Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) If:

(a) a lump sum payment of compensation is made to a person who is a veteran or a dependant of the veteran; and

(b) the compensation payment is paid in respect of the incapacity of the veteran from injury or disease or the death of the veteran; and

(c) the person is receiving, or is subsequently granted, a pension under this Part in respect of the same incapacity of the veteran from that or any other injury or disease or in respect of that death;

the following provisions have effect:

(d) the person is taken to have been, or to be, receiving payments of compensation at a rate per fortnight determined by, or under the instructions of, the Commonwealth Actuary;

(e) the person is taken to have been, or to be, receiving those payments for the period of the person's life determined by, or under the instructions of, the Commonwealth Actuary;

(f) the period referred to in paragraph (e) begins:

(i) on the day that lump sum payment is made to the person; or

(ii) on the day the pension becomes payable to the person;

whichever is the earlier day.

Note 1: Pensions under this Part are payable in respect of the incapacity of a veteran from a war - caused injury or disease or in respect of the death of the veteran (see section 13).

Note 2: A payment of arrears of periodic compensation is not a lump sum compensation payment (see subsection 30B(2)).

Lump sum payment--Safety, Rehabilitation and Compensation (Defence - related Claims) Act 1988 (section 137)

(2) If:

(a) a lump sum payment is made under section 137 of the Safety, Rehabilitation and Compensation (Defence - related Claims) Act 1988 to a person who is a veteran or a dependant of the veteran; and

(b) the payment is made in respect of the incapacity of the veteran from injury or disease or the death of the veteran; and

(c) the person is receiving, or is subsequently granted, a pension under this Part in respect of the same incapacity of the veteran from that or any other injury or disease or in respect of that death;

the following provisions have effect:

(d) the person is taken to have been, or to be, receiving payments of compensation at a rate per fortnight determined by, or under the instructions of, the Commonwealth Actuary;

(e) the person is taken to have been, or to be, receiving those payments for the period of the person's life determined by, or under the instructions of, the Commonwealth Actuary;

(f) the period referred to in paragraph (e) begins:

(i) on the day that lump sum compensation payment is made to that person; or

(ii) on the day the pension becomes payable to the person;

whichever is the later day.

Note: Pensions under this Part are payable in respect of the incapacity of a veteran from a war - caused injury or disease or in respect of the death of the veteran (see section 13).

Lump sum payment--Safety, Rehabilitation and Compensation (Defence - related Claims) Act 1988 (section 30)

(3) If:

(a) a lump sum payment is made under section 30 of the Safety, Rehabilitation and Compensation (Defence - related Claims) Act 1988 to a person who is a veteran or a dependant of the veteran; and

(b) the payment is made in respect of the incapacity of the veteran from injury or disease or the death of the veteran; and

(c) the person is receiving, or is subsequently granted, a pension under this Part in respect of the same incapacity of the veteran from that or any other injury or disease or in respect of that death;

the following provisions have effect:

(d) the person is taken to have been, or to be, receiving payments of compensation at a rate per fortnight determined by, or under the instructions of, the Commonwealth Actuary;

(e) the person is taken to have been, or to be, receiving those payments for the period until the person reaches 65;

(f) the period referred to in paragraph (e) begins:

(i) on the day that lump sum payment is made to the person; or

(ii) on the day the pension becomes payable to the person;

whichever is the later day.

Note: Pensions under this Part are payable in respect of the incapacity of a veteran from a war - caused injury or disease or in respect of the death of the veteran (see section 13).

Pension payable to one person

(4) Subject to subsection (6), if:

(a) a person is taken to be in receipt of payments of compensation at a particular rate per fortnight under subsection (1), (2) or (3); and

(b) but for this subsection, pension referred to in paragraph (1)(c), (2)(c) or (3)(c) would be payable to the person at a particular rate per fortnight;

after the lump sum payment is made, the rate per fortnight of the pension is to be reduced by the rate per fortnight of compensation.

(5) If, under subsection (4), the rate per fortnight of compensation is equal to or exceeds the rate per fortnight of pension, pension is not payable to the person.

Pension payable to 2 or more persons

(6) If:

(a) a lump sum payment is made to a person or persons in respect of the incapacity of a veteran from injury or disease or the death of the veteran; and

(b) the person or persons are taken to be in receipt of compensation under subsection (1), (2) or (3); and

(c) apart from this subsection, pensions under this Part in respect of the same incapacity of the veteran from that or any other injury or disease, or in respect of that death, would be payable to 2 or more persons at particular rates per fortnight;

after the lump sum payment is made, the sum of those rates per fortnight of pensions is to be reduced by the rate per fortnight of compensation that the person is, or the sum of the rates per fortnight of compensation that the persons are, taken to be in receipt of.

Note: Subsections (8), (9) and (10) set out how the reduction is to be made.

(7) If, under subsection (6), the rate or the sum of the rates per fortnight of compensation is equal to or exceeds the sum of the rates per fortnight of pensions, pensions are not payable to the persons.

How reduction is to be made

(8) In giving effect to subsection (6), if:

(a) pensions are payable to 2 or more persons; and

(b) one pension is to be preferred to another under subsection (12);

the preferred pension is not to be reduced until the other pension ceases to be payable because its rate per fortnight is reduced to nil.

(9) If:

(a) the rate of a pension or the rates of 2 or more pensions are reduced to nil under subsection (8); and

(b) there are 2 or more pensions that are not to be preferred to each other;

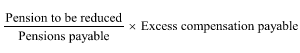

the reduction in the rate per fortnight for each of those pensions is to be worked out using the following formula:

where:

"pension to be reduced" is the rate per fortnight of the pension to be reduced.

"pensions payable" is the sum of the rates per fortnight of the pensions referred to in paragraph (b).

"excess compensation payable" is the rate per fortnight of compensation that is payable after the pension or pensions referred to in paragraph (a) are reduced to a nil rate.

(10) If:

(a) pensions are payable to 2 or more persons; and

(b) subsections (8) and (9) do not apply;

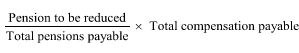

the reduction in the rate per fortnight for each pension is to be worked out using the following formula:

where:

"pension to be reduced" is the rate per fortnight of the pension to be reduced.

"total pensions payable" is the sum of the rates per fortnight of pensions payable to the persons.

"total compensation payable" is the sum of the rates per fortnight of compensation that the persons are taken to be in receipt of.

(11) If:

(a) an amount of damages payable to a veteran, or to a dependant of a veteran, is paid to the Commonwealth under section 30G or 30H; or

(b) the liability of the Commonwealth to pay damages to a veteran or to a dependant of a veteran, is, under section 30K, taken to have been discharged to the extent of a particular amount;

subsection (1) of this section applies to the veteran or the dependant as if pension commences to be payable, only after the veteran or dependant receives payments by way of instalments of pension equal to the amount referred to in paragraph (a) or (b).

Preferred pensions

(12) For the purposes of this section:

(a) a pension payable under this Part to the veteran is to be preferred to such a pension payable to a dependant of the veteran; and

(b) a pension payable under this Part to a partner or non - illness separated spouse of a veteran is to be preferred to such a pension payable to a child of the veteran; and

(c) a pension payable under this Part to the widow or widower of a deceased veteran is to be preferred to such a pension payable to a child of the veteran; and

(d) a pension payable under this Part to an older child of a veteran is to be preferred to such a pension payable to a younger child of the veteran.

(13) For the purposes of this section, a payment by way of compensation made on behalf of, or for the benefit of, a person is taken to have been made to the person.