Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated ActsPart 1 -- Amendments commencing on Royal Assent

1 Section 3 (index of definitions)

Insert the following entries in their appropriate alphabetical positions, determined on a letter - by - letter basis:

accumulated FS debt | 19AB(2) |

adjusted accumulated FS debt | 19AB(2) |

amount notionally repaid | 19AB(2) |

amount outstanding | 19AB(2) |

amount repaid | 19AB(2) |

approved course of education or study | 19AB(2), 541B(1) |

austudy payment general rate | 19AB(3) |

AWE | 19AB(2) |

category 1 student | 19AB(2) |

category 2 student | 19AB(2) |

Commissioner | 19AB(2) |

Commissioner of Taxation | 19AB(2) |

contract period | 19AB(2) |

cooling off period | 19AB(2) |

discount | 19AB(2) |

earlier date | 19AB(2) |

eligibility period | 19AB(2) |

financial corporation | 19AB(2) |

financial supplement contract | 19AB(2) |

FS assessment debt | 19AB(2) |

FS debt | 19AB(2) |

index number | 19AB(2) |

intending to undertake a course | 19AB(5) |

interest subsidy | 19AB(2) |

intermediate prescribed amount | 19AB(2) |

later date | 19AB(2) |

maximum amount of financial supplement | 19AB(2) |

maximum prescribed amount | 19AB(2) |

minimum amount of financial supplement | 19AB(2) |

minimum prescribed amount | 19AB(2) |

office | 19AB(2) |

original amount | 19AB(2) |

overpayment | 19AB(2) |

participating corporation | 19AB(2) |

principal sum | 19AB(2) |

relevant debt | 19AB(2) |

revised amount | 19AB(2) |

saved amount | 19AB(2) |

short course | 19AB(2) |

Social Security Student Financial Supplement Scheme 1998 | 19AB(2) |

supplement entitlement notice | 19AB(2) |

termination date | 19AB(2) |

termination notice | 19AB(2) |

tertiary course | 19AB(2) |

trade back | 19AB(2) |

trade in | 19AB(2) |

undertaking a course | 19AB(5) |

weekday | 19AB(2) |

wrongly paid supplement | 19AB(2) |

year | 19AB(2) |

year of income | 19AB(2) |

youth allowance general rate | 19AB(4) |

2 Before section 19B

Insert:

19AB Student Financial Supplement Scheme definitions

(1) This section has effect for the purposes of Chapter 2B.

(2) Unless the contrary intention appears:

"accumulated FS debt" has the meaning given by section 1061ZZEQ.

"adjusted accumulated FS debt" has the meaning given by section 1061ZZES.

"amount notionally repaid" has the meaning given by subsection 1061ZZCN(5) or (7), as applicable.

"amount outstanding" has the meaning given by section 1061ZZCG or 1061ZZCH, as applicable.

"amount repaid" has the meaning given by subsection 1061ZZCJ(3), as affected by section 1061ZZCL.

"approved course of education or study" has the same meaning as in subsection 541B(5).

Note: This expression is used, with the same meaning, in sections 569B and 1061PC.

"austudy payment general rate" has the meaning given by subsection (3).

"AWE" has the meaning given by section 1061ZZFF.

"category 1 student" has the meaning given by section 1061ZZ.

"category 2 student" has the meaning given by section 1061ZZA.

"Commissioner" means Commissioner of Taxation.

"Commissioner of Taxation" includes a Second Commissioner of Taxation and a Deputy Commissioner of Taxation.

"contract period" of a financial supplement contract has the meaning given by subsection 1061ZZAX(7) or 1061ZZAY(3).

"cooling off period" means a period referred to in section 1061ZZBD.

"discount" has the meaning given by section 1061ZZCM.

"earlier date" has the meaning given by paragraph 1061ZZEQ(2)(b).

"eligibility period" for a person means an eligibility period under section 1061ZY and includes an eligibility period for the purposes of the Social Security Student Financial Supplement Scheme 1998.

"financial corporation" means:

(a) a foreign corporation within the meaning of paragraph 51(xx) of the Constitution whose sole or principal business activities in Australia are the borrowing of money and the provision of finance; or

(b) a financial corporation within the meaning of that paragraph;

and includes a bank.

"financial supplement contract" means a contract referred to in subsection 1061ZZAX(2) or 1061ZZAY(1).

"FS assessment debt" means an amount that is required to be paid in respect of an accumulated FS debt under section 1061ZZEZ and is included in an assessment made under Division 7 of Part 2B.3 or under the corresponding provision of the Social Security Student Financial Supplement Scheme 1998 or of the Student Assistance Act 1973 as in force at a time before 1 July 1998.

"FS debt" has the meaning given by section 1061ZZEO.

"index number" for a quarter means the All Groups Consumer Price Index number, being the weighted average of the 8 capital cities, published by the Australian Statistician for the quarter.

"intending to undertake a course" : see subsection (5).

"interest subsidy" , in relation to financial supplement paid to a person by a participating corporation under a financial supplement contract, means the part of any subsidy paid by the Commonwealth to the corporation, without cost to the person, in respect of the supplement under the agreement entered into with the corporation under section 1061ZZAG, that is in lieu of interest.

"intermediate prescribed amount" has the meaning given by section 1061ZZFD.

"later date" has the meaning given by paragraph 1061ZZEQ(1)(a) or (2)(a), as the case requires.

"maximum amount of financial supplement" has the meaning given by section 1061ZZAK or 1061ZZAO, as the case requires, as affected by section 1061ZZAQ.

"maximum prescribed amount" has the meaning given by section 1061ZZFE.

"minimum amount of financial supplement" has the meaning given by section 1061ZZAP.

"minimum prescribed amount" has the meaning given by section 1061ZZFC.

"office" means a branch office but does not include an agency or administrative office.

"original amount" has the meaning given by subsection 1061ZZCW(1).

"overpayment" , for a person in relation to an eligibility period, means either of the following:

(a) a debt or overpayment that is to be recovered under Chapter 5 from the person during the eligibility period;

(b) an amount the person is liable to pay to the Commonwealth under section 1061ZZDE, 1061ZZDL, 1061ZZDV or 1061ZZEE that the Secretary has decided is to be recovered during the eligibility period.

"participating corporation" has the meaning given by subsection 1061ZZAG(3).

"principal sum" , at a time during the contract period of a financial supplement contract, means the total of the amounts of financial supplement paid under the contract before that time by the participating corporation to the other party to the contract.

"relevant debt" has the meaning given by section 1061ZZFB.

"revised amount" has the meaning given by subsection 1061ZZCW(1).

"saved amount" means an amount referred to in subsection 1061ZZBO(3).

"short course" means a tertiary course that is designed to be completed in, at most, 30 weeks (including vacations).

"Social Security Student Financial Supplement Scheme 1998" means the scheme of that name established by the Minister under Chapter 2B of this Act as in force before the commencement of this section.

"supplement entitlement notice" given to a person means a notice given to the person under subsection 1061ZZAC(3) or 1061ZZAD(4), or a notice referred to in subsection 1061ZZAE(3).

"termination date" of a financial supplement contract means the date set out in the contract under subsection 1061ZZAX(6) or as mentioned in subsection 1061ZZAY(2).

"termination notice" means a notice given under section 1061ZZCQ or under the corresponding provision of the Social Security Student Financial Supplement Scheme 1998 or of the Student Assistance Act 1973 as in force at a time before 1 July 1998 .

"tertiary course" means a tertiary course that is an approved course of education or study.

"trade back" has the meaning given by section 1061ZZAT.

"trade in" has the meaning given by section 1061ZZAR.

"undertaking a course" : see subsection (5).

