Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated ActsPart 1 -- Amendment of the Income Tax Assessment Act 1936

1 Subsection 92(2)

Omit "Where", substitute "Subject to section 830 - 45 of the Income Tax Assessment Act 1997 , if".

2 Section 94B (paragraph (a) of the definition of income tax law )

After "Division", insert "and Division 830 of the Income Tax Assessment Act 1997 ".

3 At the end of section 94D

Add:

(4) A limited partnership that is a foreign hybrid limited partnership in relation to a year of income because of subsection 830 - 10(1) of the Income Tax Assessment Act 1997 is not a corporate limited partnership in relation to the year of income.

Note: As result, both the normal partnership provisions and special provisions relating to foreign hybrid limited partnerships will apply to the entity.

(5) If, for the purpose of applying this Act and the Income Tax Assessment Act 1997 in relation to a partner's interest in a limited partnership, the partnership is a foreign hybrid limited partnership in relation to a year of income because of subsection 830 - 10(2) of that Act, the partnership is not a corporate limited partnership in relation to the partner's interest in relation to the year of income.

4 At the end of section 324

Add:

Note: Section 830 - 75 of the Income Tax Assessment Act 1997 sets out additional circumstances, relating to entities that are foreign hybrids, in which a gain or profit is subject to tax in a listed country.

5 After section 485

Insert:

485AA Election to exclude interests in foreign hybrids from operation of this Part

Limited partnerships that are treated as companies

(1) If:

(a) disregarding subsection 94D(5):

(i) at the end of a year of income, a taxpayer has an interest in a FIF that is a corporate limited partnership for the purposes of Division 5A of Part III in relation to the year of income; and

(ii) the interest consists of a share in the FIF; and

Note: The share will be an interest in the partnership that is treated by Division 5A of Part III as a share.

(b) the entity satisfies the requirements of paragraphs 830 - 10(1)(a) to (d) of the Income Tax Assessment Act 1997 in relation to the year of income;

the taxpayer may elect that subsection (5) of this section applies in relation to the interest in the FIF.

Actual companies

(2) If:

(a) at the end of a year of income, a taxpayer has an interest in a FIF that consists of one or more shares in the FIF; and

(b) the interest is not one to which paragraph (1)(a) applies; and

(c) the entity satisfies the requirements of paragraphs 830 - 15(1)(a) to (c) of the Income Tax Assessment Act 1997 in relation to the year of income;

the taxpayer may elect that subsection (5) of this section applies in relation to the interest in the FIF.

Time limit for making election

(3) A taxpayer must make an election under this section:

(a) on or before the day on which the taxpayer lodges its return of income for the year of income; or

(b) within a further time allowed by the Commissioner.

When election is in force

(4) If the taxpayer makes the election, it is in force during the year of income and all later years of income.

Effect of election on interest in FIF etc.

(5) While the election is in force, the operative provision, and any other provision of this Part relevant to the operation of that provision, does not apply to the taxpayer in relation to the interest in the FIF consisting of the share or shares or any option, convertible note, or other instrument, that confers an entitlement to acquire the share or shares.

Note: The election will also have the effect under Division 830 of the Income Tax Assessment Act 1997 of making the company or limited partnership a foreign hybrid in relation to the taxpayer's interest in the FIF.

Effect of election on other interests in FIF

(6) However, subsection (5) does not have effect so far as that interest in the FIF is relevant for the purpose of the application of this Part in relation to the taxpayer, or any other taxpayer, in relation to any other interest in the FIF.

Note: For example, in applying section 580 to work out other taxpayers' shares of the calculated profit of the FIF, the interest would not be disregarded.

Election irrevocable

(7) The election is irrevocable.

6 Application

The amendments made by this Part have the same application to assessments of a taxpayer, and for working out the attributable income of a CFC, as does Division 830 of the Income Tax Assessment Act 1997 .

Note: Division 830 of the Income Tax Assessment Act 1997 is inserted by Part 2 of this Schedule. Its application is given by Division 830 of the Income Tax (Transitional Provisions) Act 1997 , which is inserted by Part 3 of this Schedule.

Part 2 -- Amendment of the Income Tax Assessment Act 1997

7 Section 12 - 5 (table item headed "partnerships")

Before:

losses, partner's share of partnership loss............................ 90, 92 |

insert:

foreign hybrid loss exposure adjustment............................. 830 - 50 |

|

8 Section 36 - 25 (after the table headed " Tax losses of VCLPs, AFOFs and VCMPs ")

Insert:

Tax losses of entities that become foreign hybrids

Item | For the special rules about this situation... | See: |

1. | An entity that has a tax loss becomes a * foreign hybrid: it cannot deduct the loss while it is a foreign hybrid. | Section 830 - 115 |

9 Subsection 102 - 25(2)

Repeal the subsection, substitute:

(2) However, there are 3 exceptions: one for * CGT events J2 and J3, one for CGT event K5 and one for CGT event K12.

10 After subsection 102 - 25(2B)

Insert:

(2C) If:

(a) * CGT events happen for which you make * capital gains or * capital losses; and

(b) the capital gains or losses are taken into account in working out a * foreign hybrid net capital loss amount; and

(c) the foreign hybrid net capital loss amount is itself taken into account in determining that * CGT event K12 happens;

CGT event K12 applies in addition to the other CGT events.

11 Section 104 - 5 (before table item relating to CGT event L1)

Insert:

K12 Foreign hybrid loss exposure adjustment [See section 104 - 270] | just before the end of the income year | no capital gain | the amount stated in subsection 104 - 270(3) |

12 At the end of Subdivision 104 - K

Add:

104 - 270 Foreign hybrids: CGT event K12

(1) CGT event K12 happens if, in accordance with paragraph 830 - 50(2)(b) or (3)(b), you make a * capital loss under this section for an income year.

(2) The time of the event is just before the end of the income year.

(3) You make a capital loss equal to the amount applicable under paragraph 830 - 50(2)(b) or (3)(b).

