Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) If:

(a) a special disability trust ceases to exist or ceases to be a special disability trust; and

(b) a person had transferred an asset to the trust during the period of 5 years immediately preceding the cessation; and

(c) section 52ZZZWL, 52ZZZWM or 52ZZZWO applied to the transfer;

then the transfer is taken, after the cessation, to be a disposal or disposition of the asset that occurred at the time of the transfer.

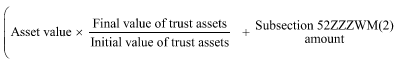

(2) The amount of the disposal or disposition is taken to be the amount worked out using the formula:

where:

"asset value" means:

(a) if section 52ZZZWL or 52ZZZWO applied to the transfer--the value of the asset at the time of the transfer; or

(b) if subsection 52ZZZWM(1) applied to the transfer--$500,000; or

(c) if subsection 52ZZZWM(2) applied to the transfer--the difference between the value of the asset at the time of the transfer and the amount that was taken under that subsection to be the amount of the disposal or disposition of the asset.

"final value of trust assets" means the value of all of the assets of the trust at the time of the cessation.

"initial value of trust assets" means the value of all of the assets of the trust at the time of the transfer.

" subsection 52ZZZWM(2) amount" means the amount (if any) that was taken under subsection 52ZZZWM(2) to be the amount of the disposal or disposition of the asset.

(3) If the special disability trust ceases to exist, or ceases to be a special disability trust, because the principal beneficiary dies, the value of the asset at the time of the transfer is taken for the purposes of this section to be the value of so much (if any) of the asset as has not been returned to the person who had transferred the asset to the trust.

(4) This section does not affect the application of section 52ZZZWL, 52ZZZWM or 52ZZZWO to the transfer prior to the cessation.