Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated ActsPart 1 -- Amendments relating to disposals of shares or units in unit trusts

Income Tax Assessment Act 1936

1 Division 17A of Part IIIA (heading)

Repeal the heading, substitute:

Division 17A -- Roll - over relief for certain disposals of assets related to small businesses

2 Subsection 160ZZPK(1)

Insert:

"approved asset" has the meaning given by subsections 160ZZPT(1AA) to (1AC).

3 Subsection 160ZZPK(1)

Insert:

"controlling individual" has the meaning given by section 160ZZPNA.

4 Subsection 160ZZPK(1) (at the end of the definition of gross non - goodwill roll - over amount )

Add "or (3A)".

5 Subsection 160ZZPK(1)

Insert:

"resident unit trust" has the same meaning as in section 102Q.

6 Subsection 160ZZPK(1) (at the end of the definition of roll - over asset )

Add ", (8) or (9)".

7 Before paragraph 160ZZPL(7)(a)

Insert:

(aa) the asset is not a share in a company or a unit in a unit trust; and

8 At the end of section 160ZZPL

Add:

(8) A share in a company is a roll - over asset in respect of a taxpayer who is an individual (other than an individual acting as a trustee) in respect of a year of income if:

(a) the company is, in respect of the year of income, a private company that is a resident; and

(b) the share is disposed of by the taxpayer in the year of income; and

(c) the taxpayer is the controlling individual of the company at the disposal test time; and

(d) the threshold criteria set out in section 160ZZPP are complied with at the disposal test time.

(9) A unit in a unit trust is a roll - over asset in respect of a taxpayer who is an individual (other than an individual acting as a trustee) in respect of a year of income if:

(a) the unit trust is a resident unit trust, but is not a publicly traded unit trust, in respect of the year of income; and

(b) the unit is disposed of by the taxpayer in the year of income; and

(c) the taxpayer is the controlling individual of the trust at the disposal test time; and

(d) the threshold criteria set out in section 160ZZPP are complied with at the disposal test time.

9 At the end of Subdivision A of Division 17A of Part IIIA

Add:

160ZZPNA Controlling individual

Explanation of section

(1) This section sets out the meaning of controlling individual of a company and of a unit trust.

Control of companies

(2) An individual is the controlling individual of a company at a particular time if, at that time, the individual:

(a) is a director and an employee (see subsection (4)) of the company; and

(b) holds all of the legal and equitable interests in shares that carry (between them) the right to exercise at least 50% of the voting power in the company; and

(c) holds all of the legal and equitable interests in shares that carry (between them) the right to receive at least 50% of any dividends that the company may pay; and

(d) holds all of the legal and equitable interests in shares that carry (between them) the right to receive at least 50% of any distribution of capital of the company.

Control of unit trusts

(3) An individual is the controlling individual of a unit trust at a particular time if, at that time, the individual:

(a) is an employee (see subsection (4)) of the trust; and

(b) has, for his or her benefit, entitlements to at least a 50% share of the income of the trust; and

(c) has, for his or her benefit, entitlements to at least a 50% share of the capital of the trust.

Employee

(4) In this section:

"employee" has the same meaning as in the Superannuation Guarantee (Administration) Act 1992 , except that subsection 12(11) of that Act is to be disregarded.

Redeemable shares to be disregarded

(5) For the purposes of subsection (2), a person who, at a particular time, holds a legal or equitable interest in a share:

(a) that is liable to be redeemed; or

(b) that, at the option of the company that issued it, is liable to be redeemed;

is taken not to hold the interest at that time.

Individual becoming director or employee within 3 months

(6) If an individual:

(a) nominates a replacement asset that is a share in a private company or a unit in a unit trust; and

(b) becomes a director and employee of the company, or an employee of the trust, as the case may be, within 3 months after he or she acquires the share or unit;

the individual is taken, for the purposes of this Division, to have been such a director and employee, or such an employee, as the case may be, at all times during that period.

10 Subdivision B of Division 17A of Part IIIA (heading)

Repeal the heading, substitute:

Subdivision B -- How roll - over relief is available on the disposal of an asset

11 Section 160ZZPO

Repeal the section, substitute:

160ZZPO What this Subdivision is about

This Subdivision sets out the way in which roll - over relief is given to a taxpayer in respect of a year of income in which certain assets (roll - over assets) are disposed of by the taxpayer.

If certain threshold criteria and other conditions are satisfied, capital gains do not accrue in respect of the disposals and net roll - over amounts are worked out for the roll - over assets.

The taxpayer may then nominate certain replacement assets in respect of the net roll - over amounts and is to apportion the net roll - over amounts to replacement assets in accordance with various rules.

The amounts apportioned are taken to reduce the cost base of the replacement assets.

12 Subsection 160ZZPP (note)

Omit "paragraph 160ZZPL(7)(b)", substitute "paragraphs 160ZZPL(7)(b), (8)(d) and (9)(d)".

13 Paragraphs 160ZZPQ(1)(c) and (d)

Repeal the paragraphs, substitute:

(c) where the roll - over asset is neither a share in a company nor a unit in a unit trust:

(i) the roll - over asset was an active asset at the disposal test time or, if it was not an active asset at that time because the relevant business had ceased to be carried on, the cessation occurred not earlier than 12 months before that time; and

(ii) the roll - over asset was an active asset during more than one - half of the period in which it was owned by the taxpayer; and

14 Subsection 160ZZPQ(3)

Repeal the subsection, substitute:

Calculation of gross non - goodwill roll - over amount for assets other than shares or units

(3) If the roll - over asset is none of the following:

(a) goodwill;

(b) a share in a company;

(c) a unit in a unit trust;

an amount (the gross non - goodwill roll - over amount ) equal to the notional capital gain is taken for the purposes of this Division to apply to the taxpayer in respect of the year of income in which the disposal occurred.

Calculation of gross non - goodwill roll - over amount for shares or units

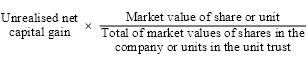

(3A) If the roll - over asset is a share in a company or a unit in a unit trust, an amount (the gross non - goodwill roll - over amount ) equal to the lesser of the following amounts is taken for the purposes of this Division to apply to the taxpayer in respect of the year of income in which the disposal occurred:

(a) an amount equal to the notional capital gain;

(b) the amount worked out using the formula:

Amount taken to be capital gain

(3B) If the gross non - goodwill roll - over amount is the amount worked out under paragraph (3A)(b), an amount equal to the difference between the notional capital gain and the amount worked out under that paragraph is taken to be a capital gain that accrued to the taxpayer in the year of income in which the disposal occurred.

Unrealised net capital gain from active assets

(3C) Subject to subsection (3D), for the purposes of paragraph (3A)(b), the unrealised net capital gain is the total of the capital gains (after deducting any capital losses) that would accrue to the company or trust at the time of the disposal, as the case may be, if all assets of the company or trust that:

(a) either:

(i) were active assets at that time; or

(ii) had ceased to be active assets because of the cessation of the relevant business of the company or trust not earlier than 12 months before that time; and

(b) had been active assets during more than one - half of the period in which they were owned by the company or were assets of the trust, as the case may be;

were disposed of at that time and the consideration for the disposal of each asset was an amount equal to the market value of the asset.

Certain assets to be disregarded in calculating unrealised net capital gain

(3D) In calculating the unrealised net capital gain referred to in subsection (3C), no regard is to be had to any asset that had been nominated by the company or trust as a replacement asset for the purposes of this Division and was acquired by the company or trust less than 5 years before the time of the disposal of the roll - over asset.

15 Subsection 160ZZPT(1)

Omit all the words after "one or more", substitute "approved assets (a replacement asset or replacement assets ) that were acquired by the taxpayer within the period beginning one year before, and ending 2 years after, the last disposal by the taxpayer of any roll - over asset in that year of income".

16 After subsection 160ZZPT(1)

Insert:

Active asset may be nominated

(1AA) An active asset is an approved asset.

Certain shares may be nominated

(1AB) A share in a company is an approved asset in respect of a taxpayer if:

(a) the taxpayer is an individual (other than an individual who is acting as a trustee); and

(b) the company is, in respect of a year of income in which the share is acquired by the taxpayer, a private company that is a resident; and

(c) the taxpayer is the controlling individual of the company immediately after the share is acquired by the taxpayer; and

(d) the total of the market values of all the active assets of the company at the time of the acquisition of the share by the taxpayer is not less than 80% of the total of the market values of all the company's assets at that time.

Certain units in unit trusts may be nominated

(1AC) A unit in a unit trust is an approved asset in respect of a taxpayer if:

(a) the taxpayer is an individual (other than an individual who is acting as a trustee); and

(b) the trust is, in respect of a year of income in which the unit is acquired by the taxpayer, a resident unit trust that is not a publicly traded unit trust; and

(c) the taxpayer is the controlling individual of the trust immediately after the unit is acquired by the taxpayer; and

(d) the total of the market values of all the active assets of the trust at the time of the acquisition of the unit by the taxpayer is not less than 80% of the total of the market values of all the assets of the trust at that time.

17 Subsections 160ZZPV(2) and (3)

Repeal the subsections, substitute:

(2) If this section applies, the following provisions have effect:

(a) the taxpayer must apportion the total net roll - over amount among the nominated replacement assets in such manner as the taxpayer determines but so that the amount apportioned to a particular asset does not exceed the lesser of:

(i) the cost base of the asset; and

(ii) if the asset is a share in a company or a unit in a unit trust--the maximum apportionment amount for the share or unit worked out under subsection (3);

(b) if an amount is apportioned to an asset that is not a depreciable asset--the cost base of the asset is taken, from the time of its acquisition by the taxpayer, to have been reduced by the amount;

(c) if an amount is apportioned to an asset that is a depreciable asset and section 160ZZPX does not apply in relation to the asset before it is disposed of--the amount is taken to be a capital gain that accrues to the taxpayer during the year of income in which the asset is disposed of;

(d) if the amount apportioned to assets under paragraph (a) is less than the total net roll - over amount--an amount equal to the difference is taken to be a capital gain that accrued to the taxpayer during the disposal year of income.

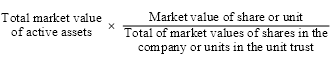

(3) The maximum apportionment amount for a share in a particular company or a unit in a particular unit trust is:

where:

"active assets" are those assets of the company or trust that were active assets of the company or trust, as the case may be, at the time of the acquisition of the shares or units.

"market value" means the market value at that time.

18 Subsections 160ZZPW(5) and (6)

Repeal the subsections, substitute:

(5) If this section applies, the following provisions also have effect:

(a) the taxpayer must apportion the residual net roll - over amount among the nominated non - goodwill replacement assets in such manner as the taxpayer determines but so that the amount apportioned to a particular asset does not exceed the lesser of:

(i) the cost base of the asset; and

(ii) if the asset is a share in a company or a unit in a unit trust--the maximum apportionment amount for the share or unit worked out under subsection (6);

(b) if an amount is apportioned to an asset that is not a depreciable asset--the cost base of the asset is taken, from the time of its acquisition by the taxpayer, to have been reduced by the amount;

(c) if an amount is apportioned to an asset that is a depreciable asset and section 160ZZPX does not apply in relation to the asset before it is disposed of--the amount is taken to be a capital gain that accrues to the taxpayer during the year of income in which the asset is disposed of;

(d) if the amount apportioned to assets under paragraph (a) is less than the residual net roll - over amount--an amount equal to the difference is taken to be a capital gain that accrued to the taxpayer during the disposal year of income.

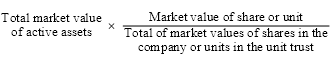

(6) The maximum apportionment amount for a share in a particular company or a unit in a particular unit trust is:

where:

"active assets" are those assets of the company or trust that were active assets of the company or trust, as the case may be, at the time of the acquisition of the shares or units.

"market value" means the market value at that time.

19 After section 160ZZPX

Insert:

160ZZPXA Change of circumstances of company or unit trust

Change of circumstances to which section applies

(1) This section applies if:

(a) there is a roll - over asset in respect of a taxpayer in respect of a year of income; and

(b) there is a net roll - over amount that applies to the taxpayer in respect of the year of income; and

(c) a replacement asset is nominated by the taxpayer under section 160ZZPT in respect of the net roll - over amount; and

(d) the replacement asset is a share in a company or a unit in a unit trust; and

(e) at a time (the change time ) after the taxpayer nominated the replacement asset:

(i) the taxpayer ceases to be the controlling individual of the company or trust; or

(ii) the total of the market values of the active assets of the company or trust falls below 80% of the total of the market values of all the assets owned by the company or the assets of the trust, as the case may be; or

(iii) the company ceases to be a private company that is a resident, the trust ceases to be a resident unit trust or the trust becomes a publicly traded unit trust, as the case may be; and

(f) the replacement asset is owned by the taxpayer immediately after the change time.