13 Section 110 - 10 (before table item relating to CGT event L1)

Insert:

K12 | Foreign hybrid loss exposure adjustment | 104 - 270 |

14 Section 112 - 97 (after table item 20)

Insert:

20A | An entity becomes or ceases to be a foreign hybrid | The total cost base and reduced cost base | Sections 830 - 80 and 830 - 85 |

15 At the end of Part 4 - 5 (before the link note)

Add:

Division 830 -- Foreign hybrids

Table of Subdivisions

Guide to Division 830

830 - A Meaning of "foreign hybrid"

830 - B Extension of normal partnership provisions to foreign hybrid companies

830 - C Special rules applicable while an entity is a foreign hybrid

830 - D Special rules applicable when an entity becomes or ceases to be a foreign hybrid

830 - 1 What this Division is about

This Division:

(a) provides for certain entities (called foreign hybrids) that are treated as partnerships for the purposes of foreign tax, but as companies for the purposes of tax within the meaning of this Act, to be treated as partnerships for the purposes of this Act; and

(b) applies special rules to the entities in addition to those that normally apply to partnerships.

[This is the end of the Guide.]

Subdivision 830 - A -- Meaning of "foreign hybrid"

Table of sections

830 - 5 Foreign hybrid

830 - 10 Foreign hybrid limited partnership

830 - 15 Foreign hybrid company

The expression foreign hybrid means:

(a) a * foreign hybrid limited partnership; or

(b) a * foreign hybrid company.

830 - 10 Foreign hybrid limited partnership

(1) A * limited partnership is a foreign hybrid limited partnership in relation to an income year if:

(a) it was formed in a foreign country; and

(b) * foreign tax is imposed under the law of the foreign country on the partners, not the limited partnership, in respect of the income or profits of the partnership for the income year; and

(c) at no time during the income year is the limited partnership, for the purposes of a law of any foreign country that imposes foreign tax on entities because they are residents of the foreign country, a resident of that country; and

(d) disregarding subsection 94D(4) of the Income Tax Assessment Act 1936 , at no time during the income year is it an Australian resident; and

(e) disregarding that subsection, in relation to the same income year of another taxpayer:

(i) the limited partnership is a * CFC at the end of a * statutory accounting period that ends in the income year; and

(ii) at the end of the statutory accounting period, the taxpayer is an * attributable taxpayer in relation to the CFC with an * attribution percentage greater than nil.

(2) If a partner in a * limited partnership makes an election under subsection 485AA(1) of the Income Tax Assessment Act 1936 in relation to the partner's interest in the partnership, then, for the purpose of applying that Act and this Act in relation to the partner's interest, the limited partnership is a foreign hybrid limited partnership in relation to any income year during which the election is in force.

830 - 15 Foreign hybrid company

(1) A company is a foreign hybrid company in relation to an income year if:

(a) at all times during the income year when the company is in existence, the partnership treatment requirements for the income year in subsection (2) or (3) are satisfied; and

(b) at no time during the income year is the company, for the purposes of a law of any foreign country that imposes * foreign tax on entities because they are residents of the foreign country, a resident of that country; and

(c) at no time during the income year is the company an Australian resident; and

(d) disregarding this Division, in relation to the same income year of another taxpayer:

(i) the company is a * CFC at the end of a * statutory accounting period that ends in the income year; and

(ii) at the end of the statutory accounting period, the taxpayer is an * attributable taxpayer in relation to the CFC with an * attribution percentage greater than nil.

Partnership treatment requirements specific to USA

(2) For the purposes of paragraph (1)(a), the partnership treatment requirements are satisfied if:

(a) the company was formed in the United States of America; and

(b) for the purposes of the law of that country relating to * foreign tax imposed by that country, the company is a limited liability company that:

(i) is treated as a partnership; or

(ii) is an eligible entity that is disregarded as an entity separate from its owner.

Partnership treatment requirements relating to any foreign country

(3) For the purposes of paragraph (1)(a), the partnership treatment requirements are also satisfied if:

(a) the company was formed in a foreign country (which may be the United States of America); and

(b) for the purposes of the law of that country relating to * foreign tax imposed by that country, the company is treated as a partnership; and

(c) regulations are in force setting out requirements to be satisfied by a company in relation to the income year for the purposes of this paragraph, and the company satisfies those requirements.

(4) Regulations for the purposes of paragraph (3)(c) cannot set out requirements in relation to any income year before the one in which the regulations are made.

(5) If a * shareholder in a company makes an election under subsection 485AA(2) of the Income Tax Assessment Act 1936 in relation to the shareholder's share or shares in the company, then, for the purpose of applying that Act and this Act in relation to the shareholder's share or shares, the company is a foreign hybrid company in relation to any income year during which the election is in force.

Subdivision 830 - B -- Extension of normal partnership provisions to foreign hybrid companies

Note: The normal partnership provisions will apply of their own force to foreign hybrids that are foreign hybrid limited partnerships.

Table of sections

830 - 20 Treatment of company as a partnership

830 - 25 Partners are the shareholders in the company

830 - 30 Individual interest of a partner in net income etc. equals percentage of notional distribution of company's profits

830 - 35 Partner's interest in assets

830 - 40 Control and disposal of share in partnership income

830 - 20 Treatment of company as a partnership

If a company is a * foreign hybrid company in relation to an income year, the * foreign hybrid tax provisions apply as if the company were a partnership, and for that purpose the following provisions of this Subdivision have effect.

830 - 25 Partners are the shareholders in the company

The partners in the partnership are the * shareholders in the company.

The individual interest of a partner in the * net income or * partnership loss of the partnership of the income year is equal to the percentage that, if the profits of the company for the income year were distributed at the end of the income year to its * shareholders:

(a) if paragraph (b) does not apply--as dividends; or

(b) if the company's * constitution or other rules provide for the distribution of profits other than as dividends--in accordance with the constitution or those rules;

the partner, as a shareholder, could reasonably be expected to receive of the total distribution.

830 - 35 Partner's interest in assets

(1) The interest that each partner has in the assets of the partnership, under the partnership agreement, is equal to the percentage in subsection (2).

(2) The percentage is the percentage that, if the capital of the company were distributed to its * shareholders on a winding - up of the company at the end of the income year, the partner, as a shareholder, could reasonably be expected to receive of the total distribution.

