Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated ActsIncome Tax Assessment Act 1997

1 Section 124 - 140 (heading)

Repeal the heading, substitute:

124 - 140 New statutory licences

2 Subsection 124 - 140(1)

Repeal the subsection, substitute:

(1) There is a roll - over if:

(a) your ownership of one or more * statutory licences (each of which is an original licence ) ends, resulting in * CGT event C2 happening to the licence (or to each of the licences as part of an * arrangement); and

(b) as a result of the CGT event or events, you are issued one or more new licences (each of which is a new licence ) for the original licence (or original licences); and

(c) the new licence authorises (or the new licences taken together authorise) substantially similar activity as that authorised by the original licence (or by the original licences taken together).

Note: If there has been a capital improvement to the original licence: see section 108 - 75.

(1A) If:

(a) you are a foreign resident just before the * CGT event happens (or just before one or more of the CGT events happens); or

(b) you are the trustee of a trust that is a * foreign trust for CGT purposes for the income year in which the event happens (or for an income year in which one or more of those events happens);

there is no roll - over under this section unless the conditions in subsection (1B) are satisfied.

(1B) The conditions are that:

(a) if there was only one original licence--the licence must be * taxable Australian property just before the * CGT event happens; and

(b) if there was more than one original licence--each original licence must be taxable Australian property just before the CGT event in relation to it happens; and

(c) if there is only one new licence--the licence must be taxable Australian property just after you * acquire it; and

(d) if there is more than one new licence--each new licence must be taxable Australian property just after you acquire it.

3 At the end of Subdivision 124 - C

Add:

124 - 145 Rollover consequences--capital gain or loss disregarded

A * capital gain or * capital loss you make from the original licence (or from each of the original licences) is disregarded.

124 - 150 Rollover consequences--partial roll - over

(1) You can obtain only a partial roll - over in relation to an original licence if the * capital proceeds for that licence includes something (the ineligible proceeds ) other than a new licence or new licences. There is no roll - over for that part (the ineligible part ) of the licence for which you received the ineligible proceeds.

Note: If there is more than one original licence, some or all of those original licences may each have an ineligible part.

(2) The * cost base of the ineligible part is that part of the cost base of the original licence as is reasonably attributable to the ineligible part.

(3) The * reduced cost base of the ineligible part is that part of the reduced cost base of the original licence as is reasonably attributable to the ineligible part.

(4) For the purposes of sections 124 - 155 and 124 - 165, for each original licence that has an ineligible part:

(a) reduce the * cost base of that licence (just before the * CGT event that happened in relation to it) by so much of that cost base as is attributable to that ineligible part; and

(b) reduce the * reduced cost base of that licence (just before the CGT event that happened in relation to it) by so much of that reduced cost base as is attributable to that ineligible part.

124 - 155 Roll - over consequences--all original licences were post - CGT

(1) This section applies if you * acquired the original licence (or all of the original licences) on or after 20 September 1985.

(2) The first element of the * cost base of the new licence (or of each of the new licences) is such amount as is reasonable having regard to:

(a) the total of the cost bases of all the original licences; and

(b) the number, * market value and character of the original licences; and

(c) the number, market value and character of the new licences.

(3) The first element of the * reduced cost base of the new licence (or of each of the new licences) is such amount as is reasonable having regard to:

(a) the total of the reduced cost bases of all the original licences; and

(b) the number, * market value and character of the original licences; and

(c) the number, market value and character of the new licences.

124 - 160 Roll - over consequences--all original licences were pre - CGT

If you * acquired the original licence (or all of the original licences) before 20 September 1985, you are taken to have acquired the new licence (or all of the new licences) before that day.

124 - 165 Roll - over consequences--some original licences were pre - CGT, others were post - CGT

(1) This section applies if:

(a) there was more than one original licence; and

(b) you * acquired one or more of the original licences before 20 September 1985; and

(c) you acquired one or more of the original licences on or after that day.

(2) Each new licence is taken to be 2 separate * CGT assets that are both * statutory licences:

(a) one (which you are taken to have * acquired on or after 20 September 1985) representing the extent to which you acquired the original licences on or after that day; and

(b) another (which you are taken to have acquired before that day) representing the extent to which you acquired the original licences before that day.

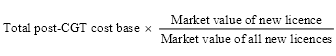

(3) The first element of the * cost base and * reduced cost base of the * CGT asset mentioned in paragraph (2)(a) in relation to a new licence is worked out under the formula:

where:

"market value of all new licences" is the total of the * market values of all of the new licences.

"market value of new licence" is the * market value of the new licence to which the * CGT asset mentioned in paragraph (2)(a) relates.

"total post-CGT cost base" is the total of the * cost bases of all the original licences that you * acquired on or after 20 September 1985.

Income Tax (Transitional Provisions) Act 1997

4 Before Division 126

Insert:

Division 124 -- Replacement - asset roll - overs

Subdivision 124 - C -- Statutory licences

124 - 140 New statutory licence--ASGE licence etc.

(1) Sections 124 - 141 and 124 - 142 apply if:

(a) there are one or more roll - overs under section 124 - 140 of the Income Tax Assessment Act 1997 where:

(i) your ownership of one or more statutory licences (each of which is an original licence ) ends, resulting in CGT event C2 happening to the licence (or to each of the licences as part of an arrangement); and

(ii) you are issued one or more new licences (each of which is a new licence ) for the original licence (or original licences); and

(b) if there was only one original licence--that licence is covered under subsection (2); and

(c) if there was more than one original licence--at least one of the original licences was covered under subsection (2); and

(d) if there is only one new licence--that licence is covered under subsection (3); and

(e) if there is more than one new licence--only one of the new licences is covered under subsection (3); and

(f) the original licence (or at least one of the original licences) has an ineligible part (as described in section 124 - 150 of the Income Tax Assessment Act 1997 ).

(2) A licence is covered under this subsection if it is:

(a) a bore licence issued under the Water Act 1912 of New South Wales; or

(b) a licence of a kind specified in the regulations.

(3) A licence is covered under this subsection if it is:

(a) an aquifer access licence under the Water Management Act 2000 of New South Wales issued in accordance with the New South Wales Achieving Sustainable Groundwater Entitlements program (the ASGE program ); or

(b) a licence of a kind specified in the regulations.

124 - 141 ASGE licence etc.--cost base of ineligible part

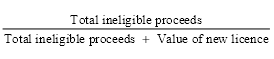

(1) For an original licence that has an ineligible part, the cost base of the ineligible part is the cost base of the original licence multiplied by the amount worked out under the formula:

where:

"total ineligible proceeds" is the total of the ineligible proceeds (as described in section 124 - 150 of the Income Tax Assessment Act 1997 ) in relation to all of the original licences that have an ineligible part.

"value of new licence" is:

(a) if the new licence is an aquifer access licence mentioned in paragraph 124 - 40(3)(a)--the 2002 value assigned under the ASGE program to the new licence; or

(b) otherwise--the value of the new licence worked out in accordance with the regulations.

(2) The regulations may specify one or more ways of working out the value of a licence (other than an aquifer access licence mentioned in paragraph 124 - 40(3)(a)) for the purposes of this section.

(3) For an original licence that has an ineligible part, the reduced cost base of the ineligible part is the reduced cost base of the original licence multiplied by the amount worked under the formula set out in subsection (1).

124 - 142 ASGE licence etc.--cost base of aquifer access licence etc.

(1) The first element of the cost base and reduced cost base of the new licence that is covered under subsection 124 - 140(3) is the total of the cost bases of the original licences.

Note: For the purposes of this section, the cost base of each original licence that has an ineligible part is reduced in accordance with subsection 124 - 150(4) of the Income Tax Assessment Act 1997 .

(2) The cost base and reduced cost base of any new licence that is not covered under subsection 124 - 140(3) is nil.

(3) Subsections (4) and (5) apply if:

(a) there was more than one original licence; and

(b) some of the original licences were acquired before 20 September 1985; and

(c) subsection 124 - 165(2) of the Income Tax Assessment Act 1997 applies in relation to the new licence that is covered under subsection 124 - 140(3) (splitting that licence into 2 separate CGT assets).

(4) For the purposes of subsection (2), treat the asset that is taken under paragraph 124 - 165(2)(a) of that Act to have been acquired on or after 20 September 1985 as a new licence that is covered under subsection 124 - 140(3) of this Act.

(5) Work out the first element of the cost base and reduced cost base of that asset in accordance with subsection 124 - 165(3) of that Act.

Part 2 -- Consequential and other amendments

Income Tax Assessment Act 1997

5 After section 112 - 53

Insert:

New statutory licence | |||

Item | In this situation: | Element affected: | See section: |

1 | New statutory licences | First element of cost base and reduced cost base | 124 - 150, 124 - 155 and 124 - 160 |

6 Section 112 - 115 (table item 5)

Omit "Renewal or extension of a statutory licence", substitute "New statutory licences".

7 After subsection 116 - 30(2)

Insert:

(2A) Subsection (2) does not apply if there is a partial roll - over for the * CGT event because of section 124 - 150.

8 Subsection 124 - 5(2) (note)

After "The consequences of a scrip for scrip roll - over are set out in Subdivision 124 - M.", insert "The consequences of replacing a statutory licence by a new statutory licence are set out in Subdivision 124 - C.".

9 Subsection 124 - 10(1) (example)

Repeal the example.

10 Subsection 124 - 10(3) (example)

Repeal the example.

11 Subsection 124 - 10(3) (note 1)

Omit "Subdivisions 124 - C (about statutory licences),".

12 Subsection 124 - 140(2) (note)

Repeal the note.

Income Tax (Transitional Provisions) Act 1997

13 After Chapter 4

Insert:

The Governor - General may make regulations prescribing matters:

(a) required or permitted by this Act to be prescribed; or

(b) necessary or convenient to be prescribed for carrying out or giving effect to this Act.

14 Application

The amendments made by this Schedule (other than item 13) apply to CGT events that happen in the 2006 - 2007 income year and later income years.