Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts

1 Section 5

Insert:

"accredited" has the meaning given by Division 2 of Part 7A.

2 Section 5

Insert:

"authorisation" has the meaning given by Division 3 of Part 7A.

3 Section 5

Insert:

"Part 7A goods" has the meaning given by section 91C.

4 Section 5

Insert:

"tax file number" has the meaning given by section 202A of the Income Tax Assessment Act 1936 .

5 At the end of section 21

Add:

(4) Part 7A goods that have been the subject of a taxable dealing are taken not to have passed through a taxing point if the Commissioner believes that:

(a) tax has not been paid, and is unlikely to be paid, in respect of the dealing; and

(b) the person who is liable to pay that tax does not intend to pay the tax; and

(c) at the time of the dealing the taxpayer referred to in subsection (1) or (2) was aware, or could reasonably have been expected to be aware, that the tax had not been paid and was unlikely to be paid.

6 At the end of section 27

Add:

(3) Subsections (1) and (2) do not apply if the quote is not effective because of section 91S.

7 At the end of section 28

Add:

(2) Subsection (1) does not apply if the quote is not effective because of section 91S.

8 At the end of subsection 29(4)

Add:

; or (e) the current goods are Part 7A goods.

9 Subsection 29(7) (at the end of the definition of countable dealing )

Add:

; (c) a dealing with Part 7A goods.

10 After section 56

Insert:

56A No credits for certain dealings with Part 7A goods

(1) A claimant is not entitled to a credit in respect of a dealing with Part 7A goods if the Commissioner believes that:

(a) tax has not been paid, and is unlikely to be paid, in respect of the dealing; and

(b) the taxpayer who is liable to pay that tax does not intend to pay the tax; and

(c) the claimant is aware, or could reasonably be expected to be aware, that the tax has not been paid and is unlikely to be paid.

(2) A claimant is not entitled to a CR26 credit in respect of a dealing with Part 7A goods if the Commissioner believes that:

(a) the amount withheld under section 91X has not been paid, and is unlikely to be paid, in respect of the dealing; and

(b) the taxpayer who is liable to pay that amount does not intend to pay the amount; and

(c) the claimant is aware, or could reasonably be expected to be aware, that the amount has not been paid and is unlikely to be paid.

11 After subsection 61(2)

Insert:

(2A) In addition to the returns required under subsections (1) and (2), a person who becomes liable to tax in respect of a dealing with Part 7A goods during a month must lodge a return within 21 days after the end of the month, or such further time as the Commissioner allows.

12 Subsection 61(3)

Omit "and (2)", substitute ", (2) and (2A)".

13 At the end of subsection 63(3)

Add "or a dealing with Part 7A goods".

Note: The heading to section 63 is altered by inserting " or a dealing with Part 7A goods " after " dealing "

14 After section 64

Insert:

64A Normal due date for payment of tax (other than tax on a customs dealing)

Tax that is payable by a person in respect of dealings (other than customs dealings) with Part 7A goods during a month becomes due for payment at the end of the 21st day after the end of that month, or at such later time as the Commissioner determines.

15 Subsection 69(2) (definition of tax )

After "includes", insert "amounts payable under Part 7A,".

16 Subsection 70(2) (definition of tax )

After "includes", insert "amounts payable under Part 7A,".

17 Subsection 71(3) (definition of tax )

After "includes", insert "amounts payable under Part 7A,".

18 Subsection 72(8) (definition of tax )

After "includes", insert "amounts payable under Part 7A,".

19 Subsection 73(7) (definition of tax )

After "includes", insert "amounts payable under Part 7A,".

20 Subsection 74(10) (after paragraph (a) of the definition of sales tax debt )

Insert:

(aa) an amount payable under Part 7A;

21 Subsection 76(3) (definition of tax )

After "includes", insert "amounts payable under Part 7A,".

22 Section 91 (penalty)

Omit "$2,000", substitute "20 penalty units".

23 After Part 7

Insert:

Part 7A -- Additional requirements for dealings with certain goods

Division 1 -- Purpose, overview and interpretation

This Part establishes a system of additional requirements for dealings with certain goods for the purpose of overcoming problems of sales tax evasion.

This Part establishes a system of additional requirements for dealings with certain goods. These goods are called Part 7A goods.

This Part establishes a system of accrediting persons (see Division 2).