"weekday" means a day from Monday to Friday (inclusive), whether or not the day is a public holiday.

"wrongly paid supplement" has the meaning given by subsections 1061ZZDB(4), 1061ZZDI(4), 1061ZZDS(4) and 1061ZZEC(4).

"year" means a calendar year.

"year of income" has the same meaning as in the Income Tax Assessment Act 1936 .

"youth allowance general rate" has the meaning given by subsection (4).

(3) A person's austudy payment general rate is the rate of austudy payment that would be payable to the person if the rate were worked out:

(a) using the Austudy Payment Rate Calculator; and

(b) not including any amount as pharmaceutical allowance or remote area allowance.

(4) A person's youth allowance general rate is the rate of youth allowance that would be payable to the person if the rate were worked out:

(a) using the Youth Allowance Rate Calculator; and

(b) not including any amount as pharmaceutical allowance, rent assistance or remote area allowance.

(5) The question whether a person is intending to undertake a course or is undertaking a course is to be determined, so far as practicable and with any necessary changes, in the same way as the question whether a person is intending to undertake study or is undertaking study, as the case may be, is determined under section 541B.

3 Subsection 23(1) (definition of financial supplement )

Repeal the definition, substitute:

"financial supplement" means a loan that has been or may be made under a financial supplement contract as defined by section 19AB.

4 Subsection 23(1) (at the end of the definition of recipient notification notice )

Add:

; or (s) section 1061ZZBR.

5 Subsection 23(1) (at the end of the definition of recipient statement notice )

Add:

; or (s) section 1061ZZBY.

6 Chapter 2B

Repeal the Chapter, substitute:

Chapter 2B--Student Financial Supplement Scheme

Part 2B.1 -- Establishment of scheme

The object of this Chapter is to establish a Student Financial Supplement Scheme enabling certain tertiary students to obtain a repayable financial supplement by entering into a contract for that purpose with a financial corporation that participates in the scheme.

(1) The scheme provides for the reduction of the rate of youth allowance, austudy payment or pensioner education supplement payable to a person who obtains financial supplement.

(2) The scheme contains provisions under which the amount of supplement that the person is eligible to obtain depends on the total rate of youth allowance, austudy payment or pensioner education supplement that the person chooses to receive. Those provisions allow the person to choose to repay some or all of the youth allowance, austudy payment or pensioner education supplement, or to receive a lower rate of payment of such an allowance, payment or supplement, in order to receive a higher amount of financial supplement.

(3) The scheme provides that the person is not liable to pay interest to the financial corporation in respect of financial supplement received by the person, but provides for payment by the Commonwealth, without cost to the person, to the financial corporation of a subsidy that includes an amount in lieu of interest.

(4) The scheme provides for the amount of the financial supplement that has to be repaid under a contract to be indexed on 1 June in the year next following the year in which the contract is entered into, and on 1 June in each later year. The amount by which the supplement is increased by indexation is owed by the person to the Commonwealth and not to the financial corporation.

(5) Under the scheme, the person is entitled, but not required, to make early repayments in respect of the supplement during the period of the contract. The scheme provides for a discount for any repayments made before the end of that period.

(6) The scheme provides that, if financial supplement paid to a person is not repaid in full before the end of the period of the contract, the obligation to repay the outstanding amount of the supplement is transferred to the Commonwealth, and the indexed amount is repayable by the person to the Commonwealth through the taxation system when the person's income reaches a specified level.

Division 2 -- Eligibility to obtain financial supplement

1061ZY Eligibility to obtain financial supplement

A person is eligible to obtain financial supplement for a period (an eligibility period ) that is a year or a part of a year if:

(a) the person is undertaking, or intending to undertake, a tertiary course at an educational institution throughout the period; and

(b) the person does not undertake a course of primary or secondary education at any time during the period; and

(c) the person is a category 1 student or a category 2 student in respect of the period; and

(d) the amount of financial supplement that the person is eligible to obtain under Division 6 for the year is not less than the minimum amount of financial supplement.

(1) A person is a category 1 student in respect of a period if, throughout the period, one or more of the payments referred to in this section are payable to the person.

(2) The payment may be youth allowance if:

(a) the person's youth allowance general rate is more than zero; and

(b) the youth allowance is payable because the person is undertaking full - time study.

(3) The payment may be austudy payment if the person's austudy payment general rate is more than zero.

(4) The payment may be pensioner education supplement.

(1) A person is a category 2 student in respect of a period if:

(a) the person is not a category 1 student in respect of the period; and

(b) throughout the period the person is undertaking full - time study; and

(c) throughout the period youth allowance at the youth allowance general rate is not payable to the person, and is not so payable only because of the operation of:

(i) Module F (the parental income test) of the Youth Allowance Rate Calculator in section 1067G; or

(ii) Module G (the family actual means test) of that Calculator; and

(d) where throughout the period youth allowance at the youth allowance general rate is not payable to the person only because of the operation of Module F of that Calculator--the person's combined parental income for the appropriate tax year under Submodule 4 of that Module is throughout the period less than the person's modified parental income free area; and

(e) where throughout the period youth allowance at the youth allowance general rate is not payable to the person only because of the operation of Module G of that Calculator--the actual means of the person's family under that Module is throughout the period less than the person's modified parental income free area; and

(f) neither section 1061ZZAA nor 1061ZZAB applies to the person.

(2) For the purposes of paragraphs (1)(d) and (e), the person's modified parental income free area is the indexed amount that would be the person's parental income free area under point 1067G - F22 if the amount of $23,400 that was specified in paragraph 1067G - F22(a) when that paragraph was enacted had been $54,949.

1061ZZAA Failure by person to comply with request to provide person's tax file number

(1) This section applies to a person if:

(a) the Secretary has requested the person under section 1061ZZBP to:

(i) give the Secretary a written statement of the person's tax file number; or

(ii) apply to the Commissioner of Taxation for a tax file number and give the Secretary a written statement of the person's tax file number after it has been issued; and

(b) at the end of 28 days after the request is made, the person has neither:

(i) given the Secretary a written statement of the person's tax file number; nor

(ii) given the Secretary an employment declaration and satisfied either subsection (2) or (3).

(2) The person satisfies this subsection if:

(a) the employment declaration states that the person:

(i) has a tax file number but does not know what it is; and

(ii) has asked the Commissioner of Taxation to inform him or her of the number; and

(b) the person has given the Secretary a document authorising the Commissioner to tell the Secretary:

(i) whether the person has a tax file number; and

(ii) if the person has a tax file number--the tax file number; and

(c) the Commissioner has not told the Secretary that the person has no tax file number.

(3) The person satisfies this subsection if:

(a) the employment declaration states that the person has applied for a tax file number; and

(b) the person has given the Secretary a document authorising the Commissioner of Taxation to tell the Secretary:

(i) if a tax file number is issued to the person--the tax file number; or

(ii) if the application is refused--that the application has been refused; or

(iii) if the application is withdrawn--that the application has been withdrawn; and

(c) the Commissioner has not told the Secretary that the person has not applied for a tax file number; and

(d) the Commissioner has not told the Secretary that an application by the person for a tax file number has been refused; and

(e) the application for a tax file number has not been withdrawn.

(1) Subject to subsection (4), this section applies to a person if:

(a) the person is requested under section 1061ZZBQ to give the Secretary a written statement of the tax file number of a parent of the person; and

(b) at the end of 28 days after the request is made the person has neither:

(i) given the Secretary a written statement of the parent's tax file number; nor

(ii) given the Secretary a declaration by the parent in a form approved by the Secretary and satisfied either subsection (2) or (3).

(2) The person satisfies this subsection if:

(a) the parent's declaration states that the parent:

(i) has a tax file number but does not know what it is; and

(ii) has asked the Commissioner of Taxation to inform him or her of his or her tax file number; and

(b) the person has given the Secretary a document signed by the parent that authorises the Commissioner to tell the Secretary:

(i) whether the parent has a tax file number; and

(ii) if the parent has a tax file number--the tax file number; and

(c) the Commissioner has not told the Secretary that the parent has no tax file number.

(3) The person satisfies this subsection if:

(a) the parent's declaration states that he or she has applied for a tax file number; and

(b) the person has given the Secretary a document signed by the parent that authorises the Commissioner of Taxation to tell the Secretary:

(i) if a tax file number is issued to the parent--the tax file number; or

(ii) if the application is refused--that the application has been refused; or

(iii) if the application is withdrawn--that the application has been withdrawn; and

(c) the Commissioner has not told the Secretary that an application by the parent for a tax file number has been refused; and

(d) the application for a tax file number has not been withdrawn.

(4) The Secretary may waive the request for a statement of the parent's tax file number if the Secretary is satisfied that:

(a) the person does not know the parent's tax file number; and

(b) the person can obtain none of the following from the parent:

(i) the parent's tax file number;

(ii) a statement of the parent's tax file number;

(iii) a declaration by the parent under subparagraph (1)(b)(ii).

Division 3 -- Decision and notice about eligibility to obtain financial supplement

(1) If a person claims youth allowance, austudy payment or pensioner education supplement, the Secretary must decide whether the person is eligible to obtain financial supplement for a period that is the whole or a part of a year.

(2) Also, if:

(a) the Secretary has made a decision in a year that a person is eligible to obtain financial supplement for a period that is the whole or a part of that year; and

(b) the person is likely to:

(i) continue to undertake the person's tertiary course in the next year; or

(ii) undertake a new tertiary course in the next year when enrolments in the course are next accepted;

the Secretary must make a new decision, as early as practicable in the next year, about whether the person is eligible to obtain financial supplement for a period that is the whole or a part of that next year.

(3) If the Secretary decides that the person is eligible to obtain financial supplement for a period, the Secretary must give the person a notice (a supplement entitlement notice ):

(a) stating that the person is eligible to obtain financial supplement for that period; and

(b) specifying the minimum and maximum amounts of financial supplement that the person can obtain.

1061ZZAD Revocation or variation of decision after review

(1) This section applies if:

(a) the Secretary has made a decision under section 1061ZZAC in relation to a person; and

(b) the Secretary has given the person a supplement entitlement notice under subsection 1061ZZAC(3) as a result of the decision; and

(c) after the notice was given the decision is reviewed under Chapter 6; and

(d) as a result of the review, the decision is revoked or varied.

(2) The revocation or variation revokes the supplement entitlement notice and the notice ceases to be valid for the purpose of applying for financial supplement.

(3) The Secretary must give the person a statement telling the person:

(a) that the decision has been revoked, or has been varied in a manner set out in the statement, as the case may be; and

(b) that the supplement entitlement notice has been revoked and ceases to be valid for the purpose of applying for financial supplement.

(4) If the decision is varied and, after the variation, the person is or becomes eligible to obtain financial supplement for a period, the Secretary must give the person a notice (also a supplement entitlement notice ):

(a) stating that the person is eligible to obtain financial supplement for that period; and

(b) specifying the minimum and maximum amounts of financial supplement that the person can obtain.

(1) This section applies if, immediately before the commencement of this Chapter, a person held a notice given under Part 3 of the Social Security Student Financial Supplement Scheme 1998.

(2) If the person had not used the notice before that commencement in an application for financial supplement under that Scheme, the person is eligible to obtain financial supplement under this Chapter for the period to which the notice related.

(3) The notice is taken to be a supplement entitlement notice given under this Division.

Division 4 -- Agreements between Commonwealth and financial corporations

1061ZZAF Applications for financial supplement

A person may apply for financial supplement only to a participating corporation.

(1) The Minister may enter into an agreement, on behalf of the Commonwealth, with a financial corporation for the payment by the corporation after the commencement of this Chapter, in the year in which this Chapter commences or a later year, of financial supplement.

(2) An agreement referred to in subsection (1) does not have any effect unless it:

(a) is expressed to have effect subject to this Chapter; and

(b) provides for the payment by the Commonwealth to the financial corporation, in respect of each amount of financial supplement paid by the corporation to a person that has not been repaid, or in respect of which the rights of the corporation have been transferred to the Commonwealth, of a subsidy of such amount or amounts, or at such rate or rates, and in respect of such period or periods, as are stated in the agreement.

(3) If such an agreement is entered into, the corporation is a participating corporation for the purposes of this Chapter in respect of the year, or each year, concerned.

(4) The parties to an agreement referred to in subsection (2) (including such an agreement as previously amended under this subsection) may enter into an agreement amending or terminating it.

(5) The amendment or termination of an agreement does not affect any financial supplement contract that was in force immediately before the amendment or termination took effect.

(6) If an agreement was in force, immediately before the commencement of this Chapter, between the Commonwealth and a financial corporation under section 1.7 of the Social Security Student Financial Supplement Scheme 1998, the amendment or termination of the agreement, and the commencement of an agreement under this section, do not affect any financial supplement contract made under that Scheme.

(7) An agreement between the Commonwealth and a financial corporation is not subject to any stamp duty or other tax under a law of a State or Territory.

(8) An officer may disclose to a participating corporation any information about a person that is relevant to the exercise or performance by the corporation of any of its rights or obligations in respect of the person under this Chapter.

(9) A participating corporation may disclose to an officer any information about a person that is relevant to the exercise or performance of any rights, powers or obligations conferred or imposed on an officer or on the Commonwealth in respect of the person under this Chapter.

Division 5 -- Application for financial supplement

A person who is eligible to obtain financial supplement for an eligibility period may apply to a participating corporation, during that period, for financial supplement.

A person may only apply for financial supplement by:

(a) completing an application form approved by the Secretary; and

(b) lodging it, with the person's supplement entitlement notice, at an office of a participating corporation.

1061ZZAJ Changing an application

A person who has applied for financial supplement for the eligibility period may, at any time, lodge another application form approved by the Secretary at an office of the participating corporation, telling the corporation that the person requires for that period:

(a) a specified lesser amount of financial supplement, which must be:

(i) not less than the total amount of financial supplement already paid to the person for the period; and

(ii) not less than the minimum amount of financial supplement in respect of the person for the year that constitutes, or includes, the eligibility period; or

(b) a specified greater amount of financial supplement, which must be not more than the maximum amount of financial supplement in respect of the person for the period.

Division 6 -- Amount of financial supplement

Subdivision A -- Category 1 students

1061ZZAK Maximum amount of financial supplement

(1) If the relevant eligibility period of a person who is a category 1 student is a year, the maximum amount of financial supplement for the period in respect of the person is the lesser of:

(a) $7,000; and

(b) the amount worked out using the following Method statement.

Method statement

Step 1 . Work out the total amount of youth allowance general rate, austudy payment general rate or pensioner education supplement that would be payable to the person for the eligibility period if the person did not apply for financial supplement.

Step 2 . Work out the total amount of advance payment deductions (if any) to be made from the person's rate of youth allowance or austudy payment, under Part 3.16A, in the eligibility period.

Subtract that total amount from the total amount worked out under Step 1.

Step 3 . Work out the total amount of overpayments (if any) for the eligibility period.

Subtract that total amount from the total amount worked out under Step 2.

Step 4 . Work out the total amount of deductions (if any) that are to be paid to the Commissioner of Taxation, under section 1359, for the eligibility period.

