Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated ActsPart 1 -- Amendments commencing on 16 July 1999

Income Tax Assessment Act 1936

1 After section 160AQCND

Insert:

160AQCNDA Carry forward of exempting surplus

(1) If a former exempting company has a class A exempting surplus at the end of a franking year, there arises at the beginning of the next franking year a class A exempting credit of the company equal to that class A exempting surplus.

(2) If a former exempting company has a class C exempting surplus at the end of a franking year, there arises at the beginning of the next franking year a class C exempting credit of the company equal to that class C exempting surplus.

2 Application

Section 160AQCNDA of the Income Tax Assessment Act 1936 applies in relation to franking years ending after 7.30 pm by legal time in the Australian Capital Territory on 13 May 1997.

Part 2 -- Amendments commencing on 22 December 1999

Division 1--Withholding from mining payments

Taxation Administration Act 1953

3 Subsection 12 - 320(2) in Schedule 1

Repeal the subsection, substitute:

(2) Subsection (1) does not require the entity to withhold more than the * mining withholding tax payable in respect of the * mining payment.

Note: Section 128V of the Income Tax Assessment Act 1936 deals with mining withholding tax liability.

Division 2--Administrative penalties

Taxation Administration Act 1953

4 Section 16 - 30 in Schedule 1 (heading)

Repeal the heading, substitute:

5 Section 16 - 35 in Schedule 1 (heading)

Repeal the heading, substitute:

6 Subsection 16 - 35(1) in Schedule 1 (note 2)

Omit "civil", substitute "administrative".

7 Section 16 - 40 in Schedule 1 (heading)

Repeal the heading, substitute:

8 Subsection 16 - 140(3) in Schedule 1

Omit "a civil", substitute "an administrative".

9 Part 4 - 25 in Schedule 1 (heading)

Repeal the heading, substitute:

Part 4 - 25 -- Charges and administrative penalties for failing to meet obligations

10 Section 288 - 10 in Schedule 1

Omit "a civil", substitute "an administrative".

11 Section 288 - 10 in Schedule 1 (note 2)

Omit "civil", substitute "administrative".

12 Section 288 - 20 in Schedule 1

Omit "a civil", substitute "an administrative".

13 Section 288 - 20 in Schedule 1 (note 2)

Omit "civil", substitute "administrative".

14 Division 298 in Schedule 1 (heading)

Repeal the heading, substitute:

Division 298 -- Machinery provisions for administrative penalties

Division 3--Correcting cross - reference

Taxation Administration Act 1953

15 Paragraph 18 - 75(3)(b) in Schedule 1

Omit "(2)(b)", substitute "(1)(b)".

Division 4--Interest on overpayments

Taxation (Interest on Overpayments and Early Payments) Act 1983

16 Paragraph 8G(1)(f)

Omit "first instalment day", substitute "final instalment day".

Part 3 -- Amendments commencing on 30 June 2000

Division 1--Life assurance company definition

Income Tax Assessment Act 1936

17 Subsection 6H(6) (paragraph (a) of the definition of credit union )

Omit "within the meaning of Division 8 of Part III".

18 Application

The amendment of section 6H of the Income Tax Assessment Act 1936 made by this Division applies in relation to years of income ending after 30 June 2000.

19 Section 102M (definition of life assurance company )

Repeal the definition.

20 Application

The amendment of section 102M of the Income Tax Assessment Act 1936 made by this Division applies in relation to years of income ending after 30 June 2000.

21 Paragraph 128B(3)(gb)

Omit "(within the meaning of Division 8)".

22 Application

The amendment of section 128B of the Income Tax Assessment Act 1936 made by this Division applies in relation to dividends paid after 30 June 2000.

23 Subsection 160AAB(1) (paragraph (a) of the definition of eligible 26AH amount )

Omit "within the meaning of Division 8".

24 Application

The amendment of paragraph (a) of the definition of eligible 26AH amount in subsection 160AAB(1) of the Income Tax Assessment Act 1936 made by this Division applies in relation to years of income ending after 30 June 2000.

25 Subsection 160AAB(1) (paragraph (b) of the definition of eligible 26AH amount )

Repeal the paragraph.

26 Application

The repeal of paragraph (b) of the definition of eligible 26AH amount in subsection 160AAB(1) of the Income Tax Assessment Act 1936 by this Division applies in relation to policies issued on or after 1 July 2000.

27 Subparagraph 279D(1)(a)(ii)

Omit "or registered organization".

28 Application

The amendment of section 279D of the Income Tax Assessment Act 1936 made by this Division applies to payments made on or after 1 July 2000.

29 Paragraphs 279E(1)(b) and (c)

Omit "or a registered organisation".

30 Application

The amendment of section 279E of the Income Tax Assessment Act 1936 made by this Division applies to policies issued on or after 1 July 2000.

31 Paragraphs 289A(1)(b) and (c)

Omit "or a registered organisation".

32 Application

The amendment of section 289A of the Income Tax Assessment Act 1936 made by this Division applies to policies issued on or after 1 July 2000.

33 Paragraph 272 - 125(2)(c) in Schedule 2F

Omit "(within the meaning of section 110)".

34 Application

The amendment of section 272 - 125 in Schedule 2F to the Income Tax Assessment Act 1936 made by this Division applies in relation to years of income ending after 30 June 2000.

Income Tax Assessment Act 1997

35 Section 10 - 5 (table item headed "insurance")

Omit " life assurance companies ", substitute " life insurance companies ".

Superannuation Contributions Tax (Assessment and Collection) Act 1997

36 Section 43 (definition of life assurance company )

Omit "Division 8 of Part III", substitute "subsection 6(1)".

37 Application

The amendment of section 43 of the Superannuation Contributions Tax (Assessment and Collection) Act 1997 made by this Division applies in relation to financial years ending after 30 June 2000.

Division 2--Disallowance of deductions

Income Tax Assessment Act 1936

38 Paragraph 51AAA(1)(a)

Omit "116CD(2), 116GB(2) or".

39 Paragraph 51AAA(1)(a)

Omit "life assurance companies, registered organisations or".

40 Application

The amendments of section 51AAA of the Income Tax Assessment Act 1936 made by this Division apply in relation to income derived on or after 1 July 2000.

Division 3--Deductions for life assurance premiums

Income Tax Assessment Act 1936

41 Paragraph 67AAA(2)(a)

Omit "a risk component within the meaning of section 110", substitute "the risk component of the premium".

42 Subsection 67AAA(3)

Insert:

"risk component" of a premium for a life assurance policy means the amount of the premium worked out on the basis specified in the regulations.

43 Application

The amendments of section 67AAA of the Income Tax Assessment Act 1936 made by this Division apply in relation to financing costs incurred on or after 1 July 2000.

Part 4 -- Amendments commencing on 1 July 2000

Division 1--Mutual life assurance company definition

Income Tax Assessment Act 1936

44 Subsection 6(1) (definition of mutual life assurance company )

Repeal the definition, substitute:

"mutual life assurance company" means a life assurance company the profits of which are divisible only among the policy holders.

45 Subsection 26BC(1) (paragraph (b) of the definition of public company )

Omit "(within the meaning of section 110)".

46 Subparagraph 103A(2)(d)(i)

Omit "as defined by section 110".

47 Subparagraph 23(4A)(c)(i)

Omit "(within the meaning of section 110 of the Assessment Act as in force immediately before 1 July 2000)".

48 Application

The amendment of subparagraph 23(4A)(c)(i) of the Income Tax Rates Act 1986 made by this Division applies in relation to the year of income including 1 July 2000 and later years of income.

Division 2--Due date for income tax

Income Tax Assessment Act 1936

49 After subsection 204(1)

Insert:

(1AA) To avoid doubt, the reference in subparagraph (1)(a)(ii) to an assessment does not include a reference to an amended assessment.

50 Application

The amendment of section 204 of the Income Tax Assessment Act 1936 made by this Division applies in relation to income tax for the 2000 - 01 year of income and later years of income.

Division 3--Repeal of various redundant provisions

Income Tax Assessment Act 1936

51 Subsection 267(1) (definition of superannuation policy )

Repeal the definition.

Income Tax Assessment Act 1997

52 Section 12 - 5 (table item headed "insurance and annuity business")

Repeal the item.

53 Section 50 - 15 (note)

Repeal the note.

Omit "• section 116DK (about life insurance companies);".