Most quotes in relation to dealings with Part 7A goods must be authorised by the Commissioner. An authorisation will only be given where the person quoting is accredited (see Division 3).

In addition, sales tax must be withheld by the purchaser of goods in certain transactions (see Division 4).

(1) Part 7A goods are goods that, if imported, would be covered by a description and corresponding tariff classification specified in the following table:

Part 7A goods | ||

Item | Description of goods | Tariff classification |

1 | Personal computers | 8471.41.00 |

2 | Laptops, Notebooks, Palmtops | 8471.30.00 |

3 | Monitors | 8471.60.00 |

4 | Keyboards | 8471.60.00 |

5 | Printers (dot matrix, ink - jet or laser) | 8471.60.00 |

6 | CD - ROM drives | 8471.90.00 |

7 | Modems | 8517.50.10 |

8 | Computer components (Motherboards, CPUs, memory, disk drives (hard and floppy), controller cards) | 8473.30.00 |

(2) Goods are also Part 7A goods if they are prescribed for the purposes of this subsection.

(3) However, goods are not Part 7A goods if they are prescribed for the purposes of this subsection.

(4) In subsection (1):

"tariff classification" means the tariff classification under which the goods are classified for the purposes of the Customs Tariff Act 1995 .

91D When a person is relevant to an application

A person (the relevant person ) is relevant to an application made by another person (the applicant ) if:

(a) the applicant is accustomed or under an obligation, or might reasonably be expected, to act in accordance with the directions, instructions or wishes of the relevant person; or

(b) the applicant is a company and the directors of the applicant are accustomed or under an obligation, or might reasonably be expected, to act in accordance with the directions, instructions or wishes of the relevant person; or

(c) the applicant is a company and the relevant person is a director of the company; or

(d) the applicant is a trust and the relevant person is a trustee of the trust; or

(e) the applicant is a partnership and the relevant person is a partner in the partnership.

(2) Paragraphs (1)(a) and (b) apply:

(a) whether the obligation is formal or informal; and

(b) whether the directions, instructions or wishes are, or might reasonably be expected to be, communicated directly or through interposed companies, partnerships or trusts.

Only certain registered persons or other persons may be accredited (section 91F).

To be accredited, people must also meet a number of conditions or be exempted from meeting particular conditions by the Commissioner (section 91G).

Even if people meet the conditions, the Commissioner has a discretion to refuse to accredit persons (section 91K).

Accreditation may be withdrawn by the Commissioner (section 91J).

A person who is accredited must comply with requirements about record - keeping and advising the Commissioner of certain matters (sections 91N and 91P).

91F Who may apply for accreditation

Registered persons

(1) A registered person may apply for accreditation.

People who grant certain leases

(2) A person (whether or not registered) may apply for accreditation if he or she has granted, or intends to grant, leases of Part 7A goods:

(a) that are eligible long - term leases or eligible short - term leases; or

(b) in relation to which section 32 would apply.

People who can quote under section 84

(3) A person (whether or not registered) who the Commissioner has allowed to quote under section 84 for a dealing with Part 7A goods may apply for accreditation.

Others may apply if Commissioner allows

(4) Any other person may, with the agreement of the Commissioner, apply for accreditation.

91G Requirements for accreditation

(1) To be accredited, a person must satisfy all of the following requirements other than those that the Commissioner exempts the person from satisfying.

(2) The first requirement is that the person must have conducted the business activities in respect of which accreditation has been sought at or from established premises that were advertised to the public as being premises from which the business was carried on.

(3) The second requirement is that the person must have a tax file number and must have quoted that tax file number in relation to each account maintained by the person for business purposes with a financial institution.

(4) The third requirement is that, if the person is an individual, the person must conduct all financial transactions relating to the business through a bank account that is, or bank accounts that are, separate from any private or domestic account maintained by the person.

(5) The fourth requirement is that the person, and each person who is relevant to the person's application, must have satisfactorily complied with his or her obligations under Acts administered by the Commissioner for the period of 3 years before the date of the application.

(6) The fifth requirement is that the person must have maintained records in English in relation to the period of 3 years before the date of the application including details of purchases and sales of goods, the names of suppliers and customers, details of purchases and sales in relation to which sales tax was not paid and details of credits claimed. The records must be located in Australia and may be kept and retained in written or electronic form.