830 - 40 Control and disposal of share in partnership income

(1) This section applies for the purposes of determining under section 94 of the Income Tax Assessment Act 1936 whether the partnership is so constituted or controlled, or its operations are so conducted, that a partner does not have the real and effective control and disposal of the partner's share, or a part of the partner's share, in the * net income of the partnership of an income year.

(2) The reference to the partner's share, or a part of the partner's share, in the * net income is a reference to any rights that the * shareholder has under the * constitution or other rules of the company that were taken into account under section 830 - 30 in working out the individual interest of the partner in the partnership's net income or * partnership loss of the income year.

Subdivision 830 - C -- Special rules applicable while an entity is a foreign hybrid

Note: In the case of a foreign hybrid company, references in this Subdivision that relate to partnerships are to be read subject to Subdivision 830 - B. For example, a reference to a partner will be a reference to a shareholder in the company who is treated by Subdivision 830 - B as a partner.

Table of sections

830 - 45 Partner's revenue and net capital losses from foreign hybrid not to exceed partner's loss exposure amount

830 - 50 Deduction etc. where partner's foreign hybrid revenue loss amount and foreign hybrid net capital loss amount are less than partner's loss exposure amount

830 - 55 Meaning of foreign hybrid net capital loss amount

830 - 60 Meaning of loss exposure amount

830 - 65 Meaning of outstanding foreign hybrid revenue loss amount

830 - 70 Meaning of outstanding foreign hybrid net capital loss amount

830 - 75 Extended meaning of subject to tax

(1) This section applies to a * limited partner in a * foreign hybrid in relation to an income year if the sum of the following amounts:

(a) any amount (a foreign hybrid revenue loss amount ) allowable to the partner as a deduction under subsection 92(2) of the Income Tax Assessment Act 1936 in respect of a * partnership loss of the foreign hybrid for the income year;

(b) any * foreign hybrid net capital loss amount of the partner in respect of the foreign hybrid for the income year;

exceeds the partner's * loss exposure amount for the income year.

Reduction in foreign hybrid revenue loss amount or foreign hybrid net capital loss amount

(2) If this section applies, the amount mentioned in paragraph (1)(a) or (b), or each of the amounts mentioned in those paragraphs, is reduced so that in total they equal the partner's * loss exposure amount. The partner must choose how much of the reduction is applied to each of the amounts.

Effect of reducing foreign hybrid net capital loss amount

(3) If the partner's * foreign hybrid net capital loss amount in respect of the * foreign hybrid for the income year is reduced under subsection (2), the partner's * net capital gain or * net capital loss for the income year is worked out by assuming that the * capital gains and * capital losses taken into account in working out the partner's foreign hybrid net capital loss amount were instead a capital loss equal to the foreign hybrid net capital loss amount after the reduction.

(1) This section applies if:

(a) the sum of a partner's * foreign hybrid revenue loss amount and * foreign hybrid net capital loss amount for a * foreign hybrid for an income year does not exceed the partner's * loss exposure amount for the foreign hybrid for the income year (the difference being the partner's available loss exposure amount ); and

(b) the partner has one or more * outstanding foreign hybrid revenue loss amounts or one or more * outstanding foreign hybrid net capital loss amounts, or both, in respect of the foreign hybrid for the income year.

Where sum of outstanding foreign hybrid revenue loss amounts and outstanding foreign hybrid net capital loss amounts does not exceed available loss exposure amount

(2) If the sum of the * outstanding foreign hybrid revenue loss amounts and the * outstanding foreign hybrid net capital loss amounts does not exceed the * available loss exposure amount:

(a) a deduction is allowable to the partner for the income year equal to the sum of the outstanding foreign hybrid revenue loss amounts; and

(b) the partner makes a * capital loss for the income year under section 104 - 270 equal to the sum of the outstanding foreign hybrid net capital loss amounts.

Where sum of outstanding foreign hybrid revenue loss amounts and outstanding foreign hybrid net capital loss amounts exceeds available loss exposure amount

(3) If the sum of the * outstanding foreign hybrid revenue loss amounts and the * outstanding foreign hybrid net capital loss amounts exceeds the * available loss exposure amount, then either or both of the following apply:

(a) a deduction is allowable to the partner for the income year equal to some or all of the outstanding foreign hybrid revenue loss amounts;

(b) the partner makes a * capital loss under section 104 - 270 equal to some or all of the outstanding foreign hybrid net capital loss amounts;

such that the sum of the deduction and the capital loss equals the available loss exposure amount.

Partner to choose how to apply subsection (3)

(4) The partner must choose:

(a) which of paragraphs (3)(a) and (b) is to apply or whether both are to apply; and

(b) the amount of the deduction or * capital loss, or the amounts of both; and

(c) the particular outstanding foreign hybrid revenue loss amounts or outstanding foreign hybrid net capital loss amounts, or both, to which they relate.

830 - 55 Meaning of foreign hybrid net capital loss amount

If:

(a) the sum of a partner's * capital losses from * CGT events happening during an income year in relation to a * foreign hybrid or * CGT assets of a foreign hybrid;

exceeds:

(b) the sum of the partner's * capital gains from CGT events happening during the income year in relation to the foreign hybrid or CGT assets of the foreign hybrid;

the partner has a foreign hybrid net capital loss amount in respect of the foreign hybrid for the income year equal to the excess.

830 - 60 Meaning of loss exposure amount

(1) The loss exposure amount of a partner in a * foreign hybrid for an income year is worked out as follows:

Method statement

Step 1. Work out the sum of the amounts or * market values of the contributions made by the partner to the * foreign hybrid that, as at the end of the income year:

(a) have not been repaid or returned to the partner; and

(b) have been contributed for at least 180 days, or are intended by the partner to remain contributed for at least 180 days.