Exception

(2) Subparagraph (1)(e)(ii) does not apply if the total of the market values of the active assets referred to in that subparagraph fell below the percentage so referred to only because of changes in the market values of assets owned by the company or trust at the time of the nomination.

Capital gain accrues when change of circumstances occurs

(3) An amount (the adjustment amount ) equal to the amount that was apportioned to the asset by the taxpayer under section 160ZZPV or 160ZZPW, as the case may be, is taken to be a capital gain that accrued to the taxpayer in the year of income in which the relevant change time occurred.

Consideration to be increased

(4) The cost base of the asset is increased, at the change time, by the adjustment amount.

20 Paragraph 160ZZPZD(1)(a)

Omit "to (d)", substitute "to (c)".

21 After paragraph 160ZZPZD(1)(a)

Insert:

(aa) the asset is a roll - over asset within the meaning of subsection 160ZZPL(7); and

22 Paragraph 160ZZPZH(2)(a)

Omit "to (d)", substitute "to (c)".

23 After paragraph 160ZZPZH(2)(a)

Insert:

(aa) the asset is a roll - over asset within the meaning of subsection 160ZZPL(7); and

24 Paragraph 160ZZPZI(2)(a)

Omit "to (d)", substitute "to (c)".

25 After paragraph 160ZZPZI(2)(a)

Insert:

(aa) the asset is a roll - over asset within the meaning of subsection 160ZZPL(7); and

26 Application of amendments

The amendments made by this Part apply to disposals of assets on or after 1 July 1997.

Part 2 -- Technical amendments

Income Tax Assessment Act 1936

27 Subsection 160ZZPK(1)

Insert:

"consideration" , in respect of the acquisition of an asset, means the amount that is that consideration within the meaning of section 160ZH.

28 Subsection 160ZZPK(1)

Insert:

"incidental costs" to a taxpayer of the acquisition of an asset means the amount constituting those costs within the meaning of section 160ZH.

29 Subsection 160ZZPK(1) (definition of total goodwill cost base )

Repeal the definition, substitute:

"total goodwill cost base" , in relation to a taxpayer in relation to a disposal year of income, means the amount that, apart from this Division, would be:

(a) the sum (worked out at the time of acquisition) of the consideration in respect of, and the incidental costs to the taxpayer of, the acquisition of the replacement goodwill asset nominated by the taxpayer in respect of a net goodwill roll - over amount that applies to the taxpayer in respect of that year of income; or

(b) if the taxpayer nominated 2 or more replacement goodwill assets in respect of such a net goodwill roll - over amount--the sum (worked out at the time of the relevant acquisition) of the considerations in respect of, and the incidental costs to the taxpayer of, the acquisition of those replacement goodwill assets.

30 Subsection 160ZZPK(1) (definition of total non - goodwill cost base )

Repeal the definition.

31 After subsection 160ZZPL(3)

Insert:

Subsection 157(3) to be disregarded

(3A) In determining for the purposes of this section whether a taxpayer is carrying on a business, subsection 157(3) is to be disregarded.

32 Subsection 160ZZPL(5)

After "roll - over asset", insert "that is an intangible asset and".

Note: The heading to subsection 160ZZPL(5) is replaced by " Exception for intangible roll - over asset whose value has been enhanced by the taxpayer ".

33 After subsection 160ZZPN(2)

Insert:

Where Public Trustee is trustee of discretionary trust

(2A) Subparagraph (2)(c)(i) does not apply to the first entity if the trustee of the trust referred to in that subparagraph is the Public Trustee of a State or Territory acting in that capacity.

34 Paragraph 160ZZPN(3)(c)

After "is", insert "not".

35 Section 160ZZPO

Omit "base", substitute "of the acquisition".

36 Subsection 160ZZPP(2)

Repeal the subsection.

37 Subsection 160ZZPP(3)

Omit "or an associate of the taxpayer".

38 After paragraph 160ZZPP(4)(a)

Insert:

Note: The assets of a taxpayer do not include shares, units or other interests in entities connected with the taxpayer (see subsection 160ZZPL(2)).

39 Paragraph 160ZZPP(4)(c)

Repeal the paragraph.

