Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) In this Part, unless the contrary intention appears:

"CPI indexation day" means:

(a) for the purposes of section 115D--the day that begins each relevant period within the meaning of that term in section 198; and

(b) for the purposes of section 115G--a day that is an indexation day for the maximum basic rate under subsection 59B(1).

"member of a Peacekeeping Force" has the same meaning as in subsection 68(1).

"member of the Forces" has the same meaning as in subsection 68(1).

"unaffected pension rate" means the rate of pension that a veteran would have received if the veteran had not undertaken a vocational rehabilitation program under the Veterans' Vocational Rehabilitation Scheme.

"unemployment" includes:

(a) retirement from remunerative work; and

(b) undertaking less than 16 hours of remunerative work in a pension period;

but does not include any period of paid leave.

"veteran" means:

(a) a person:

(i) who is, because of section 7, taken to have rendered eligible war service; or

(ii) in respect of whom a pension is payable under subsection 13(6); or

(iii) who satisfies subsection 37(3); or

(b) a member of the Forces; or

(c) a member of a Peacekeeping Force.

"work and pension income rate" of a veteran, in relation to a pension period, has the meaning given by subsections (2) and (3).

Veteran to whom section 23 applies

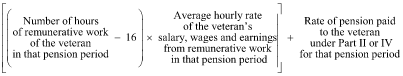

(2) If section 115D applies to a veteran because of subsection 115D(1), then the work and pension income rate of the veteran for a pension period is worked out using the following formula:

Veteran to whom section 24 applies

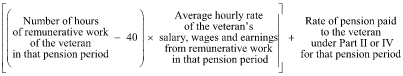

(3) If section 115D applies to a veteran because of subsection 115D(1A), then the work and pension income rate of the veteran for a pension period is worked out using the following formula: