Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts

1 Section 3 (index of definitions)

Insert the following entries in their appropriate alphabetical positions, determined on a letter - by - letter basis:

actual means | 10B(2) |

AIC scheme | 10B(2) |

appropriate tax year | 10B(2) |

base tax year | 10B(2) |

business | 10B(2) |

claimant/recipient | 10B(2) |

combined parental income | 10B(2) |

designated parent | 10B(3) |

family actual means free area | 10B(2) |

income assistance | 10B(4) |

independent employment | 10B(2) |

insolvent under administration | 10B(2) |

interest | 10B(2) |

liquid assets | 10B(2) |

net passive business loss | 10B(2) |

passive business | 10B(2) |

relevant person | 10B(2) |

savings | 10B(5) and (6) |

secondary course | 10B(2) |

secondary student | 10B(2) |

trust | 10B(2) |

unlisted public company | 10B(2) |

2 After section 10A

Insert:

10B Family actual means test definitions

(1) This section has effect for the purposes of Module G of the Youth Allowance Rate Calculator at the end of section 1067G.

(2) Unless the contrary intention appears:

"actual means" has the meaning given by point 1067G - G8.

"AIC scheme" means the Commonwealth scheme known as the Assistance for Isolated Children Scheme.

"appropriate tax year" has the meaning given by point 1067G - G4.

"base tax year" has the same meaning as in point 1067G - F5.

"business" has the meaning given by point 1067G - F19A.

"claimant/recipient" has the meaning given by point 1067G - G7.

"combined parental income" has the meaning given by point 1067G - F10.

"designated parent" has the meaning given by subsection (3).

"family actual means free area" has the meaning given by point 1067G - G14.

"income assistance" has the meaning given by subsection (4).

"independent employment" means employment engaged in by a person that is not provided by:

(a) a family member of the person; or

(b) a proprietary company, an unlisted public company, a partnership, or a trust, in which the person, or a family member of the person, has an interest.

"insolvent under administration" has the same meaning as in the Corporations Law.

"interest" in a trust:

(a) includes:

(i) the interest of a settlor in property subject to the trust; and

(ii) a power of appointment under the trust; and

(iii) a power to rescind or vary a provision of, or to rescind or vary the effect of the exercise of a power under, the trust; and

(iv) an interest that is conditional, contingent or deferred; but

(b) does not include:

(i) the interest of a person as an agent or creditor of the trustee; or

(ii) the interest of a person as a person employed by the trustee.

"liquid assets" means assets that, under subsection 14A(1), are liquid assets for Parts 2.11, 2.11A, 2.12 and 2.14.

"net passive business loss" , for the appropriate tax year, means a loss that, under subpoint 1067G - F11 (4), is a net passive business loss for that year.

"passive business" means a business that, under point 1067G - F19A, is a passive business for the purposes of subpoint 1067G - F11(4).

"relevant person" has the meaning given by point 1067G - G7.

"savings" has the meaning given by subsection (5).

"secondary course" means a course that is determined, under section 5D of the Student Assistance Act 1973 , to be a secondary course for the purposes of that Act.

"secondary student" means a person who is receiving youth allowance and is undertaking full - time study in respect of a secondary course.

"trust" does not include:

(a) a trust in relation to an account held in a bank only for the benefit of a dependent child of the trustee; or

(b) a trust under which property of the estate of a deceased person, or of a person who is an insolvent under administration, is distributed; or

(c) a trust in relation to a superannuation fund within the meaning of the Superannuation Industry (Supervision) Act 1993 that is not an excluded fund within the meaning of that Act; or

(d) a public unit trust in which units are held by 50 or more persons who are not family members of the trustee, or are offered for subscription or purchase by the public; or

(e) the trust constituted by a trust account that the trustee is required by a law to establish; or

(f) a charitable trust; or

(g) a trust created by operation of law.

"unlisted public company" means a public company that is not listed on a stock exchange.

