Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated ActsPart 1 -- Insertion of new Division 396

Income Tax Assessment Act 1997

1 After Division 387

Insert:

[The next Division is Division 396]

Division 396 -- Land transport facilities borrowings

Table of Subdivisions

Guide to Division 396

396 - A Key operative provisions

396 - B What LTF interest is covered?

396 - C Projects, borrowers and lenders

396 - D Application, approval and agreement process

396 - E Miscellaneous

396 - 5 What this Division is about

A lender can get a tax offset for certain interest it derives on an approved borrowing by another entity for the construction of land transport facilities.

For a borrowing to be approved:

(a) the borrower must apply to the Commissioner; and

(b) the Minister for Transport and Regional Development must approve the application; and

(c) that Minister, the borrower and each of the lenders must enter into an agreement.

The total of tax offsets available under this Division for an income year is subject to a limit.

Where a tax offset is given for interest, the borrower cannot deduct the interest.

Subdivision 396 - A -- Key operative provisions

396 - 10 What this Subdivision is about

This Subdivision provides for:

(a) the tax offset for the lender; and

(b) deductions not to be allowed to the borrower.

It also provides for a cap to be set on the amount of tax offsets approved for each income year.

Table of sections

Operative provisions

396 - 15 Tax offset for LTF interest on land transport facilities borrowings

396 - 20 Maximum amount of tax offsets

396 - 25 Borrower cannot deduct LTF interest for which lender has tax offset

[This is the end of the Guide.]

396 - 15 Tax offset for LTF interest on land transport facilities borrowings

(1) An entity that is a lender under a * land transport facilities borrowings agreement is entitled to a * tax offset for * LTF interest covered by the agreement.

Amount of tax offset

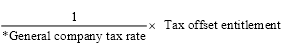

(2) The amount of the tax offset is worked out using the formula:

![]()

However, the amount cannot exceed any amount specified in the * land transport facilities borrowings agreement as the maximum * tax offset for that lender for the income year for that agreement.

(3) In subsection (2):

"LTF interest covered by agreement" means the amount of * LTF interest that is covered by the * land transport facilities borrowings agreement and that is derived by the entity in the income year.

396 - 20 Maximum cost to Commonwealth

The maximum net cost to the Commonwealth of * tax offsets to be approved under this Division for an income year (after taking into account deductions that are reduced) is the amount determined, by written notice, by the Treasurer.

Note: The maximum amount is taken into account under subsection 396 - 70(5) in approving projects.

396 - 25 Borrower cannot deduct LTF interest for which lender has tax offset

(1) The total of amounts that an entity that is a borrower under a * land transport facilities borrowings agreement can deduct for an income year for * LTF interest covered by the agreement is reduced by:

(2) In subsection (1):

"tax offset entitlement" is the total of the amounts of * tax offset worked out under subsection 396 - 15(2) for LTF interest that is covered by the agreement and that is derived by a lender in the income year.

(3) If the amount by which deductions for an income year are to be reduced by subsection (1) (or by a previous operation of this subsection) exceeds the total of those deductions:

(a) the deductions are reduced to nil; and

(b) the total amount that the borrower can deduct for the next income year for * LTF interest covered by the agreement is reduced by the total of:

(i) that excess; and

(ii) the amount worked out for that next income year using the formula in subsection (1).

Note: This can happen where interest is incurred by the borrower in an income year after the income year in which it is derived by the lender.

Subdivision 396 - B -- What LTF interest is covered?

This Subdivision sets out the interest for which a tax offset can be obtained.

Table of sections

Operative provisions

396 - 30 What is LTF interest ?

396 - 35 Interest covered by land transport facilities borrowings agreement

396 - 40 Interest ceasing to be covered by a land transport facilities borrowings agreement

[This is the end of the Guide.]

396 - 30 What is LTF interest ?

(1) LTF interest , in relation to a borrower, is:

(a) a payment of interest, or in the nature of interest, made or liable to be made by the borrower, for which the borrower is, apart from this Division, entitled to a deduction; or

(b) an amount allowable as a deduction to the borrower under section 159GT of the Income Tax Assessment Act 1936 in relation to a * borrowing that is covered by a * land transport facilities borrowings agreement.

Note: Section 159GT deals with certain securities.

