Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated ActsIncome Tax Assessment Act 1997

1 Sections 165 - 212A, 165 - 212B and 165 - 212C

Repeal the sections.

2 Section 716 - 805

Repeal the section.

Part 2 -- Consequential amendments

Income Tax Assessment Act 1997

3 Section 165 - 5

Omit:

(Companies whose total income for the income year is more than $100 million cannot satisfy the same business test for that year.)

4 Section 165 - 10 (note 1)

Omit "Note 1", substitute "Note".

5 Section 165 - 10 (note 2)

Repeal the note.

6 Subsection 165 - 13(1)

Omit "(other than a company covered by section 165 - 212A)".

7 Subsection 165 - 13(1) (note 1)

Omit "Note 1", substitute "Note".

8 Subsection 165 - 13(1) (note 2)

Repeal the note.

9 Subsection 165 - 15(2) (note)

Repeal the note.

10 Subsection 165 - 23

Omit:

(Companies whose total income for an income year is more than $100 million cannot satisfy the same business test for that year.)

11 Section 165 - 30

Repeal the section, substitute:

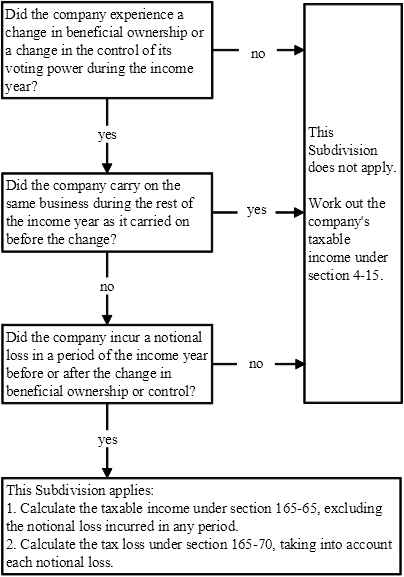

165 - 30 Flow chart showing the application of this Subdivision

Note: If the company was a partner during the income year, special rules apply to calculating a notional loss or notional taxable income.

12 Section 165 - 35 (note 3)

Repeal the note.

13 Subsection 165 - 40(2) (note)

Repeal the note.

14 Subsection 165 - 45(4) (note 3)

Repeal the note.

15 Section 165 - 93

Omit:

(Companies whose total income for the income year is more than $100 million cannot satisfy the same business test for that year.)

16 Section 165 - 99

Omit:

(Companies whose total income for an income year is more than $100 million cannot satisfy the same business test for that year.)

17 Section 165 - 115

Omit:

(Companies whose total income for an income year is more than $100 million cannot satisfy the same business test for that year.)

18 Subsection 165 - 115B(4) (note)

Repeal the note.

19 Subsection 165 - 115BA(4) (note)

Repeal the note.

20 Section 165 - 117

Omit:

(Companies whose total income for the income year is more than $100 million cannot satisfy the same business test for the second continuity period.)

21 Subsection 165 - 120(1) (note 4)

Repeal the note.

22 Subsection 165 - 126(1)

Omit "(other than a company covered by section 165 - 212A)".

23 Subsection 165 - 126(1) (note 1)

Omit "Note 1", substitute "Note:".

24 Subsection 165 - 126(1) (note 2)

Repeal the note.

25 Subsection 165 - 129(2) (note)

Repeal the note.

26 Subsection 165 - 132(1) (note)

Repeal the note.

27 Subsection 165 - 210(1)

Omit "(other than a company covered by section 165 - 212A)".

28 Subsection 165 - 210(1) (note)

Repeal the note.

29 Subsection 166 - 5(5) (note 2)

Repeal the note.

30 Subsection 166 - 5(5) (note 3)

Omit "Note 3", substitute "Note 2".

31 Subsection 166 - 20(4) (note 2)

Repeal the note.

32 Subsection 166 - 20(4) (note 3)

Omit "Note 3", substitute "Note 2".

33 Subsection 166 - 40(5) (note 2)

Repeal the note.

34 Subsection 166 - 40(5) (note 3)

Omit "Note 3", substitute "Note 2".

35 Subsection 175 - 5(2) (note)

Repeal the note.

36 Subsection 175 - 40(2) (note 1)

Omit "Note 1", substitute "Note".

37 Subsection 175 - 40(2) (note 2)

Repeal the note.

38 Subsection 175 - 80(2) (note)

Repeal the note.

39 Subsection 701 - 30(3A) (note 1)

Omit "Note 1", substitute "Note:".

40 Subsection 701 - 30(3A) (note 2)

Repeal the note.

41 Subsection 707 - 120(3) (note)

Repeal the note.

42 Subsection 707 - 125(2) (note)

Repeal the note.

43 Subsection 707 - 125(3) (note)

Repeal the note.

44 Subsection 707 - 125(4) (note 1)

Omit "Note 1", substitute "Note".

45 Subsection 707 - 125(4) (note 2)

Repeal the note.

46 Subsection 707 - 135(2) (note)

Repeal the note.

47 Subsection 707 - 210(6) (note)

Repeal the note.

48 Subsection 715 - 15(1) (note 1)

Omit "Note 1", substitute "Note".

49 Subsection 715 - 15(1) (note 2)

Repeal the note.

50 Subsection 715 - 50(1) (note)

Repeal the note.

51 Subsection 715 - 55(1) (note 1)

Omit "Note 1", substitute "Note".

52 Subsection 715 - 55(1) (note 2)

Repeal the note.

53 Subsection 715 - 60(1) (note 1)

Omit "Note 1", substitute "Note".

54 Subsection 715 - 60(1) (note 2)

Repeal the note.

55 Subsection 715 - 70(2) (note 1)

Omit "Note 1", substitute "Note".

56 Subsection 715 - 70(2) (note 2)

Repeal the note.

57 Subsection 715 - 95(3) (note 1)

Omit "Note 1", substitute "Note".

58 Subsection 715 - 95(3) (note 2)

Repeal the note.

59 Subsection 715 - 355(3) (note 1)

Omit "Note 1", substitute "Note".

60 Subsection 715 - 355(3) (note 2)

Repeal the note.

61 Subsection 715 - 360(3) (note 3)

Repeal the note.

62 Subsection 716 - 850(1) (note 1)

Omit "Note 1", substitute "Note".

63 Subsection 716 - 850(1) (note 2)

Repeal the note.

64 Subsection 719 - 260(2) (note)

Omit "(However, companies whose total income for the claim year is more than $100 million cannot satisfy the same business test for that year: see section 165 - 212A.)".

65 Subsection 719 - 260(3) (note)

Repeal the note.

66 Section 719 - 285 (note 1)

Omit "(Companies whose total income for an income year is more than $100 million cannot satisfy the same business test for the same business test period: see section 165 - 212A.)".

67 Subsection 995 - 1(1) (definition of total income )

Repeal the definition.

68 Application

The amendments made by this Schedule apply to:

(a) any tax loss that is incurred in an income year commencing on or after 1 July 2005; and

(b) any net capital loss that is made in an income year commencing on or after 1 July 2005; and

(c) any deduction in respect of a bad debt that is incurred in an income year commencing on or after 1 July 2005.