Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) This section applies to a veteran if:

(aa) the veteran has made a claim under section 14 for a pension, or an application under section 15 for an increase in the rate of the pension that he or she is receiving; and

(aab) the veteran had not yet turned 65 when the claim or application was made; and

(a) either:

(i) the degree of incapacity of the veteran from war - caused injury or war - caused disease, or both, is determined under section 21A to be at least 70% or has been so determined by a determination that is in force; or

(ii) the veteran is, because he or she has suffered or is suffering from pulmonary tuberculosis, receiving or entitled to receive a pension at the general rate; and

(b) the veteran is totally and permanently incapacitated, that is to say, the veteran's incapacity from war - caused injury or war - caused disease, or both, is of such a nature as, of itself alone, to render the veteran incapable of undertaking remunerative work for periods aggregating more than 8 hours per week; and

(c) the veteran is, by reason of incapacity from that war - caused injury or war - caused disease, or both, alone, prevented from continuing to undertake remunerative work that the veteran was undertaking and is, by reason thereof, suffering a loss of salary or wages, or of earnings on his or her own account, that the veteran would not be suffering if the veteran were free of that incapacity; and

(d) section 25 does not apply to the veteran.

(2) For the purpose of paragraph (1)(c):

(a) a veteran who is incapacitated from war - caused injury or war - caused disease, or both, shall not be taken to be suffering a loss of salary or wages, or of earnings on his or her own account, by reason of that incapacity if:

(i) the veteran has ceased to engage in remunerative work for reasons other than his or her incapacity from that war - caused injury or war - caused disease, or both; or

(ii) the veteran is incapacitated, or prevented, from engaging in remunerative work for some other reason; and

(b) where a veteran, not being a veteran who has attained the age of 65 years, who has not been engaged in remunerative work satisfies the Commission that he or she has been genuinely seeking to engage in remunerative work, that he or she would, but for that incapacity, be continuing so to seek to engage in remunerative work and that that incapacity is the substantial cause of his or her inability to obtain remunerative work in which to engage, the veteran shall be treated as having been prevented by reason of that incapacity from continuing to undertake remunerative work that the veteran was undertaking.

(2A) This section applies to a veteran if:

(a) the veteran has made a claim under section 14 for a pension, or an application under section 15 for an increase in the rate of the pension that he or she is receiving; and

(b) the veteran had turned 65 before the claim or application was made; and

(c) paragraphs (1)(a) and (1)(b) apply to the veteran; and

(d) the veteran is, because of incapacity from war - caused injury or war - caused disease or both, alone, prevented from continuing to undertake the remunerative work ( last paid work ) that the veteran was last undertaking before he or she made the claim or application; and

(e) because the veteran is so prevented from undertaking his or her last paid work, the veteran is suffering a loss of salary or wages, or of earnings on his or her own account, that he or she would not be suffering if he or she were free from that incapacity; and

(f) the veteran was undertaking his or her last paid work after the veteran had turned 65; and

(g) when the veteran stopped undertaking his or her last paid work, the veteran had been undertaking remunerative work for a continuous period of at least 10 years that began before the veteran turned 65; and

(h) section 25 does not apply to the veteran.

(2B) For the purposes of paragraph (2A)(e), a veteran who is incapacitated from war - caused injury or war - caused disease or both, is not taken to be suffering a loss of salary or wages, or of earnings on his or her own account, because of that incapacity if:

(a) the veteran has ceased to engage in remunerative work for reasons other than his or her incapacity from that war - caused injury or war - caused disease, or both; or

(b) the veteran is incapacitated, or prevented from engaging in remunerative work for some other reason.

(3) This section also applies to a veteran who has been blinded in both eyes as a result of war - caused injury or war - caused disease, or both.

(4) Subject to subsections (5), (5A) and (6), the rate at which pension is payable to a veteran to whom this section applies is $1,595.66 per fortnight.

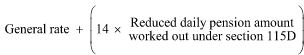

(5) Subject to subsections (5A) and (6), the rate at which pension is payable to a veteran to whom section 115D applies (veterans working under rehabilitation scheme) is the reduced amount worked out using the following formula:

(5A) If:

(a) section 115D applies to a veteran because of subsection 115D(1A); and

(b) the veteran is engaged in remunerative work of more than 8 hours, but less than 20 hours, per week as a result of undertaking a vocational rehabilitation program under the Veterans' Vocational Rehabilitation Scheme;

then, subject to subsection (6) of this section, the rate at which pension is payable to the veteran is the higher of the following amounts:

(c) the amount worked out under subsection (5) of this section;

(d) the amount under subsection 23(4).

(6) If section 25A applies to a veteran, the rate at which pension is payable to the veteran is the rate per fortnight specified in subsection (4), (5) or (5A) of this section, reduced in accordance with section 25A.