55 Subsection 995 - 1(1) (definition of CS/RA class )

Repeal the definition.

56 Subsection 995 - 1(1) (definition of CS/RA component )

Repeal the definition.

57 Subsection 995 - 1(1) (definition of registered organisation )

Repeal the definition.

58 Subsection 995 - 1(1) (definition of tax advantaged business )

Repeal the definition.

59 Subsection 995 - 1(1) (definition of tax advantaged insurance fund )

Repeal the definition.

Income Tax Assessment Act 1936

60 Subsection 6(1) (definition of SGIO )

Repeal the definition.

61 Section 24AN

Omit "or an SGIO".

62 Section 24AN (note 3)

Repeal the note.

63 Application

The amendments of section 24AN of the Income Tax Assessment Act 1936 made by this Division apply to income derived on and after 1 July 2000.

Division 5--Registered organizations

Income Tax Assessment Act 1936

64 Subsection 6H(6) (definition of credit union )

Repeal the definition, substitute:

"credit union" means a credit union as defined in section 23G, except a life assurance company.

65 Application

The amendment of section 6H of the Income Tax Assessment Act 1936 made by this Division applies to assessments for years of income starting on or after 1 July 2000.

66 Subsection 27A(1) (definition of registered organization )

Repeal the definition.

67 Paragraph 27A(12)(c)

Omit "or registered organisation".

68 Application

The amendments of section 27A of the Income Tax Assessment Act 1936 made by this Division apply to assessments for years of income starting on or after 1 July 2000.

69 Subparagraph 103A(2)(d)(iia)

Repeal the subparagraph.

70 Application

The amendment of section 103A of the Income Tax Assessment Act 1936 made by this Division applies to years of income starting on or after 1 July 2000.

71 Section 140C (definition of registered organisation )

Repeal the definition.

72 Application

The amendment of section 140C of the Income Tax Assessment Act 1936 made by this Division applies to assessments for years of income starting on or after 1 July 2000.

73 Section 140ZI

Omit "or a registered organisation".

Note: The heading to section 140ZI is altered by omitting " or registered organisation ".

74 Application

The amendment of section 140ZI of the Income Tax Assessment Act 1936 made by this Division applies to assessments for years of income starting on or after 1 July 2000.

75 Subsection 159GP(1) (definition of ineligible annuity )

Omit "or by a registered organization, within the meaning of that Subdivision,".

76 Application

The amendment of section 159GP of the Income Tax Assessment Act 1936 made by this Division applies to assessments for years of income starting on or after 1 July 2000.

77 Subsection 267(1) (definition of registered organization )

Repeal the definition.

78 Subsection 275(1)

Omit ", registered organisation".

79 Application

The amendment of subsection 275(1) of the Income Tax Assessment Act 1936 made by this Division applies in relation to years of income starting on or after 1 July 2000.

80 Paragraph 275(5)(b)

Omit "or registered organization".

81 Application

The amendment of subsection 275(5) of the Income Tax Assessment Act 1936 made by this Division applies in relation to policies issued on or after 1 July 2000.

82 Section 299B

Omit "or a registered organization".

83 Application

The amendment of section 299B of the Income Tax Assessment Act 1936 made by this Division applies to assessments for years of income starting on or after 1 July 2000.

84 Subsection 299D(1)

Omit "or a registered organization".

85 Application

The amendment of section 299D of the Income Tax Assessment Act 1936 made by this Division applies to assessments for years of income starting on or after 1 July 2000.

86 Paragraph 272 - 125(2)(d) in Schedule 2F

Repeal the paragraph.

87 Application

The amendment of section 272 - 125 in Schedule 2F to the Income Tax Assessment Act 1936 made by this Division applies on and after 1 July 2000.

Income Tax Assessment Act 1997

88 Subsection 152 - 305(1) (note 2)

Omit "or registered organisations".

89 Subsection 152 - 325(7) (note)

Omit "or registered organisations".

Superannuation Contributions Tax (Assessment and Collection) Act 1997

90 Section 43 (paragraph (b) of the definition of member )

Omit "or from a registered organisation".

91 Saving

If, immediately before 1 July 2000, a person was a member as defined in section 43 of the Superannuation Contributions Tax (Assessment and Collection) Act 1997 (as in force at that time), the person does not cease to be a member for the purposes of that Act because of the amendment of the definition of member in that section made by this Division.

