Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated ActsFunding contract

(1) The Minister, on behalf of the Commonwealth, may enter into a contract with the research body (or with the research body and other persons) that provides for the Commonwealth to make payments of the following kinds to the research body:

(a) payments in relation to wool levy ( category A payments );

(b) payments per financial year in relation to research and development ( category B payments ).

(2) Before entering into the contract, the Minister must be satisfied that the terms of the contract make adequate provision to ensure that:

(a) category A payments are spent by the research body on all or any of the following activities for the benefit of Australian woolgrowers:

(i) research and development activities;

(ii) marketing activities;

(iii) other activities; and

(b) category B payments are spent by the research body on:

(i) research and development activities for the benefit of Australian woolgrowers and the Australian community generally; and

(ii) making payments to the Commonwealth under subsection ( 7).

(3) The contract does not have to oblige the Commonwealth to pay the full amounts that could be paid out of the money appropriated by this section.

Appropriation for payments under funding contract

(4) The Consolidated Revenue Fund is appropriated for the purposes of payments by the Commonwealth under this section.

Overall limit on appropriation for category A payments

(5) For category A payments, the total limit on the appropriation is the total amount of wool levy received by the Commonwealth. For this purpose, amounts received by the Commonwealth as penalties for late payment of wool levy are to be treated as amounts of wool levy.

Overall limit on appropriation for category B payments

(6) For category B payments, the total limit on the appropriation is the sum of:

(a) the total amount of wool levy received by the Commonwealth, and for this purpose, amounts received by the Commonwealth as penalties for late payment of wool levy are not to be treated as amounts of wool levy; and

(b) amounts prescribed by the regulations.

(6A) Subsection ( 6) does not apply if the regulations so provide.

Retention limit for category B payments

(7) The category B payments made to the research body during a particular financial year are subject to the condition that, if:

(a) before the end of 31 October next following the financial year, the Minister determines the amount of the gross value of eligible wool produced in Australia in the financial year; and

(b) as at the end of 31 October next following the financial year, the sum of the category B payments that were paid to the research body during the financial year exceeds the lesser of:

(i) 0.5% of the amount of the gross value of eligible wool produced in Australia in the financial year as determined by the Minister; and

(ii) 50% of the amount spent by the research body in the financial year on activities that qualify, under the contract, as research and development activities;

the research body will pay to the Commonwealth an amount equal to the excess.

Note: This ensures that the sum of the category B payments that are retained by the research body in relation to the financial year does not exceed the lesser of the amounts calculated under subparagraphs ( b)(i) and (b)(ii).

(7A) If:

(a) before the end of 31 October next following a financial year, the Minister has not determined under subsection ( 7) the amount of the gross value of eligible wool produced in Australia in the financial year; and

(b) the Minister has determined under subsection ( 7) the amount of the gross value of eligible wool produced in Australia in the previous financial year;

the Minister is taken to have made, immediately before the end of that 31 October, a determination under subsection ( 7) that the amount of the gross value of eligible wool produced in Australia in the financial year is equal to the amount of the gross value of eligible wool produced in Australia determined under subsection ( 7) for the previous financial year.

(7B) An amount payable under subsection ( 7) by the research body:

(a) is a debt due to the Commonwealth; and

(b) may be recovered by the Minister, on behalf of the Commonwealth, by action in a court of competent jurisdiction.

(7C) A determination made under subsection ( 7) is not a legislative instrument.

(8) For the purposes of subsection ( 7), the regulations may prescribe the manner in which the Minister is to determine the gross value of eligible wool produced in Australia in a financial year.

(8A) If there is an unmatched R&D excess for a financial year that started or starts on or after 1 July 2001, the amount spent by the research body in the following financial year on activities that qualify, under the funding contract, as research and development activities is taken, for the purposes of this section (including for the purposes of this subsection and subsection ( 8B)), to be increased by the amount of the unmatched R&D excess.

Note: This means that research and development expenditure that is not "50% matched" in one financial year because of the cap in subsection ( 6) or the condition in subparagraph ( 7)(b)(i) can be carried forward into later years.

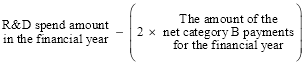

(8B) For the purposes of subsection ( 8A), there is an unmatched R&D excess for a financial year if:

(a) the research body spends a particular amount (the R&D spend amount ) in the financial year on activities that qualify, under the funding contract, as research and development activities; and

(b) because of the operation of subsection ( 6) or subparagraph ( 7)(b)(i) , the net category B payments in respect of the financial year are less than 50% of the R&D spend amount;

and the amount of the unmatched R&D excess is:

Set off

(8C) If:

(a) an amount (the first amount ) is payable by the research body under subsection ( 7); and

(b) another amount (the second amount ) is payable by the Commonwealth to the research body under the funding contract;

the Minister may, on behalf of the Commonwealth, set off the whole or a part of the first amount against the whole or a part of the second amount.

Net category B payments

(8D) For the purposes of this section, net category B payments for a financial year means the total of the category B payments made to the research body during the financial year, less the amount payable by the research body under subsection ( 7) as a condition of those category B payments.

(9) In this section:

"eligible wool" has the meaning given by the regulations.