Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) For the purposes of this Division, a person's annual notional partnered pension rate is set out in the following table:

Item | In this case: | |

1 | The person: (a) is not permanently blind; and | the sum of the adjusted percentage of the person's maximum basic rate under point SCH6 - B1 and the person's pension supplement basic amount, worked out, in each case, as at the date of grant of the designated pension if it were assumed that the person were a member of a couple at that date |

2 | The person: (a) is permanently blind; and | the sum of the person's maximum basic rate under point SCH6 - B1 and the person's pension supplement basic amount, ascertained as at the date of grant of the designated pension, if it were assumed that the person was a member of a couple as at that date |

3 | The person: (a) is a war widow/war widower--pensioner; and (b) was a war widow/war widower--pensioner throughout so much of the overall qualifying period as occurred when the person was a member of a couple | the person's annual pension rate worked out as at the date of grant of the designated pension |

4 | The person: (a) is a war widow/war widower--pensioner; but (b) was not a war widow/war widower--pensioner for some or all of the overall qualifying period occurring while the person was a member of a couple | the apportioned partnered amount worked out under subsection (2) |

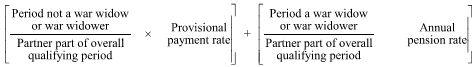

(2) For the purposes of this section, the apportioned partnered amount is:

where:

"period not a war widow or war widower" is the number of days in so much of the partner part of overall qualifying period as occurred when the person was not a war widow/war widower--pensioner.

"partner part of overall qualifying period" is the number of days in so much of the overall qualifying period as occurred when the person was a member of a couple.

"provisional payment rate" is:

(a) if the person:

(i) has, during some or all of the partnered part of the person's overall qualifying period, deferred an age service pension or a partner service pension; and

(ii) is not permanently blind;

the sum of the adjusted percentage of the person's maximum basic rate under point SCH6 - B1 and the person's pension supplement basic amount worked out, in each case, as at the date of grant of the designated pension if it were assumed that the person were a member of a couple at that date; or

(b) if the person:

(i) has, during some or all of the partnered part of the person's overall qualifying period, deferred an age service pension or a partner service pension; and

(ii) the person is permanently blind;

the sum of the person's maximum basic rate under point SCH6 - B1 and the person's pension supplement basic amount, worked out as at the date of grant of the designated pension if it were assumed that the person were a member of a couple at that date; or

(c) if the person:

(i) has, during some or all of the partnered part of the person's overall qualifying period, deferred an age pension; and

(ii) is not permanently blind;

the sum of:

(iii) the adjusted percentage of the person's maximum basic rate under Table B in point 1064 - B1 of the Social Security Act 1991 ; and

(iv) the person's pension supplement basic amount;

worked out, in each case, as at the date of grant of the designated pension if it were assumed that the person were a member of a couple at that date; or

(d) if the person:

(i) has, during some or all of the partnered part of the person's overall qualifying period, deferred an age pension; and

(ii) is permanently blind;

the sum of:

(iii) the maximum basic rate under Table B in point 1065 - B1 of the Social Security Act 1991 ; and

(iv) the person's pension supplement basic amount;

worked out, in each case, as at the date of grant of the designated pension if it were assumed that the person were a member of a couple at that date.

"period a war widow or war widower" is the number of days in so much of the partner part of overall qualifying period as occurred when the person was a war widow/war widower--pensioner.

"annual pension rate" is the person's annual pension rate, worked out as at the date of grant of the designated pension, in accordance with section 45UF.

Note: There may be circumstances where one or other of the bracketed parts of the formula will have a nil value.

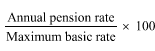

(3) For the purposes of this section, a person's adjusted percentage is the percentage worked out using the following formula (for rounding up, see subsection (4)):

where:

"maximum basic rate" is the sum of the person's maximum basic rate under point SCH6 - B1 and the person's pension supplement basic amount, ascertained as at the date of grant of the designated pension.

(4) A percentage worked out under subsection (3) is to be calculated to 3 decimal places. However, if a percentage worked out under subsection (3) would, if it were calculated to 4 decimal places, end in a digit that is greater than 4, the percentage is to be increased by 0.001.