Step 2. Subtract the sum of the amounts of:

(a) all * limited recourse debts owed by the partner at the end of the income year, to the extent that the * borrowings concerned were for the purpose of enabling the partner to make contributions to the * foreign hybrid and the debts were secured by the partner's interest in the foreign hybrid ; and

(b) all the partner's * foreign hybrid revenue loss amounts in respect of the foreign hybrid for previous income years, after any reduction under subsection 830 - 45(2) ; and

(c) all the partner's * foreign hybrid net capital loss amounts in relation to the partnership for previous income years, after any reduction under subsection 830 - 45(2); and

(d) all deductions allowed to the partner under subsection 830 - 50(2) or (3) in respect of the foreign hybrid for previous income years ; and

(e) all * capital losses that, as a result of subsection 830 - 50(2) or (3), the partner made in respect of * CGT event K12 in respect of the foreign hybrid for previous income years.

Contribution in case of foreign hybrid company

(2) For the purposes of step 1 in the method statement in subsection (1), if:

(a) the * foreign hybrid is a * foreign hybrid company; and

(b) the partner * acquired its * shares in the company from another shareholder; and

(c) the payment or other consideration for the acquisition of the shares did not constitute the making of a contribution by the partner to the foreign hybrid;

the payment or other consideration is taken:

(d) to be a contribution by the partner to the foreign hybrid; and

(e) to be so contributed for as long as the partner holds the shares; and

(f) to have been repaid to the partner to the extent of any payment that:

(i) the foreign hybrid makes to the partner in respect of the share; and

(ii) the foreign hybrid describes as a return of capital; and

(iii) is attributable to the period during which the partner has held the shares.

830 - 65 Meaning of outstanding foreign hybrid revenue loss amount

(1) This section applies if a * foreign hybrid revenue loss amount of a partner in a * foreign hybrid in relation to an income year (the reduction year ) is reduced under subsection 830 - 45(2).

(2) The partner has, for each later income year, an outstanding foreign hybrid revenue loss amount equal to the amount of the reduction, less the sum of any deductions allowable to the partner under subsection 830 - 50(2) or (3) in respect of the outstanding foreign hybrid revenue loss amount for income years between the reduction year and the later income year.

Outstanding foreign hybrid revenue loss amount not to form part of tax loss

(3) To avoid doubt, a partner's * outstanding foreign hybrid revenue loss amount for an income year cannot form part of a * tax loss for the purposes of Division 36.

830 - 70 Meaning of outstanding foreign hybrid net capital loss amount

(1) This section applies if a * foreign hybrid net capital loss amount of a partner in a * foreign hybrid in relation to an income year (the reduction year ) is reduced under subsection 830 - 45(2).

(2) The partner has, for each later income year, an outstanding foreign hybrid net capital loss amount equal to the amount of the reduction, less the sum of any * capital losses that, as a result of subsection 830 - 50(2) or (3), the partner makes in respect of * CGT event K12 in respect of the outstanding foreign hybrid net capital loss amount for income years between the reduction year and the later income year.

830 - 75 Extended meaning of subject to tax

Where entity becomes a partner

(1) If:

(a) an entity becomes a partner (the first partner ) in a * foreign hybrid in relation to an income year; and

(b) a gain or profit of a capital nature accrues to another partner as a result of the disposal of the whole or part of that other partner's interest in an asset of the foreign hybrid that happens when the first partner becomes a partner; and

(c) apart from this subsection, the gain or profit is not * subject to tax in a * listed country in any * tax accounting period; and

(d) if the foreign hybrid had disposed of the whole or an equivalent part of the asset at the time of the disposal of the whole or the part of the interest, any gain or profit of a capital nature that accrued to the foreign hybrid in respect of the disposal would have been subject to tax in a listed country in a tax accounting period;

then, for the purposes of Part X of the Income Tax Assessment Act 1936 , the gain or profit mentioned in paragraph (b) is taken to be subject to tax in the listed country, and in the tax accounting period, mentioned in paragraph (d).

Where partner increases its interest

(2) If:

(a) an entity is a partner (the first partner ) that increases its interest in a * foreign hybrid in relation to an income year; and

(b) a gain or profit of a capital nature accrues to another partner as a result of the disposal of the whole or part of that other partner's interest in an asset of the foreign hybrid that happens when the first partner increases its interest in the foreign hybrid; and

(c) apart from this subsection, the gain or profit is not * subject to tax in a * listed country in any * tax accounting period; and

(d) if the foreign hybrid had disposed of the whole or an equivalent part of the asset at the time of the disposal of the whole or the part of the interest, any gain or profit of a capital nature that accrued to the foreign hybrid in respect of the disposal would have been subject to tax in a listed country in a tax accounting period;

then, for the purposes of Part X of the Income Tax Assessment Act 1936 , the gain or profit mentioned in paragraph (b) is taken to be subject to tax in the listed country, and in the tax accounting period, mentioned in paragraph (d).

Where entity ceases to be a partner

(3) If:

(a) an entity ceases to be a partner in a * foreign hybrid in relation to an income year; and

(b) a gain or profit of a capital nature accrues to the entity as a result of the disposal of its interest in an asset of the foreign hybrid that happens when the entity ceases to be a partner; and

(c) apart from this subsection, the gain or profit is not * subject to tax in a * listed country in any * tax accounting period; and

(d) any gain or profit of a capital nature that accrues to the entity as a result of the disposal of its interest in the foreign hybrid that happens when the entity ceases to be a partner is subject to tax in a listed country in a tax accounting period;

then, for the purposes of Part X of the Income Tax Assessment Act 1936 , the gain or profit mentioned in paragraph (b) is taken to be subject to tax in the listed country, and in the tax accounting period, mentioned in paragraph (d).

Where partner disposes of part of its interest

(4) If:

(a) an entity is a partner that disposes of part of its interest in a * foreign hybrid in relation to an income year; and

(b) a gain or profit of a capital nature accrues to the entity as a result of the disposal of part of its interest in an asset of the foreign hybrid that happens when the entity disposes of the part of its interest in the foreign hybrid; and

(c) apart from this subsection, the gain or profit is not * subject to tax in a * listed country in any * tax accounting period; and

(d) any gain or profit of a capital nature that accrues to the entity as a result of the disposal of the part of its interest in the foreign hybrid is subject to tax in a listed country in a tax accounting period;

then, for the purposes of Part X of the Income Tax Assessment Act 1936 , the gain or profit mentioned in paragraph (b) is taken to be subject to tax in the listed country, and in the tax accounting period, mentioned in paragraph (d).