(3) A parent of a person (the person concerned ) is a designated parent for a youth allowance payment period if:

(a) within 10 years before 1 January in the calendar year in which the youth allowance payment period ends, the parent first entered Australia under a permanent visa or entry permit within the meaning of the Migration Act 1958 for the grant of which a criterion or requirement was that the parent demonstrate skills in business; or

(b) the parent has an interest (the value of which is $2,500 or more) in assets outside Australia and its external territories; or

(c) in the base tax year, the parent had an interest in:

(i) a proprietary company; or

(ii) an unlisted public company; or

(iii) a trust; or

(d) in the base tax year, the parent derived income of $2,500 or more from a source outside Australia and its external territories (except Norfolk Island ) that does not consist only of income from a pension or similar payment, and was either:

(i) ordinary income; or

(ii) an amount included in the person concerned's combined parental income; or

(e) the parent derived income from salary or wages in the base tax year and has claimed, or will claim, a tax deduction for a business loss (whether for that year or a previous year) that does not consist only of a net passive business loss; or

(f) in the base tax year, the parent was a member of a partnership; or

(g) in the base tax year, the parent:

(i) worked for gain or reward otherwise than under a contract of employment or apprenticeship, whether or not the parent employed one or more other persons; but

(ii) was not, in so working, wholly or mainly engaged in a primary production business owned by him or her.

(4) A payment received by a person is income assistance if it is:

(a) a youth allowance received by a person who is undertaking full - time study; or

(b) an austudy payment; or

(c) a payment under this Act (except a family tax payment), or the Veterans' Entitlements Act 1986 , that is exempt from income tax under Division 1AA of Part 3 of the Income Tax Assessment Act 1936 or Subdivision 52 - A, 52 - B or 52 - C of the Income Tax Assessment Act 1997 ; or

(d) a payment under:

(i) a Student Financial Supplement Scheme; or

(ii) the scheme known as the ABSTUDY scheme; or

(iii) the AIC scheme; or

(e) an AUSTUDY allowance; or

(f) a payment under a scholarship; or

(g) a payment by a State or Territory, or a State or Territory authority, to assist the primary, secondary or tertiary education of a student.

(5) The savings of a person include the following amounts:

(a) the person's share in any profit retained by a company of which the person is a director, or shareholder, who has a substantial influence over whether company profit is distributed to:

(i) the person or a family member of the person; or

(ii) another company, or a partnership or trust, in which the person or a family member of the person has an interest;

(b) the person's share in any profit retained by a partnership of which the person is a member who has a substantial influence over whether partnership profit is distributed to:

(i) the person or a family member of the person; or

(ii) another partnership, or a company or trust, in which the person or a family member of the person has an interest;

(c) any undistributed profit of a trust that is attributable to the person;

(d) the total undistributed profit of a trust where:

(i) the person is a trustee or beneficiary of the trust; and

(ii) no part of that undistributed profit is attributable to the person; and

(iii) the person controls the trust.

(6) For the purposes of subparagraph (5)(d)(iii), a person controls a trust if the person has:

(a) a power of appointment under the trust; or

(b) a power to rescind or vary a provision of, or to rescind or vary the effect of the exercise of a power under, the trust; or

(c) a substantial influence over whether trust profit is distributed to:

(i) the person or a family member of the person; or

(ii) another trust, or a company or partnership, in which the person or a family member of the person has an interest.

3 Section 1067G (Module G of the Youth Allowance Rate Calculator)

Repeal the Module, substitute:

Module G -- Family actual means test

How to work out effect of actual means of a person's family on maximum payment rate

1067G - G1 This is how to work out the effect (if any) of the actual means of a person's family on the person's maximum payment rate in respect of a particular youth allowance payment period.

Method statement

Step 1 . Work out whether the family actual means test applies to the person using Submodule 2.

Step 2 . If the family actual means test applies to the person, identify the appropriate tax year in relation to the person using Submodule 3.

Step 3 . Work out the actual means of the person's family for that year using Submodule 4.

Step 4 . Work out the person's family actual means free area using Submodule 5.

Step 5 . Work out the person's reduction for family actual means for that year using Submodule 6.

Submodule 2 -- Persons to whom family actual means test applies

General provision

1067G - G2 Subject to point 1067G - G3, the family actual means test applies to a person who:

(a) claims or receives youth allowance; and

(b) is not independent; and

(c) has a parent who is a designated parent.

Exceptions

1067G - G3(1) The family actual means test does not apply to a person:

(a) while a family member of the person is receiving exceptional circumstances relief payment; or

(b) for so much of the calendar year in which the relief payment is received as follows the cessation of the relief payment.

(2) In subpoint (1):

"exceptional circumstances relief payment" means:

(a) exceptional circumstances relief payment under the Farm Household Support Act 1992 ; or

(b) drought relief payment under that Act as in force immediately before the commencement of the Farm Household Support Amendment (Restart and Exceptional Circumstances) Act 1997 .

