Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) This section applies to the members of a couple.

(2) If one or both of the members of a couple have financial assets, the members of the couple are taken, for the purposes of this Act, to receive together ordinary income on those assets in accordance with this section.

(3) This is how to work out the ordinary income that the couple is taken to receive:

Method statement

Step 1. Calculate the total value of the couple's financial assets and compare it with the couple's deeming threshold.

Note 1: For financial assets see subsection 5J(1).

Note 2: For deeming threshold see subsection 46H(2).

Step 2. This step applies only if the total value of the couple's financial assets is equal to or less than the couple's deeming threshold. Multiply the total value of the financial assets by the below threshold rate. The result represents the ordinary income that the couple is taken to receive per year on their financial assets.

Note: For below threshold rate see subsection 46J(1).

Step 3. This step applies only if the total value of the couple's financial assets is higher than the couple's deeming threshold. Work out the couple's deemed income as follows:

(a) multiply the deeming threshold by the below threshold rate;

(b) subtract the deeming threshold from the total value of the couple's assets;

(c) multiply the remainder by the above threshold rate;

Note: For above threshold rate see subsection 46J(2).

(d) add up the amounts worked out at paragraph (a) and (c): the result represents the ordinary income that the couple is taken to receive per year on their financial assets.

Example: How deemed income of a couple is worked out per year for the couple's financial assets other than financial assets described in subsection (3A) (using rates and deeming thresholds in force on 1 July 2022).

Maree and Peter, a couple, have $622,000 worth of financial assets, made up of $500,000 in proceeds from the sale of the couple's principal home and $122,000 of other financial assets. Maree and Peter intend to apply the whole of the proceeds of sale to build another residence that is to be the couple's principal home. The below threshold rate is 0.25%. The above threshold rate is 2.25%.

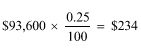

The total value of the couple's financial assets ($122,000), disregarding the whole of the proceeds of sale ($500,000--see subsection (3A)), is higher than the couple's deeming threshold ($93,600--see subsection 46H(2)). So, the deeming threshold is multiplied by the below threshold rate (0.25%):

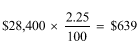

The couple's deeming threshold of $93,600 is subtracted from the total value of the couple's financial assets ($122,000), disregarding the whole of the proceeds of sale ($500,000--see subsection (3A)). The remainder is $28,400.

The amount of $28,400 is multiplied by the above threshold rate (2.25%):

The ordinary income that the couple is taken to receive on the couple's financial assets, other than financial assets described in subsection (3A), is $873 per year ($234 plus $639).

(3A) However, if subsection 52(2) applies in relation to a member of the couple and:

(a) the couple have financial assets that are proceeds:

(i) from the sale of the principal home of a member of the couple; and

(ii) described in paragraph 52(2)(a) or (c); and

(b) the earlier of the times mentioned in that paragraph has not occurred for the member of the couple and the proceeds;

then:

(c) those financial assets are to be disregarded for the purposes of working out the ordinary income the couple is taken to receive under subsection (3); and

(d) the ordinary income the couple is taken to receive per year on those financial assets is the amount worked out by multiplying the value of those financial assets by the below threshold rate.

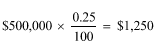

Example: To continue the example in subsection (3), Maree and Peter's financial assets ($500,000) described in this subsection are multiplied by the below threshold rate (0.25%):

The ordinary income that the couple is taken to receive on the couple's financial assets described in this subsection is $1,250 per year.

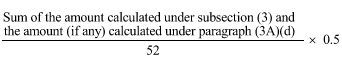

(4) Each member of the couple is taken, for the purposes of this Act, to receive, as ordinary income during each week, an amount calculated according to the formula: