section merely states that the company is not taken under section 701 - 40 (Exit history rule) to have made a loss.

(3) The * life insurance company is not prevented from * utilising the loss for the income year in which the leaving time occurs merely because this Act operates as if the life insurance company had made the loss for that year.

Tax cost setting rules for life insurance companies leaving consolidated group

713 - 575 Terminating value of certain assets where life insurance company leaves group

(1) This section applies if a * life insurance company (the leaving entity ) ceases to be a * subsidiary member of a * consolidated group at a time (the leaving time ).

(2) For the purposes of applying section 711 - 25 in relation to the leaving entity, the * head company's terminating value for an asset that it holds at the leaving time because the leaving entity is taken by subsection 701 - 1(1) to be a part of the head company is the * transfer value of the asset at the leaving time, if the asset is:

(a) a * virtual PST asset, or a * segregated exempt asset, of the head company; or

(b) held by the head company for the purpose of discharging its liabilities under the * net investment component of ordinary life insurance policies (except policies that provide for * participating benefits or * discretionary benefits under * life insurance business carried on in Australia).

713 - 580 Valuing certain liabilities where life insurance company leaves group

(1) Despite section 711 - 45, if the leaving entity mentioned in step 4 in the table in section 711 - 20 is a * life insurance company, the leaving entity's liabilities mentioned in this section are to be valued as mentioned in this section.

(2) To avoid doubt, those liabilities are the liabilities that become those of the leaving entity because section 701 - 1 (Single entity rule) ceases to apply to the leaving entity when it ceases to be a * subsidiary member of the group.

(3) The value of the leaving entity's * virtual PST liabilities (if any) is the amount worked out under section 320 - 190 at the leaving time.

(4) The value of the leaving entity's * exempt life insurance policy liabilities (if any) is the amount worked out under section 320 - 245 at the leaving time.

(5) Subsection (6) applies to a liability of the leaving entity if:

(a) the liability is under the * net risk component of a * life insurance policy; and

(b) the leaving entity could deduct under section 320 - 80 an amount for the * risk component of claims paid under the policy on or after the time it ceased to be a * member of the * consolidated group.

(6) The value of that liability is the * current termination value of the * net risk component of the * life insurance policy at the leaving time (calculated by an * actuary).

(7) The value of the leaving entity's liabilities under the * net investment component of ordinary life insurance policies is the amount worked out for those liabilities under subsection 320 - 190(2) as if those liabilities were * virtual PST liabilities.

713 - 585 Obligation to value certain assets and liabilities at leaving time

Division 320 has effect as if the time when a * life insurance company ceases to be a * subsidiary member of a * consolidated group were a * valuation time for the purposes of sections 320 - 175 and 320 - 230.

Note: This means that there must be a valuation of the virtual PST assets and virtual PST liabilities under section 320 - 175 (with the consequences set out in section 320 - 180), and a valuation of the segregated exempt assets and exempt life insurance policy liabilities under section 320 - 230 (with the consequences set out in section 320 - 235), as at that time.

26 At the end of Division 713

Add:

Subdivision 713 - M -- General insurance companies

713 - 700 What this Subdivision is about

This Subdivision sets out special rules for a general insurance company becoming or ceasing to be a subsidiary member of a consolidated group.

Table of sections

Tax cost setting rules for general insurance companies joining consolidated group

713 - 705 Certain assets taken to be retained cost base assets where general insurance company joins group

Liabilities and reserves of general insurance companies joining and leaving consolidated groups

713 - 710 Treatment of liabilities and reserves for income year when general insurance company joins or leaves group

713 - 715 If general insurance company joins consolidated group

713 - 720 If general insurance company leaves consolidated group

Tax cost setting rules for general insurance companies joining consolidated group

(1) This section applies if:

(a) a * general insurance company becomes a * subsidiary member of a * consolidated group at a time (the joining time ); and

(b) that company has demutualised under Division 9AA of Part III of the Income Tax Assessment Act 1936 ; and

(c) in the period starting just after the company demutualises and ending at the joining time, all of the * membership interests in the company were owned by the same group.

(2) A goodwill asset of the company just before the joining time is a retained cost base asset .

(3) The goodwill asset's * tax cost setting amount is its amount (worked out in accordance with subsection 121AN(2) of the Income Tax Assessment Act 1936 ) on the applicable accounting day (see subsection 121AN(4) of that Act).

Liabilities and reserves of general insurance companies joining and leaving consolidated groups

Sections 713 - 715 and 713 - 720 affect how sections 321 - 10, 321 - 15, 321 - 50 and 321 - 55 in Schedule 2J to the Income Tax Assessment Act 1936 (the affected sections ) apply in relation to these values (the affected values ):

(a) the value of the outstanding claims liability of a * general insurance company under * general insurance policies that is worked out under section 321 - 20 in Schedule 2J to the Income Tax Assessment Act 1936 ;

(b) the value of the unearned premium reserve of a general insurance company under general insurance policies that is worked out under section 321 - 60 in that Schedule.

Note 1: Sections 321 - 10 and 321 - 15 in that Schedule both operate on the basis of a comparison of the value of the outstanding claims liability of a general insurance company at the end of the current year with the value of that liability at the end of the previous income year, so that:

(a) section 321 - 10 includes an amount in the company's assessable income for the current year if the value at the end of the current year is less than the value at the end of the previous income year; and

(b) section 321 - 15 allows a deduction for the current year if the value at the end of the current year is more than the value at the end of the previous income year.