Submodule 3 -- Identification of appropriate tax year

Meaning of appropriate tax year

1067G - G4 The appropriate tax year in relation to a person for a youth allowance payment period is:

(a) the base tax year for the period; or

(b) if a determination of a tax year is made by the Secretary under point 1067G - G6 in relation to the person in respect of the period--the tax year specified in the determination.

Person who may request Secretary to determine appropriate tax year

1067G - G5(1) This point applies to a person who claims or receives youth allowance if the following conditions are satisfied.

(2) The first condition is that, except for this point, youth allowance:

(a) would not be payable to the person because the rate of youth allowance is calculated to be nil; or

(b) would be calculated to be payable at a reduced rate.

(3) The second condition is that the person gives to the Secretary, in writing:

(a) evidence, or an estimate, that the amount of the actual means of the person's family for the tax year (the following tax year ) immediately after the base tax year is substantially less than it was in the base tax year:

(i) because of a circumstance or event that is beyond the control of the person and the person's family members; or

(ii) because the person or a family member of the person is undertaking full - time study in the following tax year; or

(iii) because a designated parent of the person has ceased to be a parent of the kind referred to in paragraph 10B(3)(c), (d), (e), (f) or (g); and

(b) if subparagraph (a)(i) applies--evidence of the circumstance or event concerned;

and, if the person gives an estimate as referred to in paragraph (a), the person agrees, in writing, to the person's rate of youth allowance being recalculated if the actual means of the person's family for the following tax year exceed the amount of the estimate.

(4) For the purposes of subparagraph (3)(a)(i), an expected decrease in the profitability of a business is not ordinarily to be taken to be a circumstance or event that is beyond the control of the person and the person's family members.

(5) The third condition is that the person's family actual means are unlikely to increase beyond the amount evidenced, or estimated, under paragraph (3)(a) for the 2 years beginning on the later of the following days:

(a) 1 January in the following tax year; or

(b) the day on which the amount of the family's actual means was reduced.

Making of request

1067G - G6(1) A person to whom point 1067G - G5 applies may request the Secretary, in accordance with a form approved by the Secretary, to make a determination under this point in relation to a youth allowance payment period.

(2) If:

(a) the person makes such a request; and

(b) the youth allowance payment period to which the request relates ends on or after the later of:

(i) the day on which the request is made; or

(ii) 1 January in a year;

the Secretary must determine, subject to subpoint (3), that the appropriate tax year for the person in relation to the youth allowance payment period is the tax year immediately after the base tax year.

(3) If the request is based on an estimate, the Secretary may make a determination only if he or she is satisfied that the estimate is current and reasonable.

Submodule 4 -- Actual means of person's family

How to work out the actual means of person's family

1067G - G7(1) To work out the actual means of the family of a person (the claimant/recipient ) for the appropriate tax year, first calculate, in accordance with this Submodule, the actual means of the claimant/recipient and the actual means of each family member of the claimant/recipient and then apply the formula in subpoint 1067G - G13(1) using the results of those calculations.

(2) A reference in any of the following provisions of this Submodule to a relevant person is a reference to the claimant/recipient or a family member of the claimant/recipient.

Meaning of actual means

1067G - G8(1) Subject to point 1067G - G9, the actual means of a relevant person for the appropriate tax year is an amount equal to the total spending and savings of the person in that tax year.

(2) An amount of spending or savings is taken to have been spent or saved in the appropriate tax year if the Secretary considers that the amount should be so taken.

Amounts not included in actual means of a relevant person

1067G - G9(1) This point applies in working out the actual means, for the appropriate tax year, of a relevant person.

(2) The following amounts spent or saved in the appropriate tax year by the person are not included in the actual means of the person:

(a) spending or savings from any income assistance received by the person in that tax year;

(b) spending for the maintenance of:

(i) a child of the person if the person does not have legal responsibility for the day - to - day care, welfare and development of the child; or

(ii) a former partner of the person;

(c) spending in boarding away from home a family member who qualified for the boarding allowance under the AIC scheme--to the extent of the lesser of:

(i) the amount of the spending; and

(ii) $5,274, less the amount of the boarding allowance;

(d) spending in boarding away from home a family member who:

(i) is a secondary student; and

(ii) is not independent; and

(iii) is required to live away from home;

to the extent of the lesser of:

(iv) the amount of the spending; and

(v) $5,274, less the amount of the person's after - tax income concession (if any) for the student under point 1067G - G11;

(e) if the person has a disability--spending to acquire, or modify, property to assist the person to cope with the disability;

(f) spending or savings from any arm's length loan received by the person in that tax year;

(g) spending to repay a loan received by the person in that tax year that is not an arm's length loan, or to pay interest on the loan;

(h) spending or savings from the proceeds of any liquidation of assets of the person that were held at the beginning of that year;

(i) spending or savings from the amount of any windfall gain that is not a gift to the person;

(j) spending or savings, of not more than $6,000, from income that is exempt income under item 1.4 of the table in section 51 - 5 of the Income Tax Assessment Act 1997 ;

(k) spending or savings from any part of a lump sum compensation payment made to the person on which tax is not payable under the Income Tax Assessment Act 1936 or the Income Tax Assessment Act 1997 .

(3) Also, the actual means of the person do not include the following amounts:

(a) subject to subpoint (4), an amount equal to the amount of the income or resources of a business of the person that is deductible under the Income Tax Assessment Act 1936 , or the Income Tax Assessment Act 1997 because the amount was, or will be, necessarily incurred in carrying on the business;

(b) an amount equal to the amount of any reduction in liquid assets of the person held at the beginning of the appropriate tax year and not accounted for by spending of a kind referred to in subpoint (2).

(4) The reference in paragraph (3)(a) to the amount of the income or resources of a business of the person that is deductible does not include:

(a) the amount of any losses from the business that are carried forward from a tax year earlier than the appropriate tax year; or

(b) the amount of a contribution to a superannuation fund, in relation to the business, that exceeds:

(i) for an employee--the minimum contribution for the employee under the Superannuation Guarantee (Administration) Act 1992 ; or

(ii) for a person engaged otherwise than as an employee--the lesser of $3,000 and the total amount of the contributions for the person, and each family member of the person, for the appropriate tax year.

Amounts not included in actual means of a family member of claimant/recipient

1067G - G10 In working out the actual means, for the appropriate tax year, of a family member of the claimant/recipient, being a family member of a kind referred to in subparagraph 23(15)(b)(i), (ii) or (iii), spending or savings from any income of the family member from independent employment (except so much of such spending or savings as exceeds $6,000) is not included.

After - tax income concession for secondary student

1067G - G11(1) This point explains how a relevant person's after - tax income concession for a secondary student referred to in subparagraph 1067G - G9(2)(d)(v) is worked out.

(2) The purpose of the concession is to compensate the family of a secondary student who is required to live away from home for the additional expenditure incurred in maintaining the student while he or she is required to live away from home. The compensation is effected by reducing the actual means of the family by an amount calculated by reference to the additional amount of youth allowance that is payable because the student is required to live away from home.

(3) Accordingly, a relevant person's after - tax income concession is the amount worked out using the formula:

![]()

(4) In this section:

"after-tax income" means the amount calculated using the formula:

![]()

"income tax" means the amount of income tax, before any rebates, and without regard to any increase occurring in the tax free threshold because of section 20C or 20D of the Income Tax Rates Act 1986 , that would be notionally payable by a person for the appropriate tax year if the person's taxable income were the amount obtained by dividing the parental income by the number of parents whose income is included in the claimant/recipient's combined parental income.

"medicare levy" means the amount of medicare levy that would be notionally payable by a married person for the appropriate tax year if:

(a) the person's taxable income were the amount obtained by dividing the parental income by the number of parents whose income is included in the claimant/recipient's combined parental income; and

(b) the person were a parent of the student, and of all the family members of the student who were children referred to in paragraph 23(15)(b); and

(c) the student and each of those children had no separate net income, within the meaning of section 159J of the Income Tax Assessment Act 1936 , in the appropriate tax year.

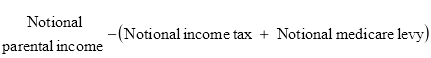

"notional after-tax income" means the amount calculated using the formula:

"notional income tax" means the amount of income tax, before any rebates, and without regard to any increase occurring in the tax free threshold because of section 20C or 20D of the Income Tax Rates Act 1986 , that would be notionally payable by a person for the appropriate tax year if the person's taxable income were the amount obtained by dividing the notional parental income by the number of parents whose income is included in the claimant/recipient's combined parental income.