40 Paragraph 160ZZPQ(1)(e)

Repeal the paragraph, substitute:

(e) if the roll - over asset was nominated as a replacement asset under a previous application of this Division--the roll - over asset was acquired by the taxpayer more than 5 years before the disposal test time; and

41 Paragraph 160ZZPR(2)(b)

Repeal the paragraph, substitute:

(b) then, in reduction of any net capital losses that:

(i) the taxpayer is taken to have incurred in respect of years of income ( applicable years of income ) earlier than the disposal year of income but not earlier than the 1995 - 96 year of income; and

(ii) would, apart from this Division, be applied in determining whether a net capital gain accrues to the taxpayer in respect of the disposal year of income (if sufficient capital gains were to accrue in the disposal year of income).

42 At the end of paragraph 160ZZPS(2)(b)

Add:

; and (iii) would, apart from this Division, be applied in determining whether a net capital gain accrues to the taxpayer in respect of the disposal year of income (if sufficient capital gains were to accrue in the disposal year of income).

43 Before subsection 160ZZPT(2)

Insert:

When nomination to be made

(1A) A nomination of a replacement asset must be made before the end of 2 years after the last disposal by the taxpayer of any roll - over asset in the year of income to which the net roll - over amount relates.

44 Paragraphs 160ZZPU(2)(a) and (b)

Repeal the paragraphs, substitute:

(a) the taxpayer must apportion the whole of the net goodwill roll - over amount among the nominated replacement assets in such manner as the taxpayer determines but so that the amount apportioned to a particular asset does not exceed the sum of:

(i) the amount that, at the time of the acquisition of the asset, was the consideration in respect of the acquisition of the asset; and

(ii) the amount that, at that time, was the total of the incidental costs to the taxpayer of the acquisition of the asset; and

(b) if an amount is apportioned to an asset--the amount is to be applied, at the time of the acquisition of the asset by the taxpayer, in reduction of the following amounts in such proportions as the taxpayer determines:

(i) the amount that, at the time of the acquisition of the asset, was the consideration in respect of the acquisition of the asset;

(ii) the amount that, at that time, was the total of the incidental costs to the taxpayer of the acquisition of the asset.

45 Paragraphs 160ZZPU(3)(a) and (b)

Repeal the paragraphs, substitute:

(a) the taxpayer must apportion so much of the net goodwill roll - over amount as is equal to the total goodwill cost base among the nominated replacement assets so that the amount apportioned to a particular asset does not exceed the sum of:

(i) the amount that, at the time of the acquisition of the asset, was the consideration in respect of the acquisition of the asset; and

(ii) the amount that, at that time, was the total of the incidental costs to the taxpayer of the acquisition of the asset;

(b) if an amount is apportioned to an asset--the consideration in respect of the acquisition of the asset and the incidental costs to the taxpayer of the acquisition of the asset are each taken, at the time of the acquisition of the asset by the taxpayer, to be nil;

46 Paragraphs 160ZZPV(2)(a) and (b)

Repeal the paragraphs, substitute:

(a) the taxpayer must apportion the total net roll - over amount among the nominated replacement assets in such manner as the taxpayer determines but so that the amount apportioned to a particular asset does not exceed the lesser of:

(i) the sum of the acquisition amounts set out in subsection (2B); and

(ii) if the asset is a share in a company or a unit in a unit trust--the maximum apportionment amount for the share or unit worked out under subsection (3);

(b) if an amount is apportioned to an asset that is not a depreciable asset--the amount is to be applied in reduction of the acquisition amounts for the asset in such proportions as the taxpayer determines;

47 After subsection 160ZZPV(2)

Insert:

(2A) The reductions set out in paragraph (2)(b) are taken to have been made at the time of the acquisition of the asset by the taxpayer.

(2B) The acquisition amounts for an asset are:

(a) the amount that, at the time of the acquisition of the asset, was the consideration in respect of the acquisition of the asset; and

(b) the amount that, at that time, was the total of the incidental costs to the taxpayer of the acquisition of the asset.

