Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) This section applies for the purpose of working out a dollar amount under paragraph 6(a) or (b) or 7(a) or (b) for the calendar year (the current year ) beginning on 1 January 2019 or a later calendar year (the current year ) if in the previous year the Minister did not make an instrument under section 7A for the purposes of that paragraph for the current year.

(2) The dollar amount under that paragraph is on 1 January of the current year replaced by the amount worked out using the formula:

![]()

Indexation factor

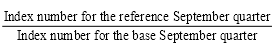

(2A) The indexation factor for a 1 January is the number worked out using the formula:

where:

"base September quarter" means the last September quarter before the reference September quarter.

"reference September quarter" means the September quarter in the year before the current year.

Rounding factors and amounts etc.

(3) The indexation factor worked out under subsection ( 2A) must be rounded up or down to 3 places (rounding up in the case of exactly halfway between).

(4) Amounts worked out under subsection ( 2) for the purposes of paragraph 6(a) or 7( a ) must be rounded to the nearest whole dollar (rounding up in the case of 50 cents).

( 5 ) Amounts worked out under subsection ( 2) for the purposes of paragraph 6(b) or 7(b) must be rounded to the nearest whole cent (rounding up in the case of 0.5 cent).

( 6 ) If at any time (whether before or after the commencement of this section) the Australian Statistician has changed or changes the index reference period for the Consumer Price Index, then, for the purposes of applying this section after the change, only index numbers published in terms of the new index reference period are to be used.

Publication

(7) The Minister must cause each amount worked out under subsection ( 2) to be made publicly available in any manner he or she considers appropriate.