(2) LTF interest , in relation to a lender, is:

(a) a payment of interest, or in the nature of interest, made or liable to be made to the lender, that is included in the lender's assessable income for an income year; or

(b) an amount included in the assessable income of the lender under section 159GQ of the Income Tax Assessment Act 1936 in relation to a * borrowing that is covered by a * land transport facilities borrowings agreement.

Note: Section 159GQ deals with certain securities.

396 - 35 Interest covered by land transport facilities borrowings agreement

(1) * LTF interest that is derived by an entity is covered by a * land transport facilities borrowings agreement if:

(a) the entity is a lender under the agreement; and

(b) the LTF interest arises under a * borrowing that is covered by the agreement when the interest is derived.

(2) * LTF interest that is incurred by an entity is covered by a * land transport facilities borrowings agreement if:

(a) the entity is the borrower under the agreement; and

(b) the LTF interest arises under a * borrowing that is covered by the agreement at the time that the LTF interest is incurred.

396 - 40 Interest ceasing to be covered by a land transport facilities borrowings agreement

* LTF interest ceases to be covered by a * land transport facilities borrowing agreement if the borrower or a lender breaches the agreement and the Minister for Transport and Regional Development decides:

(a) that the breach is a material breach of the agreement; and

(b) not to agree to vary the agreement in a way that would cause the breach to no longer be a breach.

Subdivision 396 - C -- Projects, borrowers and lenders

This Subdivision explains the projects that can be approved and who can be approved as borrowers or lenders.

Where a project and a borrower are approved, a land transport facilities borrowings agreement is entered into under Subdivision 396 - D.

Table of sections

Operative provisions

396 - 45 What projects can be approved?

396 - 50 Who can be approved as a borrower?

396 - 55 Who can be a lender?

[This is the end of the Guide.]

396 - 45 What projects can be approved?

(1) To be approved, a project must be the construction of a * land transport facility or the construction or acquisition of one or more * related facilities.

(2) A land transport facility is a road, tunnel, bridge, or railway line, in Australia, that is to be used for the transport of the public or their goods at a charge to them (whether the transport is by the member of the public concerned or by another entity).

(3) Related facilities are facilities in Australia that are reasonably necessary for a * land transport facility to be able to operate for the purpose for which it was constructed.

(4) The following are examples of * related facilities:

(a) * plant and other equipment (for example, rolling stock in the case of a railway) for use in operating the * land transport facility;

(b) buildings or other structures from which staff are to operate the land transport facility;

(c) buildings or other structures for storing freight, cargo, plant, fuel, stores or equipment;

(d) stations or passenger or freight terminals;

(e) maintenance facilities.

(5) A road, road bridge or road tunnel to provide access to a * land transport facility that is a railway is not a related facility (or part of the land transport facility itself).

(6) A railway, railway bridge or railway tunnel to provide access to a * land transport facility that is a road is not a related facility (or part of the land transport facility itself).

Note: Items 20 and 21 of Schedule 3 to the Taxation Laws Amendment Act (No. 1) 1998 treat certain facilities as if they were land transport facilities or related facilities.

396 - 50 Who can be approved as a borrower?

(1) An entity can only be approved as a borrower in relation to a particular project if the entity is:

(a) an incorporated body; or

(b) a * corporate limited partnership; or

(c) a * corporate unit trust; or

(d) a * public trading trust;

and intends to continue to be that type of entity for the period covered by the agreement.

(2) An entity cannot be approved as a borrower if the entity is making the * borrowing in partnership with another entity.

(3) An entity cannot be approved as a borrower if the entity:

(a) is a government body (within the meaning of subsection 93D(1) of the Development Allowance Authority Act 1992 ); or

(b) is government owned (within the meaning of subsection 93I(3) of that Act);

unless the entity is covered by subsection 93I(4) of that Act.

A lender must be an Australian resident for the whole of an income year to be entitled to a * tax offset under this Division for that income year.

Subdivision 396 - D -- Application, approval and agreement process

This Subdivision sets out the process for applications to be made and approved and agreements to be entered into.

Table of sections

Operative provisions

396 - 60 Applications

396 - 65 Minister or Commissioner may seek more information

396 - 70 Minister for Transport and Regional Development to consider applications

396 - 75 Selection criteria

396 - 80 Land transport facilities borrowings agreements

396 - 85 Conditions to be in all agreements

396 - 90 Variation of agreements

[This is the end of the Guide.]

