Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) Where:

(a) a person is, or becomes, entitled to a pension under this Division because the person is:

(i) a spouse in relation to a contributing member who died on or after the commencement of the Commonwealth Superannuation Schemes Amendment Act 1992 ; or

(ii) a widow or widower of a contributing member who died on or after the commencement of the Defence Legislation Amendment Act (No. 2) 1990 but before the commencement of the Commonwealth Superannuation Schemes Amendment Act 1992 ; or

(iii) a widow or widower of a contributing member who died on or after 15 October 1990 but before the commencement of the Defence Legislation Amendment Act (No. 2) 1990 ; and

(b) in the case of a contributing member referred to in subparagraph (a)(iii)--that member is a member of a prescribed class of deceased spouses;

the person (in this section called the elector ) may, by notice in writing given to CSC, elect to commute a portion of his or her pension in accordance with this section.

(1A) In subsection (1), widow and widower have their respective meanings given by this Act as in force immediately before the commencement of the Commonwealth Superannuation Schemes Amendment Act 1992 .

(2) A notice given by an elector under subsection (1) must:

(a) specify the amount that is to be payable to him or her by virtue of the commutation (in this section called the commuted amount ); and

(b) be given not later than one year after the elector becomes entitled to the pension.

(3) The amount referred to in subsection (2) must not exceed an amount calculated in accordance with the following formula:

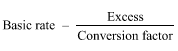

![]()

where:

Annual Rate of Pay is the annual rate of pay at the time of death of the deceased contributing member who was, immediately before his or her death, the spouse of the elector.

(4) Where an elector makes an election under this section, then, subject to subsection (4A):

(a) the Commonwealth must pay to the elector the commuted amount; and

(b) the amount per annum of the pension payable to the elector, on and after the day on which the election takes effect, is the amount per annum that, but for this paragraph, would be payable to the elector, reduced by an amount calculated by dividing the commuted amount by 25.

(4A) If:

(a) an elector makes an election under this section; and

(b) the deceased contributing member's surcharge debt account is in debit when the pension becomes payable to the elector;

the following provisions apply:

(c) the Commonwealth must pay to the elector the difference between the commuted amount and:

(i) the member's surcharge deduction amount; or

(ii) if the member's surcharge deduction amount exceeds the commuted amount--so much of the surcharge deduction amount as does not exceed the commuted amount;

(d) the amount per annum of the pension payable to the elector, on and after the day on which the election takes effect, is:

(i) if subparagraph (ii) does not apply--the amount per annum referred to in paragraph (4)(b); or

(ii) if the member's surcharge deduction amount exceeds the commuted amount--the amount per annum worked out by using the formula:

where:

"basic rate" means the amount per annum referred to in paragraph (4)(b).

"conversion factor" is the factor that is applicable to the member under the determination made by CSC under section 124A.

excess means the amount by which the member's surcharge deduction amount exceeds the commuted amount.

(5) For the purposes of this section, an election is taken to have been made, and takes effect, on the day on which the notice of election is received by CSC.