92 Section 43 (definition of registered organisation )

Repeal the definition.

93 Section 43 (paragraph (c) of the definition of superannuation provider )

Omit "company; or", substitute "company.".

94 Section 43 (paragraph (d) of the definition of superannuation provider )

Repeal the paragraph.

95 Saving

If, immediately before 1 July 2000, an entity (as defined in the Income Tax Assessment Act 1997 ) was a superannuation provider as defined in section 43 of the Superannuation Contributions Tax (Assessment and Collection) Act 1997 (as in force at that time), the entity does not cease to be a superannuation provider for the purposes of that Act because of the amendments of the definition of superannuation provider in that section made by this Division.

Superannuation Guarantee (Administration) Act 1992

96 Paragraph 15A(3)(a)

Omit "or a registered organisation".

Note: The heading to subsection 15A(3) is altered by omitting " or registered organisation ".

97 Subsection 15A(6) (definition of benefit body )

Omit ", an RSA provider or a registered organisation", substitute "or an RSA provider".

98 Subsection 15A(6) (definition of life assurance company )

Omit "27A(1)", substitute "6(1)".

99 Subsection 15A(6) (definition of registered organisation )

Repeal the definition.

100 Application

The amendments of the Superannuation Guarantee (Administration) Act 1992 made by this Division apply in relation to test times (within the meaning of section 15A of that Act) on or after 1 July 2000.

Division 6--Miscellaneous amendments relating to repeal of Divisions 8 and 8A of Part III of the Income Tax Assessment Act 1936

Income Tax Assessment Act 1936

101 Subsection 27A(1) (paragraph (a) of the definition of eligible annuity )

Repeal the paragraph.

102 Subsection 27A(1) (paragraph (a) of the definition of qualifying annuity )

Repeal the paragraph, substitute:

(a) an annuity purchased after 12 January 1987, wholly with rolled - over amounts, that has at any time been an eligible annuity in relation to any taxpayer; or

103 Subparagraph 27A(12)(c)(iii)

Omit "an Australian policy (as defined by subsection 110(1))", substitute "a life assurance policy issued in Australia".

104 Application

The amendments of section 27A of the Income Tax Assessment Act 1936 made by this Division apply to assessments for years of income starting on or after 1 July 2000.

105 Subsection 67AAA(3) (definition of life assurance policy )

Repeal the definition.

106 Application

The amendment of section 67AAA of the Income Tax Assessment Act 1936 made by this Division applies to assessments for years of income starting on or after 1 July 2000.

107 Section 102M (definition of eligible policy )

Repeal the definition, substitute:

"eligible policy" means:

(a) an exempt life insurance policy (as defined in the Income Tax Assessment Act 1997 ); or

(b) a virtual PST life insurance policy (as defined in that Act).

108 Section 102M (definition of life assurance business )

Repeal the definition.

109 Application

The amendments of section 102M of the Income Tax Assessment Act 1936 made by this Division apply to assessments for years of income starting on or after 1 July 2000.

110 Subsection 159SJ(1) (paragraph (a) of the definition of applicable fund )

Omit "a CS policy, or an exempt policy,", substitute "an exempt life insurance policy (as defined in the Income Tax Assessment Act 1997 )".

111 Subsection 159SJ(1) (definition of CS policy )

Repeal the definition.

112 Subsection 159SJ(1) (definition of exempt policy )

Repeal the definition.

113 Subsection 159SJ(1) (paragraph (b) of the definition of superannuation pension )

Omit "a CS policy or an exempt policy, being in each case a policy", substitute "an exempt life insurance policy (as defined in the Income Tax Assessment Act 1997 ) that is".

114 Application

The amendments of section 159SJ of the Income Tax Assessment Act 1936 made by this Division apply to assessments for years of income starting on or after 1 July 2000.

115 Subparagraph 279D(1)(a)(ii)

Omit "an exempt policy (within the meaning of Division 8 of Part III) or RA policy (within the meaning of Division 8 of Part III)", substitute "either an exempt life insurance policy (as defined in the Income Tax Assessment Act 1997 ) or a life assurance policy covered by subparagraph (b)(i) of the definition of virtual PST life insurance policy in subsection 995 - 1(1) of that Act while the policy was held by the deceased person,".