(1) An entity that wants to be approved as a borrower in relation to a particular project must give a written application to the Commissioner.

(2) The application must be in a form approved in writing by the Commissioner and must contain all information that is required for proper completion of the form.

Electronic applications

(3) An approval by the Commissioner of a form of application may require or permit the application to be given on a specified kind of data processing device, or by way of electronic transmission, in accordance with specified software requirements.

396 - 65 Minister or Commissioner may seek more information

(1) The Minister for Transport and Regional Development or the Commissioner may, in writing, ask an applicant to provide additional information for the purpose of determining the applicant's application.

(2) The Minister for Transport and Regional Development does not have to consider, or further consider, the application until the additional information has been provided.

396 - 70 Minister for Transport and Regional Development to consider applications

(1) The Minister for Transport and Regional Development is to consider applications and to decide:

(a) whether to approve the borrower and the project; and

(b) if so, whether to set a maximum amount of * tax offsets for the project for each income year covered by the approval.

(2) A decision to approve a borrower and a project must be in writing and must specify:

(a) the borrower; and

(b) the project; and

(c) the income years covered by the approval; and

(d) if a maximum amount of * tax offsets for the project for each income year covered by the approval is set--the maximum amount for each income year.

The amount may be different for different years.

(3) The decision may include conditions to which the approval is subject.

(4) The approval must not cover an income year that starts more than 5 years after the first * borrowing is made in respect of the project.

(5) In making a decision under paragraphs (1)(a) and (1)(b), the Minister for Transport and Regional Development must attempt to ensure that the maximum net cost referred to in section 396 - 20 for any income year will not be exceeded.

(6) For the purposes of subsection (5), where no maximum amount is specified in relation to a project, the Minister for Transport and Regional Development is to take account of the expected amount of tax offsets for that project.

(7) The Minister for Transport and Regional Development does not need to make the decision within any particular time. For example, the Minister for Transport and Regional Development may decide to make decisions under subsection (1) on only 2 days in a year.

(1) In making a decision, the Minister for Transport and Regional Development is to take into account the following matters:

(a) the commercial viability of the * land transport facilities;

(b) the benefit that the borrower would receive from having the * tax offset available to lenders;

(c) the estimated taxation revenue that would be forgone as a result of allowing the * tax offsets;

(d) any economic or social benefits or costs associated with the project;

(e) the extent to which the project conforms to Commonwealth and State government policies and planning requirements;

(f) the extent to which persons who are likely to be affected by the project have been consulted in relation to the project;

(g) any other matter that the Minister for Transport and Regional Development considers is relevant.

(2) The Minister for Transport and Regional Development is also to take into account any advice from the Commissioner in relation to the application of this Act in relation to the project or any * borrowings or proposed borrowings relating to the project.

Example: The Commissioner may advise the Minister that a lender is not an Australian resident or that section 51AD of the Income Tax Assessment Act 1936 may apply to the project.

396 - 80 Land transport facilities borrowings agreements

(1) If the Minister for Transport and Regional Development has made a decision approving a project and a borrower, the Minister for Transport and Regional Development must enter into a land transport facilities borrowings agreement with the borrower that sets out the lender, or lenders, that will be entitled to a * tax offset.

(2) Each lender specified in the agreement must also be a party to the agreement.

(3) The agreement must specify:

(a) the project; and

(b) the borrower; and

(c) each of the lenders that will be entitled to a * tax offset under the agreement; and

(d) the income years covered by the agreement; and

(e) the * borrowings that are covered by the agreement; and

(f) any conditions to which the agreement is subject.

(4) If the Minister for Transport and Regional Development has specified, in the decision under section 396 - 70, the maximum amount of * tax offsets allowable for any income year for the project, the agreement must specify the maximum amount of tax offset allowable that will be available for each lender for each income year. The total of the amounts specified must not exceed the maximum specified in the decision.

(5) The conditions specified in the agreement must include:

(a) the conditions set out in section 396 - 85; and

(b) any conditions specified by the Minister for Transport and Regional Development in the decision under section 396 - 70;

but may include such other conditions as the Minister for Transport and Regional Development considers appropriate.

