Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated ActsCharge or encumbrance relating to a single asset

(1) For the purposes of the application of this Subdivision (other than this section) to a particular individual and a particular company or trust, if:

(a) there is a charge or encumbrance over a particular asset of the company or trust; and

(b) the charge or encumbrance relates exclusively to that asset;

the value of the asset is to be reduced by the value of the charge or encumbrance.

(2) Subsection (1) does not apply to a charge or encumbrance over an asset of a company or trust to the extent that:

(a) the charge or encumbrance is a collateral security; or

(b) the charge or encumbrance was given for the benefit of an entity other than the company or trust; or

(c) the value of the charge or encumbrance is excluded under subsection (6).

Charge or encumbrance relating to 2 or more assets

(3) For the purposes of the application of this Subdivision (other than this section) to a particular individual and a particular company or trust, if:

(a) there is a charge or encumbrance over a particular asset (the first asset ) of the company or trust; and

(b) the charge or encumbrance relates to the first asset and one or more other assets of the company or trust;

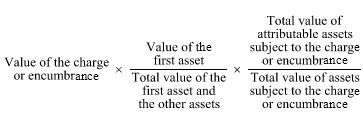

the value of the first asset is to be reduced by the amount worked out using the formula:

(4) Subsection (3) does not apply to a charge or encumbrance over an asset of the company or trust to the extent that:

(a) the charge or encumbrance was given for the benefit of an entity other than the company or trust; or

(b) the value of the charge or encumbrance is excluded under subsection (6).

(5) If (apart from this section), under section 52ZZR, there is included in the value of the individual's assets an amount equal to the individual's asset attribution percentage of the value of an asset held by the company or trust, the asset held by the company or trust is an attributable asset for the purposes of subsection (3).

Exclusion

(6) The Commission may, by writing, determine that, for the purposes of the application of this section to a specified individual and a specified company or trust, the whole or a specified part of a specified charge or encumbrance over one or more of the assets of the company or trust is excluded for the purposes of paragraphs (2)(c) and (4)(b).

(7) A determination under subsection (6) has effect accordingly.

(8) In making a determination under subsection (6), the Commission must comply with any relevant decision - making principles.