Note: Section 1359 provides for the deduction and payment to the Commissioner of Taxation of amounts of tax that a person is required to pay.

Subtract that total amount from the total amount worked out under Step 3.

Step 5 . Work out the total amount (if any) of youth allowance general rate, austudy payment general rate or pensioner education supplement that has already been paid for the eligibility period.

Ignore any amount that has already been dealt with under Step 2.

Ignore any amount that is taken never to have been paid because of section 1061ZZAW.

Subtract the total amount from the amount worked out under Step 4.

Step 6 . Multiply the amount left by 2.

Step 7 . If the result is not a number of whole dollars, round the result up to the next number of whole dollars.

(2) If the relevant eligibility period of a person who is a category 1 student is less than a year, the maximum amount of financial supplement for the period in respect of the person is the lesser of:

(a) the amount worked out using the Method statement in subsection (1); and

(b) the amount worked out using the following Method statement.

Method statement

Step 1 . Multiply $7,000 by the number of weekdays in the eligibility period.

Step 2 . Divide the result by the number of weekdays in the year in which the eligibility period is included.

If the result is not a number of whole dollars, round the result up to the next number of whole dollars.

(3) This section has effect subject to Subdivision C.

Subdivision B -- Category 2 students

1061ZZAL Change in eligibility period

(1) The maximum amount of financial supplement in respect of a person who is a category 2 student depends on the person's eligibility period.

(2) If the person is undertaking, or intends to undertake, a short course, it is necessary to work out whether the person's eligibility period is to be changed under section 1061ZZAM.

(3) If the person is neither undertaking, nor intending to undertake, a short course, it is necessary to work out whether the person's eligibility period is to be changed under section 1061ZZAN.

1061ZZAM Eligibility period (short course)

(1) This section explains whether, and how, to change the eligibility period for a person who is undertaking, or intending to undertake, a short course.

(2) Subject to subsection (3), the eligibility period that would have applied to the person apart from this subsection (the eligibility period otherwise applicable ) must be changed if the person applied for financial supplement more than 4 weeks after being given a supplement entitlement notice.

(3) The Secretary may decide that the eligibility period otherwise applicable is not to be changed if the Secretary is satisfied that:

(a) the person took reasonable steps to apply within 4 weeks after being given a supplement entitlement notice; and

(b) circumstances beyond the person's control prevented the person from applying within the 4 weeks; and

(c) the person applied as soon as practicable after the circumstances stopped.

(4) If the eligibility period otherwise applicable is to be changed, the person's new eligibility period is the period:

(a) starting on the later of:

(i) the day when the person applied; and

(ii) the start of the eligibility period otherwise applicable; and

(b) ending when the eligibility period otherwise applicable would have ended.

1061ZZAN Eligibility period (no short course)

(1) This section explains whether, and how, to change the eligibility period for a person who is neither undertaking, nor intending to undertake, a short course.

(2) Subject to subsection (3), the eligibility period that would have applied to the person apart from this subsection (the eligibility period otherwise applicable ) must be changed if the person applied for financial supplement after 31 May in the year in which the period is included.

(3) The Secretary may decide that the period is not to be changed if the Secretary is satisfied that:

(a) the person took reasonable steps to apply within 4 weeks after being given a supplement entitlement notice; and

(b) circumstances beyond the person's control prevented the person from applying within the 4 weeks; and

(c) the person applied as soon as practicable after the circumstances stopped.

(4) If the eligibility period otherwise applicable is to be changed and the person applied before 1 October in the year, the person's new eligibility period is the period:

(a) starting on the later of 1 July and the start of the eligibility period otherwise applicable; and

(b) ending when the eligibility period otherwise applicable would have ended.

(5) If the eligibility period otherwise applicable is to be changed and the person applied on or after 1 October in the year, the person's new eligibility period is the period:

(a) starting on the later of:

(i) the day when the person applied; and

(ii) the start of the eligibility period otherwise applicable; and

(b) ending when the eligibility period otherwise applicable would have ended.

1061ZZAO Maximum amount of financial supplement

(1) If:

(a) the person is undertaking, or intending to undertake, a short course; or

(b) the person is neither undertaking, nor intending to undertake, a short course and the person's eligibility period is less than a year;

the maximum amount of financial supplement for the eligibility period in respect of the person is worked out using the following Method statement.

Method statement

Step 1 . Multiply $2,000 by the number of weekdays in the eligibility period.

Step 2 . Divide the result by the number of weekdays in the year that includes the eligibility period.

If the result is not a number of whole dollars, round the result up to the next number of whole dollars.

(2) If the person is neither undertaking, nor intending to undertake, a short course, and the person's eligibility period is a year, the maximum amount of financial supplement for the eligibility period in respect of the person is $2,000.

(3) This section has effect subject to Subdivision C.

Subdivision C -- Provisions applying to both category 1 students and category 2 students

1061ZZAP Minimum amount of financial supplement

The minimum amount of financial supplement in respect of a person is $500.

1061ZZAQ Person doing more than one course

(1) This section applies if a person undertakes, or intends to undertake, more than one tertiary course in the same period in a year.

(2) The maximum amount of financial supplement for the period in respect of the person is the maximum amount worked out under this Division for the period in respect of the person for one of the courses.

(1) Financial supplement will be paid to a person who is eligible to obtain financial supplement at a rate determined by the person's financial supplement contract.

(2) If youth allowance, austudy payment or pensioner education supplement is payable to the person, the payment of financial supplement will reduce the rate at which the youth allowance, austudy payment or pensioner education supplement is payable.

(3) The reduction of the rate of payment is a trade in .

(4) The Division explains how trade in works.

(1) The period for which a payment of financial supplement will be made is an instalment period .

(2) Subject to subsection (3), the rate of youth allowance, austudy payment or pensioner education supplement that would have been payable to the person in an instalment period is reduced by an amount equal to one - half of the amount of financial supplement to be paid during the instalment period under the financial supplement contract.

(3) If, apart from this subsection, the amount by which the rate would be reduced is an amount including one - half of a cent, the amount is to be increased by one - half of a cent.

(4) This section has effect despite any other provision of this Act.

Subdivision A -- Purpose of Division

(1) If a person who is eligible to obtain financial supplement wishes to obtain financial supplement, the person may repay an amount of youth allowance, austudy payment or pensioner education supplement.

(2) If a person who is obtaining financial supplement wishes to increase the amount of financial supplement, the person may repay an amount of youth allowance, austudy payment or pensioner education supplement.

(3) The repayment of the youth allowance, austudy payment or pensioner education supplement is a trade back .

(4) This Division explains how trade back works.

(5) This Division also sets out the effect of trade back.

(6) This Division does not affect the operation of Chapter 5.

1061ZZAU Election to repay youth allowance, austudy payment or pensioner education supplement

(1) A person to whom youth allowance, austudy payment or pensioner education supplement was payable during a payment period may elect to repay to the Commonwealth some or all of the youth allowance, austudy payment or pensioner education supplement.

(2) The person must make the election using the form approved under paragraph 1061ZZAI(a).

(3) A payment period is:

(a) the part of a year starting on 1 January and ending on 31 May; or

(b) the part of a year starting on 1 July and ending on 30 September.

(1) A person who is not obtaining financial supplement may, in order to obtain financial supplement, repay to the Commonwealth youth allowance, austudy payment or pensioner education supplement:

(a) while the person is eligible to obtain financial supplement; and

(b) during the payment period.

(2) However, if the person does not repay youth allowance, austudy payment or pensioner education supplement during the payment period, the person may, in order to obtain financial supplement, repay youth allowance, austudy payment or pensioner education supplement after that period if the Secretary is satisfied that:

(a) the person took reasonable steps to repay it during the payment period; and

(b) circumstances beyond the person's control prevented the person from repaying it during the period; and

(c) the person repays it as soon as practicable after the end of the payment period and during the year that includes the payment period.