Note: In the case of a foreign hybrid company, references in this Subdivision that relate to partnerships are to be read subject to Subdivision 830 - B. For example, a reference to a partner will be a reference to a shareholder in the company who is treated by Subdivision 830 - B as a partner.

Table of sections

830 - 80 Setting the tax cost of partners' interests in the assets of an entity that becomes a foreign hybrid

830 - 85 Setting the tax cost of assets of an entity when it ceases to be a foreign hybrid

830 - 90 What the expression tax cost is set means

830 - 95 What the expression tax cost setting amount means

830 - 100 What the expression tax cost means

830 - 105 What the expression asset - based income tax regime means

830 - 110 No disposal of assets etc. on entity becoming or ceasing to be a foreign hybrid

830 - 115 Tax losses cannot be transferred to a foreign hybrid

830 - 120 End of CFC's last statutory accounting period

830 - 125 How long interest in asset, or asset, held

(1) This section applies if:

(a) an entity is a * foreign hybrid in relation to an income year (the hybrid year ); and

(b) the entity was in existence at the end of the preceding income year (which may be the income year before this Division first applies to the entity); and

(c) the entity was not a foreign hybrid in relation to that preceding income year.

(2) For the purposes of applying an * asset - based income tax regime for the hybrid year and each later income year in relation to which the entity continues to be a foreign hybrid, the * tax cost is set at the start of the hybrid year, for each asset of the * foreign hybrid in which each partner has an interest at that time.

830 - 85 Setting the tax cost of assets of an entity when it ceases to be a foreign hybrid

(1) This section applies if:

(a) an entity is a * foreign hybrid in relation to an income year; and

(b) the entity is in existence at the start of the next income year; and

(c) the entity is not a foreign hybrid in relation to that income year (the post - hybrid year ).

(2) For the purposes of applying an * asset - based income tax regime for the post - hybrid year and each later income year in relation to which the entity continues not to be a foreign hybrid, the * tax cost is set at the start of the post - hybrid year, for each asset of the entity at that time.

830 - 90 What the expression tax cost is set means

The following table explains what the expression tax cost is set at the start of the hybrid year or the post - hybrid year means, in relation to an asset in which a partner has an interest or in relation to an asset of the entity, for the purposes of each * asset - based income tax regime:

Tax cost is set | |||

Item | If the following asset - based income tax regime is to apply: | The expression means that: |

|

1 | Subdivisions 40 - A to 40 - D, sections 40 - 425 to 40 - 445 and Subdivision 328 - D | the * adjustable value of the interest or the asset at the start of the hybrid year or the post - hybrid year is varied so that it equals the partner's * tax cost setting amount for the interest, or the entity's tax cost setting amount for the asset, at that time in relation to the * asset - based income tax regime | |

2 | Division 70 | the value of the interest or the asset at the start of the hybrid year or the post - hybrid year under Division 70 is varied so that it equals the partner's * tax cost setting amount for the interest, or the entity's tax cost setting amount for the asset, at that time in relation to the * asset - based income tax regime | |

3 | Part 3 - 1 or 3 - 3 | the * cost base or * reduced cost base of the interest or the asset at the start of the hybrid year or the post - hybrid year is varied so that it equals the partner's * tax cost setting amount for the interest, or the entity's tax cost setting amount for the asset, at that time in relation to the * asset - based income tax regime | |

4 | Division 16E of Part III of the Income Tax Assessment Act 1936 | the Division applies as if the interest or the asset were * acquired by the partner or the entity at the start of the hybrid year or the post - hybrid year for a payment equal to the partner's * tax cost setting amount for the interest, or the entity's tax cost setting amount for the asset, at that time in relation to the * asset - based income tax regime | |

5 | Any other provision of this Act or the Income Tax Assessment Act 1936 | the cost of the interest or asset at the start of the hybrid year or the post - hybrid year is varied so that it equals the partner's * tax cost setting amount for the interest, or the entity's tax cost setting amount for the asset, at that time in relation to the * asset - based income tax regime | |

830 - 95 What the expression tax cost setting amount means

(1) A partner's tax cost setting amount for an interest of the partner in an asset at the start of the hybrid year, in relation to an * asset - based income tax regime, is worked out as follows:

Method statement

Step 1. Work out what would have been the entity's * tax cost of the asset for the purposes of applying the * asset - based income tax regime as at the start of the hybrid year if it were not a * foreign hybrid in relation to the hybrid year.

Step 2. Multiply the result of step 1 by:

(a) if the entity is a * foreign hybrid company in relation to the hybrid year--the percentage applicable to the partner under subsection 830 - 35(2); or

(b) if the entity is a * foreign hybrid limited partnership in relation to the hybrid year--the individual interest of the partner in the asset, expressed as a percentage of the interests of all of the partners in the asset.

Step 3. If the partner paid a premium in respect of the * acquisition of its interest in the asset (see subsection (2)), add the amount of the premium to the result of step 2. If the partner received a discount in respect of the acquisition (see subsection (2)), subtract the amount of the discount from the result of step 2, but not to the extent that this would result in a negative amount.

The result of step 3 is the partner's tax cost setting amount in respect of the asset.

(2) Work out whether the partner paid a premium or received a discount for its interest in the asset using the following method statement:

Method Statement

Step 1. Add up all the amounts paid by the partner before the start of the hybrid year for its * shares in the entity (if the entity was a company), or for its interests in the assets of the entity and in the entity (if the entity was a * limited partnership), that it held at the start of the hybrid year, and subtract all amounts received by the partner in respect of those shares or interests by way of reduction in capital of the entity.

Step 2. Work out the amount that, if the capital of the entity had been distributed to its * shareholders on a winding - up or to its partners on a dissolution, at the end of the income year before the hybrid year, the partner could reasonably be expected to have received of the total distribution.

Step 3. If the result of step 1 exceeds the result of step 2, the partner paid a premium for its interest in the asset. If the result of step 2 exceeds the result of step 1, the partner received a discount for its interest in the asset.

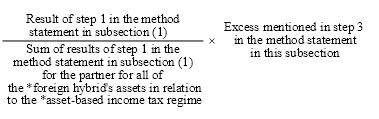

Step 4. Work out the amount of the premium or discount using the formula:

(3) The entity's tax cost setting amount for an asset at the start of the post - hybrid year in relation to an * asset - based income tax regime is equal to the sum of what the partners' * tax costs for their interests in the asset would be at that time for the purpose of applying the asset - based income tax regime if the entity had continued to be a * foreign hybrid in relation to that income year.

830 - 100 What the expression tax cost means

The tax cost of a partner's interest in an asset or of an asset of the entity for the purposes of applying an * asset - based income tax regime at the start of the post - hybrid year or the hybrid year is worked out using the following table:

Tax cost of an asset | ||

Item | If the asset - based income tax regime is: | the tax cost of the interest or the asset is: |

1 | Subdivisions 40 - A to 40 - D, sections 40 - 425 to 40 - 445 and Subdivision 328 - D | the * adjustable value of the interest or the asset at the start of the post - hybrid year or the hybrid year |

2 | Division 70 | the value of the interest or the asset at the start of the post - hybrid year or the hybrid year under Division 70 |

3 | Part 3 - 1 or 3 - 3 | the * cost base or * reduced cost base of the interest or the asset at the start of the post - hybrid year or the hybrid year |

4 | Division 16E of Part III of the Income Tax Assessment Act 1936 | the amount that the partner or entity would need to receive if it were to dispose of the interest or asset at the start of the post - hybrid year or the hybrid year without an amount being assessable income of, or deductible to, the partner or entity under section 159GS of the Income Tax Assessment Act 1936 |

5 | Any other provision of this Act or the Income Tax Assessment Act 1936 | the cost of the interest or the asset at the start of the post - hybrid year or the hybrid year |

830 - 105 What the expression asset - based income tax regime means

The provisions listed in the first column in relation to each item in the table in section 830 - 100 are an asset - based income tax regime .

830 - 110 No disposal of assets etc. on entity becoming or ceasing to be a foreign hybrid

To avoid doubt, the fact that an entity becomes or ceases to be a * foreign hybrid in relation to an income year does not cause:

(a) a * CGT event to happen to any * CGT asset consisting of:

(i) any * share or interest in the entity; or

(ii) any interest in an asset of the entity; or

(b) a disposal or any other event to happen to any other asset consisting of such a share or interest.

830 - 115 Tax losses cannot be transferred to a foreign hybrid

(1) If an entity is a * foreign hybrid in relation to an income year, it cannot deduct in that income year a * tax loss for a * loss year in relation to which it was not a foreign hybrid.

Former foreign hybrid can deduct tax losses for income years before it became a foreign hybrid

(2) This section does not prevent an entity that:

(a) is not a * foreign hybrid in relation to an income year (the post - hybrid year ); and

(b) was a foreign hybrid in relation to a previous income year; and

(c) was not a foreign hybrid in relation to an income year (the pre - hybrid year ) before the previous year;

from deducting, in the post - hybrid year, a * tax loss for the pre - hybrid year.

830 - 120 End of CFC's last statutory accounting period

If:

(a) a taxpayer is a partner in an entity that becomes a * foreign hybrid in relation to an income year; and

(b) the entity was a * CFC at the end of the taxpayer's preceding income year; and

(c) the last * statutory accounting period of the CFC did not end at the end of the taxpayer's preceding income year; and

(d) if it had so ended, the taxpayer would have been an * attributable taxpayer in relation to the CFC;

for the purposes of working out the * attributable income of the CFC for the taxpayer in respect of the last statutory accounting period of the CFC, that statutory accounting period ends at the end of the taxpayer's preceding income year.

830 - 125 How long interest in asset, or asset, held

Partner's interest in asset when entity becomes a foreign hybrid

(1) If an entity becomes a * foreign hybrid company in relation to an income year, the interest that a partner has in an asset as mentioned in section 830 - 35 is taken to have been held by the partner (except for the purposes of having the * tax cost of the interest set) from the later of the following times:

(a) when the entity * acquired the asset;

(b) when the partner acquired its * shares in the entity.

Entity's asset when it ceases to be a foreign hybrid company

(2) If:

(a) an entity is not a * foreign hybrid company in relation to an income year (the post - hybrid year ); and

(b) the entity was a * foreign hybrid company in relation to the preceding income year; and

(c) during:

(i) that preceding income year; or

(ii) any earlier income year in relation to which the entity was also a foreign hybrid;

but not at the start of the first income year in relation to which the entity was a foreign hybrid company, the partners in the foreign hybrid company * acquired an interest in an asset that is an asset of the entity at the start of the post - hybrid year;

the asset is taken to have been held by the entity (except for the purposes of having the * tax cost of the asset set) from the time the partners acquired their interests in the asset.

16 Subsection 995 - 1(1)

Insert:

"asset-based income tax regime" has the meaning given by section 830 - 105.

17 Subsection 995 - 1(1)

Insert:

"attributable taxpayer" has the meaning given by Part X of the Income Tax Assessment Act 1936 .

18 Subsection 995 - 1(1)

Insert:

"attribution percentage" has the meaning given by Part X of the Income Tax Assessment Act 1936 .

19 Subsection 995 - 1(1)

Insert:

"available loss exposure amount" has the meaning given by paragraph 830 - 50(1)(a).

20 Subsection 995 - 1(1) (at the end of the definition of company )

Add:

Note: Division 830 treats foreign hybrid companies as partnerships.

21 Subsection 995 - 1(1)

Insert:

"foreign hybrid" has the meaning given by section 830 - 5.

22 Subsection 995 - 1(1)

Insert:

"foreign hybrid" company has the meaning given by section 830 - 15.

23 Subsection 995 - 1(1)

Insert:

"foreign hybrid limited partnership" has the meaning given by section 830 - 10.

24 Subsection 995 - 1(1)

Insert:

"foreign hybrid net capital loss amount" has the meaning given by section 830 - 55.

25 Subsection 995 - 1(1)

Insert:

"foreign hybrid revenue loss amount" has the meaning given by paragraph 830 - 45(1)(a).

