Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

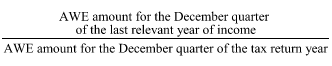

Commonwealth Consolidated Acts(1) The ATI indexation factor is:

where:

"AWE amount" for a December quarter of a year of income means the amount published for the reference period in the quarter by the Australian Statistician in a document titled "Average Weekly Earnings, Australia" (or, if that title changes, in a replacement document) under the headings "Average Weekly Earnings--Trend--Persons--All employees total earnings" (or, if any of those headings change, under any replacement headings).

"December quarter" of a year of income means the quarter ending on 31 December of that year.

"reference period" in a December quarter of a year of income means the period described by the Australian Statistician as the last pay period ending on or before the third Friday of the middle month of the quarter.

"tax return year" means:

(a) if subsection 58(3) applies--the year of income before the last relevant year of income in relation to a child support period; or

(b) if subsection 58(4) applies--the earlier year of income that applies under paragraph 58(4)(c).

(2) The ATI indexation factor is to be calculated to 3 decimal places (rounding up if the fourth decimal place is 5 or more).

(3) If:

(a) the Australian Statistician publishes an AWE amount (the later amount ) for a December quarter of a year of income; and

(b) the later amount is published in substitution for an AWE amount for that quarter that was previously published by the Australian Statistician or that was applicable because of subsection (5);

the publication of the later amount is to be disregarded for the purposes of this section.

Determination of amount by Minister

(4) If the Australian Statistician has not published an AWE amount for a December quarter of a year of income before the end of the first 31 March after the end of that quarter, the Minister may, by legislative instrument, determine an amount for that quarter.

(5) If the Minister does so, the AWE amount for that quarter is taken to be the amount determined in the instrument under subsection (4) for that quarter.