116 Application

The amendment of section 279D of the Income Tax Assessment Act 1936 made by this Division applies to assessments for years of income starting on or after 1 July 2000.

117 Subsection 290A(4) (definition of CS policy )

Repeal the definition.

118 Subsection 290A(4) (subparagraph (b)(ii) of the definition of fixed interest complying ADF )

Repeal the subparagraph, substitute:

(ii) virtual PST life insurance policies (as defined in the Income Tax Assessment Act 1997 ) issued by a life assurance company.

119 Application

The amendments of section 290A of the Income Tax Assessment Act 1936 made by this Division apply to years of income starting on or after 1 July 2000.

120 Subsection 482(1)

Omit "an Australian policy as defined by section 110", substitute "a policy issued in Australia".

121 Application

The amendment of section 482 of the Income Tax Assessment Act 1936 made by this Division applies in relation to notional accounting periods starting on or after 1 July 2000.

Division 7--Life assurance company definition in section 27A of the Income Tax Assessment Act 1936

Income Tax Assessment Act 1936

122 Subsection 27A(1) (definition of life assurance company )

Repeal the definition.

123 Application

The amendment of section 27A of the Income Tax Assessment Act 1936 made by this Division applies to assessments for years of income starting on or after 1 July 2000.

124 Section 140C (definition of life assurance company )

Repeal the definition.

125 Application

The amendment of section 140C of the Income Tax Assessment Act 1936 made by this Division applies to assessments for years of income starting on or after 1 July 2000.

126 Subsection 159GP(1) (definition of ineligible annuity )

Omit ", within the meaning of Subdivision AA of Division 2,".

127 Application

The amendment of section 159GP of the Income Tax Assessment Act 1936 made by this Division applies to assessments for years of income starting on or after 1 July 2000.

Superannuation Guarantee (Administration) Act 1992

128 Subsection 15A(6) (definition of life assurance company )

Omit "27A(1)", substitute "6(1)".

129 Application

The amendment of the Superannuation Guarantee (Administration) Act 1992 made by this Division applies in relation to test times (within the meaning of section 15A of that Act) on or after 1 July 2000.

Part 5 -- Amendment commencing on 30 June 2001

Taxation Administration Act 1953

130 Paragraph 298 - 5(b) in Schedule 1

Omit "162 - C", substitute "162 - D".

Part 6 -- Amendments commencing on 1 July 2001

Income Tax Assessment Act 1936

131 Subsection 22A(1) (table item 7, column headed "Corresponding provision of the Income Tax Assessment Act 1997 ")

Omit "sections 50 - 10 and 50 - 20", substitute "section 50 - 10".

132 Section 102M (paragraph (a) of the definition of exempt entity )

Omit "50 - 20,".

133 Application

The amendment of section 102M of the Income Tax Assessment Act 1936 made by this Part applies in relation to the year of income including 1 July 2001 and later years of income.

134 Subsection 121F(1) (paragraph (aa) of the definition of relevant exempting provision )

Omit "50 - 20,".

135 Application

The amendment of section 121F of the Income Tax Assessment Act 1936 made by this Part applies in relation to the year of income including 1 July 2001 and later years of income.

136 Subparagraph 128B(3)(a)(i)

Omit ", 50 - 10 or 50 - 20", substitute "or 50 - 10".

137 Application

The amendment of section 128B of the Income Tax Assessment Act 1936 made by this Part applies in relation to income derived on or after 1 July 2001.

138 Paragraph 269B(1)(b)

Omit "50 - 20,".

139 Paragraph 272 - 90(7)(b) in Schedule 2F

Omit ", 50 - 10 or 50 - 20", substitute "or 50 - 10".

140 Application

The amendment of paragraph 272 - 90(7)(b) in Schedule 2F to the Income Tax Assessment Act 1936 made by this Part applies in relation to the year of income including 1 July 2001 and later years of income.

Income Tax Assessment Act 1997

141 Section 11 - 5 (table item headed "finance")

Repeal the item.

142 Subparagraph 43 - 55(1)(a)(i)

Omit "50 - 20,".

143 Application

The amendment of section 43 - 55 of the Income Tax Assessment Act 1997 made by this Part applies in relation to the income year including 1 July 2001 and later income years.

