Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated ActsAssessment of annual rate

(1) The Registrar must assess an annual rate of child support payable by a parent for a child for a day in a child support period as the rate specified in subsection (2) if:

(a) the parent did not receive an income support payment during the last relevant year of income; and

(b) the following amount is less than the pension PP (single) maximum basic amount:

(i) if subparagraph (ii) does not apply--the parent's adjusted taxable income determined in accordance with section 43 for the last relevant year of income for the child support period;

(ii) if the day occurs in the application period for an income election made by the parent--the amount that applied under subsection 60(2) or (3), or that was worked out under subsection 62A(1); and

(c) the parent does not have at least shared care of the child during the relevant care period.

How much is the annual rate

(2) The annual rate of child support payable is $1060.

Note: The annual rate of child support specified in subsection (2) is indexed under section 153A.

(3) The Registrar must not assess the total annual rate of child support payable by a parent under subsection (1) (including any child support that is not actually payable because of subsection 40B(1)) for a day in a child support period as more than 3 times the rate specified in subsection (2).

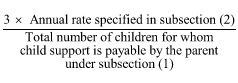

(4) If an annual rate of child support is payable by a parent under subsection (1) (including any child support that is not actually payable because of subsection 40B(1)) for more than 3 children for a day in a child support period, then the annual rate of child support payable by the parent for each child for a day in the child support period is:

(4A) For the purposes of subsection (4), if a parent is liable to pay child support for one or more children under an administrative assessment under the law of a reciprocating jurisdiction, then that child support is taken to be payable by the parent for those children under subsection (1).

Paying the annual rate to more than one person

(5) If, (disregarding section 40B) the rate under subsection (2) or (4) would be payable for a child to:

(a) a parent and a non - parent carer of the child; or

(b) 2 non - parent carers of the child;

then, subject to section 40B, the annual rate of child support for the child worked out under this section is payable in accordance with section 40A.

Note: Under section 40B, a non - parent carer of a child is not entitled to be paid child support unless he or she applies under section 25A in relation to the child.