(7) The sixth requirement is that:

(a) if the person is an individual--the person; or

(b) if the person is a company--at least one director of the company; or

(c) if the person is a trust--the trustee of the trust; or

(d) if the person is a partnership--at least one partner in the partnership;

is an Australian citizen or is the holder of a permanent visa (within the meaning of the Migration Act 1958 ).

(8) The seventh requirement is that, in the period of 3 years before the date of the application:

(a) the person has not, whether in Australia or another country, been convicted of any offence, or been subject to any penalty, in relation to taxation requirements, customs requirements, the misdescription of goods, trade practices, fair trading or the defrauding of a government; or

(b) if the person is not an individual--no person who is relevant to the person's application, whether in Australia or another country, has been convicted of any offence, or been subject to any penalty, in relation to taxation requirements, customs requirements, the misdescription of goods, trade practices, fair trading or the defrauding of a government.

(9) The eighth requirement is that:

(a) the person has not been refused accreditation or had his or her accreditation revoked in the previous 3 years; or

(b) if the person is not an individual--no person who is relevant to the person's application has been refused accreditation or had his or her accreditation revoked in the previous 3 years.

(10) The ninth requirement is that:

(a) the person has not, in the previous 3 years, been a person who is relevant to another person's application at a time when the other person's application did not satisfy the previous eight requirements; or

(b) if the person is not an individual--no person who is relevant to the person's application has, in the previous 3 years, been a person who is relevant to another person's application at a time when the other person's application did not satisfy the previous eight requirements.

91H Application for accreditation

(1) An application for accreditation must be in a form approved in writing by the Commissioner for the purpose and must contain the information necessary for the proper completion of the form.

Electronic applications

(2) An approval given by the Commissioner of a form of application may require or permit the application to be given on a specified kind of data processing device, or by way of electronic transmission, in accordance with specified software requirements.

(1) If the Commissioner receives an application that is properly made under section 91H and the applicant satisfies all necessary tests under section 91G, the Commissioner must accredit the applicant unless the Commissioner exercises his or her discretion under section 91K.

(2) Once granted, accreditation remains in force until the end of any period specified by the Commissioner unless it is revoked under section 91L.

(3) The accreditation may be given in writing or by way of electronic transmission.

91K Commissioner's discretion to refuse accreditation

The Commissioner may refuse to accredit a person if:

(a) the Commissioner has reasonable grounds for believing that sales tax will not be, or is unlikely to be, paid in relation to transactions with Part 7A goods dealt with by the person; or

(b) the person's application is false or misleading in a material particular (either because of something stated in the application or something left out);

and the Commissioner believes that the refusal would assist in achieving the purpose of this Part.

91L Revocation of accreditation

(1) The Commissioner may, by written notice given to a person, revoke the person's accreditation at a particular time if the Commissioner believes that, if the person made an application at that time:

(a) the person would not be covered by section 91F; or

(b) the person would not satisfy all of the requirements in section 91G; or

(c) the Commissioner would exercise his or her discretion under section 91K.

(2) If a person requests the Commissioner to revoke his or her accreditation, the Commissioner must revoke the person's accreditation.

91M Review of decisions on accreditation

A person who is affected by a decision:

(a) under section 91J or 91K to refuse to accredit; or

(b) under section 91L to revoke accreditation;

and is dissatisfied with the decision may object against the decision in the manner set out in Part IVC of the Taxation Administration Act 1953 .

91N Accredited persons to advise Commissioner of certain matters

(1) This section applies if, at a particular time, a person who is accredited becomes aware that, if the person made an application for accreditation at that time:

(a) the person would not be covered by section 91F; or

(b) the person would not satisfy all of the requirements in section 91G.

(2) If this section applies, the accredited person must notify the Commissioner of that fact and provide the Commissioner with details of circumstances that cause this section to apply. The notification and the details must be given in writing within 7 days of the time mentioned in subsection (1).

Offence of contravening subsection (2)

(3) A person who contravenes subsection (2) is guilty of an offence punishable on conviction by a fine not exceeding 50 penalty units.

91P Additional information about transactions

In addition to any returns required under section 61, the Commissioner may direct a person to give to the Commissioner such information as the Commissioner:

(a) requires in respect of dealings by the person with Part 7A goods; or

(b) if the person is accredited--considers is relevant to the person's accreditation.

91Q Commissioner may publicise who is accredited

(1) The Commissioner may publish, or otherwise publicise, the names, accreditation numbers and registration numbers of persons who are accredited or whose accreditation is revoked.