Note 2: Sections 321 - 50 and 321 - 55 in that Schedule both operate on the basis of a comparison of the value of the unearned premium reserve of a general insurance company at the end of the current year with the value of that reserve at the end of the previous income year, so that:

(a) section 321 - 50 includes an amount in the company's assessable income for the current year if the value at the end of the current year is less than the value at the end of the previous income year; and

(b) section 321 - 55 allows a deduction for the current year if the value at the end of the current year is more than the value at the end of the previous income year.

713 - 715 If general insurance company joins consolidated group

(1) This section applies if a * general insurance company becomes a * subsidiary member of a * consolidated group at a time (the joining time ).

(2) The object of this section is to ensure that the * head company of the * consolidated group bears the income tax consequences relating to changes after the joining time in the affected values.

Note: The general insurance company bears the income tax consequences relating to a change in the affected values before the joining time, because section 701 - 30 ensures that the affected sections apply in relation to a part of the income year before that time when the company was not a subsidiary member of a consolidated group as if that part were an income year.

(3) The affected sections apply for the head company core purposes set out in section 701 - 1 (Single entity rule) as if each of the affected values at the end of the last income year ending before the joining time were the amount that would have been that value had that income year ended just before the joining time.

713 - 720 If general insurance company leaves consolidated group

(1) This section applies if a * general insurance company ceases to be a * subsidiary member of a * consolidated group at a time (the leaving time ) in an income year (the leaving year ).

(2) The object of this section is to ensure that:

(a) the * head company of the * consolidated group bears the income tax consequences relating to changes before the leaving time in the affected values; and

(b) the * general insurance company bears the income tax consequences relating to changes after the leaving time in the affected values.

Head company's income or deduction

(3) For the head company core purposes set out in section 701 - 1 (Single entity rule) relating to the leaving year (but not later income years), the affected sections have effect as if each of the affected values at the end of the leaving year for the * head company of the * consolidated group were increased by the relevant value for the * general insurance company at the end of the previous income year worked out under subsection (5).

General insurance company's income or deduction

(4) For the entity core purposes set out in section 701 - 1 (Single entity rule) relating to the * general insurance company and the leaving year, the affected sections have effect as if each of the affected values for the general insurance company at the end of the previous income year were worked out under subsection (5).

Working out affected values at the end of the previous income year

(5) Work out each of the affected values for the * general insurance company at the end of the previous income year as if it had ended at the leaving time.

27 Subsection 995 - 1(1) (definition of retained cost base asset )

Omit "subsection 705 - 25(5) and 713 - 515(1)", substitute "subsections 705 - 25(5), 713 - 515(1) and 713 - 705(2)".

28 Subsection 995 - 1(1) (definition of terminating value )

Omit "705 - 30 and 711 - 30", substitute "705 - 30, 711 - 30 and 713 - 575".

Income Tax (Transitional Provisions) Act 1997

29 After paragraph 707 - 325(1)(e)

Insert:

(ea) neither of these sections applies in relation to the value donor as joining entity at the time the group became a consolidated group:

(i) section 713 - 535 (Losses of entities whose membership interests are virtual PST assets of life insurance company);

(ii) section 713 - 540 (Losses of entities whose membership interests are segregated exempt assets of life insurance company); and

30 At the end of subsection 707 - 325(5)

Add:

Note: For the purposes of paragraph (5)(a), ignore losses to which section 713 - 535 (Losses of entities whose membership interests are virtual PST assets of life insurance companies) of the Income Tax Assessment Act 1997 applies. See section 707 - 355 of this Act.

31 At the end of subsection 707 - 327(5)

Add:

Note: For the purposes of subparagraph (5)(a)(i), ignore losses to which section 713 - 535 (Losses of entities whose membership interests are virtual PST assets of life insurance companies) of the Income Tax Assessment Act 1997 applies. See section 707 - 355 of this Act.

32 At the end of subsection 707 - 328A(4)

Add:

Note: For the purposes of subparagraph (4)(a)(i), ignore losses to which section 713 - 535 (Losses of entities whose membership interests are virtual PST assets of life insurance companies) of the Income Tax Assessment Act 1997 applies. See section 707 - 355 of this Act.

33 At the end of subsection 707 - 350(5)

Add:

Note: For the purposes of paragraph (5)(a), ignore losses to which section 713 - 535 (Losses of entities whose membership interests are virtual PST assets of life insurance companies) of the Income Tax Assessment Act 1997 applies. See section 707 - 355 of this Act.

34 At the end of Subdivision 707 - C

Add:

707 - 355 Ignore certain losses in working out when a choice can be made under this Subdivision

In working out when a choice may be made under subsection 707 - 325(5), 707 - 327(5), 707 - 328A(4) or 707 - 350(5), ignore losses to which section 713 - 535 of the Income Tax Assessment Act 1997 applies.

Note: That section deals with losses transferred under Subdivision 707 - A of that Act from certain wholly - owned subsidiaries of life insurance companies that are members of a consolidated group.

35 At the end of Division 713

Add:

Subdivision 713 - M -- General insurance companies

Table of sections

713 - 700 Application

Subdivision 713 - M of the Income Tax Assessment Act 1997 applies on and after 1 July 2002.