Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

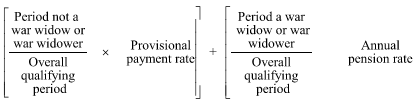

Commonwealth Consolidated ActsFor the purposes of subsection 45UG(1A), the apportioned amount is:

where:

"annual pension rate" is the person's annual pension rate, worked out as at the date of grant of the designated pension, in accordance with section 45UF.

"period a war widow or war widower" is the number of days in so much of the overall qualifying period as occurred when the person was a war widow/war widower--pensioner.

"period not a war widow or war widower" is the number of days in so much of the overall qualifying period as occurred when the person was not a war widow/war widower--pensioner.

"provisional payment rate" is:

(a) if the person has, during some or all of the person's overall qualifying period, deferred:

(i) an age service pension; or

(ii) a partner service pension; and

the person is not permanently blind--the person's provisional payment rate under method statement 1 in subpoint SCH6 - A1(2), worked out as at the date of grant of the designated pension, if it were assumed that the person's maximum payment rate were the sum of the person's maximum basic rate under point SCH6 - B1 and the person's pension supplement basic amount; or

(b) if the person has, during some or all of the person's overall qualifying period, deferred:

(i) an age service pension; or

(ii) a partner service pension; and

the person is permanently blind--the sum of the person's maximum basic rate under point SCH6 - B1 and the person's pension supplement basic amount, worked out as at the date of grant of the designated pension; or

(c) if the person has, during some or all of the person's overall qualifying period, deferred age pension and is not permanently blind--the person's provisional annual payment rate under the method statement in point 1064 - A1 of the Social Security Act 1991 , worked out as at the date of grant of the designated pension, if it were assumed that the person's maximum payment rate were the sum of the person's maximum basic rate under Table B in point 1064 - B1 of the Social Security Act 1991 and the person's pension supplement basic amount; or

(d) if the person has, during some or all of the person's overall qualifying period, deferred age pension and is permanently blind--the sum of the maximum basic rate under Table B in point 1065 - B1 of the Social Security Act 1991 and the person's pension supplement basic amount, worked out as at the date of grant of the designated pension.

Note: If the person did not accrue any pension bonus in relation to the designated pension, the latter bracketed part of the formula for the apportioned amount will have a nil value.