(3) A person who is obtaining financial supplement may, in order to increase the amount of financial supplement, repay to the Commonwealth youth allowance, austudy payment or pensioner education supplement:

(a) while the person is eligible to obtain financial supplement; and

(b) during the year in which the youth allowance, austudy payment or pensioner education supplement was paid.

If an amount is repaid by a person under this Division, the amount is taken never to have been paid to the person.

Division 9 -- Financial supplement contracts

Subdivision A -- Making a contract for payment of financial supplement

1061ZZAX Making a contract between person and participating corporation

(1) If a person applies to a participating corporation under Division 5 for the payment of financial supplement for an eligibility period, the corporation must, as soon as practicable, accept the application by written notice to the person.

(2) A contract is made when the corporation accepts the application by giving the notice referred to in subsection (1). The contract is a financial supplement contract .

(3) A financial supplement contract is a contract for the making of a loan by the corporation to the person under this Division without any requirement on the person to pay interest.

(4) The contract must be for the amount of financial supplement for which the person from time to time asks, but the amount must not be less than the minimum amount, or more than the maximum amount, of financial supplement that the person is, from time to time, eligible to obtain under Division 6.

(5) The contract must also allow, but not compel, the person to make repayments during the contract period under Division 13 of the amount outstanding at any time under the contract.

(6) The contract must set out the termination date for the contract. The date to be set out is the last day of the contract period.

(7) The contract period is the period beginning on the day when the contract is made and ending on 31 May in the year in which the last of the periods referred to in paragraph 1061ZZCH(1)(b) ends.

(1) A contract is also a financial supplement contract if it is a contract referred to in section 8.2 of the Social Security Student Financial Supplement Scheme 1998.

(2) The termination date for the contract is the date set out in the contract.

(3) The contract period is the period beginning on the day when the contract was made and ending on 31 May in the year in which the last of the periods referred to in paragraph 1061ZZCH(1)(b) ended or ends.

1061ZZAZ Liability for money paid under a financial supplement contract

(1) A participating corporation may rely on advice given by the Commonwealth to decide:

(a) whether it must pay financial supplement to a person; and

(b) the amount of financial supplement.

(2) An amount paid to a person by a corporation, relying on advice given by the Commonwealth, is taken to be financial supplement paid under the contract even though the person may not have been eligible to obtain the amount.

(3) Subsection (2) does not affect the operation of Part 2B.2.

1061ZZBA Validity of financial supplement contract

(1) The validity of a financial supplement contract with a person is not affected merely because the person was not eligible to obtain financial supplement when the contract was made, or ceases at a later time to be eligible.

(2) The contract is not invalid, and is not voidable, under any other law (whether written or unwritten) in force in a State or Territory.

(3) The contract is not invalid merely because the person is an undischarged bankrupt when the contract is made.

(4) Bankruptcy does not release a person from his or her obligations under the contract.

Subdivision B -- When a financial supplement contract can be cancelled

1061ZZBB Person has right to cancel financial supplement contract

(1) A person who makes a financial supplement contract has a right to cancel the contract.

(2) Subsection (1) does not affect the operation of section 1061ZZCU.

(3) If, under section 1061ZZBF, the person waives his or her right to cancel the contract, sections 1061ZZBC to 1061ZZBE do not apply to the contract.

1061ZZBC How to cancel financial supplement contract

(1) To exercise the right to cancel the contract, the person must give to the participating corporation written notice that the person is withdrawing his or her application for financial supplement

(2) The notice must be lodged at an office of the corporation.

1061ZZBD When to cancel financial supplement contract

The person's right may be exercised within 14 days (the cooling off period ) after the day when the contract is made under section 1061ZZAX.

1061ZZBE Payments made during cooling off period

(1) In the cooling off period, the participating corporation must not make a payment to the person under the contract.

(2) If the corporation makes a payment to the person under the contract within the cooling off period, the payment is taken not to be a payment of financial supplement if the person repays to the corporation an amount equal to the payment within 7 days after the date of the payment.

(3) If the corporation makes a payment to the person under the contract after the cooling off period and the person has exercised the right to cancel the contract, the payment is taken not to be a payment of financial supplement if the person repays to the corporation an amount equal to the payment within 7 days after the date of the payment.

1061ZZBF Person may waive right to cancel contract

The person may waive the right to cancel the contract.

1061ZZBG How to waive right to cancel contract

To waive the right to cancel the contract, the person must give to the participating corporation written notice that he or she is waiving the right to cancel the contract.

1061ZZBH When to waive right to cancel contract

To exercise the right of waiver, the person must give the participating corporation the notice referred to in section 1061ZZBG immediately after the contract is made under section 1061ZZAX.

Subdivision C -- Financial supplement contract exempt from certain laws and taxes

1061ZZBI Financial supplement contract exempt from certain laws and taxes

(1) A law of a State or Territory about giving credit or other financial assistance does not apply to a financial supplement contract.

(2) An application for the payment of financial supplement, a financial supplement contract, or an act or thing done or transaction entered into under such a contract, is not taxable under any law of a State or Territory.

Division 10 -- Payment of financial supplement

1061ZZBJ Payment by instalments

(1) Financial supplement is to be paid by instalments for periods determined by the Secretary.

(2) Instalments of financial supplement are to be paid at times determined by the Secretary.

If the amount of an instalment includes a fraction of a cent, the amount is to be rounded to the nearest whole cent (0.5 cent being rounded upwards).

1061ZZBL To whom instalments must be paid

(1) If a person who is a category 1 student is trading in, or trading back, youth allowance, financial supplement must be paid to the person to whom instalments of youth allowance are or were being paid under section 559D or 559E.

(2) If a person who is a category 1 student is trading in, or trading back, austudy payment, financial supplement must be paid to the person to whom instalments of austudy payment are or were being paid under section 584D.

(3) If a person who is a category 1 student is trading in, or trading back, pensioner education supplement, financial supplement must be paid to the person to whom instalments of pensioner education supplement are or were being paid under section 1061PZK.

(4) If a person who is a category 2 student obtains financial supplement, it must be paid to the person to whom instalments of youth allowance would be paid under section 559D or 559E if youth allowance were payable to the student.

(5) This section does not affect the liability of a person to make repayments under Part 2B.3.

1061ZZBM Payment into bank account

(1) If an amount of financial supplement is paid to a person, it must be paid to the credit of a bank account nominated and maintained by the person.

(2) The bank account may be maintained by the person alone or jointly or in common with someone else.

Division 11 -- Protection of financial supplement

1061ZZBN Financial supplement to be absolutely inalienable

Financial supplement is absolutely inalienable, whether by way of, or in consequence of, sale, assignment, charge, execution, bankruptcy or otherwise.

1061ZZBO Effect of garnishee or attachment order

(1) This section applies if:

(a) a person has an account with a financial institution (whether the account is maintained by the person alone, or jointly or in common with someone else); and

(b) a court order in the nature of a garnishee order comes into force in respect of the account; and

(c) an amount of financial supplement has been paid (whether on the person's own behalf or not) to the credit of the account in the 4 weeks immediately before the court order came into force.

(2) The court order does not apply to the saved amount (if any) in the account.

(3) The saved amount is the amount worked out using the following Method statement.

Method statement

Step 1 . Work out the amount of financial supplement paid to the credit of the account in the 4 weeks.

Step 2 . Subtract from that amount the total amount withdrawn from the account in the 4 weeks.

The amount left is the saved amount.