48 Paragraphs 160ZZPW(3)(a) and (b)

Repeal the paragraphs, substitute:

(a) the taxpayer must apportion the whole of the net goodwill roll - over amount among the replacement assets that are nominated in respect of the net goodwill roll - over amount in such manner as the taxpayer determines but so that the amount apportioned to a particular asset does not exceed the sum of:

(i) the amount that, at the time of the acquisition of the asset, was the consideration in respect of the acquisition of the asset; and

(ii) the amount that, at that time, was the total of the incidental costs to the taxpayer of the acquisition of the asset;

(b) if an amount is apportioned to an asset--the amount is to be applied, at the time of the acquisition of the asset by the taxpayer, in reduction of the following amounts in such proportions as the taxpayer determines:

(i) the amount that, at the time of the acquisition of the asset, was the consideration in respect of the acquisition of the asset;

(ii) the amount that, at that time, was the total of the incidental costs to the taxpayer of the acquisition of the asset.

49 Paragraphs 160ZZPW(4)(a) and (b)

Repeal the paragraphs, substitute:

(a) the taxpayer must apportion so much of the net goodwill roll - over amount as is equal to the total goodwill cost base among the replacement assets that are nominated in respect of the net goodwill roll - over amount so that the amount apportioned to a particular asset does not exceed the sum of:

(i) the amount that, at the time of the acquisition of the asset, was the consideration in respect of the acquisition of the asset; and

(ii) the amount that, at that time, was the total of the incidental costs to the taxpayer of the acquisition of the asset; and

(b) if an amount is apportioned to an asset--the consideration in respect of the acquisition of the asset and the incidental costs to the taxpayer of the acquisition of the asset are each taken, at the time of the acquisition of the asset by the taxpayer, to be nil; and

50 Paragraphs 160ZZPW(5)(a) and (b)

Repeal the paragraphs, substitute:

(a) the taxpayer must apportion the residual net roll - over amount among the nominated non - goodwill replacement assets in such manner as the taxpayer determines but so that the amount apportioned to a particular asset does not exceed the lesser of:

(i) the sum of the acquisition amounts set out in subsection (5B); and

(ii) if the asset is a share in a company or a unit in a unit trust--the maximum apportionment amount for the share or unit worked out under subsection (6);

(b) if an amount is apportioned to an asset that is not a depreciable asset--the amount is to be applied in reduction of the acquisition amounts for the asset in such proportions as the taxpayer determines;

51 After subsection 160ZZPW(5)

Insert:

(5A) The reductions set out in paragraph (5)(b) are taken to have been made at the time of the acquisition of the asset by the taxpayer.

(5B) The acquisition amounts for an asset are:

(a) the amount that, at the time of the acquisition of the asset, was the consideration in respect of the acquisition of the asset; and

(b) the amount that, at that time, was the total of the incidental costs to the taxpayer of the acquisition of the asset; and

52 Subparagraph 160ZZPX(1)(d)(i)

Before "ceases", insert "if the replacement asset is not a share in a company or a unit in a unit trust--".

53 Subsection 160ZZPX(3)

Repeal the subsection, substitute:

Consideration to be increased

(3) If the replacement asset is not a depreciable asset, the amount that, at the time of the acquisition of the asset, was the consideration in respect of the acquisition of the asset is to be increased, at the change time, by the adjustment amount.

54 Subsection 160ZZPXA(4)

Omit "cost base", substitute "amount that, at the time of the acquisition of the asset, was the consideration in respect of the acquisition".

55 Subsection 160ZZPY(3)

Repeal the subsection, substitute:

Consideration to be increased

(3) If the replacement asset is not a depreciable asset, the amount that, at the time of the acquisition of the asset, was the consideration in respect of the acquisition of the asset is taken, for the purposes of the application of this Part in relation to the person who acquired the asset, to be increased, from the time of the acquisition, by the adjustment amount.

56 Paragraph 160ZZPZ(1)(b)

Omit "section 160ZZPX", substitute "sections 160ZZPX and 160ZZPXA".

57 Paragraph 160ZZPZ(2)(b)

Omit "section 160ZZPX", substitute "sections 160ZZPX and 160ZZPXA".

58 Application of amendments

(1) The amendments made by items 32, 35 and 44 to 51 and 53 to 55 apply to disposals of assets after 23 October 1997.

(2) The amendment made by item 40 applies in respect of roll - over assets acquired after 23 October 1997.

(3) The amendments made by items 31, 33, 34, 36 to 39, 41 to 43, 52, 56 and 57 apply to disposals of assets on or after 1 July 1997.