396 - 85 Conditions to be in all agreements

(1) All * land transport facilities borrowings agreements must include the following conditions:

(a) that the facilities covered by the agreement will be used in accordance with subsection (2);

(b) that the borrower and each of the lenders will do each of the things that they state in the agreement that they will do;

(c) that the borrower will not do anything that will cause section 51AD of the Income Tax Assessment Act 1936 or Division 16D of Part III of that Act to apply to any of the facilities concerned;

(d) that the * borrowings will only be used in the construction of the facilities or the construction or acquisition of * related facilities;

(e) that the borrower will keep proper records in respect of all dealings by the borrower with the borrowed money;

(f) that the borrower and each of the lenders will keep proper records in respect of the doing of all other things specified in the agreement (for example, in respect of things done in constructing any facility);

(g) that the borrower and each of the lenders will inform the Commissioner of any breach of the agreement within 30 days of becoming aware of the breach;

(h) that each of the lenders will, as soon as is practicable, inform the borrower of the amount of any tax offset to which the lender is entitled for a borrowing under the agreement.

(2) A facility is used in accordance with this subsection if the borrower:

(a) owns the facility (or holds a * quasi - ownership right granted by an * exempt Australian government agency over land to which the facility is attached); and

(b) uses the facility principally for gaining or producing assessable income; and

(c) effectively controls the use of the facility (other than by leasing it);

from the time that the facility is first used until the end of the last income year covered by the agreement.

396 - 90 Variation of agreements

(1) The parties to a * land transport facilities borrowings agreement may revoke or vary the agreement.

(2) In addition, the Minister for Transport and Regional Development and the borrower may enter into an agreement to replace an existing agreement where a lender is to cease to be covered or a new lender is to be covered. Each lender that is specified in the replacement agreement must also be a party to the replacement agreement.

(3) Any varied or replacement agreement must comply with subsections 396 - 80(4) and (5).

Subdivision 396 - E -- Miscellaneous

Table of sections

396 - 95 Provision of information

396 - 100 Publication of information about approvals and agreements

396 - 105 Delegation by Minister for Transport and Regional Development

396 - 110 Decision by Minister for Transport and Regional Development not reviewable by AAT

396 - 95 Provision of information

(1) Any information that was provided under this Division may be given to:

(a) a Minister or an individual or employee under the control of a Minister; or

(b) an employee of, or individual performing services for, the Commonwealth;

if the person giving the information considers that it would assist the administration of this Division. This can be done despite any prohibition in section 16 of the Income Tax Assessment Act 1936 or section 3C of the Taxation Administration Act 1953 .

(2) Any person who is given information under this section, and any person or employee under his or her control, is subject to the same rights, privileges, obligations and liabilities, under subsections 16(2) and (3) of the Income Tax Assessment Act 1936 and 3C(2), (3) and (4) of the Taxation Administration Act 1953 in relation to that information, as if he or she were an officer within the meaning of section 16 of the Income Tax Assessment Act 1936 or section 3C of the Taxation Administration Act 1953 .

396 - 100 Publication of information about approvals and agreements

The Minister for Transport and Regional Development may publish any information that is included in an approval or an agreement under this Division. This can be done despite any prohibition in section 16 of the Income Tax Assessment Act 1936 or section 3C of the Taxation Administration Act 1953 .

396 - 105 Delegation by Minister for Transport and Regional Development

The Minister for Transport and Regional Development may, by written notice, delegate to the Secretary to that Minister's Department, or to a person holding or performing the duties of a * Senior Executive Service office in that Minister's Department, all or any of that Minister's powers under this Division other than that Minister's powers under section 396 - 70.

396 - 110 Decision by Minister for Transport and Regional Development not reviewable by AAT

The * AAT must not, in reviewing any decision, review a decision of the Minister for Transport and Regional Development under this Division (other than a decision under section 396 - 40) or any decision by any person that was preliminary to such a decision.

Income Tax Assessment Act 1997

2 Section 9 - 1

Omit "(as defined in section 94D)"

3 Section 13 - 1 (before the entry dealing with leave payments)

Insert:

land transport facilities borrowings | Division 396 |

4 Paragraph 25 - 5(2)(c)

Omit "borrowing", substitute " * borrowing".

5 Subsection 25 - 25(1)

Omit "borrowing", substitute " * borrowing".