Division 12 -- Obligations of category 2 students

Subdivision A -- Statements about tax file numbers

Request for tax file number

(1) The Secretary may request, but not compel, a person who is a category 2 student and is obtaining financial supplement:

(a) if the person has a tax file number--to give the Secretary a written statement of the person's tax file number; or

(b) if the person does not have a tax file number:

(i) to apply to the Commissioner of Taxation for a tax file number; and

(ii) to give the Secretary a written statement of the person's tax file number after the Commissioner has issued it.

Failure to satisfy request

(2) A person is not eligible to obtain financial supplement if, at the end of 28 days after a request is made:

(a) the person has failed to satisfy the request; and

(b) the Secretary has not exempted the person from having to satisfy the request.

Request for parent's tax file number

(1) If:

(a) a person (the recipient ) who is a category 2 student is obtaining financial supplement; and

(b) the income of a parent of the recipient is required to be taken into account for the purpose of working out the recipient's eligibility for financial supplement; and

(c) the parent is in Australia ;

the Secretary may request, but not compel, the recipient to give the Secretary a written statement of the parent's tax file number.

Failure to satisfy request

(2) A recipient is not eligible to obtain financial supplement if, at the end of 28 days after the request is made:

(a) the recipient has failed to satisfy the request; and

(b) the Secretary has not exempted the recipient from having to satisfy the request.

(3) In this section:

"parent" has the same meaning as in paragraph (b) of the definition of parent in subsection 5(1).

Note 1: In some cases the request can be satisfied in relation to a parent by giving the Secretary a declaration by the parent about the parent's tax file number and an authority by the parent to the Commissioner of Taxation to give the Secretary certain information relevant to the parent's tax file number (see subsections 1061ZZAB(2) and (3).

Note 2: The Secretary may waive the requirement in some cases (see subsection 1061ZZAB(4)).

Subdivision B -- Notice of events or changes in circumstances

1061ZZBR Secretary may give notice requiring information

(1) The Secretary may give a notice under this section to a person who is a category 2 student if:

(a) financial supplement is paid to the person on the person's own behalf; or

(b) financial supplement is paid to someone else, on the person's behalf, under section 1061ZZBL.

(2) The notice must require the person to tell the Department if:

(a) a stated event or change of circumstances happens; or

(b) the person becomes aware that a stated event or change of circumstances is likely to happen.

1061ZZBS Event or change relevant to payment

An event or change of circumstances is not to be stated in a notice given under section 1061ZZBR unless the event or change of circumstances might affect the payment of financial supplement.

1061ZZBT Formalities related to notice

Subject to section 1061ZZBU, a notice under section 1061ZZBR:

(a) must be in writing; and

(b) may be given personally or by post; and

(c) must state how the person is to give the information to the Department; and

(d) must state the period in which the person is to give the information to the Department; and

(e) must state that the notice is a recipient notification notice given under this Act.

A notice under section 1061ZZBR is not invalid merely because it does not comply with paragraph 1061ZZBT(c) or (e).

1061ZZBV Period within which information to be given

(1) Subject to this section, the period stated under paragraph 1061ZZBT(d) must be the period of 14 days after:

(a) the day on which the event or change of circumstances happens; or

(b) the day on which the person becomes aware that the event or change of circumstances is likely to happen.

(2) If the Secretary is satisfied that there are special circumstances related to the person to whom the notice under section 1061ZZBR is to be given, the period to be stated under paragraph 1061ZZBT(d) is such period as the Secretary directs in writing, being a period that ends not less than 15 days, and not more than 28 days, after:

(a) the day on which the event or change of circumstances happens; or

(b) the day on which the person becomes aware that the event or change of circumstances is likely to happen.

(3) If the notice specifies an event consisting of the death of a person, the period to be stated under paragraph 1061ZZBT(d) is a period of 28 days after the day on which the event happens.

(4) If the notice requires the person to tell the Department of a proposal by the person to leave Australia , subsection (1) does not apply to that requirement.

(5) If the notice requires information about receipt of a compensation payment, the period stated under paragraph 1061ZZBT(d) in relation to the information must end at least 7 days after the day when the person becomes aware that he or she has received, or is to receive, a compensation payment.

1061ZZBW Refusal or failure to comply with notice

A person must not, without reasonable excuse, intentionally or recklessly refuse or fail to comply with a notice under section 1061ZZBR to the extent that the person is capable of complying with the notice.

Penalty: Imprisonment for 6 months.

Note: Subsection 4B(2) of the Crimes Act 1914 allows a court that convicts an individual of an offence to impose a fine instead of, or in addition to, a term of imprisonment. The maximum fine that a court can impose on the individual is worked out by multiplying the maximum term of imprisonment (in months) by 5, and then multiplying the amount of a penalty unit by the resulting number. The amount of a penalty unit is stated in section 4AA of that Act.

This Subdivision extends to:

(a) acts, omissions, matters and things outside Australia whether or not in a foreign country; and

(b) all people irrespective of their nationality or citizenship.

Subdivision C -- Notice about a matter relevant to payment of financial supplement

1061ZZBY Secretary may give notice requiring statement on matter

(1) The Secretary may give a notice under this section to a person who is a category 2 student if:

(a) financial supplement is paid to the person on the person's own behalf; or

(b) financial supplement is paid to someone else, on the person's behalf, under section 1061ZZBL.

(2) The notice must require the person to give the Department a statement about a matter that might affect the payment of financial supplement.

1061ZZBZ Formalities related to notice

Subject to section 1061ZZCA, a notice under section 1061ZZBY:

(a) must be in writing; and

(b) may be given personally or by post; and

(c) must state how the statement is to be given to the Department; and

(d) must state the period within which the person is to give the statement to the Department; and

(e) must state that the notice is a recipient statement notice given under this Act.

A notice under section 1061ZZBY is not invalid merely because it does not comply with paragraph 1061ZZBZ(c) or (e).

1061ZZCB Period within which statement to be given

The period stated under paragraph 1061ZZBZ(d) must be at least 14 days after the day on which the notice is given.

1061ZZCC Statement must be in approved form

A statement given in response to a notice under section 1061ZZBY must be in writing and in accordance with a form approved by the Secretary.

1061ZZCD Refusal or failure to comply with notice

A person must not, without reasonable excuse, intentionally or recklessly refuse or fail to comply with a notice under section 1061ZZBY to the extent that the person is capable of complying with the notice.

Penalty: Imprisonment for 6 months.

Note: Subsection 4B(2) of the Crimes Act 1914 allows a court that convicts an individual of an offence to impose a fine instead of, or in addition to, a term of imprisonment. The maximum fine that a court can impose on the individual is worked out by multiplying the maximum term of imprisonment (in months) by 5, and then multiplying the amount of a penalty unit by the resulting number. The amount of a penalty unit is stated in section 4AA of that Act.

This Subdivision extends to:

(a) acts, omissions, matters and things outside Australia whether or not in a foreign country; and

(b) all people irrespective of their nationality or citizenship.

Division 13 -- Early repayments of financial supplement

1061ZZCF Application of Subdivision

This Subdivision has effect subject to section 1061ZZEE.

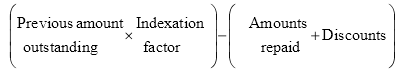

(1) The amount outstanding under a financial supplement contract at a time (the test time ) before 1 June in the year immediately after the year in which the contract was made is the amount worked out using the formula:

![]()

(2) For the purpose of applying the formula in subsection (1) at the test time:

"amounts repaid" means the total of the amounts repaid under the contract before the test time.

"discounts" means the total of the discounts to which the person became entitled before the test time.

"principal sum" means the principal sum at the test time.