26 Subsection 995 - 1(1)

Insert:

"foreign hybrid tax provisions" means:

(a) the Income Tax Assessment Act 1936 (other than Division 5A of Part III); and

(b) this Act (other than Subdivision 830 - A and 830 - B); and

(c) an Act that imposes any tax payable under the Income Tax Assessment Act 1936 or this Act; and

(d) the Income Tax Rates Act 1986 ; and

(e) the Taxation Administration Act 1953 , so far as it relates to an Act covered by paragraph (a), (b) or (c); and

(f) any other Act, so far as it relates to an Act covered by paragraph (a), (b), (c), (d) or (e); and

(g) regulations under an Act covered by any of the preceding paragraphs.

27 Subsection 995 - 1(1)

Insert:

"foreign tax" has the meaning given by section 6AB of the Income Tax Assessment Act 1936 .

28 Subsection 995 - 1(1)

Insert:

"loss exposure amount" has the meaning given by section 830 - 60.

29 Subsection 995 - 1(1)

Insert:

"outstanding foreign hybrid net capital loss amount" has the meaning given by section 830 - 70.

30 Subsection 995 - 1(1)

Insert:

"outstanding foreign hybrid revenue loss amount" has the meaning given by section 830 - 65.

31 Subsection 995 - 1(1) (at the end of the definition of partnership )

Add:

Note: Division 830 treats foreign hybrid companies as partnerships.

32 Subsection 995 - 1(1)

Insert:

"statutory accounting period" has the meaning given by Part X of the Income Tax Assessment Act 1936 .

33 Subsection 995 - 1(1)

Insert:

"subject to tax" has the meaning given by Part X of the Income Tax Assessment Act 1936 .

34 Subsection 995 - 1(1)

Insert:

"tax accounting period" has the meaning given by Part X of the Income Tax Assessment Act 1936 .

35 Subsection 995 - 1(1)

Insert:

"tax cost" has the meaning given by section 830 - 100.

36 Subsection 995 - 1(1) (at the end of the definition of tax cost is set )

Add "or 830 - 90".

37 Subsection 995 - 1(1) (at the end of the definition of tax cost setting amount )

Add "or 830 - 95".

Part 3 -- Amendment of the Income Tax (Transitional Provisions) Act 1997

38 At the end of Part 4 - 5

Add:

Division 830 -- Application of the foreign hybrid rules

Table of sections

830 - 1 Standard application

830 - 5 Election to extend standard application for foreign hybrids

830 - 10 Election to extend standard application for CFCs with direct or indirect interests in foreign hybrid

830 - 15 Modified version of income tax law to apply for certain past income years

830 - 20 Modifications of income tax law

Foreign hybrids

(1) Division 830 of the Income Tax Assessment Act 1997 applies to assessments for the 2003 - 2004 income year, and each later income year, of a taxpayer who will as a result be a partner in an entity that is a foreign hybrid in relation to that income year.

CFCs that are, directly or indirectly, partners in foreign hybrids

(2) Division 830 of the Income Tax Assessment Act 1997 applies for the purpose of working out the attributable income, in relation to an attributable taxpayer, for:

(a) the statutory accounting period that starts on 1 July 2003 or on the day on which, as a result of an election under subsection 319(2) of the Income Tax Assessment Act 1936 , the statutory accounting period that would otherwise start on 1 July 2003 starts; and

(b) each later statutory accounting period;

of a CFC that:

(c) will as a result be a partner in an entity that is a foreign hybrid in relation to that statutory accounting period; or

(d) has, directly or indirectly through one or more other entities, an interest in another entity that will, as a result, be a foreign hybrid in relation to that statutory accounting period.

830 - 5 Election to extend standard application for foreign hybrids

(1) If a taxpayer will, as a result of making an election under this subsection, be a partner in an entity that is a foreign hybrid in relation to the 2002 - 2003 income year, the taxpayer may elect that Division 830 of the Income Tax Assessment Act 1997 applies to the taxpayer's assessment for the 2002 - 2003 income year.

(2) If:

(a) a taxpayer is, as a result of subsection 830 - 1(1) of this Act, a partner in an entity that is a foreign hybrid in relation to the 2003 - 2004 income year; and

(b) the entity is a foreign hybrid in relation to that income year in a case where the requirements in subsection 830 - 15(3) of the Income Tax Assessment Act 1997 are satisfied;

the taxpayer may elect that Division 830 of the Income Tax Assessment Act 1997 applies to the taxpayer's assessment for the 2002 - 2003 income year as if the entity were a foreign hybrid in relation to that income year.

(3) A taxpayer must make an election under this section:

(a) on or before the day on which the taxpayer lodges its income tax return for the 2003 - 2004 income year; or

(b) within a further time allowed by the Commissioner.

(4) The election is irrevocable.

(1) If:

(a) an entity is an attributable taxpayer in relation to a CFC at the end of the statutory accounting period that starts on 1 July 2002 or on the day on which, as a result of an election under subsection 319(2) of the Income Tax Assessment Act 1936 , the statutory accounting period that would otherwise start on 1 July 2002 starts; and

(b) either:

(i) if the attributable taxpayer makes an election under this subsection, the CFC will, as a result, be a partner in an entity that is a foreign hybrid in relation to that statutory accounting period; or

(ii) the CFC has, directly or indirectly through one or more other entities, an interest in another entity that, if the attributable taxpayer makes an election under this subsection, will, as a result, be a foreign hybrid in relation to that statutory accounting period;

the attributable taxpayer may elect that Division 830 of the Income Tax Assessment Act 1997 applies for the purpose of working out the attributable income of the CFC for the statutory accounting period.

(2) If:

(a) for the purpose of working out the attributable income of a CFC in relation to an attributable taxpayer, a CFC:

(i) is, as a result of subsection 830 - 1(2) of this Act, a partner in an entity that is a foreign hybrid in relation to the statutory accounting period mentioned in paragraph (a) of that subsection; or

(ii) has, directly or indirectly through one or more other entities, an interest in another entity that is, as a result of subsection 830 - 1(2) of this Act, a foreign hybrid in relation to that statutory accounting period; and

(b) the entity mentioned in subparagraph (a)(i) or (ii) is also a foreign hybrid in relation to that statutory accounting period in a case where the requirements in subsection 830 - 15(3) of the Income Tax Assessment Act 1997 are satisfied;

the attributable taxpayer may elect that Division 830 of the Income Tax Assessment Act 1997 applies for the purpose of working out the attributable income of the CFC, in relation to the attributable taxpayer, for the preceding statutory accounting period.

(3) An attributable taxpayer must make an election under this section:

(a) on or before the day on which it lodges its income tax return for the 2003 - 2004 income year; or

(b) within a further time allowed by the Commissioner.

(4) The election is irrevocable.

830 - 15 Modified version of income tax law to apply for certain past income years

Basic rule

(1) Subject to subsection (3), if:

(a) an income year (the past income year ) of a taxpayer started before:

(i) if section 830 - 5 of this Act does not apply to the taxpayer--the 2003 - 2004 income year; or

(ii) if that section applies to the taxpayer--the 2002 - 2003 income year; and

(b) either:

(i) a statutory accounting period of a CFC, in relation to which the taxpayer was an attributable taxpayer at the end of that period and had an attribution percentage greater than nil, ended in the past income year; or

(ii) the taxpayer had an interest in a FIF at the end of the past income year; and

(c) the CFC or FIF would have been a foreign hybrid in relation to the past income year under:

(i) section 830 - 10 of the Income Tax Assessment Act 1997 (disregarding paragraph (1)(e) of that section); or

(ii) section 830 - 15 of that Act (disregarding paragraph (1)(d) and subsection (3) of that section);

if that section had been in force in the past income year;

then, for the purposes mentioned in subsection (2) of this section, the Income Tax Assessment Act 1936 applies with the modifications set out in section 830 - 20 of this Act in working out:

(d) the attributable income of the CFC for the statutory accounting period that ended in the past income year; or

(e) the notional income of the FIF for the notional accounting period that ends in the past income year.

Purposes

(2) The purposes are:

(a) any amendment of an assessment of the taxpayer for the past income year made before the commencement of this section; and

(b) the making of an assessment of the taxpayer for the past income year between the commencement of this section and the end of 30 June 2004; and

(c) any amendment of such an assessment; and

(d) the making of any assessment of the taxpayer for the past income year that takes place after 30 June 2004 and before the end of the time within which, if that assessment had been made on 1 July 2004, the Commissioner could amend the assessment under paragraph 170(2)(b), (c) or (d) of the Income Tax Assessment Act 1936 ; and

(e) any amendment of such an assessment.

Exception

(3) If:

(a) apart from this subsection, subsection (1) would apply to a taxpayer in relation to a CFC for a past income year; and

(b) before the commencement of this section, the taxpayer lodged its income tax return for the past income year; and

(c) the taxpayer prepared the income tax return on the basis that, for the purposes of Part X of the Income Tax Assessment Act 1936 , the CFC was a resident of no particular unlisted country;

then subsection (1) does not apply to the taxpayer in relation to the CFC for the past income year unless:

(d) if there is only one past income year to which paragraphs (a) to (c) of this subsection apply--the taxpayer elects that the subsection applies for the past income year; or

(e) if there is more than one past income year to which paragraphs (a) to (c) of this subsection apply--the taxpayer elects that the subsection applies for all of those past income years.

(4) The taxpayer must make the election:

(a) on or before the day on which the taxpayer lodges its income tax return for the 2003 - 2004 income year; or

(b) within a further time allowed by the Commissioner.

(5) The election is irrevocable.

830 - 20 Modifications of income tax law

(1) This section sets out the modifications of the Income Tax Assessment Act 1936 that, if section 830 - 15 of this Act so provides, apply in working out for a taxpayer:

(a) the attributable income of a CFC for the statutory accounting period that ended in an income year; or

(b) the notional income of a FIF for the notional accounting period that ended in an income year.

CFC--residence

(2) If the CFC is not a resident of a particular listed country or a particular unlisted country for the purposes of Part X of the Income Tax Assessment Act 1936 (including after applying section 331 of that Act), then for the purposes of that Part, the CFC is taken to be a resident of the country under whose laws it was formed.

CFC--foreign tax paid by taxpayer

(3) For the purpose of subsection 393(1) of the Income Tax Assessment Act 1936 , if the taxpayer paid foreign tax (the actual foreign tax ) on its interest in an amount included in the notional assessable income of the CFC for the statutory accounting period, then the CFC is taken to have paid foreign tax in respect of the amount equal to the actual foreign tax divided by the taxpayer's direct attribution interest in the CFC at the end of the statutory accounting period.

CFC--foreign tax paid by another CFC

(4) For the purpose of subsection 393(1) of the Income Tax Assessment Act 1936 , if:

(a) on the assumption in paragraph 830 - 15(1)(c) of this Act, another CFC (the tracing CFC ) would have been a partner in the foreign entity that the CFC mentioned in subsection (1) of this section (the foreign hybrid CFC ) would have been; and

(b) the taxpayer had an attribution tracing interest in the tracing CFC that was taken into account in calculating the taxpayer's attribution percentage for the foreign hybrid CFC at the end of the statutory accounting period; and

(c) the tracing CFC paid foreign tax (the actual foreign tax ) on its interest in an amount included in the notional assessable income of the foreign hybrid CFC for the statutory accounting period;

then the foreign hybrid CFC is taken to have paid foreign tax, in respect of the amount included in its notional assessable income, equal to the actual foreign tax divided by the tracing CFC's direct attribution interest in the foreign hybrid CFC at the end of the statutory accounting period.

FIF--foreign tax paid by taxpayer

(5) For the purpose of section 573 of the Income Tax Assessment Act 1936 , if the taxpayer paid foreign tax (the actual foreign tax ) on its interest in an amount included in the notional income of the FIF for the notional accounting period, then the FIF is taken to have paid foreign tax in respect of that amount equal to the actual foreign tax divided by the attribution percentage applicable under section 581 of that Act to the taxpayer in respect of the taxpayer's interests in the FIF at the end of the notional accounting period.