Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) If:

(a) periodic payments of compensation are made to a person who is a veteran or a dependant of the veteran; and

(b) the compensation payments are made in respect of the incapacity of the veteran from injury or disease or the death of the veteran; and

(c) the person receives, or is subsequently granted, a pension under this Part in respect of the same incapacity of the veteran from that or any other injury or disease or in respect of that death;

the rate per fortnight of the person's pension that would, apart from this subsection, be payable to the person for the periodic payments period is to be reduced by the rate per fortnight of the periodic compensation.

Note 1: For periodic payments period see subsection (10).

Note 2: Pensions under this Part are payable in respect of the incapacity of a veteran from a war - caused injury or disease or in respect of the death of the veteran (see section 13).

(2) If, under subsection (1), the rate per fortnight of the periodic compensation is equal to or exceeds the rate per fortnight of pension, pension is not payable to the person.

Pension payable to 2 or more persons

(3) If:

(a) periodic payments of compensation are made to a person or persons in respect of the incapacity of a veteran from injury or disease or the death of the veteran; and

(b) apart from this subsection, pensions under this Part in respect of the same incapacity of the veteran from that or any other injury or disease, or in respect of that death, would be payable to 2 or more persons for the periodic payments period at particular rates per fortnight;

the sum of those rates per fortnight of pensions for the periodic payments period is to be reduced by the rate per fortnight of the periodic compensation or the sum of the rates per fortnight of the periodic compensation.

Note: Subsections (5), (6) and (7) set out how the reduction is to be made.

(4) If, under subsection (3), the rate or the sum of the rates per fortnight of periodic compensation is equal to or exceeds the sum of the rates per fortnight of pensions, pensions are not payable to the persons.

How reduction is to be made

(5) In giving effect to subsection (3), if:

(a) pensions are payable to 2 or more persons; and

(b) one pension is to be preferred to another under subsection (8);

the preferred pension is not to be reduced until the other pension ceases to be payable because its rate per fortnight is reduced to nil.

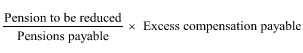

(6) In giving effect to subsection (3), if:

(a) the rate of a pension or the rates of 2 or more pensions are reduced to nil under subsection (5); and

(b) there are 2 or more pensions that are not to be preferred to each other;

the reduction in the rate per fortnight for each of those pensions is to be worked out using the following formula:

where:

"pension to be reduced" is the rate per fortnight of the pension to be reduced.

"pensions payable" is the sum of the rates per fortnight of the pensions referred to in paragraph (b).

"excess compensation payable" is the rate per fortnight of periodic compensation that is payable after the pension or pensions referred to in paragraph (a) are reduced to a nil rate.

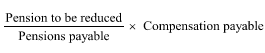

(7) If:

(a) pensions are payable to 2 or more persons; and

(b) subsections (5) and (6) do not apply;

the reduction in the rate per fortnight for each pension is to be worked out using the following formula:

where:

"pension to be reduced" is the rate per fortnight of the pension to be reduced.

"pensions payable" is the sum of the rates per fortnight of pensions payable to the persons.

"compensation payable" is the sum of the rates per fortnight of periodic compensation that is payable to the persons.

Preferred pensions

(8) For the purposes of this section:

(a) a pension payable under this Part to the veteran is to be preferred to such a pension payable to a dependant of the veteran; and

(b) a pension payable under this Part to a partner or non - illness separated spouse of a veteran is to be preferred to such a pension payable to a child of the veteran; and

(c) a pension payable under this Part to the widow or widower of a veteran is to be preferred to such a pension payable to a child of the veteran; and

(d) a pension payable under this Part to an older child of a veteran is to be preferred to such a pension payable to a younger child of the veteran.

(9) For the purposes of this section, a payment by way of compensation made on behalf of, or for the benefit of, a person is taken to have been made to the person.

(10) In this section:

"periodic payments period" means:

(a) the period to which a periodic compensation payment, or a series of periodic compensation payments, relates; or

(b) in the case of a payment of arrears of periodic compensation payments--the period to which those payments would have related if they had not been made by way of arrears payment.