Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) This section applies to a person who is not a member of a couple.

(2) A person who has financial assets is taken, for the purposes of this Act, to receive ordinary income on those assets in accordance with this section.

(3) This is how to work out the ordinary income that the person is taken to receive:

Method statement

Step 1. Calculate the total value of the person's financial assets and compare it with the person's deeming threshold.

Note 1: For financial assets see subsection 5J(1).

Note 2: For deeming threshold see subsection 46H(1).

Step 2. This step applies only if the total value of the person's financial assets is equal to or less than the person's deeming threshold. Multiply the total value of the financial assets by the below threshold rate. The result represents the ordinary income that the person is taken to receive per year on his or her financial assets.

Note: For below threshold rate see subsection 46J(1).

Step 3. This step applies only if the total value of the person's financial assets is higher than the person's deeming threshold. Work out the person's deemed income as follows:

(a) multiply the deeming threshold by the below threshold rate;

(b) subtract the deeming threshold from the total value of the person's financial assets;

(c) multiply the remainder by the above threshold rate;

Note: For above threshold rate see subsection 46J(2).

(d) add up the amounts worked out at paragraph (a) and (c): the result represents the ordinary income that the person is taken to receive per year on his or her financial assets.

Example: How deemed income of a person who is not a member of a couple is worked out per year for the person's financial assets other than financial assets described in subsection (3A) (using rates and deeming thresholds in force on 1 July 2022).

Elaine, a single pensioner, has $164,000 worth of financial assets, made up of $150,000 in proceeds from the sale of Elaine's principal home and $14,000 of other financial assets. Elaine intends to apply $100,000 of the proceeds of sale to purchase another residence that is to be Elaine's principal home. The below threshold rate is 0.25%. The above threshold rate is 2.25%.

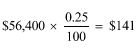

The total value of Elaine's financial assets ($64,000), disregarding part of the proceeds of sale ($100,000--see subsection (3A)), is higher than Elaine's deeming threshold ($56,400--see subsection 46H(1)). So, the deeming threshold is multiplied by the below threshold rate (0.25%):

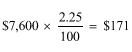

Elaine's deeming threshold of $56,400 is subtracted from the total value of Elaine's financial assets ($64,000), disregarding part of the proceeds of sale ($100,000--see subsection (3A)). The remainder is $7,600.

The amount of $7,600 is multiplied by the above threshold rate (2.25%):

The ordinary income that Elaine is taken to receive on Elaine's financial assets, other than financial assets described in subsection (3A), is $312 per year ($141 plus $171).

(3A) However, if subsection 52(2) applies in relation to the person and:

(a) the person has financial assets that are proceeds:

(i) from the sale of the person's principal home; and

(ii) described in paragraph 52(2)(a) or (c); and

(b) the earlier of the times mentioned in that paragraph has not occurred for the person and the proceeds;

then:

(c) those financial assets are to be disregarded for the purposes of working out the ordinary income the person is taken to receive under subsection (3); and

(d) the ordinary income the person is taken to receive per year on those financial assets is the amount worked out by multiplying the value of those financial assets by the below threshold rate.

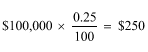

Example: To continue the example in subsection (3), Elaine's financial assets ($100,000) described in this subsection are multiplied by the below threshold rate (0.25%):

The ordinary income that Elaine is taken to receive on Elaine's financial assets described in this subsection is $250 per year.

(4) The person is taken, for the purposes of this Act, to receive one fifty - second of the sum of the amount calculated under subsection (3) and the amount (if any) calculated under paragraph (3A)(d) as ordinary income of the person during each week.