6 Subsection 25 - 25(2)

Omit "borrowed", substitute " * borrowed".

7 Subsection 25 - 25(3)

Omit "borrowed", substitute " * borrowed".

10 Subsection 25 - 30(3)

Omit "borrowed", substitute " * borrowed".

11 Subsection 995 - 1(1)

Insert:

"borrowing" means any form of borrowing, whether secured or unsecured, and includes the raising of funds by the issue of a bond, debenture, discounted security or other document evidencing indebtedness.

12 Subsection 995 - 1(1)

Insert:

"corporate limited partnership" has the meaning given by section 94D of the Income Tax Assessment Act 1936 .

13 Subsection 995 - 1(1)

Insert:

"corporate unit trust" has the meaning given by section 102J of the Income Tax Assessment Act 1936 .

14 Subsection 995 - 1(1)

Insert:

"general company tax rate" means the rate of tax imposed on taxable incomes of companies (except companies that are registered organisations, life assurance companies and companies that are PDFs throughout the last day of the year of income).

15 Subsection 995 - 1(1)

Insert:

"land transport facilities borrowings agreement" has the meaning given by section 396 - 80.

16 Subsection 995 - 1(1)

Insert:

"land transport facility" has the meaning given by section 396 - 45.

17 Subsection 995 - 1(1)

Insert:

"LTF interest" has the meaning given by sections 396 - 30 and 396 - 35.

18 Subsection 995 - 1(1)

Insert:

"public trading trust" has the meaning given by section 102R of the Income Tax Assessment Act 1936 .

19 Subsection 995 - 1(1)

Insert:

"related facility" in relation to a * land transport facility has the meaning given by section 396 - 45.

Part 3 -- Transitional and application provisions

20 Division 396 also applies to certain other infrastructure borrowings

(1) Division 396 of the Income Tax Assessment Act 1997 applies to the following as if they were land transport facilities:

(a) an infrastructure facility (within the meaning of section 93L of the Development Allowance Authority Act 1992 ) where an application had been made for a certificate under Part 3 of Chapter 3 of that Act on or before 14 February 1997 in respect of borrowings in connection with the facility;

(b) an infrastructure facility (within the meaning of section 93L of the Development Allowance Authority Act 1992 ) that is an extension of a an infrastructure facility in respect of which a certificate under Part 3 of Chapter 3 of that Act is in force.

(2) That Division also applies to facilities that are related facilities (within the meaning of section 93M of the Development Allowance Authority Act 1992 ) in relation to facilities covered by subsection (1) as if they were related facilities to land transport facilities.

21 Certain projects taken to be approved

(1) This item applies to an infrastructure facility or a related facility (within the meaning of section 93L or 93M of the Development Allowance Authority Act 1992 ) if:

(a) an application had been made for a certificate under Part 3 of Chapter 3 of that Act on or before 14 February 1997 in respect of borrowings in connection with the facility; and

(b) a certificate had been issued under that Act in respect of those borrowings but the certificate is not effective because of the operation of the Taxation Laws Amendment (Infrastructure Borrowings) Act 1997 ; and

(c) the Minister for Transport and Regional Development determines, by written notice, that this item applies to the facility.

(2) A determination is to include all of the matters that would be set out if the determination were a decision to approve a borrower and a project under section 396 - 70 of the Income Tax Assessment Act 1997 .

(3) The income years specified in the determination must not include an income year that starts more than 5 years after the first borrowing is made in respect of the project.

(4) The Minister for Transport and Regional Development must not specify in the determination a maximum amount of tax offsets for the project for an income year that would cause the maximum amount referred to in section 396 - 20 of the Income Tax Assessment Act 1997 for that income year to be exceeded.

(5) If this item applies to an infrastructure facility:

(a) Division 396 of the Income Tax Assessment Act 1997 applies to the facility as if it were a land transport facility; and

(b) the Minister for Transport and Regional Development is taken to have made a decision under section 396 - 70 of the Income Tax Assessment Act 1997 to approve the borrower and the project specified in the determination.

22 Provision of information by Development Allowance Authority

Section 93ZF of the Development Allowance Authority Act 1992 applies as if paragraph (d) of that section included a reference to this Part of this Schedule and to Division 396 of the Income Tax Assessment Act 1997 .