(2) In addition, the Commissioner may, if requested:

(a) advise a person whether or not another person is accredited and, if so, whether the person is registered; and

(b) if the information is required for the purposes of section 91S, advise a person whether or not a person who is not accredited is registered.

(3) This section operates despite anything in this Act or the Taxation Administration Act 1953 .

Division 3 -- Authorisation of certain transactions

This Division provides for the Commissioner to authorise quotations in respect of particular dealings with goods. Without an authorisation, the quote will not be effective.

Authorisations may be sought, and may be given, in any way that the Commissioner decides. This could be orally or by way of electronic transmission.

The authorisation may be given in relation to a particular dealing or may be a standing authorisation that applies to specified kinds of dealings.

91S Quote not effective without authorisation

(1) A quote in relation to a dealing with Part 7A goods is only effective if:

(a) the person quoting is accredited and the quote is authorised by the Commissioner; or

(b) the quote is a quote of an exemption declaration, the dealing is not a local entry and the person making the quote intends to use the goods so as to satisfy an exemption item (other than a prescribed exemption item); or

(c) the dealing is not a local entry and the person making the quote:

(i) is registered; and

(ii) is not acquiring the goods for resale; and

(iii) satisfies the low purchase value test (see subsections (2) and (3)) in relation to that dealing; or

(d) the quote is made in prescribed circumstances; or

(e) the person accepting the quote satisfies the Commissioner that he or she was satisfied on reasonable grounds that paragraph (a), (b), (c) or (d) applied.

(2) For a person to satisfy the low purchase value test in relation to a dealing (the current dealing ), the total of the value of:

(a) the current dealing; and

(b) all other acquisitions of Part 7A goods for which the person quoted in the 12 months before the current dealing;

must be less than $6,000 or such other amount as is prescribed.

(3) In addition, the person must have an expectation (based on reasonable grounds) that the total of the value of all acquisitions of Part 7A goods by the person in the 12 months after the current dealing for which the person will quote will be less than $6,000 or such other amount as is prescribed.

(4) For a person (the seller ) to be satisfied that another person (the purchaser ) satisfies the low purchase value test in relation to a dealing, the seller must obtain from the purchaser a signed statement, in a form approved in writing by the Commissioner, that the purchaser satisfies the low purchase value test in relation to the dealing.

(5) A person must not, in relation to any dealing with goods, falsely represent that the person satisfies the low purchase value test in relation to that dealing.

Penalty: 50 penalty units.

91T Method of obtaining authorisation

(1) A person who wants an authorisation in relation to a quote for a dealing must seek the authorisation in a manner approved in writing by the Commissioner.

(2) The person may seek authorisation in relation to a single quote or in relation to quotes for a class of dealings. An authorisation in relation to a class of dealings is a standing authorisation .

(3) Without limiting the Commissioner's power under subsection (1), the Commissioner may approve authorisations being sought orally or by way of electronic transmission.

91U Giving of authorisation by Commissioner

(1) If a person seeks an authorisation in relation to a single dealing, the Commissioner must give the authorisation unless:

(a) the person making the quote is not accredited; or

(b) the quote would not be effective even if the Commissioner authorised it; or

(c) the Commissioner considers that there are reasonable grounds for believing that sales tax will not be, or is unlikely to be, paid in relation to the dealing or in relation to other dealings with those Part 7A goods.

Example: The Commissioner may believe that sales tax will not be paid in relation to a later sale to a retailer that is made by the person who buys the goods from the person making the application.

(2) If a person seeks a standing authorisation, the Commissioner may give the standing authorisation if the Commissioner considers that there are reasonable grounds for believing that sales tax will be paid in relation to all dealings that would be covered by the standing authorisation and in relation to other dealings with the goods covered by those dealings.

(3) The Commissioner may also, on his or her own initiative, give a person a standing authorisation covering such dealings as the Commissioner determines if the Commissioner considers that there are reasonable grounds for believing that sales tax will be paid in relation to all dealings that would be covered by the standing authorisation.

(4) A standing authorisation does not cover a quote if:

(a) the person making the quote is not accredited; or

(b) the quote would not be effective even if the Commissioner authorised it.

(5) The Commissioner may, by written notice, revoke a standing authorisation.

(6) A person who is affected by a decision:

(a) to refuse to authorise a transaction; or

(b) to refuse to give a standing authorisation; or

(c) to revoke a standing authorisation;

and is dissatisfied with the decision may object against the decision in the manner set out in Part IVC of the Taxation Administration Act 1953 .

(7) In determining that there are reasonable grounds for believing that sales tax will not be, or is unlikely to be, paid in relation to transactions with Part 7A goods dealt with by the person, the Commissioner is not limited to considering dealings to which the person is a party.

An authorisation may be given in such form, including orally or by way of electronic transmission, as the Commissioner considers appropriate.

Division 4 -- Withholding of sales tax on dealings with Part 7A goods

This Division provides for the withholding of sales tax from payments in respect of certain dealings with Part 7A goods. The dealings are those where an accredited person or a retailer purchases goods from an unaccredited person.

It also sets out the way in which the tax, and associated forms, must be sent to the Commissioner.

(1) If an accredited person makes a payment to a person in respect of a taxable dealing that is the purchase of Part 7A goods for the purpose of resale from a person who is not accredited, the accredited person must deduct the withholding amount from the payment.

(2) If, after the day prescribed for the purposes of this subsection, a person who is a retailer in relation to particular Part 7A goods makes a payment to a person in respect of a taxable dealing that is the purchase of those Part 7A goods from a person who is not accredited, the retailer must deduct the withholding amount from the payment.

(3) Subsections (1) and (2) do not apply if the accredited person, or the retailer (as the case requires):

(a) took reasonable steps to determine whether the other person was accredited; and

(b) as a result, reasonably believed that the other person was accredited.

(4) A person, other than a government body, who contravenes this section is guilty of an offence punishable on conviction by a maximum fine of 20 penalty units.

91Y Working out the withholding amount

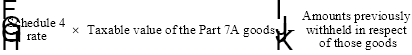

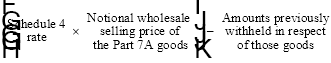

(1) The withholding amount for a payment that is made in respect of the purchase of Part 7A goods where the purchase involves only Part 7A goods and an invoice is given for the purchase is:

(2) In any other case, the withholding amount for a payment that is made in respect of the purchase of Part 7A goods is:

(3) In this section:

"notional wholesale selling price" has the same meaning as in Table 1 in Schedule 1.

"Schedule 4 rate" is the rate of tax that applies to taxable dealings with goods covered by Schedule 4 to the Exemptions and Classifications Act.

91Z Reporting and remitting amounts

(1) A person who makes one or more payments covered by section 91X in a month must send all amounts deducted under section 91X from the payments to the Commissioner within 21 days after the end of the month (or such longer period as the Commissioner allows).

(2) The person must also:

(a) complete and sign a withholding advice form in respect of the amounts; and

(b) make 2 copies of the form; and

(c) give a copy of the form to the seller; and

(d) send the form to the Commissioner within 21 days after the end of the month (or such longer period as the Commissioner allows).

(3) The person must keep the copies of all of the forms that the person is required to make under this section (other than those copies required to be given to the seller or sent to the Commissioner) for at least 5 years after the end of the financial year in which the payments to which the copies relate were made. The copies must be kept in Australia.

(4) A person, other than a government body, who contravenes subsection (1) is guilty of an offence punishable on conviction by imprisonment for 12 months. In addition, the court may order the person to pay to the Commissioner as a penalty an amount not greater than the amount required to be deducted under section 91X from any payment to which the contravention relates.

(5) A person, other than a government body, who contravenes subsection (2) or (3) is guilty of an offence punishable on conviction by a fine of 20 penalty units.

91ZA Refund of deductions in certain cases

(1) If a person has applied for a refund and the Commissioner is satisfied that:

(a) a deduction was made from a payment to the applicant; and

(b) the whole or a part of the amount of the deduction (the relevant amount ) was made due to an act or omission of the applicant or another person; and

(c) having regard to:

(i) the purposes of this Division; and

(ii) the nature of the act or omission referred to in paragraph (b); and

(iii) such other matters (if any) as the Commissioner thinks fit;

it would be fair and reasonable to refund the relevant amount to the applicant, the Commissioner must refund the relevant amount to the applicant.

(2) No person is entitled to a credit in respect of an amount refunded under subsection (1).

(3) A person who is affected by a decision to refuse to refund an amount under subsection (1) and is dissatisfied with the decision may object against the decision in the manner set out in Part IVC of the Taxation Administration Act 1953 .

91ZB Failure to make deductions from payments

(1) A person, other than a government body, who refuses or fails, at the time of making a payment, to deduct from the payment the amount required to be deducted under this Division, is liable to pay to the Commissioner, by way of penalty:

(a) an amount (the undeducted amount ) equal to the amount that the person failed to deduct; and

(b) an amount equal to 16% per annum of so much of the undeducted amount as remains unpaid, worked out from the end of the period within which the person, had the person deducted the required amount, would have been required to pay the amount to the Commissioner.

(2) A government body, other than the Commonwealth, that refuses or fails, at the time of making a payment, to deduct from the payment the amount required to be deducted under this Division, is liable to pay to the Commissioner, by way of penalty, an amount equal to 16% per annum of the amount that the body refused or failed to deduct in respect of the period:

(a) starting at the end of the period within which the body, had it deducted the required amount, would have been required to pay the amount to the Commissioner; and

(b) ending on the day on which the whole of the amount payable by the body under this subsection in respect of the undeducted amount is paid.

91ZC Failure to pay amounts deducted to Commissioner

(1) Where an amount (the principal amount ) payable to the Commissioner by a person other than the Commonwealth under subsection 91Z(1) remains unpaid at the end of the period within which it is required to be paid:

(a) the principal amount continues to be payable by the person to the Commissioner; and

(b) the person is liable to pay to the Commissioner, by way of penalty, the amount worked out under subsection (2) or (3).

(2) If the person is not a government body, the amount is the sum of:

(a) an amount (the relevant penalty amount ) equal to 20% of the principal amount; and

(b) an amount at the rate of 16% per annum of the sum of so much of the principal amount as remains unpaid and so much of the relevant penalty amount as remains unpaid, worked out from the end of that period.

(3) If the person is a government body, the amount is 16% per annum of so much of the principal amount as remains unpaid, worked out from the end of that period.

(1) In this Division:

"government body" means the Commonwealth, a State, a Territory or an authority of the Commonwealth, a State or a Territory.

(2) For the purposes of this Division, a person is a retailer of particular Part 7A goods if:

(a) the person is mainly a retailer in relation to the Part 7A goods; and

(b) the person did not manufacture the Part 7A goods; and

(c) the person will not use the Part 7A goods as raw materials in manufacturing.

(3) A person is mainly a retailer in relation to particular Part 7A goods if the person sells Part 7A goods and:

(a) wholesale sales and indirect marketing sales of Part 7A goods do not account for more than half of the total value of all sales of Part 7A goods by the person during the 12 months ending at the time of the relevant dealing with the particular Part 7A goods; or

(b) the person has an expectation (based on reasonable grounds) that wholesale sales and indirect marketing sales of Part 7A goods will not account for more than half of the total value of all sales of Part 7A goods by the person during the 12 months starting at the time of the relevant dealing with the particular Part 7A goods.

For this purpose, the value of a sale of goods is the price for which the goods are sold.

Division 5 -- General provisions about offences

(1) A person must not, in relation to any dealings with goods:

(a) falsely represent that the person is an accredited person; or

(b) falsely represent that a quote is authorised under section 91U.

Penalty: 20 penalty units.

(2) Strict liability applies to subsection (1).

Note: For strict liability , see section 6.1 of the Criminal Code .

91ZF Application of the Criminal Code

Chapter 2 of the Criminal Code applies to all offences against this Part.

24 Schedule 1 (at the end of Table 3)

Add:

CR26 | Credit for amounts withheld on Part 7A goods | Claimant has become liable to tax on an assessable dealing with Part 7A goods and another person has withheld an amount in respect of that dealing under section 91X. | the amount withheld | the later of the time when the claimant pays the tax on the assessable dealing and the time when the Commissioner receives the form under subsection 91Z(2) in respect of the amount withheld |

25 Application

(1) The amendment made by item 5 applies in relation to dealings after 23 October 1997.

(2) The amendment made by item 10 applies in relation to credits applied for after 23 October 1997.

(3) Divisions 3 and 4 of Part 7A of the Sales Tax Assessment Act 1992 apply to dealings on or after a date to be prescribed.

26 Transitional--record keeping requirements

For the purposes of applications made within 3 years after the commencement of this item, subsection 91G(6) applies as if the requirement for the records to have been kept in English was limited to records that are kept after the commencement of this item.