"notional medicare levy" means the amount of medicare levy that would be notionally payable by a married person for the appropriate tax year if:

(a) the person's taxable income were the amount obtained by dividing the notional parental income by the number of parents whose income is included in the claimant/recipient's combined parental income; and

(b) the person were a parent of the student, and of all the family members of the student who were children referred to in paragraph 23(15)(b); and

(c) the student and each of those children had no separate net income, within the meaning of section 159J of the Income Tax Assessment Act 1936 , in the appropriate tax year.

"notional parental income" means the minimum amount of the combined parental income in relation to the student for the appropriate tax year that would cause the student's youth allowance rate to be reduced to nil if the student's maximum basic rate were the amount specified in column 3 of item 1 of Table BA in point 1067G - B2 as at 1 January of that year.

"number of students" means the number of persons who:

(a) are included in the group of persons constituted by the student and his or her family members; and

(b) are secondary students; and

(c) receive youth allowance; and

(d) are not independent; and

(e) are required to live away from home.

"parental income" means the minimum amount of the combined parental income in relation to the student for the appropriate tax year that would cause the student's youth allowance rate to be reduced to nil if the student's maximum basic rate were the amount specified in column 3 of item 3 of Table BA in point 1067G - B2 as at 1 January of that year.

Powers of Secretary to determine fair market value

1067G - G12(1) If the Secretary considers that an amount of spending that would otherwise be included in the actual means of a relevant person does not represent the fair market value of the matter or thing to which the spending related:

(a) the Secretary must determine the fair market value of the matter or thing; and

(b) an amount equal to the value so determined is taken to be the amount of the spending.

(2) If the Secretary considers that spending by a person other than a family member of a relevant person is spending for the benefit of the relevant person:

(a) the Secretary must determine the fair market value of the matter or thing to which the spending related; and

(b) an amount equal to the value so determined is taken to be an amount of spending by the relevant person.

Actual means of family of claimant/recipient

1067G - G13(1) The actual means of the family of a claimant/recipient for the appropriate tax year is the amount worked out using the formula:

![]()

(2) In this section:

"after-tax income" , in relation to a parent of the claimant/recipient for the appropriate tax year, means the gross income of the parent for that year less any income tax or medicare levy payable in respect of the parent's taxable income for that year.

"GAM (gross actual means)" , in relation to the claimant/recipient's family for the appropriate tax year, means the total of the amounts of the actual means, for that year, of the claimant/recipient and of each of the family members of the claimant/recipient.

"NITML (notional income tax/medicare levy)" , in relation to a parent of the claimant/recipient for the appropriate tax year, means the sum of:

(a) the amount of income tax, before any rebates, and without regard to any increase occurring in the tax free threshold because of section 20C or 20D of the Income Tax Rates Act 1986 that would be notionally payable by the parent for that year; and

(b) the amount of medicare levy that would be notionally payable by the parent for that year if none of the parent's children who are children referred to in paragraph 23(15)(b) had a separate net income within the meaning of section 159J of the Income Tax Assessment Act 1936 in that year;

that would result in the after - tax income of the parent for that year being an amount equal to one - half of GAM of the claimant/recipient's family for that year.

"NPBL (net passive business loss)" means the sum of the net passive business losses (if any) of each of the parents of the claimant/recipient in the appropriate tax year.

"TFTI (tax-free threshold increase)" means 20% of the total of the amounts calculated in respect of each of the parents of the claimant/recipient for the appropriate tax year under section 20C (without regard to section 20K) of the Income Tax Rates Act 1986 .

"TNITML (total notional income tax/medicare levy)" means the total of the amounts of NITML in relation to each of the parents of the claimant/recipient for the appropriate tax year.

Submodule 5 -- Family actual means free area

Family actual means free area

1067G - G14 A person's family actual means free area is the amount that is the person's parental income free area worked out under Submodule 5 of Module F.

Submodule 6 -- Reduction for family actual means

Reduction for family actual means

1067G - G15(1) A person's reduction for family actual means for the appropriate tax year is the amount obtained by dividing by 26 the person's family actual means excess for that year.

(2) A person's family actual means excess for the appropriate tax year is the amount worked out using the formula:

![]()

where:

"actual family means" means the actual means of the person's family for that year.

"actual means free area" means the person's family actual means free area.

(3) If the amount worked out under subsection (2) is an amount of dollars and cents, disregard the amount of cents.

(4) If the amount worked out under subsection (2) is less than $1, the amount is taken to be nil.