Part 7 -- Amendments commencing on Royal Assent

Income Tax Assessment Act 1997

144 Section 208 - 145 (table item 2, column headed "If:")

Omit "this item", substitute "item 7 of the table in section 208 - 115".

145 Application

The amendment of section 208 - 145 of the Income Tax Assessment Act 1997 made by this Part applies in relation to income years ending on or after 1 July 2002.

146 Subsection 995 - 1(1)

Insert:

"SPOR taxpayer" has the meaning given by section 6AD of the Income Tax Assessment Act 1936 .

147 Subsection 12(6)

After "13", insert ", 14".

148 Paragraph 12(7)(a) (definition of B )

Omit "or credit", substitute ", credit or other tax offset (as defined in the Income Tax Assessment Act 1997 )".

149 Paragraph 12(7)(b) (definition of B )

Omit "or credit", substitute ", credit or other tax offset (as defined in the Income Tax Assessment Act 1997 )".

150 Paragraph 12(8)(a) (definition of B )

Omit "or credit", substitute ", credit or other tax offset (as defined in the Income Tax Assessment Act 1997 )".

151 Paragraph 12(8)(b) (definition of B )

Omit "or credit", substitute ", credit or other tax offset (as defined in the Income Tax Assessment Act 1997 )".

152 Subsections 23(5) and (6)

Omit "or credit", substitute ", credit or other tax offset (as defined in the Income Tax Assessment Act 1997 )".

153 Application

The amendments of the Income Tax Rates Act 1986 (except the amendment of subsection 12(6) of that Act) made by this Part apply to assessments for the 1998 - 99 year of income and later years of income.

Income Tax (Transitional Provisions) Act 1997

154 After Division 205

Insert:

Division 208 -- Exempting entities and former exempting entities

Table of sections

208 - 111 Converting former exempting company's exempting account balance on 30 June 2002

208 - 111 Converting former exempting company's exempting account balance on 30 June 2002

(1) This section has effect for the purposes of working out the following for a company that was a former exempting company (as defined in Part IIIAA of the Income Tax Assessment Act 1936 ) at the end of 30 June 2002:

(a) whether the company has an exempting surplus or an exempting deficit for the purposes of the Income Tax Assessment Act 1997 at a time after 30 June 2002;

(b) the company's class A exempting account balance (as defined in that Part) at a time after 30 June 2002;

(c) the company's class C exempting account balance (as defined in that Part) at a time after 30 June 2002.

Class A exempting surplus at the end of 30 June 2002

(2) If the company had a class A exempting surplus (as defined in Part IIIAA of the Income Tax Assessment Act 1936 ) at the end of 30 June 2002:

(a) a class A exempting debit equal to the surplus is taken to have arisen immediately before the end of 30 June 2002 for the purposes of that Part; and

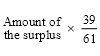

(b) an exempting credit of the amount worked out using the formula is taken to have arisen at the start of 1 July 2002 in the exempting account that the company has under section 208 - 110 of the Income Tax Assessment Act 1997 :

Note: Section 205 - 5 (with sections 160APU and 160AQCNM of the Income Tax Assessment Act 1936 ) may affect whether the company had such a surplus at the end of 30 June 2002 and the amount of that surplus, but this section does not (because this section affects the company's exempting account balance only after then).

Class C exempting surplus at the end of 30 June 2002

(3) If the company had a class C exempting surplus (as defined in Part IIIAA of the Income Tax Assessment Act 1936 ) at the end of 30 June 2002:

(a) a class C exempting debit equal to the surplus is taken to have arisen immediately before the end of 30 June 2002 for the purposes of that Part; and

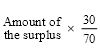

(b) an exempting credit of the amount worked out using the formula is taken to have arisen at the start of 1 July 2002 in the exempting account that the company has under section 208 - 110 of the Income Tax Assessment Act 1997 :

Note: Section 205 - 5 (with sections 160APU and 160AQCNM of the Income Tax Assessment Act 1936 ) may affect whether the company had such a surplus at the end of 30 June 2002 and the amount of that surplus, but this section does not (because this section affects the company's exempting account balance only after then).

Class A exempting deficit at end of 30 June 2002

(4) If the company had a class A exempting deficit (as defined in Part IIIAA of the Income Tax Assessment Act 1936 ) at the end of 30 June 2002 and its 2001 - 02 franking year (as defined in that Part) ended earlier:

(a) a class A exempting credit equal to the deficit is taken to have arisen at the end of 30 June 2002 for the purposes of that Part; and

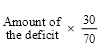

(b) an exempting debit of the amount worked out using the formula is taken to have arisen at the start of 1 July 2002 in the exempting account that the company has under section 208 - 110 of the Income Tax Assessment Act 1997 :

Note: If the company's 2001 - 02 franking year ended at the end of 30 June 2002 and it would have had a class A exempting deficit at that time apart from section 160AQCNO of the Income Tax Assessment Act 1936 , that section will have eliminated the deficit and either:

(a) increased the company's liability for franking deficit tax; or

(b) reduced the franking credit arising under section 205 - 10 of this Act in the franking account the company has under the Income Tax Assessment Act 1997 .

Class C exempting deficit at end of 30 June 2002

(5) If the company had a class C exempting deficit (as defined in Part IIIAA of the Income Tax Assessment Act 1936 ) at the end of 30 June 2002 and its 2001 - 02 franking year (as defined in that Part) ended earlier:

(a) a class C exempting credit equal to the deficit is taken to have arisen at the end of 30 June 2002 for the purposes of that Part; and

(b) an exempting debit of the amount worked out using the formula is taken to have arisen at the start of 1 July 2002 in the exempting account that the company has under section 208 - 110 of the Income Tax Assessment Act 1997 :

Note: If the company's 2001 - 02 franking year ended at the end of 30 June 2002 and it would have had a class C exempting deficit at that time apart from section 160AQCNO of the Income Tax Assessment Act 1936 , that section will have eliminated the deficit and either:

(a) increased the company's liability for franking deficit tax; or

(b) reduced the franking credit arising under section 205 - 10 of this Act in the franking account the company has under the Income Tax Assessment Act 1997 .

Taxation Administration Act 1953

155 Subsection 2(1) (at the end of paragraphs (a) to (dac) of the definition of law enforcement agency )

Add "or".

156 Subsection 2(1) (paragraph (dad) of the definition of law enforcement agency )

Repeal the paragraph.

157 Subsection 2(1) (at the end of paragraph (dae) of the definition of law enforcement agency )

Add "or".

158 Subsection 2(1) (paragraph (daf) of the definition of law enforcement agency )

Repeal the paragraph, substitute:

(daf) the Crime and Misconduct Commission of Queensland; or

159 Subsection 2(1) (at the end of paragraph (da) of the definition of law enforcement agency )

Add "or".

160 Sections 47 and 48

Repeal the sections.

Part 8 -- Amendments commencing on Royal Assent or later

Income Tax Assessment Act 1936

161 Subsection 121F(1) (paragraph (c) of the definition of relevant exempting provision )

Repeal the paragraph, substitute:

(c) paragraph 320 - 37(1)(a) of the Income Tax Assessment Act 1997 ;

162 Application

The amendment of section 121F of the Income Tax Assessment Act 1936 applies in relation to amounts derived on or after 1 July 2000.

Taxation Administration Act 1953

163 Section 16 - 43 in Schedule 1 (heading)

Repeal the heading, substitute:

164 Subsection 16 - 43(2) in Schedule 1 (note)

Omit "civil", substitute "administrative".

Notes to the Taxation Laws Amendment Act (No. 1) 2004

Note 1

The Taxation Laws Amendment Act (No. 1) 2004 as shown in this compilation comprises Act No. 101 , 200 4 amended as indicated in the Tables below.

Table of Acts

Act | Number | Date | Date of commencement | Application, saving or transitional provisions |

Taxation Laws Amendment Act (No. 1) 2004 | 101 , 200 4 | 30 June 200 4 | See s. 2(1) |

|

Tax Laws Amendment (2010 Measures No. 2) Act 2010 | 75 , 2010 | 28 June 2010 | Schedule 6 (item 36 ): 29 June 2010 | -- |

Table of Amendments

ad. = added or inserted am. = amended rep. = repealed rs. = repealed and substituted | |

Provision affected | How affected |

S. 4 .................... | rep . No. 75 , 2010 |