1061ZZCH Calculation of amount outstanding under financial supplement contract at a later time

(1) Subject to subsections 1061ZZCN(6) and (7), the amount outstanding under a financial supplement contract at a time (the test time ) during a period of 12 months (the test period ) referred to in either of the following paragraphs:

(a) the period of 12 months beginning on 1 June in the year immediately after the year in which the contract was made; or

(b) any of the following 3 periods of 12 months;

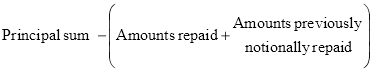

is the amount worked out using the formula:

(2) For the purpose of applying the formula in subsection (1) at the test time:

"amounts repaid" means the total of the amounts repaid under the contract during the test period but before the test time.

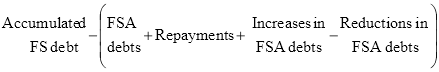

"discounts" means the total of the discounts to which the person became entitled during the test period but before the test time.

"indexation factor" means the number worked out using the method statement in subsection (3).

"previous amount outstanding" means the amount outstanding under the contract immediately before the beginning of the test period.

(3) The Method statement for the purposes of the definition of indexation factor in subsection (2) is as follows:

Method statement

Step 1 . Work out the total of the index number for the March quarter in the later reference period and the index numbers for the 3 immediately preceding quarters.

Step 2 . Work out the total of the index number for the March quarter in the earlier reference period and the index numbers for the 3 immediately preceding quarters.

Step 3 . Divide the total worked out under Step 1 by the total worked out under Step 2.

Step 4 . Round the result to 3 decimal places.

(4) In subsection (3):

"earlier reference period" means the period of 12 months immediately before the later reference period.

"later reference period" means the period of 12 months immediately before the test period.

(5) If an indexation factor worked out under subsection (3) would end with a number greater than 4, were it to be worked out to 4 decimal places, the indexation factor is increased by 0.001.

(6) If, apart from this subsection, an amount worked out under this section would be an amount of dollars and cents, disregard the amount of the cents.

1061ZZCI Notification of amount outstanding

(1) The Secretary must give to a person who is a party to a financial supplement contract with a participating corporation a notice of an amount outstanding under the contract that exists on:

(a) 1 June in the year following the year in which the contract was made; or

(b) 1 June in any of the following 3 years.

(2) The notice must state the amount outstanding under the contract at that date.

Subdivision B -- Person's rights to make repayments during contract period

1061ZZCJ Person not required to, but may, make repayments during contract period

(1) Subject to sections 1061ZZDE, 1061ZZDL, 1061ZZDV and 1061ZZEE, a person who is a party to a financial supplement contract with a participating corporation is not required during the contract period to make a repayment of the amount outstanding under the contract.

(2) Non - payment by the person during the contract period of the amount outstanding is not a default under the contract for the purposes of any law of the Commonwealth, of a State or of a Territory.

(3) However, the person may, at any time during the contract period, make a repayment (an amount repaid ) to the corporation of the whole or a part of the amount outstanding at that time.

(4) Subsection (3) has effect subject to section 1061ZZCL.

1061ZZCK What happens if person makes an excess repayment

If a person purports to make a repayment to a participating corporation under a financial supplement contract by paying an amount under subsection 1061ZZCJ(3) that exceeds the amount that, having regard to the discount to which the person is entitled, would be needed to pay in full the amount outstanding, the excess:

(a) is taken not to be a repayment; and

(b) must be repaid by the corporation to the person.

1061ZZCL Amount repaid not to include certain amounts

If the person makes a repayment under subsection 1061ZZCJ(3), the amount repaid is to be disregarded for the purposes of this Division:

(a) to the extent to which it relates to wrongly paid supplement; or

(b) if it is repaid after the giving of a notice under section 1061ZZCZ, 1061ZZDG, 1061ZZDQ or 1061ZZEA.

1061ZZCM How to work out discount

(1) If, during the contract period, a person makes a repayment of an amount that is less than the amount outstanding, the person is entitled, in respect of the repayment, to a discount of an amount worked out using the formula:

![]()

(2) If, during the contract period, a person makes a repayment of an amount that is equal to the amount outstanding, the person is entitled, in respect of the repayment, to a discount of an amount worked out using the formula:

![]()

(3) If, apart from this subsection, an amount worked out under subsection (1) or (2) would be an amount of dollars and cents, the amount is to be rounded to the nearest number of whole dollars (rounding 50 cents upwards).

1061ZZCN Effect of making a repayment during contract period

Application

(1) This section applies if a person, at a time (the repayment time ) during the contract period of a financial supplement contract made by the person with a participating corporation, makes a repayment (the relevant repayment ) in respect of the amount outstanding under the contract. For the purposes of this section, it is first necessary to work out whether an indexation amount is taken to have existed in respect of the contract immediately before the repayment time.

When an indexation amount is taken to have existed

(2) For the purposes of this section, an indexation amount is taken to have existed in respect of the contract immediately before the repayment time if:

(a) an amount outstanding under the contract existed immediately before the repayment time under section 1061ZZCH; and

(b) that amount outstanding exceeds the amount worked out using the formula:

Meaning of expressions used in formula

(3) For the purpose of applying the formula in subsection (2) immediately before the repayment time:

"amounts repaid" means the total of the amounts repaid under the contract before the repayment time.

"amounts previously notionally repaid" means the total of the amounts notionally repaid under the contract before the repayment time because of the application of this section in respect of previous repayments.

"principal sum" means the principal sum immediately before the repayment time.

What constitutes indexation amount

(4) The indexation amount referred to in subsection (2) is the amount of the excess referred to in paragraph (2)(b).

If no indexation amount

(5) If no indexation amount existed in respect of the contract immediately before the repayment time, the person is taken to have repaid to the corporation at the repayment time an amount (an amount notionally repaid ) equal to the discount to which the person is entitled in respect of the relevant repayment.

If discount does not exceed indexation amount

(6) If:

(a) an indexation amount existed in respect of the contract immediately before the repayment time; and

(b) the discount to which the person is entitled in respect of the relevant repayment is equal to or less than the indexation amount;

the amount outstanding under the contract is taken to be reduced by the discount.

If discount exceeds indexation amount

(7) If:

(a) an indexation amount existed in respect of the contract immediately before the repayment time; and

(b) the discount to which the person is entitled in respect of the relevant repayment exceeds the indexation amount;

the following paragraphs have effect:

(c) the amount outstanding under the contract is taken to be reduced by the indexation amount;

(d) the person is taken to have repaid to the corporation at the repayment time an amount (an amount notionally repaid ) equal to the excess.

Commonwealth to pay corporation amounts notionally repaid

(8) The Commonwealth must pay to the corporation an amount equal to any amount notionally repaid.

1061ZZCO Rights and liabilities of participating corporation if repayment made

(1) This section applies if, immediately after a repayment is made under a financial supplement contract made by a participating corporation, the total of the amounts repaid and the amounts notionally repaid is equal to or exceeds the principal sum.

(2) The corporation's rights under the contract are, by this subsection, transferred to the Commonwealth immediately after the repayment is made.

(3) If the total of the amounts repaid and the amounts notionally repaid exceeds the principal sum, the corporation must pay the excess to the Commonwealth.

Subdivision C -- What happens at the end of the contract period

1061ZZCP Corporation's rights at end of contract period

(1) This section applies if, at the end of the contract period of a financial supplement contract made by a participating corporation, the corporation's rights under the contract have not previously been transferred to the Commonwealth.

(2) The corporation's rights under the contract are, by this subsection, transferred to the Commonwealth at the end of the contract period.

(3) If the principal sum exceeds the total of the amounts repaid and the amounts notionally repaid, the Commonwealth must pay the excess to the corporation.

(1) As soon as practicable after the termination date of a financial supplement contract made by a person with a participating corporation, the Secretary must arrange for written notice (the termination notice ) to be given to the person if such a notice has not already been given under the Social Security Student Financial Supplement Scheme 1998 or the Student Assistance Act 1973 as in force at a time before 1 July 1998.

(2) The termination notice must:

(a) state that, at the end of the contract period, the person no longer owes a debt to the corporation under the contract and will not receive a discount for repayments made after that time; and

(b) state that, on a date referred to in the notice, being 1 June immediately following the termination date, the person incurred or will incur an FS debt or FS debts to the Commonwealth; and

(c) specify the amount of that debt or the amounts of those debts; and

(d) state that the person is entitled at any time to make repayments in respect of that debt or those debts and that so much of that debt or those debts as is not voluntarily repaid by the person will be recovered through the taxation system.

1061ZZCR Secretary may give notice correcting information in previous notice

If, after a notice has been given to a person under this Division or under the corresponding provision of the Social Security Student Financial Supplement Scheme 1998 or of the Student Assistance Act 1973 as in force at a time before 1 July 1998 (including a notice previously given under this section or under a provision of that Scheme or Act corresponding to this section), the Secretary is satisfied that significant information in the notice was not, or is no longer, correct, the Secretary must arrange for a further written notice to be given to the person setting out the correct information.

1061ZZCS Person may request notice to be corrected

(1) If a person considers that a notice given to the person under this Division or under the corresponding provision of the Social Security Student Financial Supplement Scheme 1998 or of the Student Assistance Act 1973 as in force at a time before 1 July 1998, was not, or is no longer, correct in a significant respect, the person may, by writing, request the Secretary to correct the notice.

(2) The person must make the request within 14 days after the date when the notice was received by the person or within such further period as the Secretary allows.

(3) A request must set out the information that is considered to be incorrect and the grounds on which the person considers the information to be incorrect.

(4) If a request is received by the Secretary, the Secretary must arrange, as soon as practicable, for it to be considered and for written notice of the decision on the request to be given to the person.

1061ZZCT Effect of notices and requests

(1) A notice to a person under this Division or under the corresponding provision of the Social Security Student Financial Supplement Scheme 1998 or of the Student Assistance Act 1973 as in force at a time before 1 July 1998, is intended only to give information to the person and an FS debt of the person is not affected by a failure to give a notice or by any incorrect statement or information in a notice given under this Division or that corresponding provision.

(2) The making by a person of a request for a notice to be corrected does not affect an FS debt of the person.

Part 2B.2 -- Payments of financial supplement under scheme to stop in certain circumstances

Division 1 -- Payments to stop at request of recipient

1061ZZCU Person may ask for payment to stop

A person who is a party to a financial supplement contract with a participating corporation may, by written notice to the corporation lodged at an office of the corporation, tell the corporation that he or she does not want further payments under the contract to be made after a day stated in the notice.

(1) If a person gives a notice referred to in section 1061ZZCU, the corporation is discharged from liability to make further payments to the person under the contract from the end of the day stated in the notice.

(2) However, if the corporation continues to make payments to the person after that day, any amounts paid after that day or the end of 4 weeks after the day on which the notice was given to the corporation, whichever is the later:

(a) are taken not to be payments of financial supplement made under the contract; and

(b) are repayable by the person to the corporation; and

(c) may be recovered by the corporation as a debt due to it by the person.

Subdivision A -- Notice that payments are to stop

1061ZZCW Secretary must give notice to person and corporation

(1) This section applies if:

(a) a person is a party to a financial supplement contract with a participating corporation; and

(b) the decision (the original decision ) made in respect of the person under section 1061ZZAC, or under Part 3 of the Social Security Student Financial Supplement Scheme 1998, is reviewed under Chapter 6; and

(c) the person remains eligible to obtain financial supplement for the year or part of the year to which the contract relates; and

(d) because of the review, the original decision is varied so that the maximum amount (the original amount ) of financial supplement that the person is eligible to obtain under the contract is reduced to another amount (the revised amount ); and

(e) the revised amount is equal to or less than the amount of financial supplement that the person has already been paid under the contract.

(2) The Secretary must give written notice to the person and to the corporation:

(a) stating:

(i) that this section applies to the contract; and

(ii) that the corporation must stop paying financial supplement to the person; and

(b) specifying:

(i) the revised amount that the person is eligible to obtain; and

(ii) the amount (if any) of financial supplement paid in excess of the revised amount.

(1) If the Secretary gives a notice under section 1061ZZCW to the person and the corporation, then, unless the decision on the review is set aside or varied after a further review under Chapter 6, the following provisions have effect.

(2) From the time when the notice is given to the corporation, the corporation is discharged from liability to make further payments to the person under the contract.

(3) However, if the corporation continues to make payments to the person after that time, any amounts paid after the end of 4 weeks after the day on which the notice is given to the corporation:

(a) are taken not to be payments of financial supplement made under the contract; and

(b) are repayable by the person to the corporation; and

(c) may be recovered by the corporation as a debt due to it by the person.

1061ZZCY This Subdivision is subject to sections 1061ZZFS and 1061ZZFT

This Subdivision has effect subject to sections 1061ZZFS and 1061ZZFT.

Subdivision B -- Original amount paid because person failed to notify change of circumstances

1061ZZCZ Secretary may give notice to person and corporation

(1) If the Secretary is satisfied that:

(a) a person who is a party to a financial supplement contract with a participating corporation was given a notice under section 1061ZZCW; and

(b) the person failed to tell the Secretary, in response to a notice under section 561B, 586B, 1061PZQ or 1061ZZBR, about the happening of, or about becoming aware of the likely happening of, a stated event or change of circumstances within the period prescribed for complying with the notice; and

(c) the person was paid the original amount after the end of that period; and

(d) the payment of the original amount after the end of that period resulted from the person's failure to comply with the notice referred to in paragraph (b);

the Secretary may give to the person and the corporation a notice stating that he or she is so satisfied and telling them that this Subdivision applies in relation to them.

(2) If the Secretary is satisfied that:

(a) a person who is a party to a financial supplement contract with a participating corporation was given a notice under section 14.5 of the Social Security Student Financial Supplement Scheme 1998; and

(b) the person failed to tell the Secretary, in response to a notice under section 561B, 586B or 1061PZQ, or a notice under section 12.2 of that Scheme, about the happening of, or about becoming aware of the likely happening of, a stated event or change of circumstances within the period prescribed for complying with the notice; and

(c) the person was paid the original amount after the commencement of this Chapter; and

(d) the payment of the original amount after the commencement of this Chapter resulted from the person's failure to comply with the notice referred to in paragraph (b);

the Secretary may give to the person and the corporation a notice stating that he or she is so satisfied and telling them that this Subdivision applies in relation to them.

If the Secretary gives a notice under section 1061ZZCZ to the person and the corporation, then, unless the decision to give the notice is set aside or varied after a review under Chapter 6, the following provisions have effect.

1061ZZDB Transfer of corporation's rights to Commonwealth

(1) On the giving of the notice to the corporation, the corporation's rights referred to in subsection (2) or (3), as the case may be, are transferred to the Commonwealth by this subsection.

(2) If the notice was given under subsection 1061ZZCZ(1), the rights transferred are the corporation's rights under the contract that relate to payment of financial supplement during the period:

(a) beginning at the end of the period referred to in paragraph 1061ZZCZ(1)(b); and

(b) ending at the end of the period of 4 weeks referred to in subsection 1061ZZCX(3).

(3) If the notice was given under subsection 1061ZZCZ(2), the rights transferred are the corporation's rights under the contract that relate to payment of financial supplement during the period: